NIFTY to hit 28,300! Part 3 of the Market Strategy 2025 by ICICI Direct research gives our top picks to ride this wave! A 🧵.

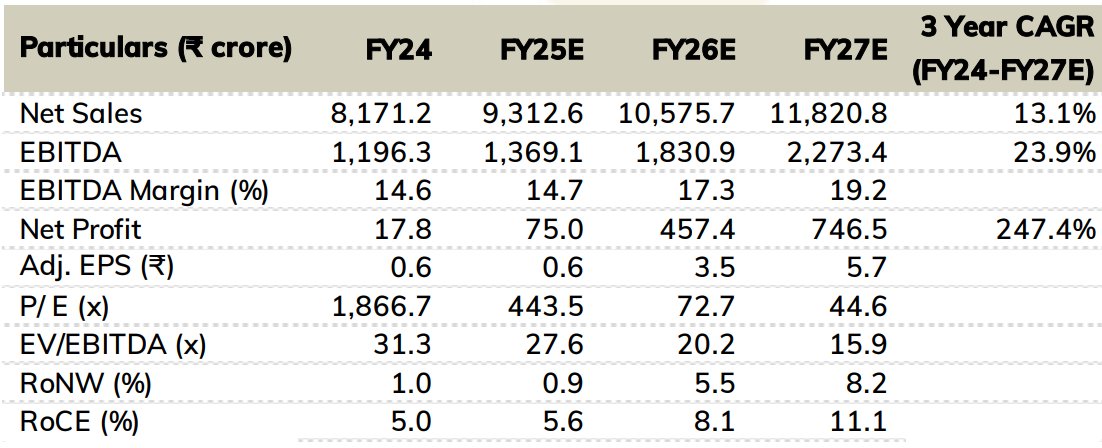

Piramal Pharma (PIRPHA)

A pharma powerhouse, excelling in CRDMO and complex hospital generics, and well-positioned for growth in GLP-1 and ADCs.

Target Price: ₹ 320 (26% Upside)

(1/n)

Piramal Pharma (PIRPHA)

A pharma powerhouse, excelling in CRDMO and complex hospital generics, and well-positioned for growth in GLP-1 and ADCs.

Target Price: ₹ 320 (26% Upside)

(1/n)

Loading suggestions...