What factors will determine commodity moves in CY25?

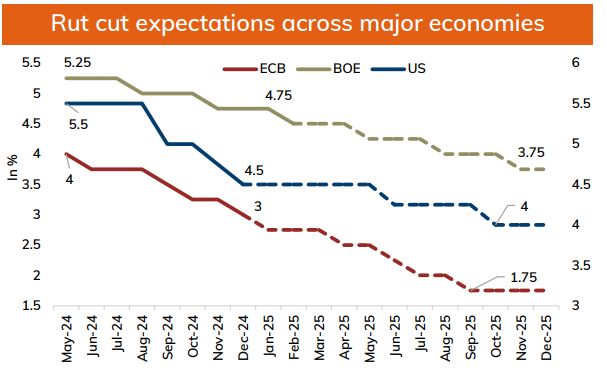

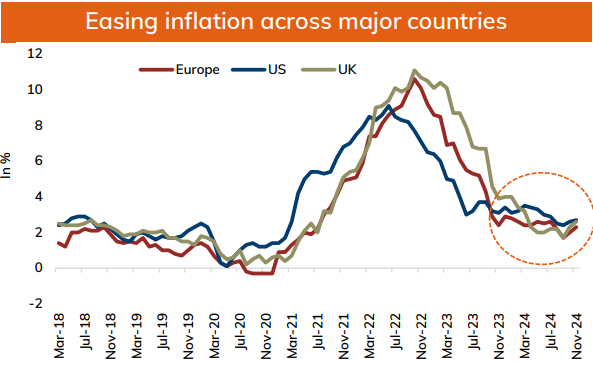

US Inflation & Fed Policy

Core inflation in the US is expected to stay above the Fed’s 2% target due to strong economic growth and inflationary pressures from new immigration and trade policies. The Fed may slow down the pace of rate cuts but maintain a cautious stance.

Europe Inflation & ECB Policy

In contrast, Europe’s inflation is likely to fall below central bank targets, with the ECB expected to continue aggressive monetary easing and cut rates below 2%.

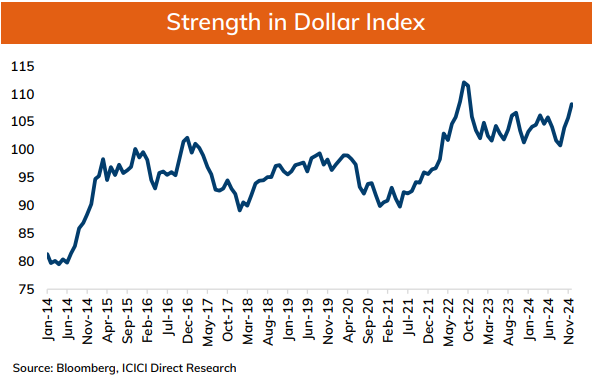

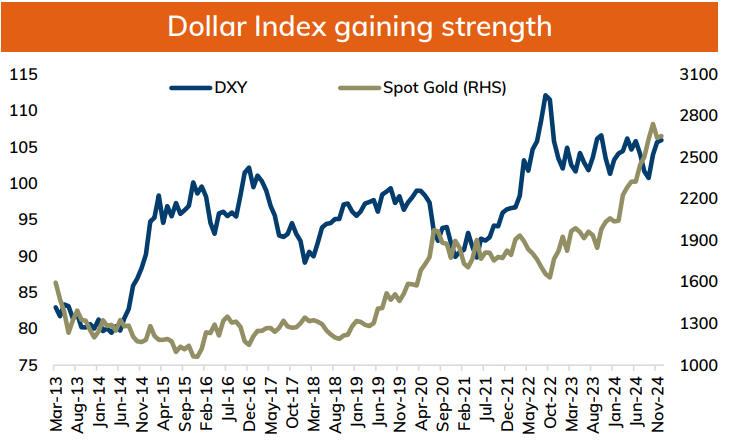

Strong US Dollar

A Donald Trump presidency could lead to a strong dollar, as his immigration, trade, and tax policies are likely to spur inflation. Additionally, higher tariffs on US trading partners could hurt their economic growth, widening interest rate differentials and further supporting the dollar.

US Inflation & Fed Policy

Core inflation in the US is expected to stay above the Fed’s 2% target due to strong economic growth and inflationary pressures from new immigration and trade policies. The Fed may slow down the pace of rate cuts but maintain a cautious stance.

Europe Inflation & ECB Policy

In contrast, Europe’s inflation is likely to fall below central bank targets, with the ECB expected to continue aggressive monetary easing and cut rates below 2%.

Strong US Dollar

A Donald Trump presidency could lead to a strong dollar, as his immigration, trade, and tax policies are likely to spur inflation. Additionally, higher tariffs on US trading partners could hurt their economic growth, widening interest rate differentials and further supporting the dollar.

What factors will determine commodity moves in CY25?

Global Growth in 2025

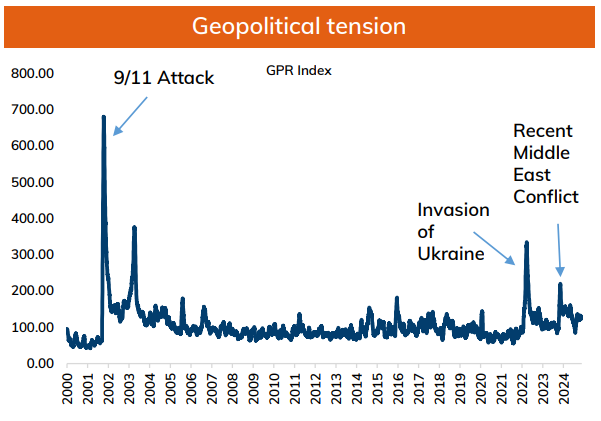

The global economy is projected to grow at a steady pace of 3.2%, supported by low inflation, steady employment growth, and continued monetary easing. However, risks remain due to geopolitical tensions in Eastern Europe and the Middle East.

Trade War Risks

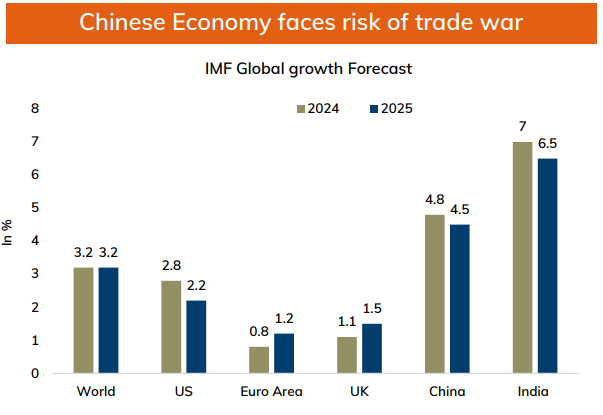

If Donald Trump enacts import tariffs (10% globally and 60% or more on Chinese goods), it could trigger a trade war, disrupting global trade and economic stability.

China's Economic Challenges

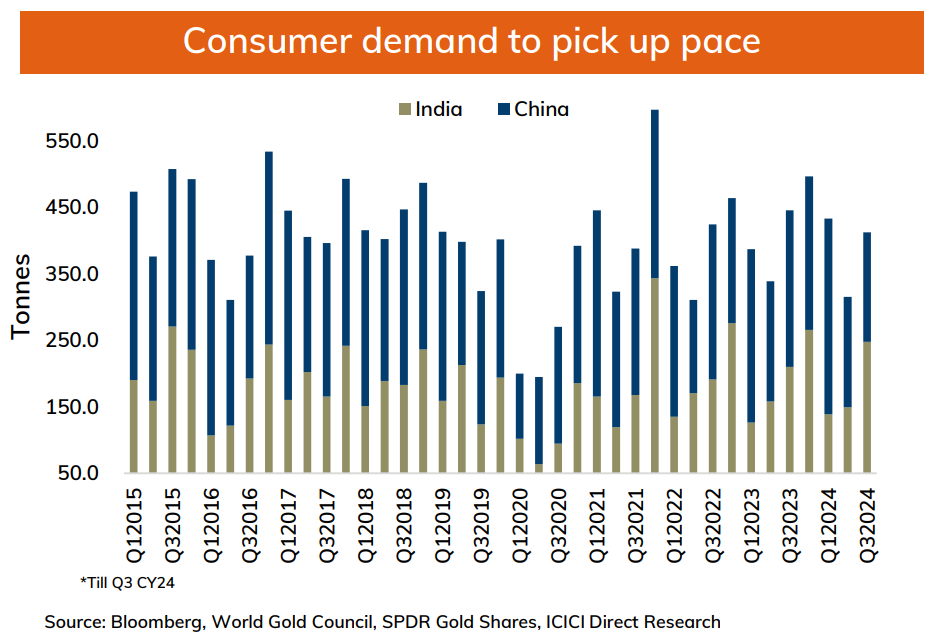

China's growth is likely to slow down, impacted by a prolonged housing downturn and the resumption of a trade war. While exports have been a key growth driver for China in 2024, higher tariffs could undermine this recovery, further dampening economic momentum.

Global Growth in 2025

The global economy is projected to grow at a steady pace of 3.2%, supported by low inflation, steady employment growth, and continued monetary easing. However, risks remain due to geopolitical tensions in Eastern Europe and the Middle East.

Trade War Risks

If Donald Trump enacts import tariffs (10% globally and 60% or more on Chinese goods), it could trigger a trade war, disrupting global trade and economic stability.

China's Economic Challenges

China's growth is likely to slow down, impacted by a prolonged housing downturn and the resumption of a trade war. While exports have been a key growth driver for China in 2024, higher tariffs could undermine this recovery, further dampening economic momentum.

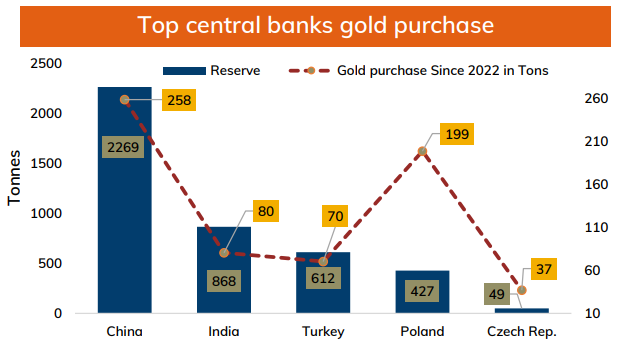

Global central banks purchased ~186tonnes of gold in Q3CY24 which is lesser then compared to same quarter last year, but still looked healthy. Moreover, central banks have purchased 694tonnes of gold this year so far which is in line with same period of 2022. Looking at the current situation, the central bank will continue to add gold to diversify their reserves for financial or strategic reasons

China’s central bank broke the silence and re-entered the market after 6 month pause and purchased 5tonnes of gold in November taking reserves to 2269tonnes. China remained one of the top gold buyer of 2024 with 34tonnes. Looking at the current scenario PBOC is likely to continue to add gold to its reserves as it has low amount relative to other FX assets

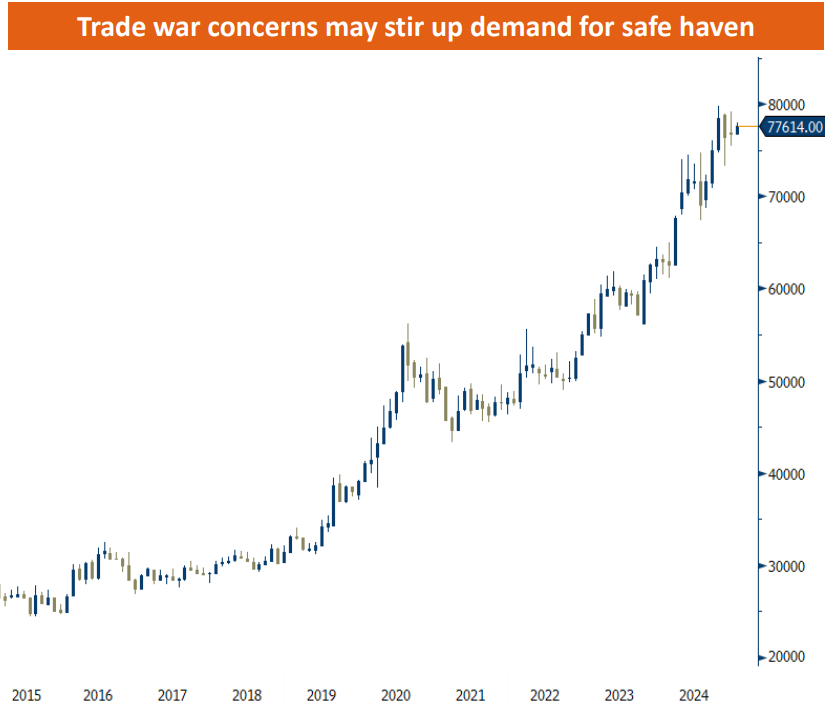

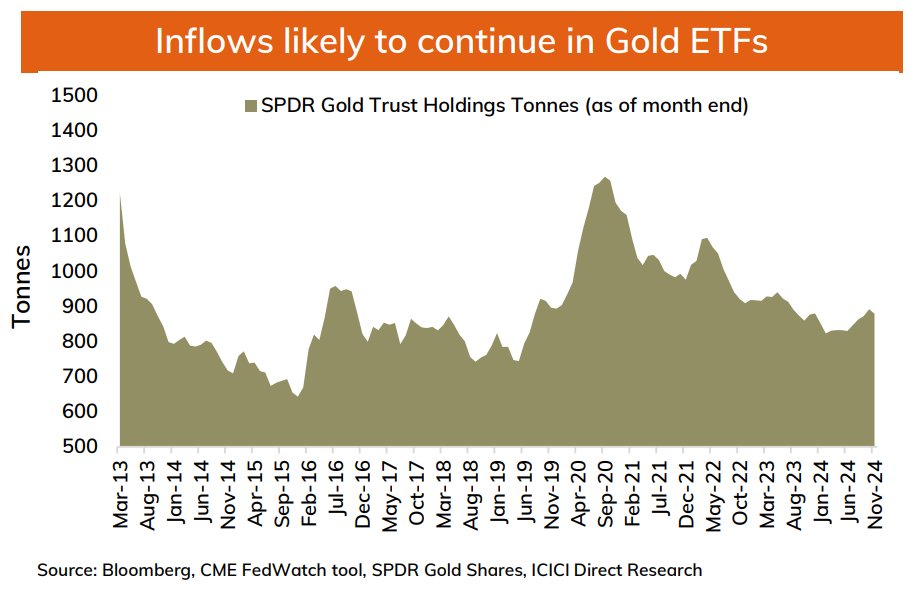

In 2024, we saw inflows in ETF for 6 consecutive month till October turning holdings positive as investors flocked to safe haven assets amid geopolitical tensions and market uncertainties. However, outflows were witnessed in November amid strong dollar and rise in US treasury yields. We believe fresh investment demand may kick in 2025 as investors will buy gold as store value amid concerns over trade war

Dollar Index has already started gaining steam and is likely to rise further as Trump policies on trade and immigration could spur inflation in US crumpling Fed’s ability to cut rates with higher magnitude. Moreover, as trade war commences uncertainty about growth could hurt market sentiments, supportive for dollar.

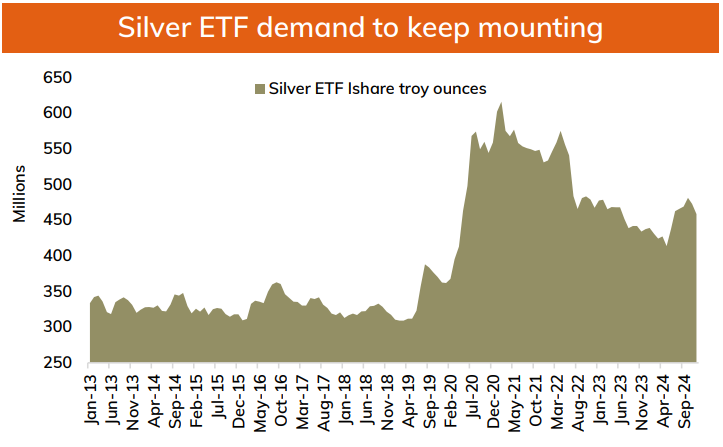

Going ahead, demand for ETF may surge in 2025 amid rate cut across major economies, hopes for more stimulus packages from China and elevated geopolitical tensions x.com

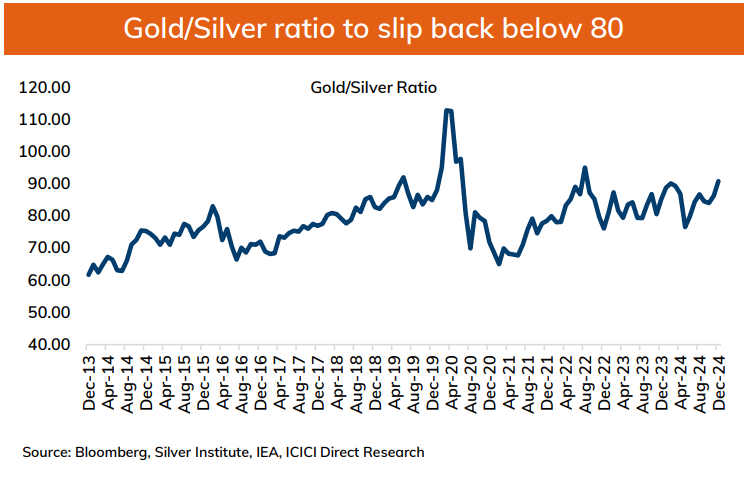

We expect silver to outperform gold in 2025 taking ratio again down below 80 level, which is standing near 89 right now x.com

Loading suggestions...