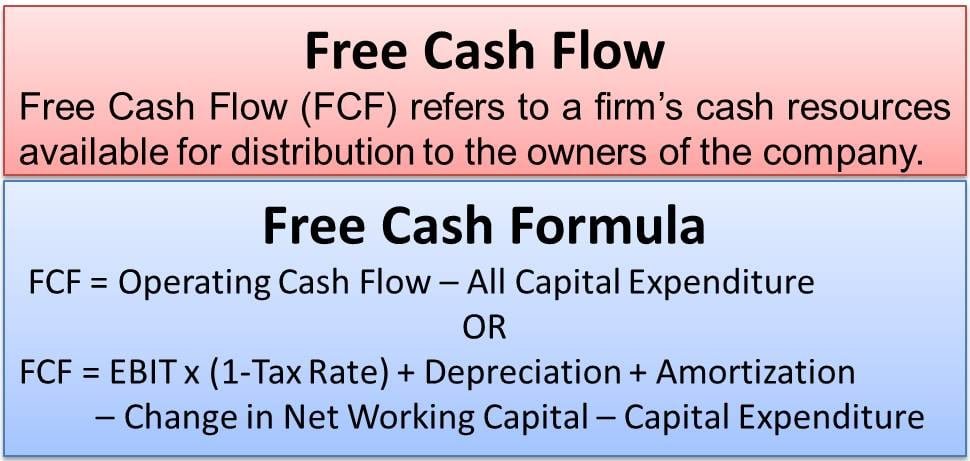

1. What is free cash flow?

FCF is the cash that enters a company minus the cash that leaves it over a specific period. x.com

FCF is the cash that enters a company minus the cash that leaves it over a specific period. x.com

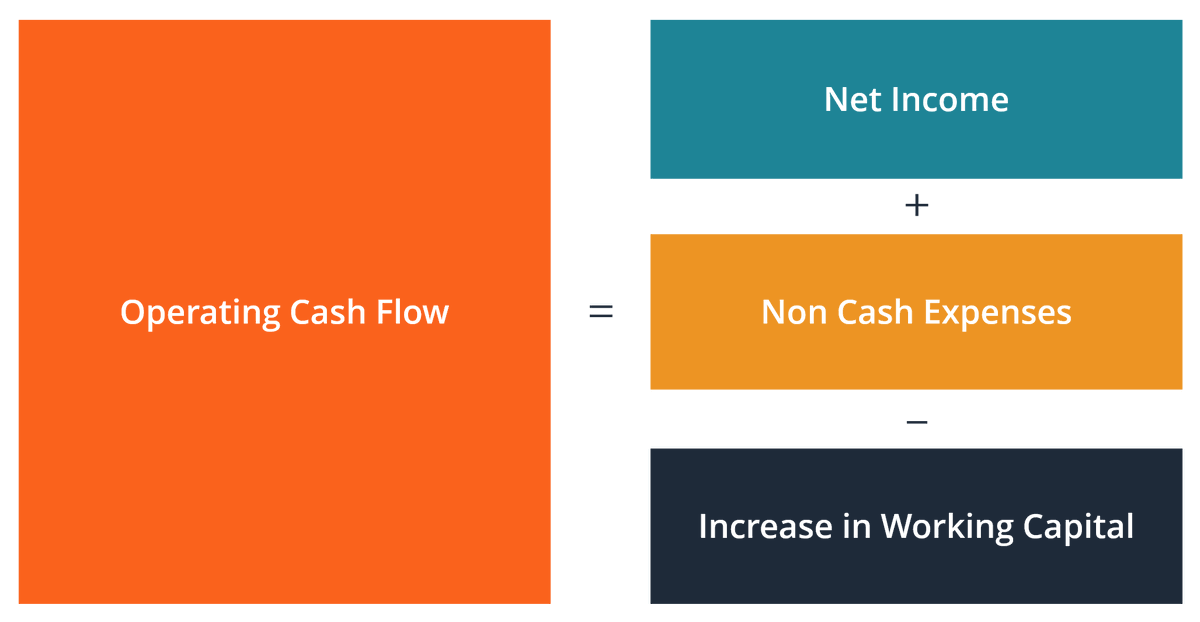

2. Operating cash flow (OCF)

This measures the cash generated from a company's normal business operations.

Think of it as the cash created by selling products or services. x.com

This measures the cash generated from a company's normal business operations.

Think of it as the cash created by selling products or services. x.com

3. CAPEX stands for capital expenditures. It's the money spent to maintain or grow a company's physical assets, like buildings or machinery.

🔹 Maintenance CAPEX = Investments in existing assets

🔹 Growth CAPEX = Investments in new assets for expansion x.com

🔹 Maintenance CAPEX = Investments in existing assets

🔹 Growth CAPEX = Investments in new assets for expansion x.com

4. CAPEX changes FCF

FCF can decrease when a company invests heavily in growth (high Growth CAPEX).

This isn’t always bad—growth investments create long-term value if done wisely.

Some prefer calculating FCF using only Maintenance CAPEX: x.com

FCF can decrease when a company invests heavily in growth (high Growth CAPEX).

This isn’t always bad—growth investments create long-term value if done wisely.

Some prefer calculating FCF using only Maintenance CAPEX: x.com

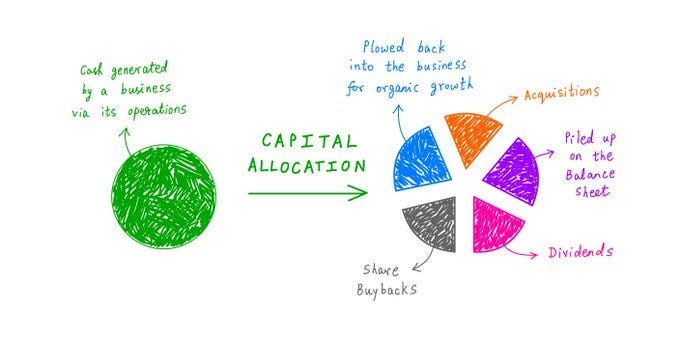

5. Capital allocation

Here’s how companies can allocate FCF:

✅ Reinvest in organic growth

✅ Pay down debt

✅ Mergers & Acquisitions (M&A)

✅ Pay dividends

✅ Buy back shares

Efficient capital allocation is key to long-term success. x.com

Here’s how companies can allocate FCF:

✅ Reinvest in organic growth

✅ Pay down debt

✅ Mergers & Acquisitions (M&A)

✅ Pay dividends

✅ Buy back shares

Efficient capital allocation is key to long-term success. x.com

6. Why is FCF important?

Unlike net income, FCF shows actual cash movement—not just accounting metrics.

Earnings are an opinion; cash is a fact.

Unlike net income, FCF shows actual cash movement—not just accounting metrics.

Earnings are an opinion; cash is a fact.

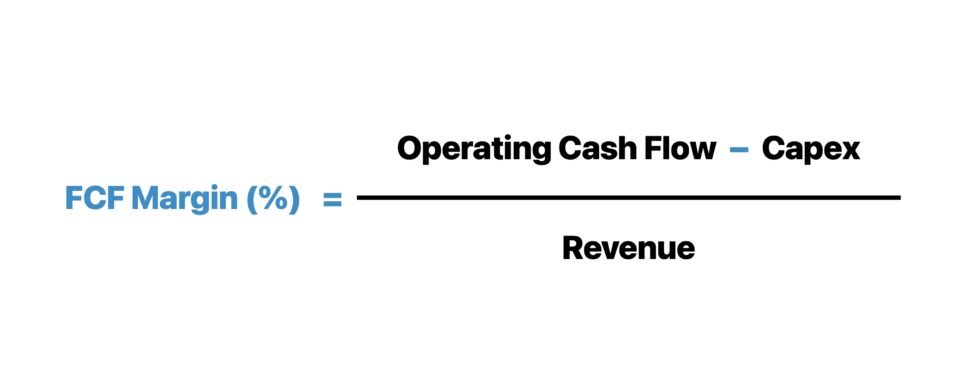

7. FCF Margin

Want to measure profitability?

Look at the FCF margin.

For example, Visa has a 52.0% FCF margin, generating $52 in cash for every $100 in sales. Compare that to General Electric’s 6.9%. 🤔 x.com

Want to measure profitability?

Look at the FCF margin.

For example, Visa has a 52.0% FCF margin, generating $52 in cash for every $100 in sales. Compare that to General Electric’s 6.9%. 🤔 x.com

8. FCF Conversion

Quality companies convert most of their earnings into FCF.

FCF Conversion = (Free Cash Flow / Net Earnings)

Large gaps between earnings and FCF signal low earnings quality.

Quality companies convert most of their earnings into FCF.

FCF Conversion = (Free Cash Flow / Net Earnings)

Large gaps between earnings and FCF signal low earnings quality.

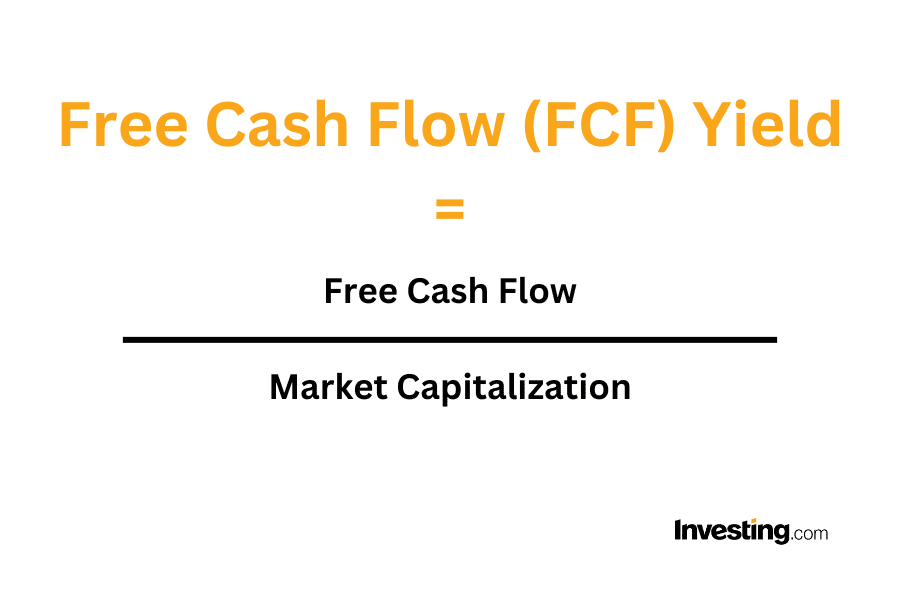

9. FCF Yield

FCF Yield helps assess a company’s valuation.

The higher the FCF Yield, the cheaper the stock.

Compare this to a company's historical average for perspective. x.com

FCF Yield helps assess a company’s valuation.

The higher the FCF Yield, the cheaper the stock.

Compare this to a company's historical average for perspective. x.com

10. Beware of Stock-Based Compensation!

Some tech companies dilute shareholder value by issuing stock to employees.

To account for this, adjust FCF:

FCF = Operating Cash Flow - CAPEX - Stock-Based Compensation

Some tech companies dilute shareholder value by issuing stock to employees.

To account for this, adjust FCF:

FCF = Operating Cash Flow - CAPEX - Stock-Based Compensation

11. Bottom Line:

Free Cash Flow is a powerful metric for evaluating companies. It’s more reliable than earnings and shows you where a company stands financially.

Want to make better investment decisions? Focus on FCF and how companies allocate it! x.com

Free Cash Flow is a powerful metric for evaluating companies. It’s more reliable than earnings and shows you where a company stands financially.

Want to make better investment decisions? Focus on FCF and how companies allocate it! x.com

That's it for today.

Did you enjoy this? Grab the e-book about mastering free cash flow right here: compounding-quality.kit.com

Did you enjoy this? Grab the e-book about mastering free cash flow right here: compounding-quality.kit.com

Loading suggestions...