Valuation is an art

You try to buy stocks for less than what they're worth

Here's everything you need to know: x.com

You try to buy stocks for less than what they're worth

Here's everything you need to know: x.com

1. Introduction

Valuation is the process of determining the true value of an asset.

It is an analytical process to arrive at a fair and accurate price for an asset or a company

Valuation is the process of determining the true value of an asset.

It is an analytical process to arrive at a fair and accurate price for an asset or a company

2. Importance of valuation

1) It can help investors make informed decisions about whether to buy, or sell an investment.

2) Businesses can use valuation to determine the value of their company. x.com

1) It can help investors make informed decisions about whether to buy, or sell an investment.

2) Businesses can use valuation to determine the value of their company. x.com

3) Accurate valuation reports can improve a business's credibility with investors.

4) In the context of mergers and acquisitions, valuation helps in determining a fair purchase price. x.com

4) In the context of mergers and acquisitions, valuation helps in determining a fair purchase price. x.com

5. Discounted cash-flow valuation

A DCF determines the value of a stock, a business, or any other asset based on its future cash flows.

Valuation is done by calculating the sum of the present value of all its future cash flow discounted. x.com

A DCF determines the value of a stock, a business, or any other asset based on its future cash flows.

Valuation is done by calculating the sum of the present value of all its future cash flow discounted. x.com

7. Discounted cash-flow implications

Note that discounted valuation is not perfect.

The future cash flows of an asset or investment are uncertain. x.com

Note that discounted valuation is not perfect.

The future cash flows of an asset or investment are uncertain. x.com

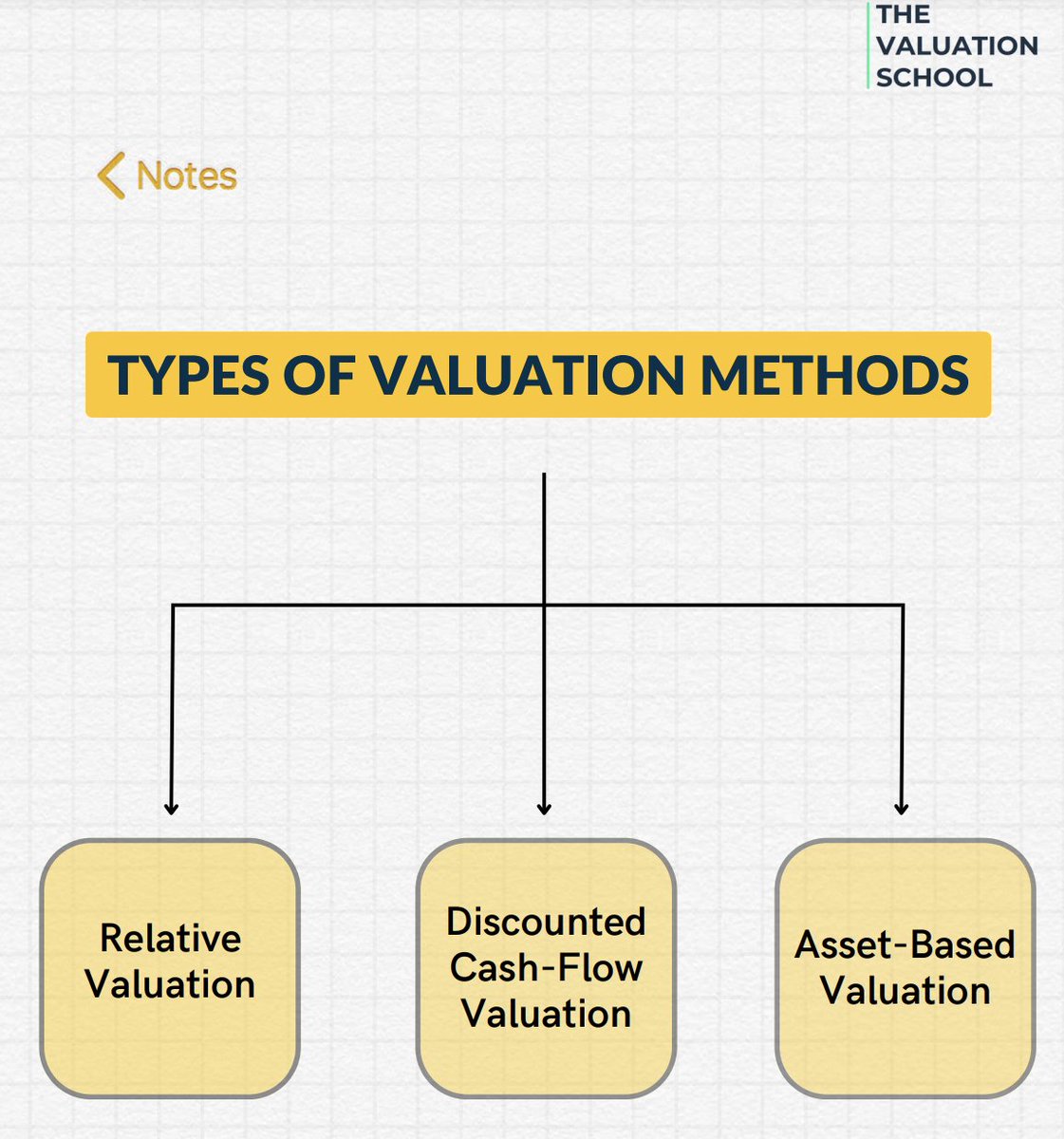

8. Relative valuation

Relative valuation is a method that compares an asset to the value of similar assets in the market.

The key concept? Assets with similar characteristics and risk profiles should have similar values.

Relative valuation is a method that compares an asset to the value of similar assets in the market.

The key concept? Assets with similar characteristics and risk profiles should have similar values.

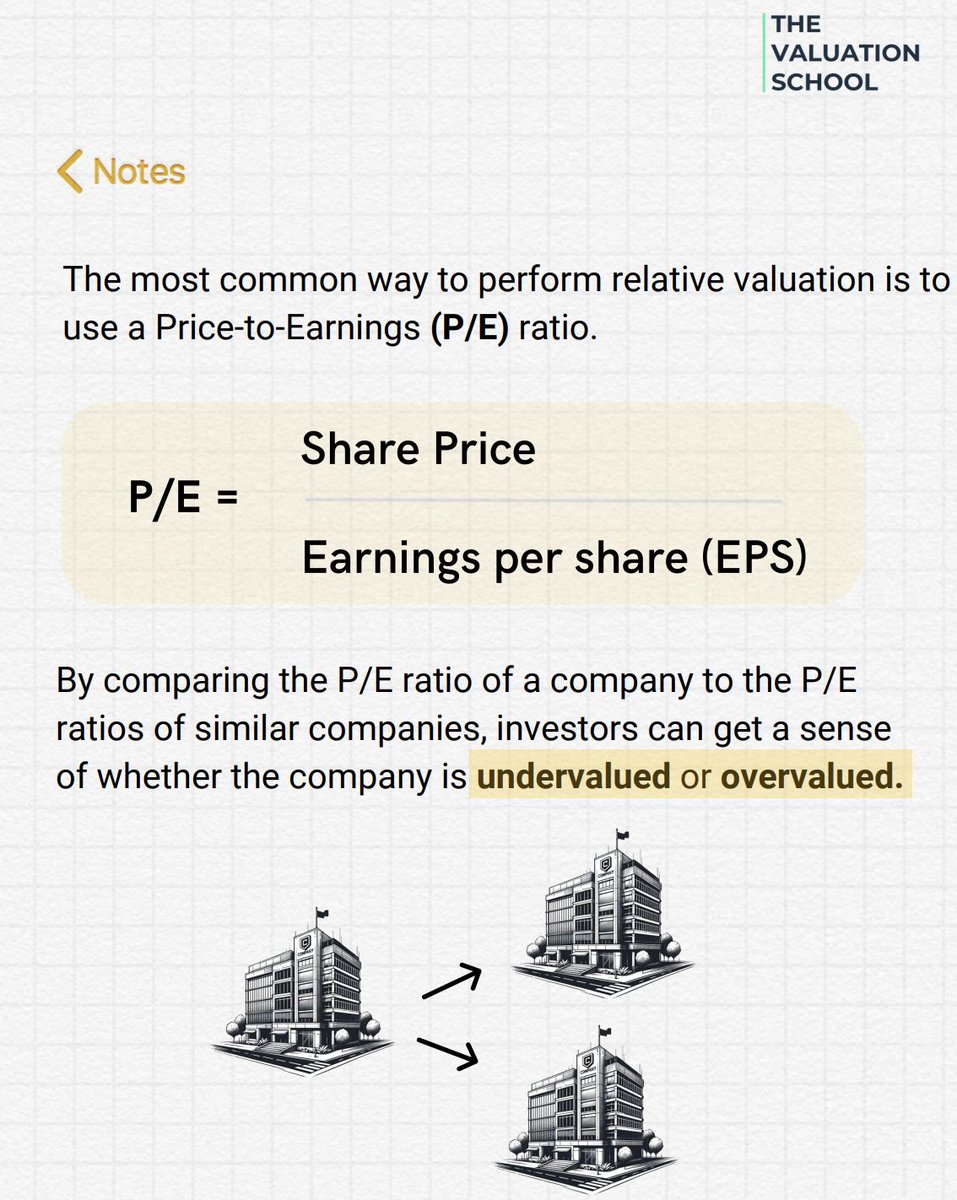

9. Relative valuation: Price-to-earnings

The most common way to perform relative valuation is to

use a Price-to-Earnings (P/E) ratio.

P/E = Share Price / Earnings per share (EPS) x.com

The most common way to perform relative valuation is to

use a Price-to-Earnings (P/E) ratio.

P/E = Share Price / Earnings per share (EPS) x.com

10. Relative valuation: other methods

Other common multiples are the Price-to-book (P/B) ratio, the Price-to-sales (P/S) ratio, and the Price-to-cashflow (P/CF) ratio. x.com

Other common multiples are the Price-to-book (P/B) ratio, the Price-to-sales (P/S) ratio, and the Price-to-cashflow (P/CF) ratio. x.com

11. Asset-based valuation

Asset-based valuation estimates the fair market value of underlying assets.

This approach focuses on the balance sheet items. x.com

Asset-based valuation estimates the fair market value of underlying assets.

This approach focuses on the balance sheet items. x.com

Asset-based valuation identifies and values tangible and intangible assets.

Net asset value is calculated by subtracting liabilities. x.com

Net asset value is calculated by subtracting liabilities. x.com

Asset-based valuation is useful but not without flaws.

Other valuation methods should complement asset-based approaches for accuracy. x.com

Other valuation methods should complement asset-based approaches for accuracy. x.com

Want to learn more? Grab my free Financial Analysis course here: compounding-quality.ck.page

👏 Source: The Valuation School & Parth Verma. Give them a follow! 👏

Loading suggestions...