Sure, other tokens will outperform ETH but crypto overall will outperform all other assets, in my view.

My hunch is that the market is caught underweight (as it is in equities too) and the path of pain is higher. But, that is just shorter-term thoughts.

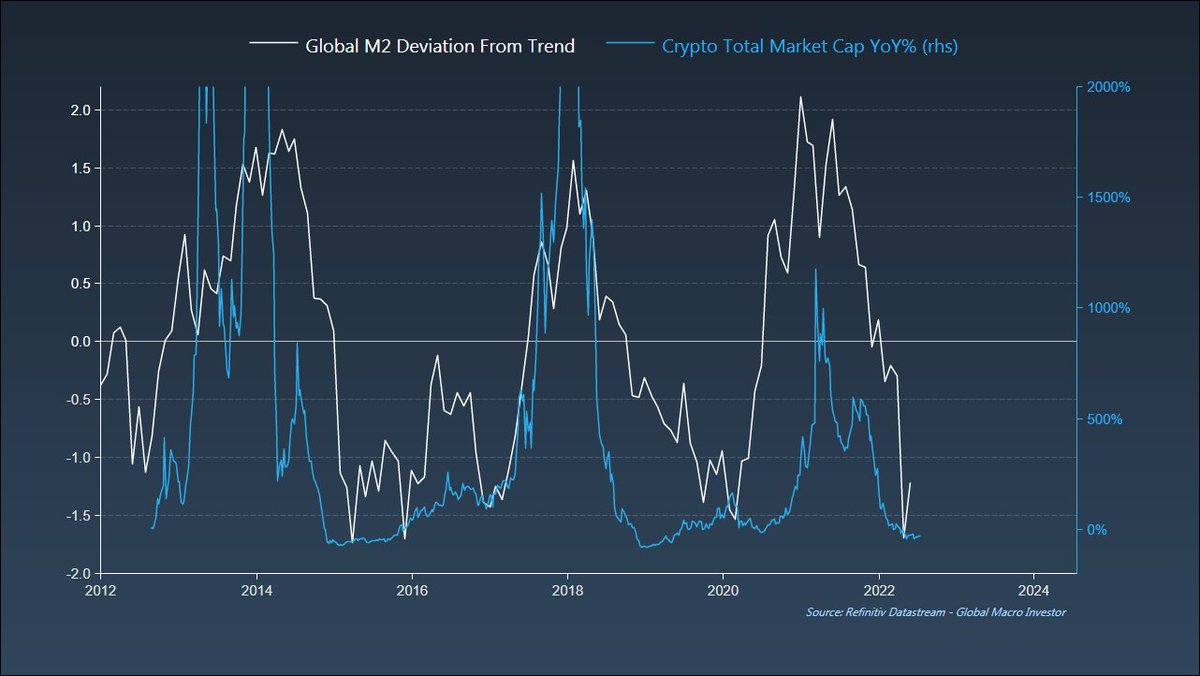

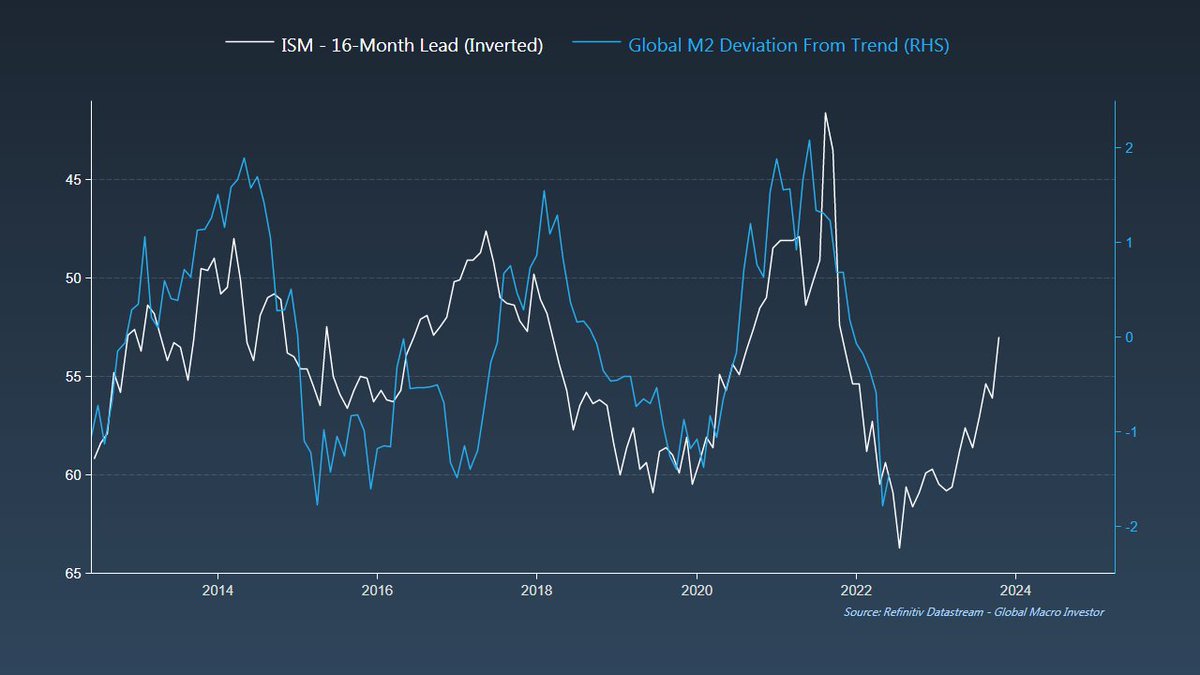

The long-term is clear.

My hunch is that the market is caught underweight (as it is in equities too) and the path of pain is higher. But, that is just shorter-term thoughts.

The long-term is clear.

Loading suggestions...