Capex: To be back on track post elections impact

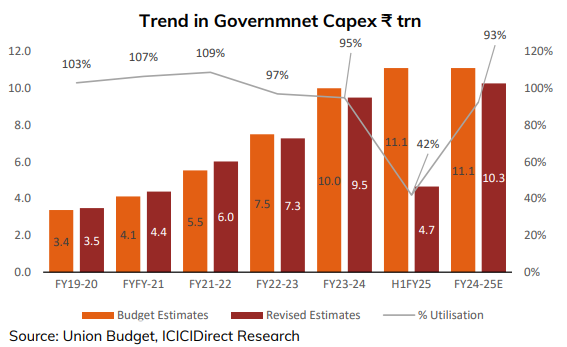

🔸H1FY25 saw subdued capex trends, but activity has significantly picked up since September 2024.

🔸The government is on track to achieve 93% of its ambitious ₹10.3 lakh crore capex target for FY25.

🔸A similar pattern was observed during the 2019-20 election cycle, where capex slowed during polling but rebounded strongly afterward.

🔸A repeat of this trend is anticipated in H2FY25/CY25, supported by post-election stability.

(2/n)

🔸H1FY25 saw subdued capex trends, but activity has significantly picked up since September 2024.

🔸The government is on track to achieve 93% of its ambitious ₹10.3 lakh crore capex target for FY25.

🔸A similar pattern was observed during the 2019-20 election cycle, where capex slowed during polling but rebounded strongly afterward.

🔸A repeat of this trend is anticipated in H2FY25/CY25, supported by post-election stability.

(2/n)

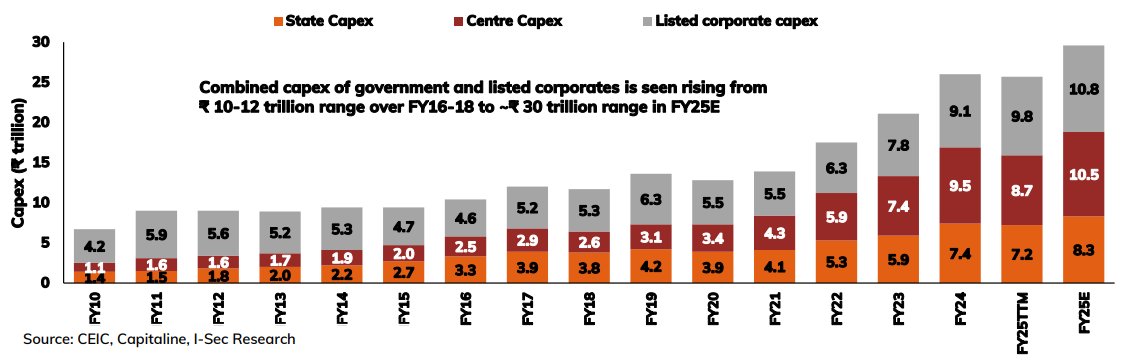

🔸Listed corporate capex is estimated at ₹ 10.8 trillion. Corporate capex continues to rise despite challenges (19% YoY) in FY25E driven by old-economy sectors (energy, metals, utilities, telecom, auto, industrials etc.).

🔸While corporate capex is growing, it remains at a two-decade low relative to central government capex, which stands at ₹10.5 trillion (11% YoY growth) for FY25E.

🔸The ratio of listed corporate capex to central government capex was at its peak (~5x) in FY09, indicating significant untapped potential for corporate capex resurgence.

(3/n)

🔸While corporate capex is growing, it remains at a two-decade low relative to central government capex, which stands at ₹10.5 trillion (11% YoY growth) for FY25E.

🔸The ratio of listed corporate capex to central government capex was at its peak (~5x) in FY09, indicating significant untapped potential for corporate capex resurgence.

(3/n)

Power: Decadal capex momentum across value chain

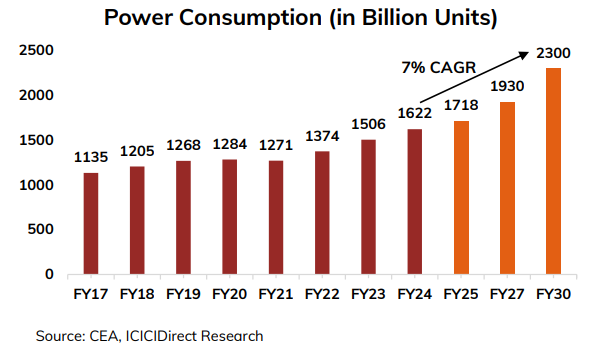

🔸India's power demand is expected to grow at 7% annually from FY24 to FY30.

🔸Renewable energy capacity will grow at 21% annually, while thermal energy will grow at 6% annually.

🔸This includes adding 125 GW of renewable energy to support the green hydrogen ecosystem.

🔸By FY30, renewables' share in India's energy mix is set to rise from 41% (FY23) to 61%.

🔸Achieving this will need a ₹30 lakh crore investment, with government utilities focusing on thermal and renewables and the private sector primarily on renewables.

(4/n)

🔸India's power demand is expected to grow at 7% annually from FY24 to FY30.

🔸Renewable energy capacity will grow at 21% annually, while thermal energy will grow at 6% annually.

🔸This includes adding 125 GW of renewable energy to support the green hydrogen ecosystem.

🔸By FY30, renewables' share in India's energy mix is set to rise from 41% (FY23) to 61%.

🔸Achieving this will need a ₹30 lakh crore investment, with government utilities focusing on thermal and renewables and the private sector primarily on renewables.

(4/n)

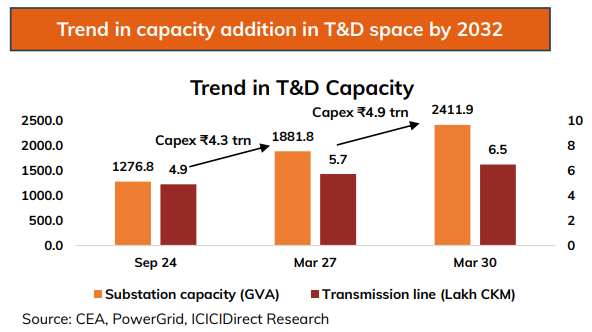

Power T&D– Strong focus of National Electricity Plan

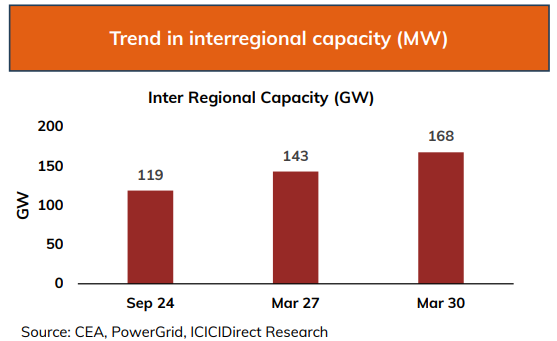

🔸The Ministry of Power has finalized the National Electricity Plan (NEP) for Central and State transmission systems, involving a massive investment of ₹9.15 lakh crore.

🔸The plan aims to address growing energy needs, targeting a peak demand of 458 GW by 2032.

Key upgrades include

🔸Transmission network capacity expansion from 4.9 lakh km to 6.5 lakh km.

🔸Transformer capacity increase from 1,277 GVA to 2,412 GVA (11.2% CAGR).

🔸Inter-region electricity transfer capacity rising from 119 GW to 168 GW.

Beneficiaries of asset additions

🔸Powergrid: Higher capex under the TBCB framework.

🔸KEC International & Kalpataru Projects: EPC work for transmission lines and substations.

🔸ABB: Substation equipment and transformers.

(5/n)

🔸The Ministry of Power has finalized the National Electricity Plan (NEP) for Central and State transmission systems, involving a massive investment of ₹9.15 lakh crore.

🔸The plan aims to address growing energy needs, targeting a peak demand of 458 GW by 2032.

Key upgrades include

🔸Transmission network capacity expansion from 4.9 lakh km to 6.5 lakh km.

🔸Transformer capacity increase from 1,277 GVA to 2,412 GVA (11.2% CAGR).

🔸Inter-region electricity transfer capacity rising from 119 GW to 168 GW.

Beneficiaries of asset additions

🔸Powergrid: Higher capex under the TBCB framework.

🔸KEC International & Kalpataru Projects: EPC work for transmission lines and substations.

🔸ABB: Substation equipment and transformers.

(5/n)

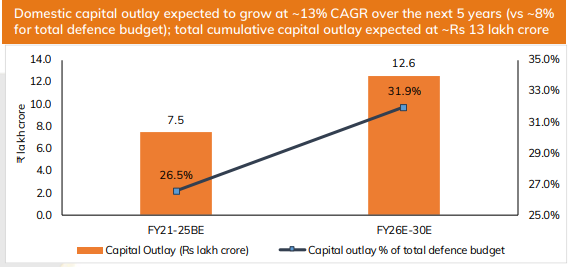

Defence Sector – A decade of transformation through indigenization

🔸Total capital outlay for defense is expected at ₹12-13 lakh crore over FY26-30.

🔸The domestic procurement budget has grown at a 15% CAGR over FY20-25, compared to total capital outlay growth of 9% CAGR. Domestic procurement now makes up 75% of the defense capital outlay, up from 58% in FY20.

🔸Contracts worth ₹8-10 lakh crore are expected to be awarded to domestic defense companies in the next 5-7 years, reflecting robust tendering and awarding activities.

🔸By FY29, the government targets:

- Annual defense production of ₹3 lakh crore (~19% CAGR).

- Defense exports of ₹50,000 crore (~19% CAGR).

🔸Policy reforms aim to boost indigenization, integrating private players, MSMEs, and start-ups into the defense supply chain.

🔸Defense electronics are projected to grow to 35-40% of total production (from the current 25-30%) due to the rising demand for modernized platforms.

(6/n)

🔸Total capital outlay for defense is expected at ₹12-13 lakh crore over FY26-30.

🔸The domestic procurement budget has grown at a 15% CAGR over FY20-25, compared to total capital outlay growth of 9% CAGR. Domestic procurement now makes up 75% of the defense capital outlay, up from 58% in FY20.

🔸Contracts worth ₹8-10 lakh crore are expected to be awarded to domestic defense companies in the next 5-7 years, reflecting robust tendering and awarding activities.

🔸By FY29, the government targets:

- Annual defense production of ₹3 lakh crore (~19% CAGR).

- Defense exports of ₹50,000 crore (~19% CAGR).

🔸Policy reforms aim to boost indigenization, integrating private players, MSMEs, and start-ups into the defense supply chain.

🔸Defense electronics are projected to grow to 35-40% of total production (from the current 25-30%) due to the rising demand for modernized platforms.

(6/n)

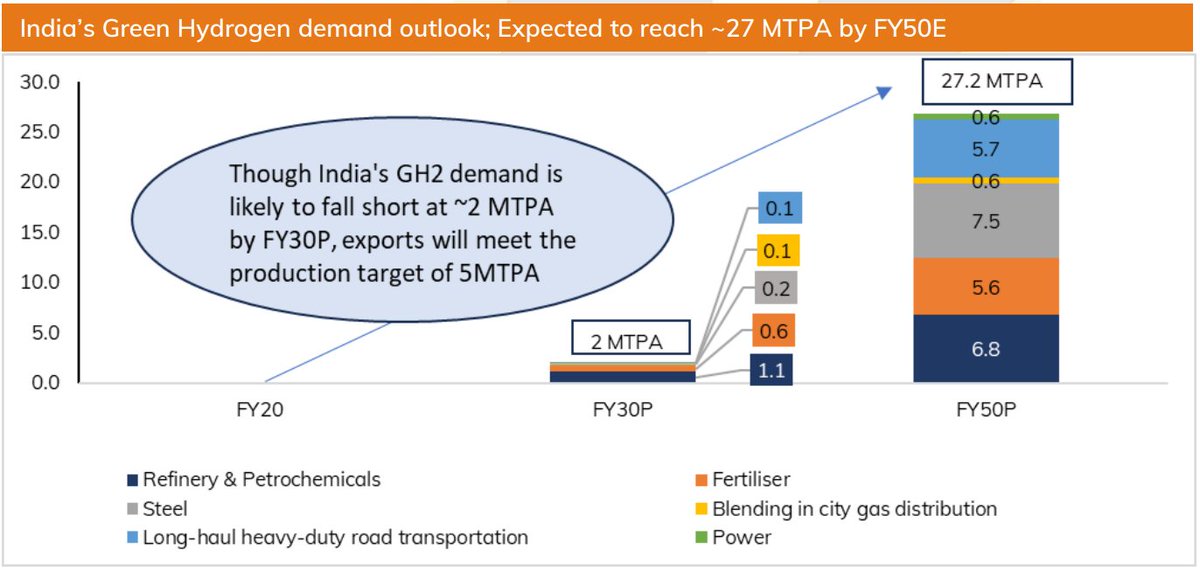

Green Hydrogen – India aiming for significant global share, presents huge opportunity

🔸Global hydrogen demand is expected to reach 150 MTPA by 2030, with 51 MTPA met through green hydrogen (GH2).

🔸In India, domestic green hydrogen demand is projected at 2 MTPA by FY30, below the National Green Hydrogen Mission's (NGHM) target of 5 MTPA, primarily due to high production costs.

🔸Green hydrogen costs (LCOH) are approximately 1.75x higher than grey hydrogen and 1.5x higher than brown hydrogen, hindering adoption.

🔸Economic viability depends on

- 35%-40% reduction in electrolyzer prices.

- 12%-14% improvement in efficiency.

- Continued policy support.

🔸Export markets will play a critical role in achieving India’s 5 MTPA GH2 production target, with countries like the EU, Japan, Singapore, and South Korea expressing interest in GH2 imports for decarbonization.

🔸Capex opportunity of ~₹10 lakh crore by 2030 across the GH2 value chain

- ₹4.5 lakh crore for renewable power.

- ₹4 lakh crore for ammonia production.

- ₹2 lakh crore for electrolyzers.

🔸LCOH of GH2 is expected to fall further from USD 1.6/kg by FY30, driven by reductions in renewable power and electrolyzer costs.

(7/n)

🔸Global hydrogen demand is expected to reach 150 MTPA by 2030, with 51 MTPA met through green hydrogen (GH2).

🔸In India, domestic green hydrogen demand is projected at 2 MTPA by FY30, below the National Green Hydrogen Mission's (NGHM) target of 5 MTPA, primarily due to high production costs.

🔸Green hydrogen costs (LCOH) are approximately 1.75x higher than grey hydrogen and 1.5x higher than brown hydrogen, hindering adoption.

🔸Economic viability depends on

- 35%-40% reduction in electrolyzer prices.

- 12%-14% improvement in efficiency.

- Continued policy support.

🔸Export markets will play a critical role in achieving India’s 5 MTPA GH2 production target, with countries like the EU, Japan, Singapore, and South Korea expressing interest in GH2 imports for decarbonization.

🔸Capex opportunity of ~₹10 lakh crore by 2030 across the GH2 value chain

- ₹4.5 lakh crore for renewable power.

- ₹4 lakh crore for ammonia production.

- ₹2 lakh crore for electrolyzers.

🔸LCOH of GH2 is expected to fall further from USD 1.6/kg by FY30, driven by reductions in renewable power and electrolyzer costs.

(7/n)

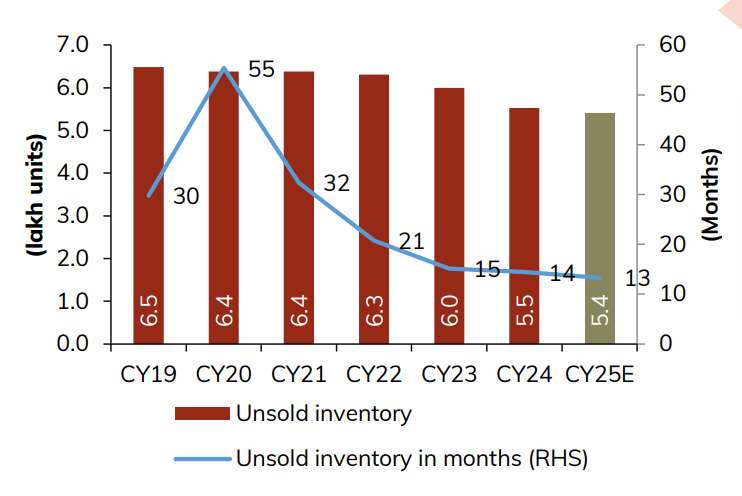

Real Estate – Bigger players to sustain growth

🔸The real estate sector saw 16% growth, reaching a sales value of ₹5.7 lakh crore, driven by price hikes and higher luxury home sales, leading to a 30% increase in realizations.

🔸Sales of homes priced above ₹4 crore grew by 37.8% YoY (CBRE data). This trend is expected to continue in 2025, fueled by rising economic confidence and a growing number of HNIs and UHNIs.

🔸Top 11 listed real estate players plan to launch ~253 mn sq ft over the next few years, with ~57 mn sq ft launched in H1FY25, indicating high supply in the upcoming quarters.

🔸Prices have increased 40-50% over 2-3 years, which may moderate demand.

🔸Growth will likely favor large players with strong balance sheets and a focus on luxury offerings.

(8/n)

🔸The real estate sector saw 16% growth, reaching a sales value of ₹5.7 lakh crore, driven by price hikes and higher luxury home sales, leading to a 30% increase in realizations.

🔸Sales of homes priced above ₹4 crore grew by 37.8% YoY (CBRE data). This trend is expected to continue in 2025, fueled by rising economic confidence and a growing number of HNIs and UHNIs.

🔸Top 11 listed real estate players plan to launch ~253 mn sq ft over the next few years, with ~57 mn sq ft launched in H1FY25, indicating high supply in the upcoming quarters.

🔸Prices have increased 40-50% over 2-3 years, which may moderate demand.

🔸Growth will likely favor large players with strong balance sheets and a focus on luxury offerings.

(8/n)

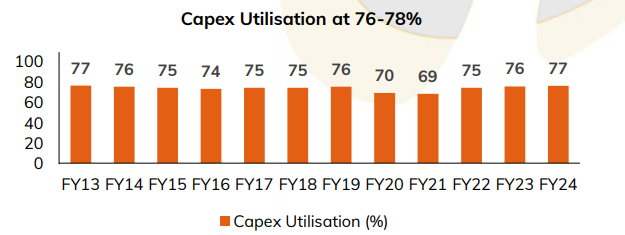

Banks: Corporate lending to steer growth from hereon

🔸Historically, private capex has outpaced government capex, but in the last 6-7 years, private capex has fallen to levels similar to government capex.

🔸With capacity utilization at 76-78%, a revival in private capex is anticipated.

🔸This revival is expected to drive corporate lending, becoming a key growth driver for advances, while the retail segment is likely to maintain steady growth.

(9/n)

🔸Historically, private capex has outpaced government capex, but in the last 6-7 years, private capex has fallen to levels similar to government capex.

🔸With capacity utilization at 76-78%, a revival in private capex is anticipated.

🔸This revival is expected to drive corporate lending, becoming a key growth driver for advances, while the retail segment is likely to maintain steady growth.

(9/n)

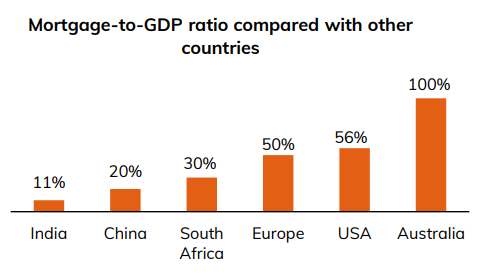

Housing Finance: Beneficiary with relative resilience

🔸India's mortgage penetration is currently lower than other emerging economies.

🔸Factors like rising per capita income, favourable demographics, and government initiatives are expected to fuel mortgage growth.

🔸The rising mortgage-to-GDP ratio indicates improved penetration, showcasing long-term growth potential for the sector.

(10/n)

🔸India's mortgage penetration is currently lower than other emerging economies.

🔸Factors like rising per capita income, favourable demographics, and government initiatives are expected to fuel mortgage growth.

🔸The rising mortgage-to-GDP ratio indicates improved penetration, showcasing long-term growth potential for the sector.

(10/n)

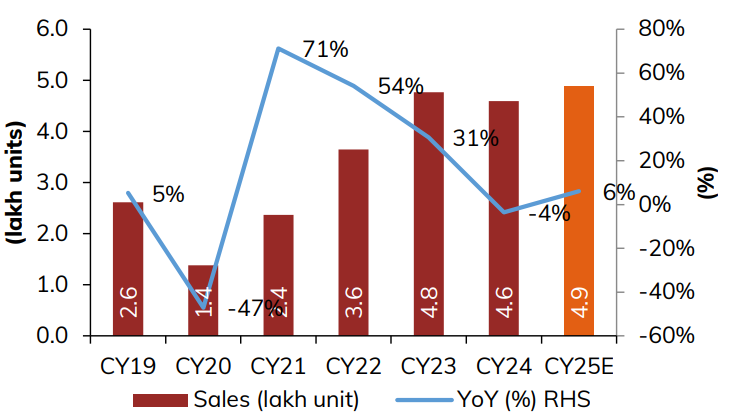

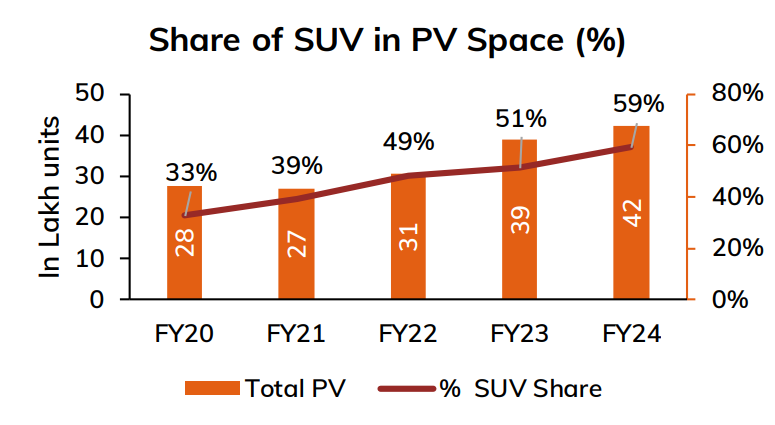

Auto Industry - Premiumization to drive value growth

🔸Domestic auto volumes have rebounded strongly, with PV sales surpassing all-time highs in FY23 and expected to grow modestly. Other segments are likely to peak by FY26-27.

🔸Consumers now prefer performance, technology, and safety-oriented vehicles, supported by higher disposable incomes.

🔸Over the last 5 years, 30+ SUVs were launched compared to only 4 hatchbacks and 3 sedans. SUV volumes grew at a CAGR of 22%, significantly outpacing the industry growth of 5%.

🔸There's a notable increase in features like sunroofs, automatic transmissions, and alloy wheels, reflecting a shift in consumer preferences.

(11/n)

🔸Domestic auto volumes have rebounded strongly, with PV sales surpassing all-time highs in FY23 and expected to grow modestly. Other segments are likely to peak by FY26-27.

🔸Consumers now prefer performance, technology, and safety-oriented vehicles, supported by higher disposable incomes.

🔸Over the last 5 years, 30+ SUVs were launched compared to only 4 hatchbacks and 3 sedans. SUV volumes grew at a CAGR of 22%, significantly outpacing the industry growth of 5%.

🔸There's a notable increase in features like sunroofs, automatic transmissions, and alloy wheels, reflecting a shift in consumer preferences.

(11/n)

Hospitals- Riding on improving macros besides premiumization theme

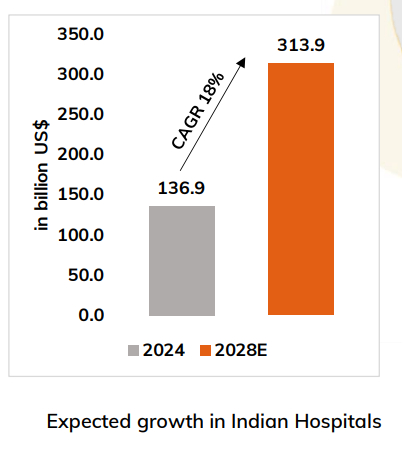

🔸The hospitals sector is projected to grow at a CAGR of ~18% from 2024-28, reaching $314 billion, driven by rising incomes, lifestyle changes, and improved diagnostics and insurance coverage.

🔸With existing capacities nearing saturation, hospitals plan to add 42% more beds over the next 3-4 years, led by 11 major players.

🔸A transition from communicable to non-communicable diseases is driving demand for high-end procedures and advanced treatments.

🔸Growth in radiology diagnostics supports early detection of critical diseases, leading to timely hospitalization.

🔸Accelerated adoption of health insurance post-COVID and rising awareness for quality treatment are key growth drivers.

(13/n)

🔸The hospitals sector is projected to grow at a CAGR of ~18% from 2024-28, reaching $314 billion, driven by rising incomes, lifestyle changes, and improved diagnostics and insurance coverage.

🔸With existing capacities nearing saturation, hospitals plan to add 42% more beds over the next 3-4 years, led by 11 major players.

🔸A transition from communicable to non-communicable diseases is driving demand for high-end procedures and advanced treatments.

🔸Growth in radiology diagnostics supports early detection of critical diseases, leading to timely hospitalization.

🔸Accelerated adoption of health insurance post-COVID and rising awareness for quality treatment are key growth drivers.

(13/n)

Loading suggestions...