Financial Ratios in Fundamental Analysis (A Mega Thread) full of learnings ...

Like & Share With all to spread learnings... x.com

Like & Share With all to spread learnings... x.com

1⃣

Understanding #financialratios is key to analysing a company’s financial health & comparing it with its peers.

Here’s a quick breakdown of the most important ratios every Indian investor must know! 👇👇👇

#fundamentalanalysis #investing

Understanding #financialratios is key to analysing a company’s financial health & comparing it with its peers.

Here’s a quick breakdown of the most important ratios every Indian investor must know! 👇👇👇

#fundamentalanalysis #investing

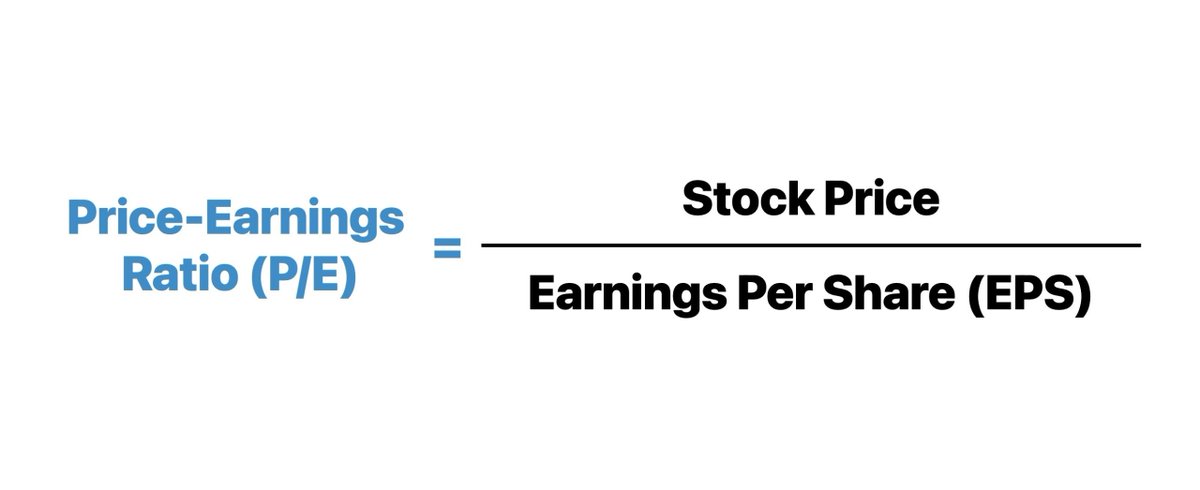

2⃣ - Price-to-Earnings (P/E) Ratio

Formula: Stock Price ÷ Earnings Per Share (EPS)

Shows how much you’re paying for ₹1 of earnings.

High P/E: Could indicate overvaluation or strong growth prospects.

Compare within the same industry.

#fundamentalanalysis x.com

Formula: Stock Price ÷ Earnings Per Share (EPS)

Shows how much you’re paying for ₹1 of earnings.

High P/E: Could indicate overvaluation or strong growth prospects.

Compare within the same industry.

#fundamentalanalysis x.com

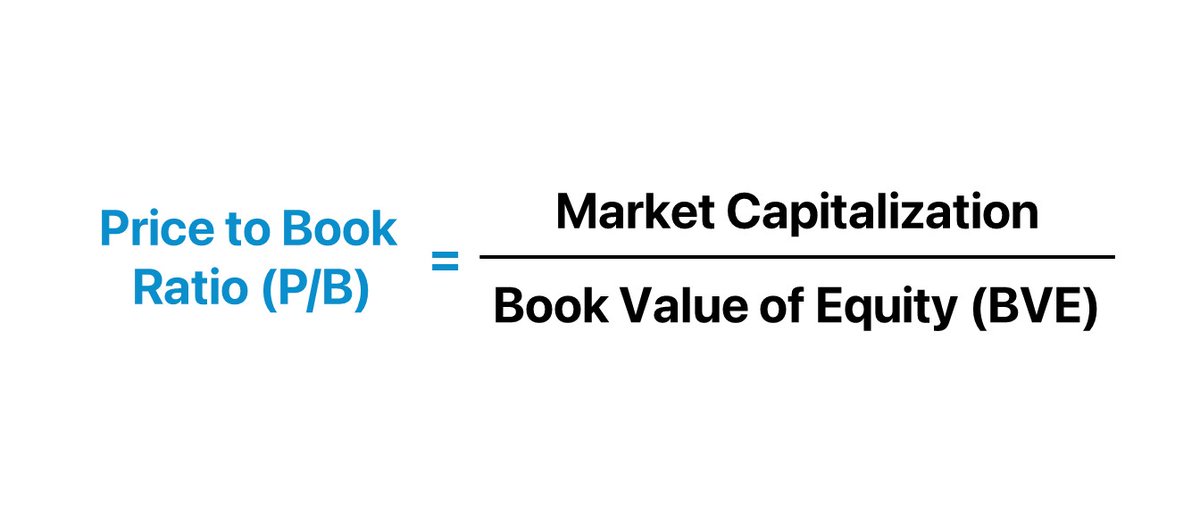

3⃣ - Price-to-Book (P/B) Ratio

Formula: Market Price ÷ Book Value Per Share

Useful for financial & asset-heavy sectors like banks, NBFCs & real estate.

Low P/B (<1) may signal undervaluation, but could also indicate poor fundamentals.

#fundamentalanalysis #investing #shares x.com

Formula: Market Price ÷ Book Value Per Share

Useful for financial & asset-heavy sectors like banks, NBFCs & real estate.

Low P/B (<1) may signal undervaluation, but could also indicate poor fundamentals.

#fundamentalanalysis #investing #shares x.com

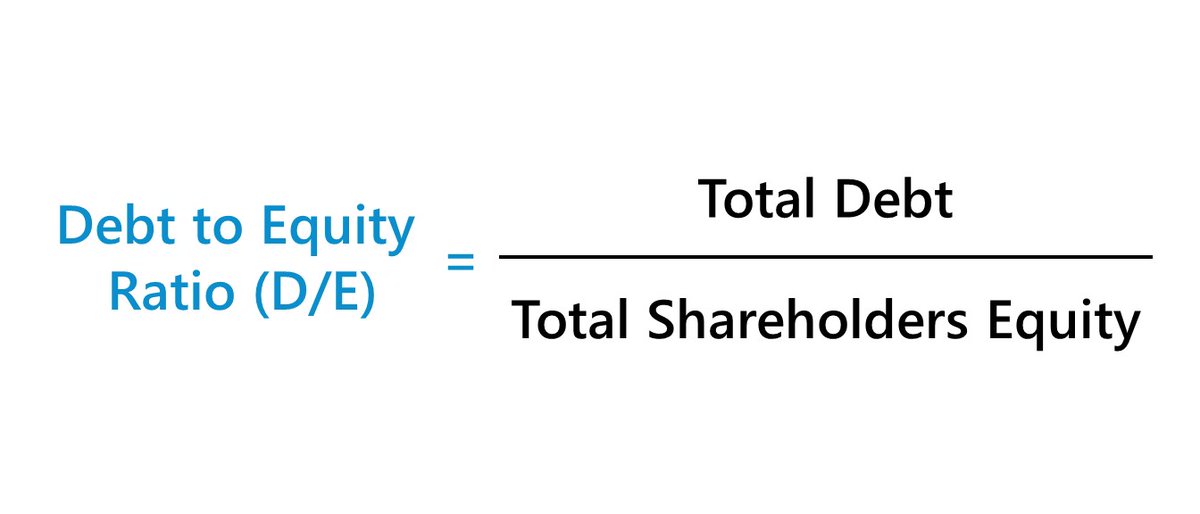

4⃣ - Debt-to-Equity (D/E) Ratio

Formula: Total Debt ÷ Shareholders’ Equity

Indicates a company’s leverage.

D/E <1 is considered safe for most industries.

Capital-intensive sectors (e.g., power, infra) may have higher D/E, but monitor cash flows!

@nid_rockz @caniravkaria x.com

Formula: Total Debt ÷ Shareholders’ Equity

Indicates a company’s leverage.

D/E <1 is considered safe for most industries.

Capital-intensive sectors (e.g., power, infra) may have higher D/E, but monitor cash flows!

@nid_rockz @caniravkaria x.com

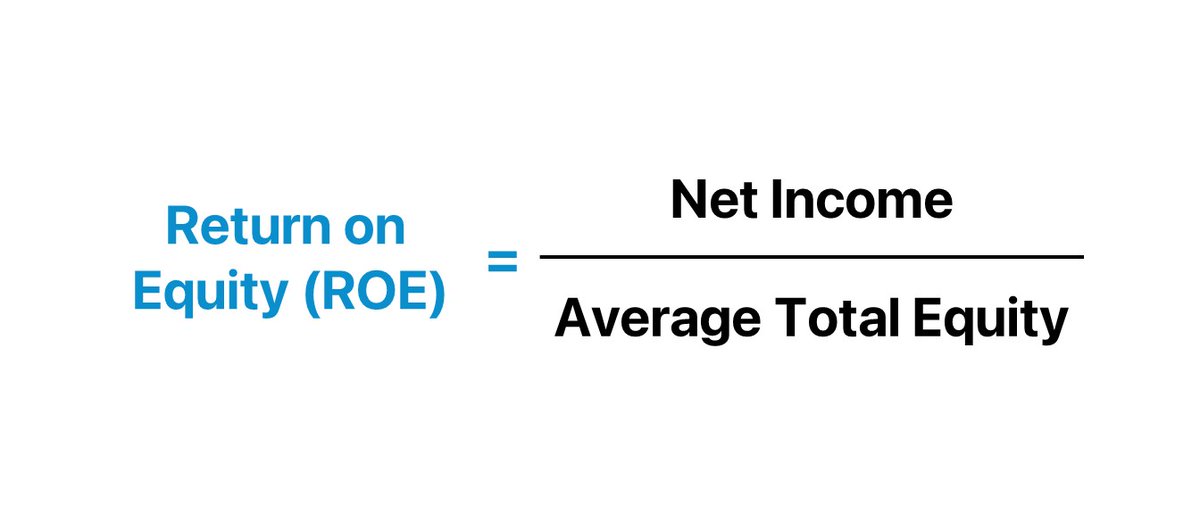

5⃣ - Return on Equity (ROE)

Formula: Net Income ÷ Shareholders’ Equity

Measures how efficiently a company uses shareholders' funds to generate profits.

High ROE (>20% is ideal) is a good sign, but beware of companies with high debt boosting ROE artificially. x.com

Formula: Net Income ÷ Shareholders’ Equity

Measures how efficiently a company uses shareholders' funds to generate profits.

High ROE (>20% is ideal) is a good sign, but beware of companies with high debt boosting ROE artificially. x.com

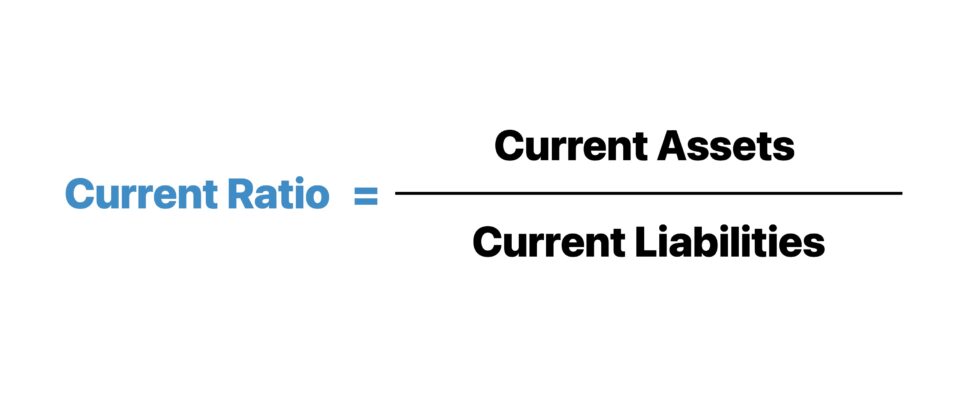

6⃣ - Current Ratio

Formula: Current Assets ÷ Current Liabilities

Reflects short-term liquidity.

Ideal range: 1.5 to 2. A ratio <1 indicates possible liquidity stress.

Useful when analysing small & mid-cap companies with tight working capital cycles. x.com

Formula: Current Assets ÷ Current Liabilities

Reflects short-term liquidity.

Ideal range: 1.5 to 2. A ratio <1 indicates possible liquidity stress.

Useful when analysing small & mid-cap companies with tight working capital cycles. x.com

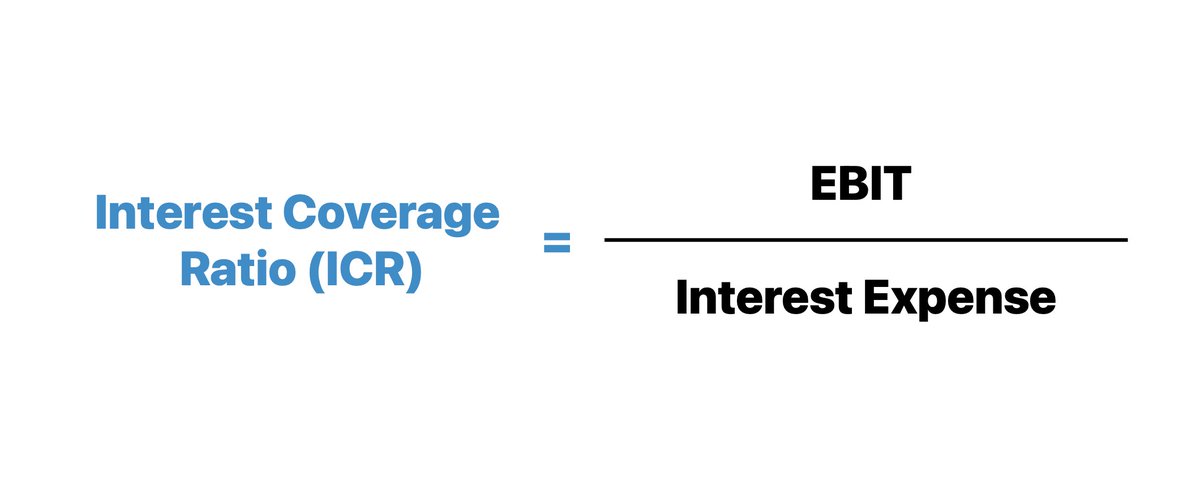

7⃣ - Interest Coverage Ratio

Formula: EBIT ÷ Interest Expense

Measures a company’s ability to pay interest on its debt.

Higher = Safer. A ratio <2 can indicate financial stress.

E.g., Critical for analysing Indian companies in sectors like steel, infra, or airlines. x.com

Formula: EBIT ÷ Interest Expense

Measures a company’s ability to pay interest on its debt.

Higher = Safer. A ratio <2 can indicate financial stress.

E.g., Critical for analysing Indian companies in sectors like steel, infra, or airlines. x.com

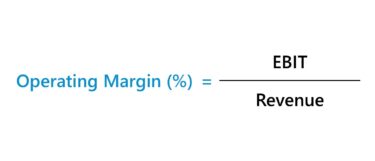

8⃣ - Operating Profit Margin (OPM)

Formula: Operating Profit ÷ Revenue

High OPM = Operational efficiency & pricing power.

Compare OPM across time to track margin trends.

E.g., FMCG companies like Nestlé India often have stable & high OPM due to brand strength. x.com

Formula: Operating Profit ÷ Revenue

High OPM = Operational efficiency & pricing power.

Compare OPM across time to track margin trends.

E.g., FMCG companies like Nestlé India often have stable & high OPM due to brand strength. x.com

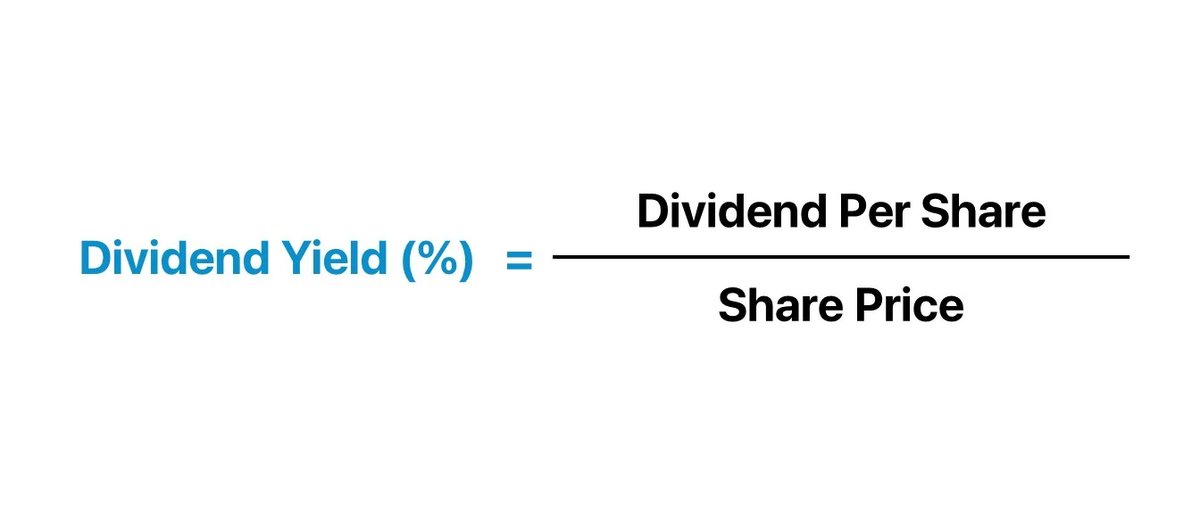

9⃣ - Dividend Yield

Formula: Annual Dividend ÷ Market Price

A higher dividend yield (>3%) is attractive for income-focused investors.

#StockMarket #StockMarketIndia #Shares x.com

Formula: Annual Dividend ÷ Market Price

A higher dividend yield (>3%) is attractive for income-focused investors.

#StockMarket #StockMarketIndia #Shares x.com

🔟 - Earnings Per Share (EPS)

Formula: Net Profit ÷ Total Shares Outstanding

Shows profitability per share. A consistently rising EPS indicates strong fundamentals.

E.g., Compare EPS growth trends of companies. x.com

Formula: Net Profit ÷ Total Shares Outstanding

Shows profitability per share. A consistently rising EPS indicates strong fundamentals.

E.g., Compare EPS growth trends of companies. x.com

1⃣1⃣ - Pro Tip

Financial Ratios are indicators, not absolute truths.

Always compare them with industry peers & averages.

Dig deeper into the reasons behind good or bad numbers to uncover the full story! 📚

Learn basics of Fundamental Analysis Before Investing in any Stock.

Financial Ratios are indicators, not absolute truths.

Always compare them with industry peers & averages.

Dig deeper into the reasons behind good or bad numbers to uncover the full story! 📚

Learn basics of Fundamental Analysis Before Investing in any Stock.

Beginners can read this book to learn basics of Fundamental Analysis of Shares -

amzn.to

Book is also available in Hindi, Gujarati and Marathi languages on Amazon and Flipkart.

amzn.to

Book is also available in Hindi, Gujarati and Marathi languages on Amazon and Flipkart.

Loading suggestions...