Macro Update:

When the world's most important collateral, US treasuries, undergo unprecedented volatility, margin calls are everywhere. When the position you borrow to invest in has massive volatility too, there are even more margin calls.

Welcome to 2022. 1/

When the world's most important collateral, US treasuries, undergo unprecedented volatility, margin calls are everywhere. When the position you borrow to invest in has massive volatility too, there are even more margin calls.

Welcome to 2022. 1/

As I have pointed out many times, the tightening of financial conditions caused by commodities, rates and the dollar is the largest in history. The GS financial conditions index is not only lagging but it doesn't fully capture the situation.

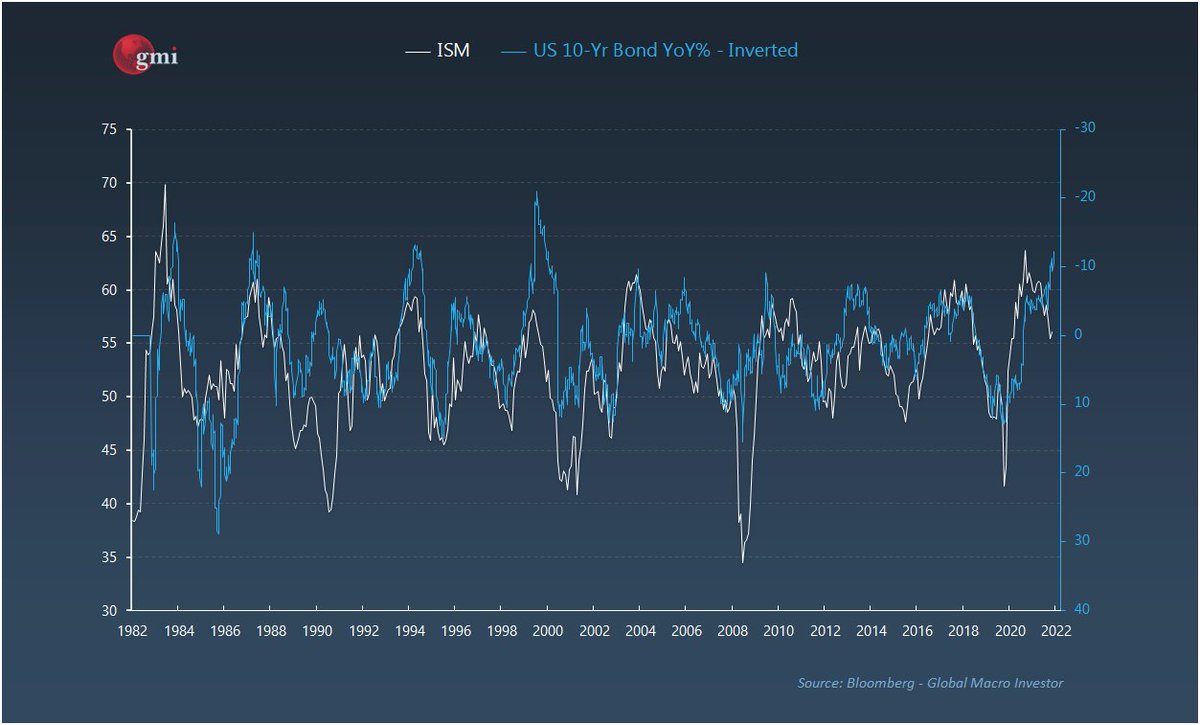

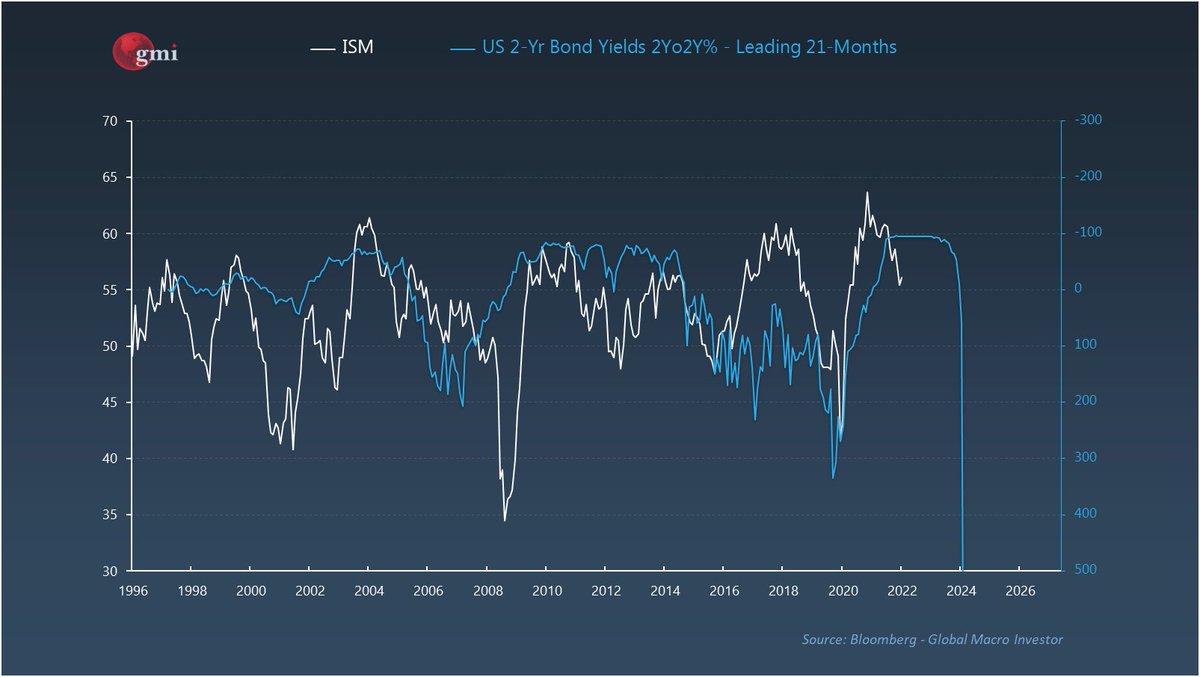

In fact, going back to 1970, every time the ISM hit 50 the Fed paused or cut. Thus the ISM is THE key variable. In nearly all examples, CPI was still elevated or hadn't even peaked...

I think the ISM is going to fall fast and hard.

I think the ISM is going to fall fast and hard.

The question is whether this ends up being a drawn out recession like 2008 where the market rallied and fell again as earnings got crushed or if it's going to be a fast a furious one like 1974.

It is too early to tell. My guess is that the bond market will tell us.

It is too early to tell. My guess is that the bond market will tell us.

Everyone is waiting for what is going to break. My view is that it is the US economy.

Equities don't yet feel out of the woods.

Good luck out there. There are no safe bets. but for longer-term investors, things are starting to get more interesting.

Equities don't yet feel out of the woods.

Good luck out there. There are no safe bets. but for longer-term investors, things are starting to get more interesting.

Again, the risk is a longer recession but my probabilistic framework acknowledges this risk but it is not my base case.

جاري تحميل الاقتراحات...