How does Warren Buffett calculate the intrinsic value of a stock?

He looks at the Owner’s Earnings.

Today, I'll teach you everything you should know 👇 x.com

He looks at the Owner’s Earnings.

Today, I'll teach you everything you should know 👇 x.com

1. Formula

Owner’s Earnings = Earnings Per Share (EPS) + Dividend Per Share

It reflects the real cash flow available to investors after all expenses are covered. x.com

Owner’s Earnings = Earnings Per Share (EPS) + Dividend Per Share

It reflects the real cash flow available to investors after all expenses are covered. x.com

2. Importance

In the long run, stock prices always follow a company’s Owner’s Earnings. 📈

By focusing on this metric, you can:

- Avoid market noise

- See a company’s true performance

In the long run, stock prices always follow a company’s Owner’s Earnings. 📈

By focusing on this metric, you can:

- Avoid market noise

- See a company’s true performance

3. Owner's Earnings growth > 12%

We want to invest in companies that can grow their Owner’s Earnings by at least 12% annually.

The higher the growth, the better your returns.

We want to invest in companies that can grow their Owner’s Earnings by at least 12% annually.

The higher the growth, the better your returns.

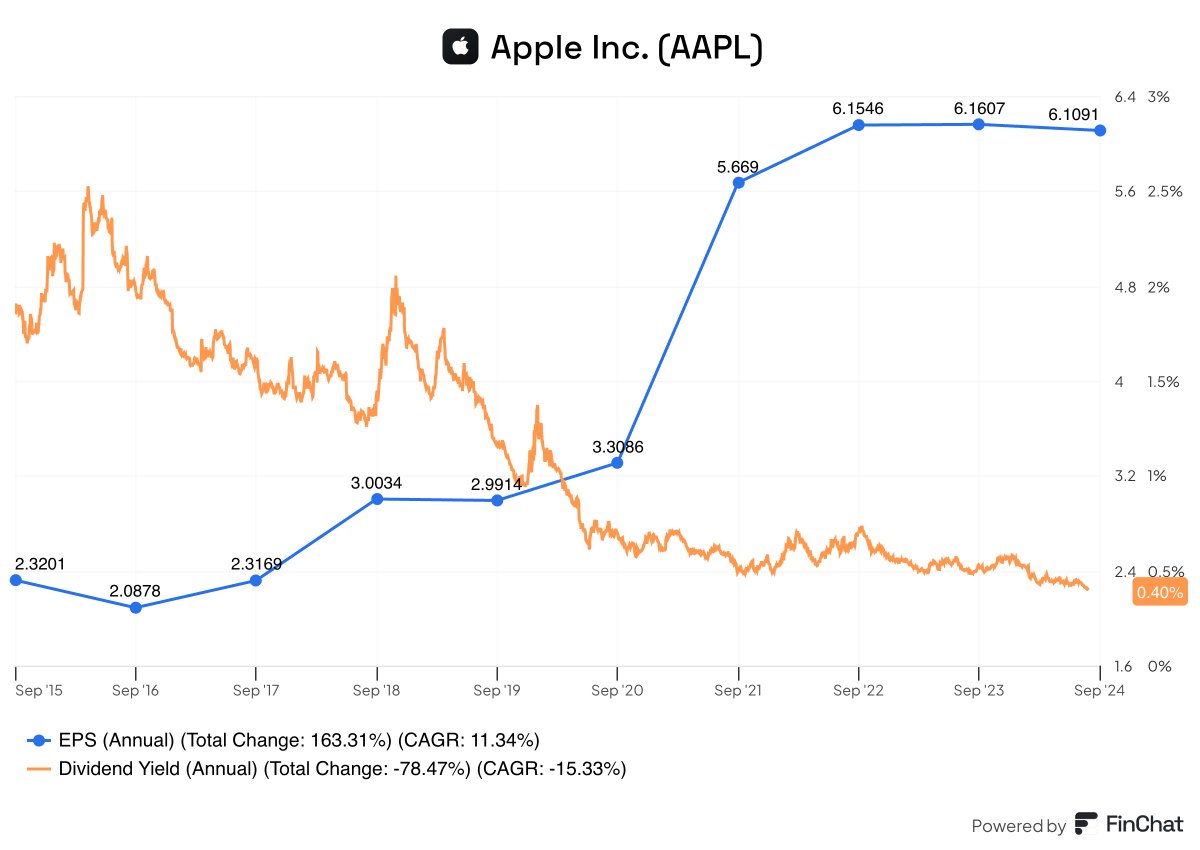

4. Example

Growth in Owner's Earnings = EPS Growth + Dividend Yield

Apple as an example:

If EPS grows 11.3%

Dividend yield is 0.4%

➡️ Growth in Owner’s Earnings = 11.7% x.com

Growth in Owner's Earnings = EPS Growth + Dividend Yield

Apple as an example:

If EPS grows 11.3%

Dividend yield is 0.4%

➡️ Growth in Owner’s Earnings = 11.7% x.com

5. Conclusion

Focusing on Owner's Earnings gives you clarity.

No noise from short-term market swings

A true picture of long-term profitability x.com

Focusing on Owner's Earnings gives you clarity.

No noise from short-term market swings

A true picture of long-term profitability x.com

That's it for today. Did you enjoy this?

Grab this PDF with more than 100 (!) examples of Quality Stocks: compounding-quality.ck.page

Grab this PDF with more than 100 (!) examples of Quality Stocks: compounding-quality.ck.page

Loading suggestions...