(1) About company:

Hi-Tech Pipes Limited (HTPL) is one of India’s biggest steel pipe and tube manufacturers, producing structural tubes, CR sheets, galvanized coils, solar structures, and metal crash barriers. x.com

Hi-Tech Pipes Limited (HTPL) is one of India’s biggest steel pipe and tube manufacturers, producing structural tubes, CR sheets, galvanized coils, solar structures, and metal crash barriers. x.com

(2) Hi-Tech Pipes serves a broad range of industries:

- Infrastructure

- Real Estate

- Automobile

- Agriculture

- Oil & Gas

- Defense

- Industrial Sectors

- Telecommunications

- Housing

- Infrastructure

- Real Estate

- Automobile

- Agriculture

- Oil & Gas

- Defense

- Industrial Sectors

- Telecommunications

- Housing

(3) H1 FY25 consolidated performance:

Revenue: +13.31%

EBITDA: +77%

PAT: +95.46%

Sales Volume (MT): +32.59%

EBITDA per MT: +33.51% x.com

Revenue: +13.31%

EBITDA: +77%

PAT: +95.46%

Sales Volume (MT): +32.59%

EBITDA per MT: +33.51% x.com

(6) Management outlook for the company:

- Hi-Tech believes it can reach its FY25 target of 500,000 tons, having managed challenges in the first half and expecting a better second half of the year.

- Company plans to double its manufacturing capacity from 1 million to 2 million tons to meet rising demand in infrastructure, construction, and renewable energy.

- India's steel pipes and tubes market is 9-10 million tons and is expected to grow by 15% yearly.

- Company has received its largest order in the solar energy sector and expects growth to continue. Solar projects currently bring 10% of their revenue, and they plan to increase this.

- Hi-Tech believes it can reach its FY25 target of 500,000 tons, having managed challenges in the first half and expecting a better second half of the year.

- Company plans to double its manufacturing capacity from 1 million to 2 million tons to meet rising demand in infrastructure, construction, and renewable energy.

- India's steel pipes and tubes market is 9-10 million tons and is expected to grow by 15% yearly.

- Company has received its largest order in the solar energy sector and expects growth to continue. Solar projects currently bring 10% of their revenue, and they plan to increase this.

(8) Financial Metrics:

■ CMP: 162

■ Mcap: 3,298 crores

■ TTM PE: 67

■ Forward PE: 46

■ ROCE: 11%

■ ROE: 8%

■ D/E Ratio: 0.38

■ Current ratio: 1.63

■ OPM: 5%

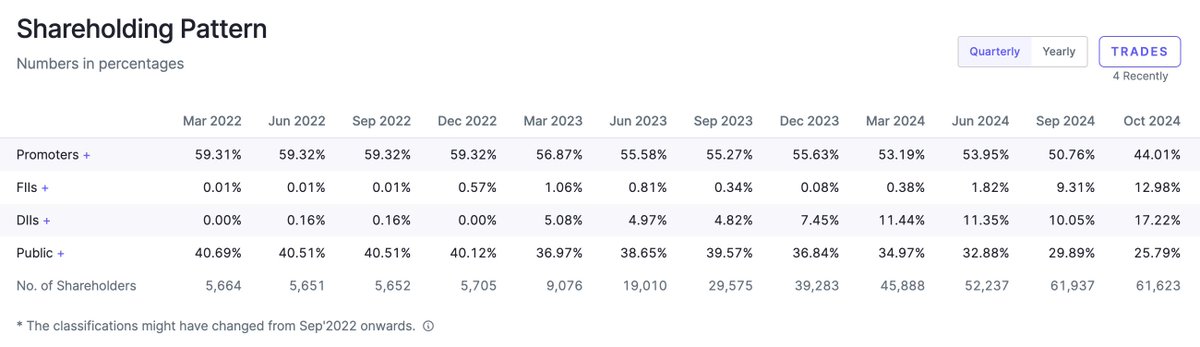

■ Promoter holdings: 44%

■ 3 years sales, profit growth: 29% and 31%

■ CMP: 162

■ Mcap: 3,298 crores

■ TTM PE: 67

■ Forward PE: 46

■ ROCE: 11%

■ ROE: 8%

■ D/E Ratio: 0.38

■ Current ratio: 1.63

■ OPM: 5%

■ Promoter holdings: 44%

■ 3 years sales, profit growth: 29% and 31%

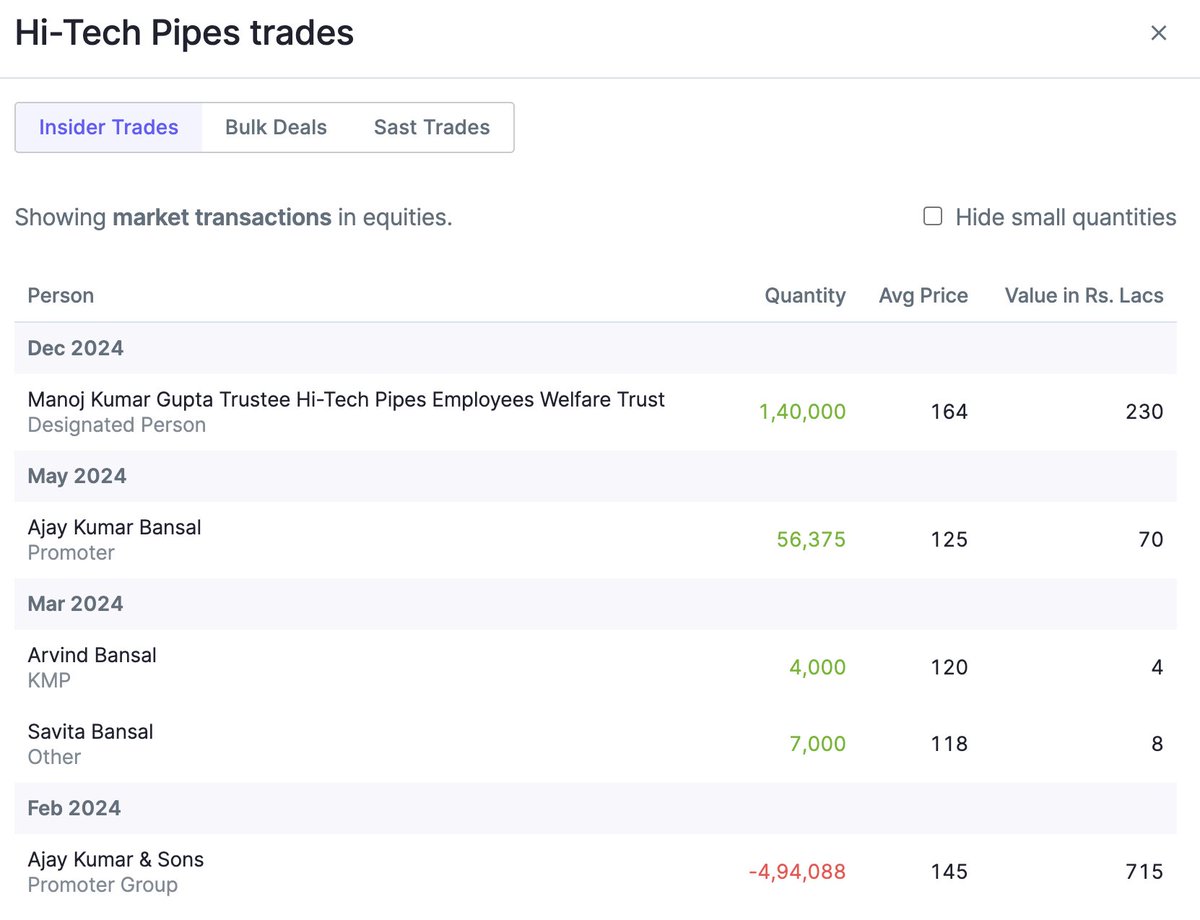

(9) Shareholding pattern:

- FII has been growing its stake over the past 4 quarters.

- DIIs raised their stake by 7.17% in the previous quarter. x.com

- FII has been growing its stake over the past 4 quarters.

- DIIs raised their stake by 7.17% in the previous quarter. x.com

(10) Chart overview:

Price chart is creating a wedge pattern at the 200 SMA, and a breakout above the upper line could spark an uptrend rally. x.com

Price chart is creating a wedge pattern at the 200 SMA, and a breakout above the upper line could spark an uptrend rally. x.com

That's it for today!

If you found this useful:

(1) Follow @rohaninvestor for more such threads.

(2) Bookmark this thread.

x.com

If you found this useful:

(1) Follow @rohaninvestor for more such threads.

(2) Bookmark this thread.

x.com

Loading suggestions...