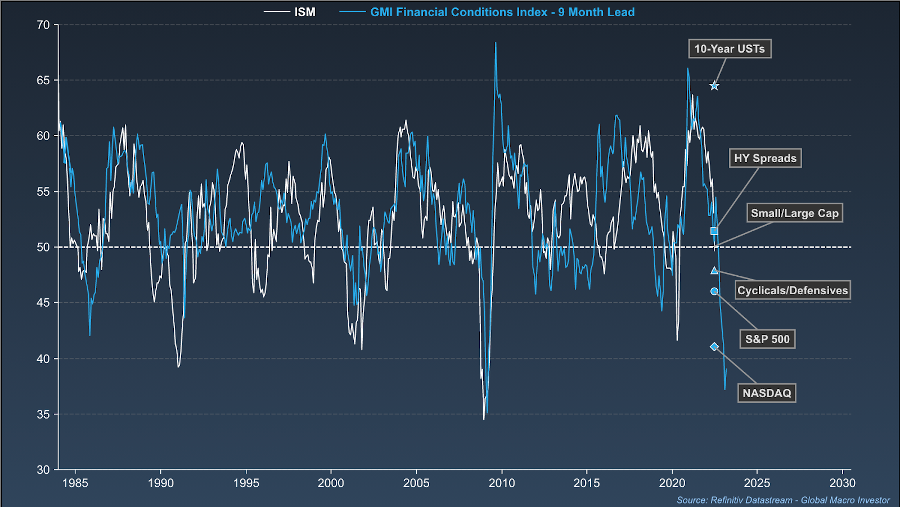

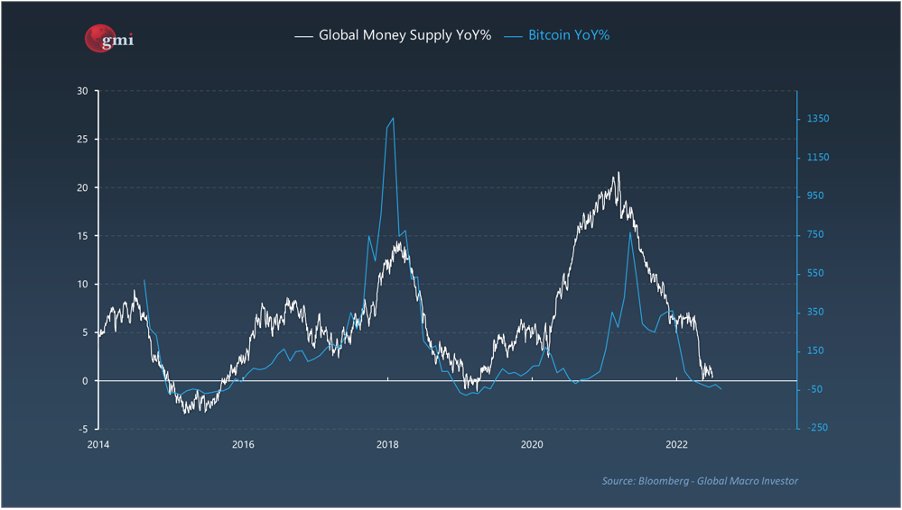

The next 2 to 3 months will reveal a lot. As Stan Druckmiller says, the job of a macro investor is to buy or sell assets that are the most mispriced for the 12 to 18 months out. In the next 12 to 18 months we will have had a recession. Monetary conditions will be much weaker.

Just to be clear - I think risk assets probably go lower before reversing but not 100% sure. Yes, there is a risk of an extended recession like 2001/2 or 2008/9 but I dont really see that being the higher odds. Im still using 1947, 1974 and 2018 as my blended hypothesis

جاري تحميل الاقتراحات...