What just happened?

The Fed cut interest rates by 25 basis points which is exactly what 97% of market participants wanted.

But, the S&P 500 just posted its largest post-Fed drop since March 2020, erasing $1.8 TRILLION of market cap.

Why? Let us explain.

(a thread)

The Fed cut interest rates by 25 basis points which is exactly what 97% of market participants wanted.

But, the S&P 500 just posted its largest post-Fed drop since March 2020, erasing $1.8 TRILLION of market cap.

Why? Let us explain.

(a thread)

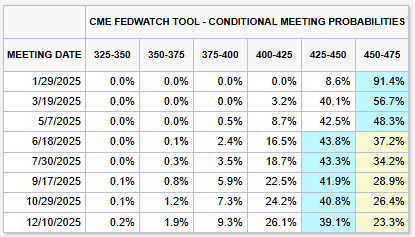

Going into the Fed decision, there was a 97% chance of the Fed cutting interest rates by 25 basis points.

Their 25 basis point cut marked 100 basis points of cuts in 2024, "continuing" the Fed pivot.

However, markets price-in Fed decisions well before they are announced. x.com

Their 25 basis point cut marked 100 basis points of cuts in 2024, "continuing" the Fed pivot.

However, markets price-in Fed decisions well before they are announced. x.com

In reality, today's market reaction had NOTHING to do with the rate decision.

Rather, it would about the Fed's outlook for 2025 which shifted SHARPLY in the hawkish direction.

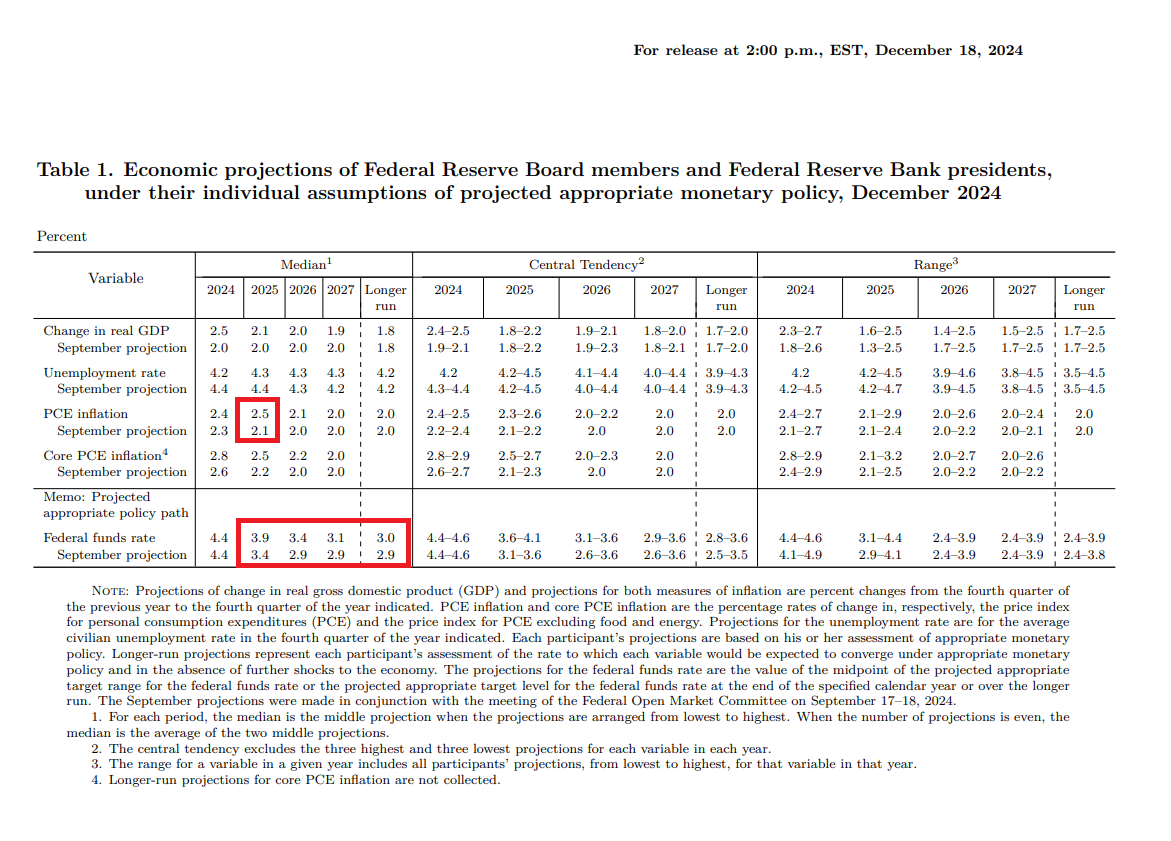

As seen below, the Fed revised their 2025 outlook from 3 rate cuts to 2 rate cuts, a total of 50 bps. x.com

Rather, it would about the Fed's outlook for 2025 which shifted SHARPLY in the hawkish direction.

As seen below, the Fed revised their 2025 outlook from 3 rate cuts to 2 rate cuts, a total of 50 bps. x.com

Meanwhile, the Fed raised their PCE inflation expectation from 2.1% to 2.5% at the end of 2025.

Furthermore, the Fed now sees inflation at 2.1% at the end of 2026, still slightly above their 2.0% target.

Clearly, the Fed has acknowledged that inflation is an issue, once again. x.com

Furthermore, the Fed now sees inflation at 2.1% at the end of 2026, still slightly above their 2.0% target.

Clearly, the Fed has acknowledged that inflation is an issue, once again. x.com

As we explained in our December 15th thread, inflation is clearly back on the rise.

In fact, 3-month annualized core CPI inflation is now back up to an alarming 4%!

Core PCE inflation is trending back toward 3.5%+ and PPI inflation is also on the rise.

x.com

In fact, 3-month annualized core CPI inflation is now back up to an alarming 4%!

Core PCE inflation is trending back toward 3.5%+ and PPI inflation is also on the rise.

x.com

The stock market's decline accelerated after Powell said one specific sentence in his press conference today:

"Today was a closer call but we decided it was the right call."

The US Dollar surged to its highest since November 2022 after he said that. x.com

"Today was a closer call but we decided it was the right call."

The US Dollar surged to its highest since November 2022 after he said that. x.com

On top of this, Cleveland Fed President Beth Hammack dissented in today's decision.

1 out of 19 Fed officials sees no rate cuts in 2024 and 3 officials see just 2 rate cuts.

Only 5 Fed officials currently see 3 or more interest rate cuts in 2025 in a sudden hawkish shift. x.com

1 out of 19 Fed officials sees no rate cuts in 2024 and 3 officials see just 2 rate cuts.

Only 5 Fed officials currently see 3 or more interest rate cuts in 2025 in a sudden hawkish shift. x.com

This led to what appears to have been the biggest panic sell in the market since the Yen carry trade collapsed.

Small cap stocks fell nearly 5% today and the Dow posted a 10-day losing streak for the first time since 1974.

Sentiment is shifting as we look into 2025. x.com

Small cap stocks fell nearly 5% today and the Dow posted a 10-day losing streak for the first time since 1974.

Sentiment is shifting as we look into 2025. x.com

In a market that has been so strongly driven by momentum, today marked a clear reversal.

Sentiment will almost always win over fundamentals when talking about near-term fluctuations in markets.

Sentiment is the ultimate driver of price.

Can sentiment be restored here? x.com

Sentiment will almost always win over fundamentals when talking about near-term fluctuations in markets.

Sentiment is the ultimate driver of price.

Can sentiment be restored here? x.com

As we began writing four weeks ago, we expect larger swings in markets ahead.

Volatility is set to return in 2025 and we are trading it.

Want to get ahead of the next big move?

Subscribe now at the link below to access our analysis and alerts:

thekobeissiletter.com

Volatility is set to return in 2025 and we are trading it.

Want to get ahead of the next big move?

Subscribe now at the link below to access our analysis and alerts:

thekobeissiletter.com

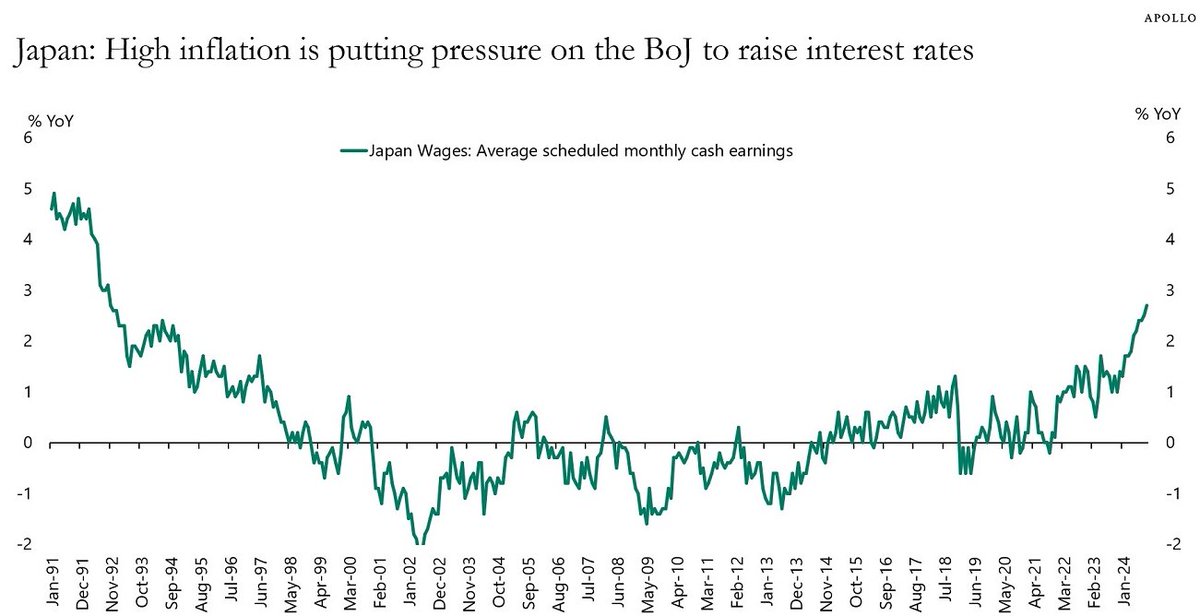

Lastly, global economies are at an incredibly unique point in time right now.

While the US is cutting rates, Japan is raising rates.

And while China deals with deflation, Europe and the US have inflation.

Follow us @KobeissiLetter for real time analysis as this develops. x.com

While the US is cutting rates, Japan is raising rates.

And while China deals with deflation, Europe and the US have inflation.

Follow us @KobeissiLetter for real time analysis as this develops. x.com

Loading suggestions...