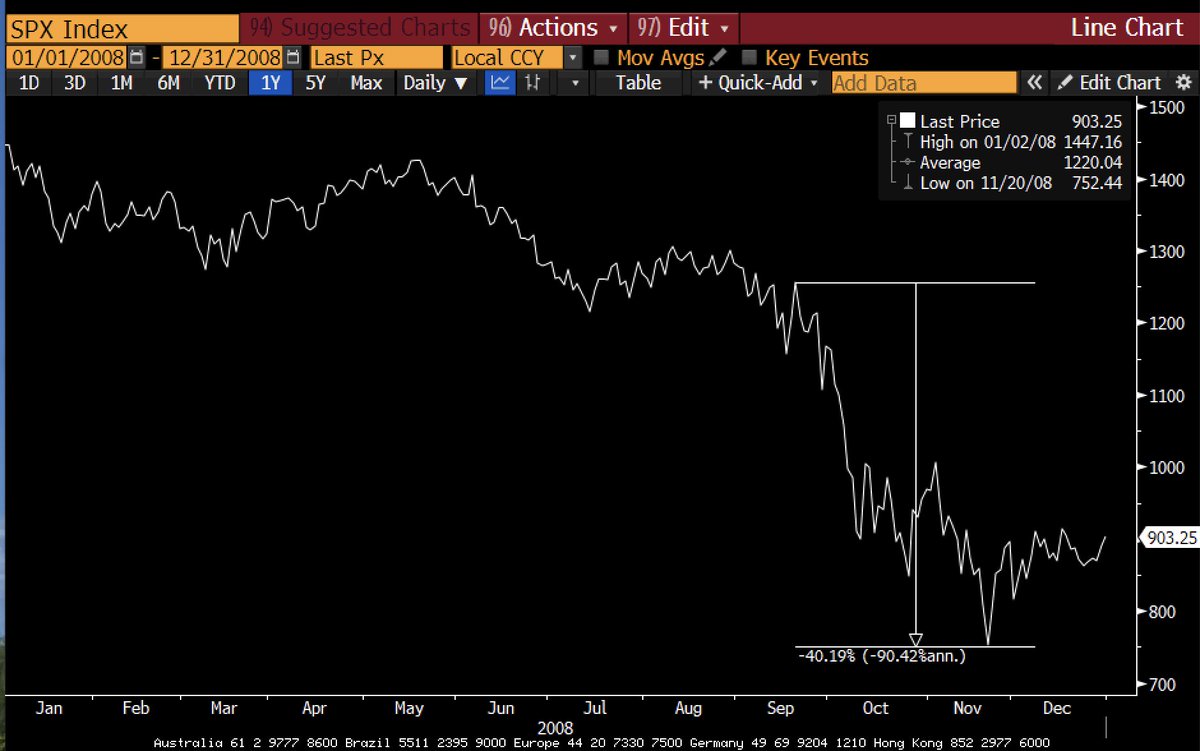

October is the month stock market crashes - It is also the month that kills bear markets...

Let's dig in... 1/

Let's dig in... 1/

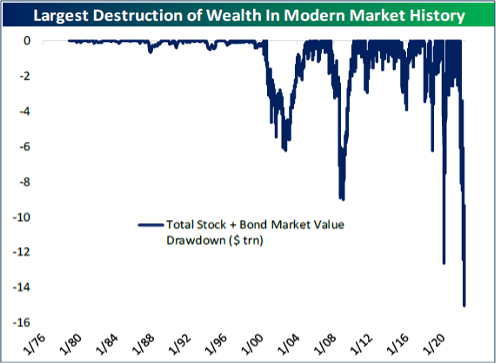

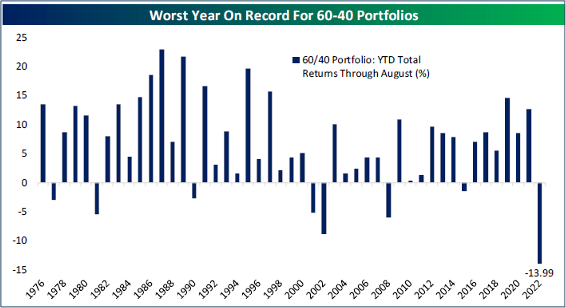

With 76 million Boomers up shit creek without a paddle and most US politicians being Boomers too, the pressure will mount on the central bank to halt this.

They have 3 choices:

They have 3 choices:

1. Reverse QT and rate hikes and risk their biggest fear of being Arthur Burns and not their hero, Volker.

Unlikely to happen until growth utterly implodes (market is already pricing in a recession). Reverse in 2023.

Unlikely to happen until growth utterly implodes (market is already pricing in a recession). Reverse in 2023.

2. Stop QT and hikes very soon and go to data dependent. This is the easiest option and most likely path this year. Growth still implodes as damage has been done. Reverse it 2023.

3. Keep going with the tightening which will force the politicians to fiscally stimulate as unemployment rises or if real wages remain negative (See UK/Europe for details - a shit show).

Who knows how this will play out, but without a larger financial crisis (which doesn't seem likely as we have all the tools to stop that) it is hard to see this morph outside of a nasty recession in early 2023. Obviously, things can change...

The markets job is to look forward 6 months+.

In 6 months time, there will be more liquidity.

Meanwhile, everyone already knows about recession and earnings risks

Any marginal decrease in hawkishness is all it takes to change sentiment and force people back into the market

In 6 months time, there will be more liquidity.

Meanwhile, everyone already knows about recession and earnings risks

Any marginal decrease in hawkishness is all it takes to change sentiment and force people back into the market

Let's see...

Its crash month (and reversal month)!

Be careful out there. You don't need to try to catch a falling knife but its worth having a plan...

Its crash month (and reversal month)!

Be careful out there. You don't need to try to catch a falling knife but its worth having a plan...

@threadreaderapp unroll

Loading suggestions...