Jim Simons solved the market

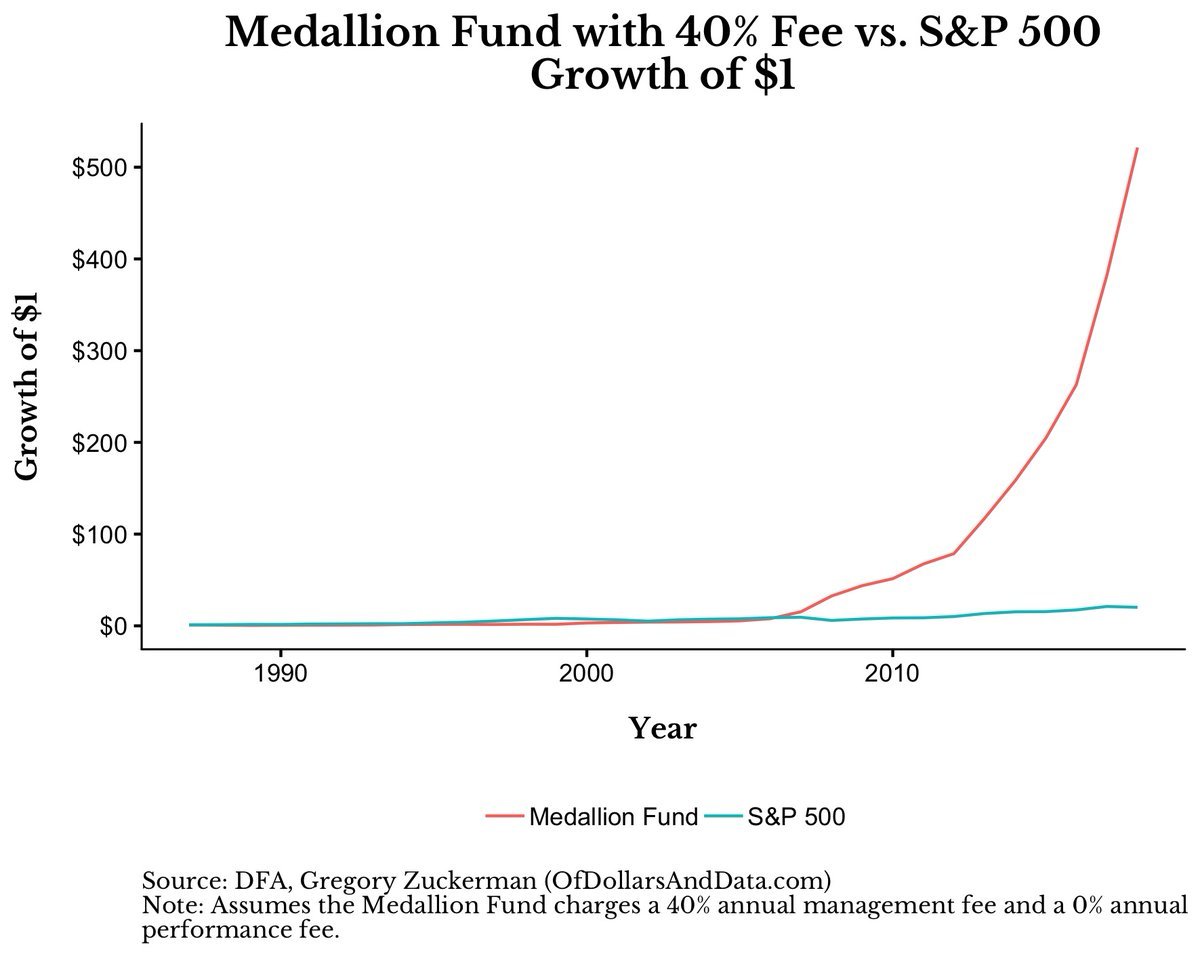

In three decades, he averaged a return of 66% (!) per year

Today, I'll give you his most important lessons👇 x.com

In three decades, he averaged a return of 66% (!) per year

Today, I'll give you his most important lessons👇 x.com

1. Simons wasn’t a finance guy—he was a mathematician.

His edge? He saw markets not as economics, but as patterns in data.

The biggest chances come from approaching problems differently.

His edge? He saw markets not as economics, but as patterns in data.

The biggest chances come from approaching problems differently.

2. In 1978, he quit academia to trade full-time.

He knew little about markets but had one core belief: numbers don’t lie.

If patterns existed, he could find them with math. x.com

He knew little about markets but had one core belief: numbers don’t lie.

If patterns existed, he could find them with math. x.com

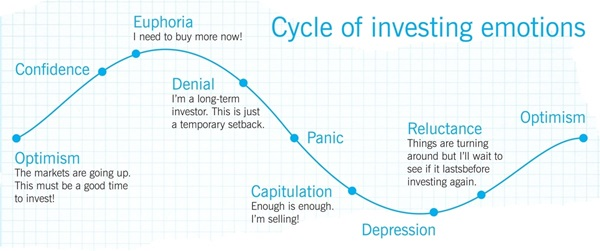

3. The biggest enemy in investing? Your own emotions.

His first years were rough. He lost money trying to combine math with intuition.

He realized: human judgment was the problem.

So he removed emotions and let algorithms trade for him. x.com

His first years were rough. He lost money trying to combine math with intuition.

He realized: human judgment was the problem.

So he removed emotions and let algorithms trade for him. x.com

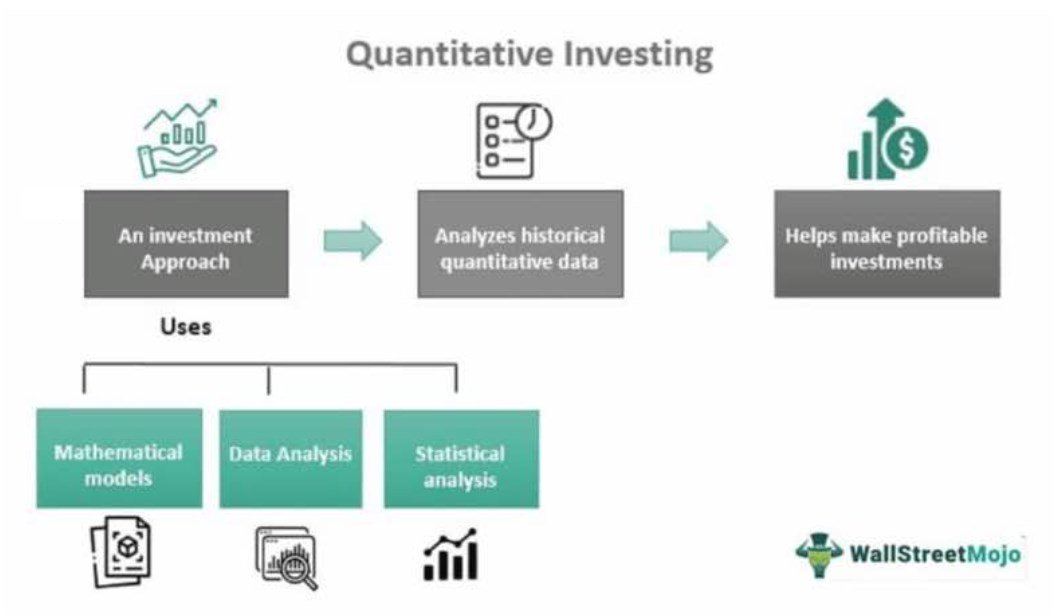

4. In 1980s, his fund started cracking the market using quantitative models.

His team? Not finance pros.

Math PhDs, physicists, and coders. x.com

His team? Not finance pros.

Math PhDs, physicists, and coders. x.com

5. Simons focused on patterns.

His models detected small inefficiencies in price movements.

Small edges, when repeated over time, compound into massive profits. x.com

His models detected small inefficiencies in price movements.

Small edges, when repeated over time, compound into massive profits. x.com

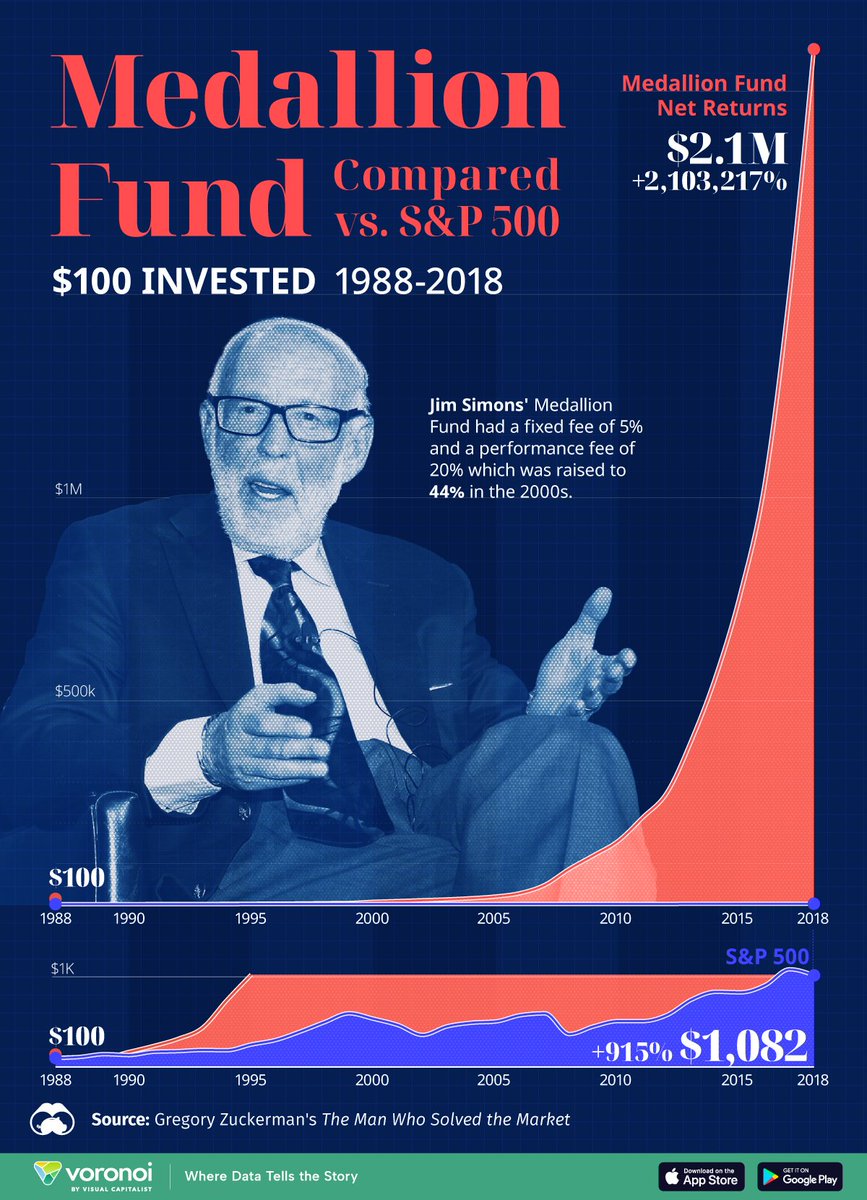

6. In 1990s, his flagship Medallion Fund was unstoppable.

It returned 66% per year before fees.

Simons' fund was the most profitable fund ever. x.com

It returned 66% per year before fees.

Simons' fund was the most profitable fund ever. x.com

7. Simons never took outside money for Medallion after 2005.

Why? It was too profitable to share.

The fund was limited to employees. It turned them into billionaires. x.com

Why? It was too profitable to share.

The fund was limited to employees. It turned them into billionaires. x.com

8. Despite his success, Simons admitted: “We don’t know why our models work. We just know they do.”

His strength wasn’t certainty, it was trust in the math. x.com

His strength wasn’t certainty, it was trust in the math. x.com

9. Jim Simons retired in 2021 with a net worth of $23 billion

He has built the most successful trading firm in history.

And yet, most investors still don’t study him. x.com

He has built the most successful trading firm in history.

And yet, most investors still don’t study him. x.com

That's it for today. Did you like this?

Here's an incredible article about Jim Simons: compounding-quality.kit.com

Here's an incredible article about Jim Simons: compounding-quality.kit.com

Loading suggestions...