Which is a better measure of Valuation ~ 𝗣/𝗘 𝗼𝗿 𝗘𝗩/𝗘𝗕𝗜𝗧𝗗𝗔?

Let's find out⤵️

#StockMarketIndia #Finances

Let's find out⤵️

#StockMarketIndia #Finances

𝗪𝗵𝗮𝘁 𝗶𝘀 𝗣/𝗘 𝗥𝗮𝘁𝗶𝗼?

➱Formula: Price of 1 Share ÷ Earnings Per Share (EPS)

➱Meaning: How much ₹ investors are willing to pay for every ₹1 a company earns.

Think of P/E as the price you pay for a restaurant's meal vs. how tasty (valuable) that meal actually is.

➱Formula: Price of 1 Share ÷ Earnings Per Share (EPS)

➱Meaning: How much ₹ investors are willing to pay for every ₹1 a company earns.

Think of P/E as the price you pay for a restaurant's meal vs. how tasty (valuable) that meal actually is.

𝗗𝗿𝗮𝘄𝗯𝗮𝗰𝗸𝘀 𝗼𝗳 𝗣/𝗘 𝗥𝗮𝘁𝗶𝗼 🚨

1️⃣It ignores debt:

• P/E only looks at equity value

• If a company has huge loans, it might show a low P/E and look cheap, even if it’s not.

1️⃣It ignores debt:

• P/E only looks at equity value

• If a company has huge loans, it might show a low P/E and look cheap, even if it’s not.

2️⃣P/E reflects market perception:

• Share price (numerator) is decided by investors.

• High-growth or “famous” companies often get a higher P/E.

• Share price (numerator) is decided by investors.

• High-growth or “famous” companies often get a higher P/E.

3️⃣Growth Matters:

A P/E ratio alone isn’t enough.

Why? A company growing 20% every year will justify a higher P/E than one growing 5%.

A P/E ratio alone isn’t enough.

Why? A company growing 20% every year will justify a higher P/E than one growing 5%.

𝗪𝗵𝗮𝘁 𝗮𝗯𝗼𝘂𝘁 𝗘𝗩/𝗘𝗕𝗜𝗧𝗗𝗔 𝗥𝗮𝘁𝗶𝗼? 🤔This ratio has 2 parts:

1️⃣ EV (Enterprise Value) = What it costs to buy the entire company today.

Formula: Equity Value + Debt – Cash

1️⃣ EV (Enterprise Value) = What it costs to buy the entire company today.

Formula: Equity Value + Debt – Cash

2️⃣ EBITDA = Operating Profit before interest, tax, depreciation & amortization.

Basically, What the business earns from operations.

Basically, What the business earns from operations.

Let's simplify EV with a Shop Example:

Imagine you’re buying a shop for ₹10L.

🔹 The seller has a ₹2L loan

🔹 The shop has ₹3L cash in its tijori

Your actual “cost” of acquiring the shop:

₹10L (price) + ₹2L (loan) - ₹3L (cash) = ₹9L

That’s the Enterprise Value (EV)

Imagine you’re buying a shop for ₹10L.

🔹 The seller has a ₹2L loan

🔹 The shop has ₹3L cash in its tijori

Your actual “cost” of acquiring the shop:

₹10L (price) + ₹2L (loan) - ₹3L (cash) = ₹9L

That’s the Enterprise Value (EV)

𝗪𝗵𝗮𝘁 𝗮𝗯𝗼𝘂𝘁 𝗘𝗕𝗜𝗧𝗗𝗔?

It's like looking at a shop's core profits without worrying about extra costs like:

• Loan interest payments

• Taxes

• Depreciation of assets

Why?

Bcoz these costs vary by business, & EBITDA helps compare their true operating performance

It's like looking at a shop's core profits without worrying about extra costs like:

• Loan interest payments

• Taxes

• Depreciation of assets

Why?

Bcoz these costs vary by business, & EBITDA helps compare their true operating performance

𝗘𝗩/𝗘𝗕𝗜𝗧𝗗𝗔: 𝗪𝗵𝗮𝘁 𝗱𝗼𝗲𝘀 𝗶𝘁 𝗺𝗲𝗮𝗻?

It tells you the payback period for your investment.

Example:

If EV = ₹2000 Cr & EBITDA = ₹200 Cr:

EV/EBITDA = 10x

Meaning: It’ll take 10 years for the company’s operating profits to repay your investment.

It tells you the payback period for your investment.

Example:

If EV = ₹2000 Cr & EBITDA = ₹200 Cr:

EV/EBITDA = 10x

Meaning: It’ll take 10 years for the company’s operating profits to repay your investment.

𝗪𝗵𝗶𝗰𝗵 𝗥𝗮𝘁𝗶𝗼 𝗶𝘀 𝗕𝗲𝘁𝘁𝗲𝗿? ⚖️

➱ P/E Ratio: Best for sectors with high growth & low debt (e.g., IT).

➱ EV/EBITDA: Best for capital-intensive sectors with high debt, like:

• Cement🏗️

• Steel 🏢

• Telecom 📞

It accounts for debt and gives a clearer picture.

➱ P/E Ratio: Best for sectors with high growth & low debt (e.g., IT).

➱ EV/EBITDA: Best for capital-intensive sectors with high debt, like:

• Cement🏗️

• Steel 🏢

• Telecom 📞

It accounts for debt and gives a clearer picture.

Final Verdict 🏆

• Use P/E for growth-focused, low-debt companies.

• Use EV/EBITDA for high-debt sectors or M&A analysis.

Smart investors use both depending on the situation.

What’s your favorite ratio? Drop your thoughts below⤵️

• Use P/E for growth-focused, low-debt companies.

• Use EV/EBITDA for high-debt sectors or M&A analysis.

Smart investors use both depending on the situation.

What’s your favorite ratio? Drop your thoughts below⤵️

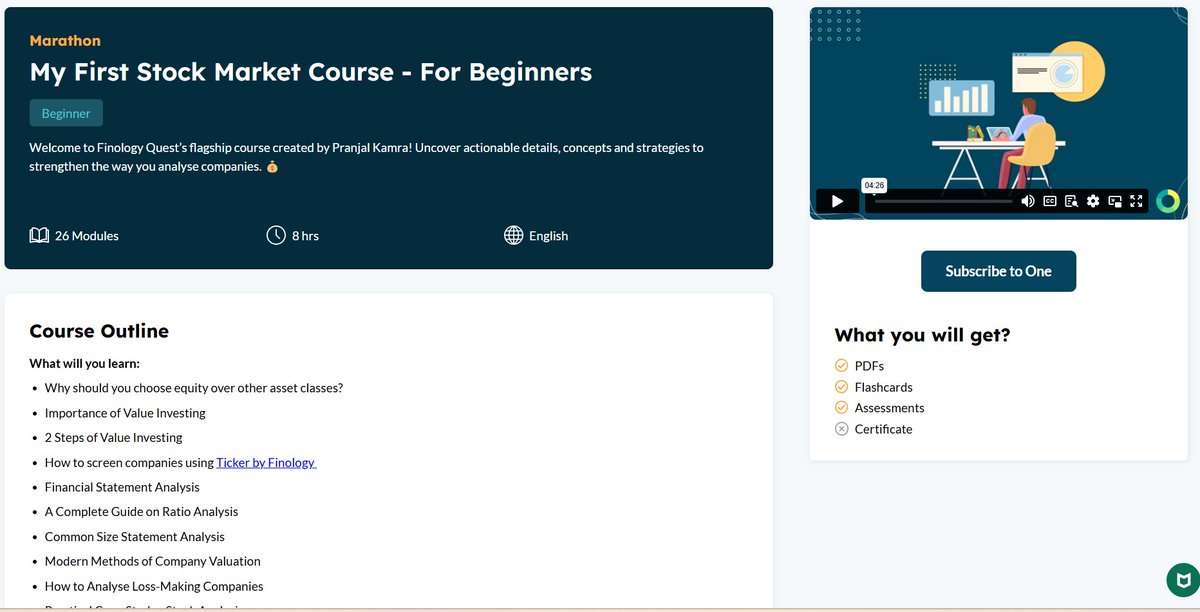

Want to learn more about reliable financial concepts tools?

View👉 @Finology_Quest and explore My First Stock Market Course! - tinyurl.com x.com

View👉 @Finology_Quest and explore My First Stock Market Course! - tinyurl.com x.com

جاري تحميل الاقتراحات...