This is David Ryan.

He turned $20k into $900k in just 3 years. How?

He mastered the art of identifying big winners, timing trades, and scaling aggressively.

Here are 8 advanced lessons from his incredible journey 🧵👇 x.com

He turned $20k into $900k in just 3 years. How?

He mastered the art of identifying big winners, timing trades, and scaling aggressively.

Here are 8 advanced lessons from his incredible journey 🧵👇 x.com

1. The Secret of Market Leaders

Ryan didn’t waste time on laggards. He hunted stocks with early leadership, a sign of institutional buying.

The tool? The RS (Relative Strength) line.

👉 If the RS line is making new highs while price consolidates, it’s a green flag for a breakout.

👉 Ryan always said: “Leadership precedes price. Follow the leaders.”

Ryan didn’t waste time on laggards. He hunted stocks with early leadership, a sign of institutional buying.

The tool? The RS (Relative Strength) line.

👉 If the RS line is making new highs while price consolidates, it’s a green flag for a breakout.

👉 Ryan always said: “Leadership precedes price. Follow the leaders.”

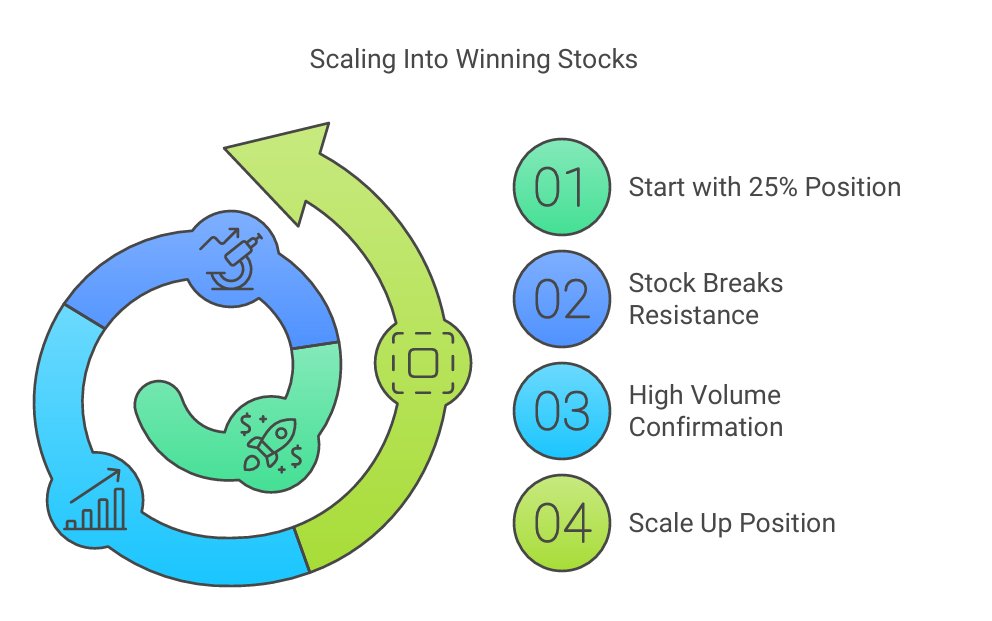

2. Scaling Like a Pro

Buying and holding is one thing. Scaling into winners is another.

Ryan started small and built size as the stock proved him right. His goal? To build concentrated positions in 2–4 big movers.

Here’s how you can do it:

✅ Start with 25% of your planned position.

✅ Add when the stock breaks resistance with high volume.

The key: Only scale when the trade is working.

Buying and holding is one thing. Scaling into winners is another.

Ryan started small and built size as the stock proved him right. His goal? To build concentrated positions in 2–4 big movers.

Here’s how you can do it:

✅ Start with 25% of your planned position.

✅ Add when the stock breaks resistance with high volume.

The key: Only scale when the trade is working.

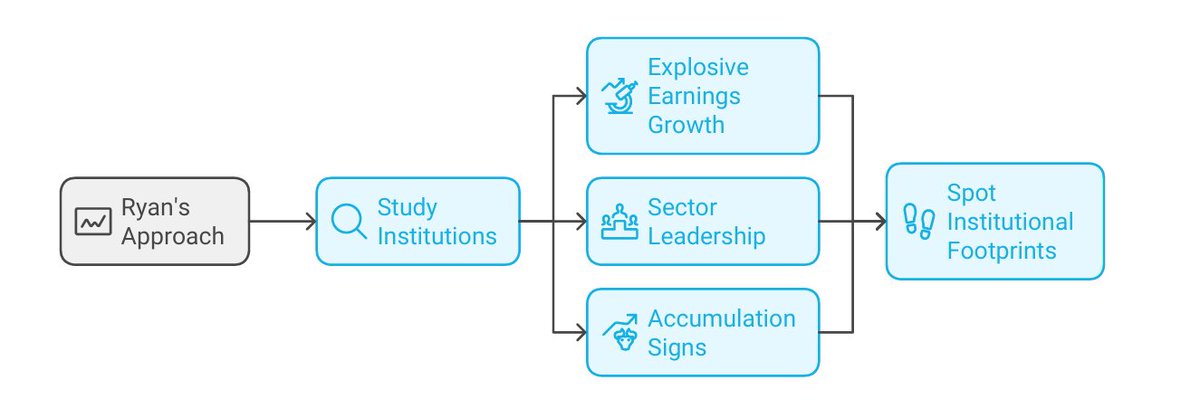

3. Think Like Institutions

Institutions don’t nibble—they devour. Ryan studied the stocks that attracted big money.

The criteria?

🚀 Explosive earnings growth.

🚀 Leadership within the sector.

🚀 Accumulation signs (heavy volume on up days).

Institutions leave footprints. Ryan’s skill was spotting them early.

Institutions don’t nibble—they devour. Ryan studied the stocks that attracted big money.

The criteria?

🚀 Explosive earnings growth.

🚀 Leadership within the sector.

🚀 Accumulation signs (heavy volume on up days).

Institutions leave footprints. Ryan’s skill was spotting them early.

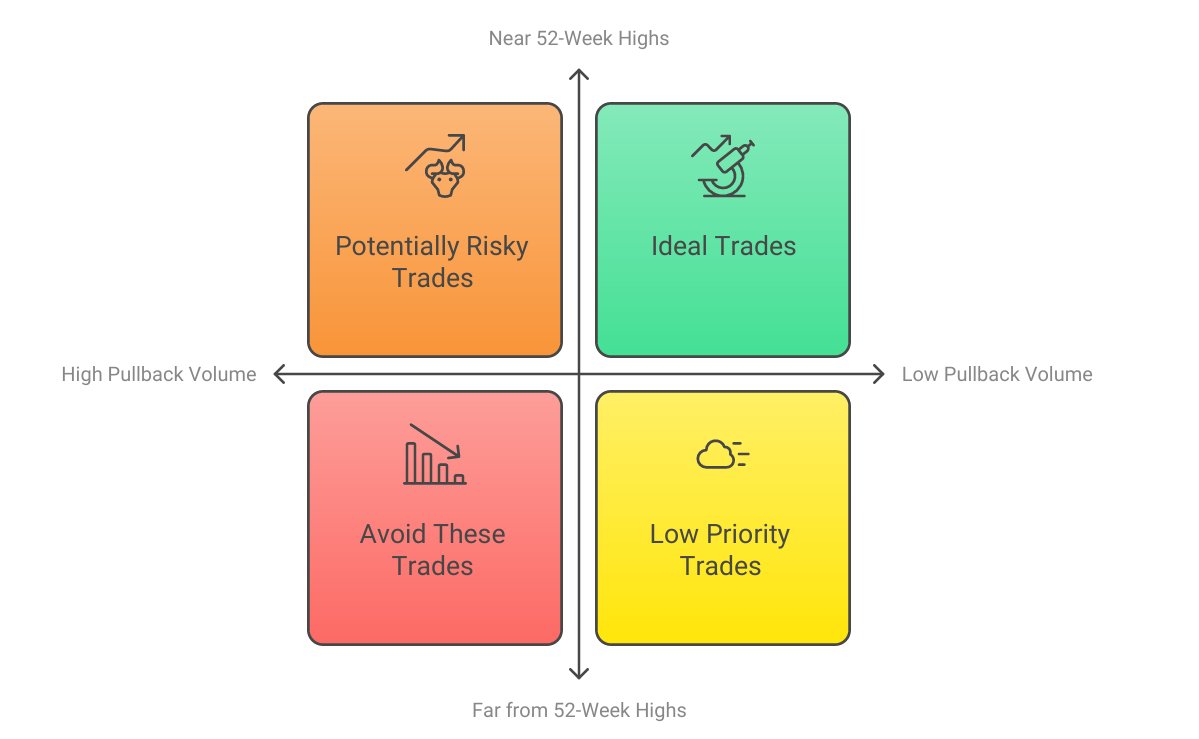

4. Block the Noise, Focus on the Charts

Ryan ignored news, opinions, and distractions. His edge? A laser focus on the charts.

Daily routine:

📊 Study 100+ charts.

📊 Hunt for setups that fit your system.

One tip Ryan swore by: “The best trades come from stocks near 52-week highs with low-volume pullbacks.”

Ryan ignored news, opinions, and distractions. His edge? A laser focus on the charts.

Daily routine:

📊 Study 100+ charts.

📊 Hunt for setups that fit your system.

One tip Ryan swore by: “The best trades come from stocks near 52-week highs with low-volume pullbacks.”

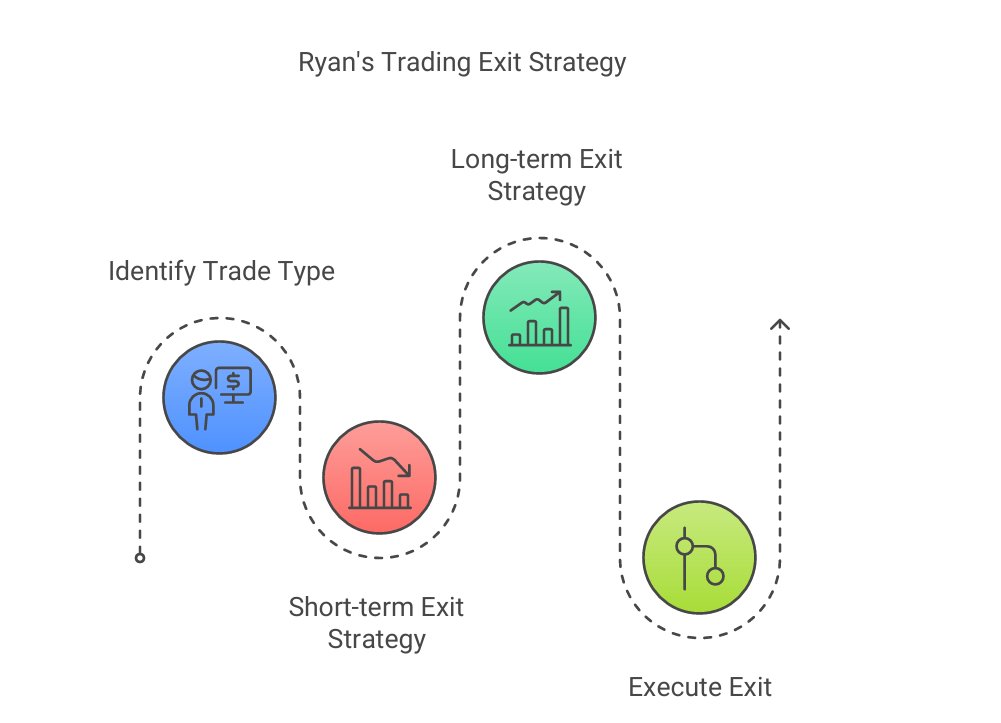

5. Exits Are as Important as Entries

Ryan was ruthless with exits. He sold into strength and cut losers early.

Here’s how he timed exits:

📌 Short-term trades: Exit below the 10-day moving average.

📌 Long-term trades: Exit when the price breaks the 50-day moving average.

It’s not about emotions—it’s about the chart.

Ryan was ruthless with exits. He sold into strength and cut losers early.

Here’s how he timed exits:

📌 Short-term trades: Exit below the 10-day moving average.

📌 Long-term trades: Exit when the price breaks the 50-day moving average.

It’s not about emotions—it’s about the chart.

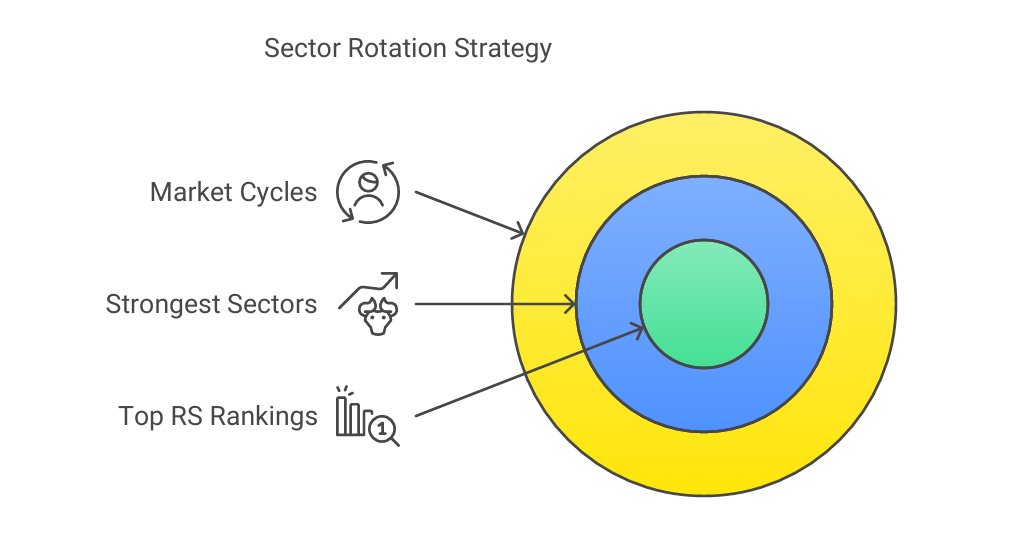

6. Follow Sector Rotation

Money flows in cycles. Ryan understood this and aligned himself with the strongest sectors.

His formula:

✅ Track the strongest sectors weekly.

✅ Focus only on stocks in those sectors with top RS rankings.

Markets may shift, but leadership is always clear if you know where to look.

Money flows in cycles. Ryan understood this and aligned himself with the strongest sectors.

His formula:

✅ Track the strongest sectors weekly.

✅ Focus only on stocks in those sectors with top RS rankings.

Markets may shift, but leadership is always clear if you know where to look.

7. Respect Market Conditions

Ryan didn’t force trades in a bad market. If the market was bearish, he stayed out.

His rule:

👉 If the market is below the 200-day moving average, play defense.

👉 If it’s above, focus on offense.

You don’t need to trade all the time. Sometimes, doing nothing is the smartest move.

Ryan didn’t force trades in a bad market. If the market was bearish, he stayed out.

His rule:

👉 If the market is below the 200-day moving average, play defense.

👉 If it’s above, focus on offense.

You don’t need to trade all the time. Sometimes, doing nothing is the smartest move.

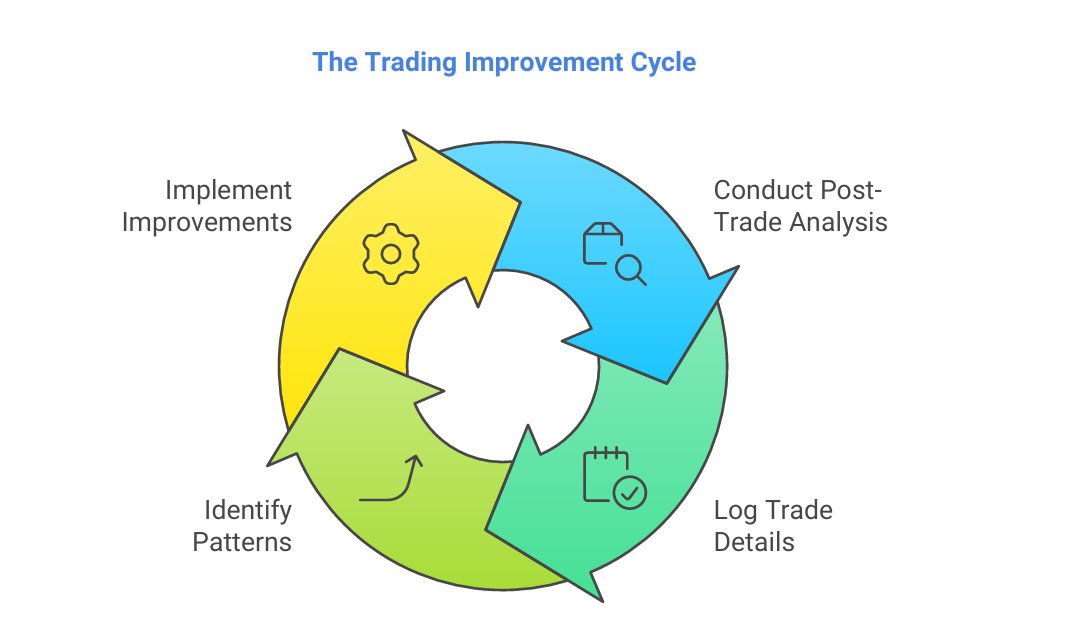

8. Review, Refine, Repeat

Ryan’s biggest advantage? Relentless post-trade analysis.

He reviewed every trade—wins and losses—to refine his strategy.

Start your own journal:

📝 Log the setup, emotions, execution, and outcome of every trade.

📝 Look for patterns. Fix what’s broken.

Small improvements compound over time.

Ryan’s biggest advantage? Relentless post-trade analysis.

He reviewed every trade—wins and losses—to refine his strategy.

Start your own journal:

📝 Log the setup, emotions, execution, and outcome of every trade.

📝 Look for patterns. Fix what’s broken.

Small improvements compound over time.

If you like Such Learning Posts

( 1 ) Please Follow me on X

@ankurpatel59

My YouTube Videos will also help you to Up Your Trading Game.

( 2 )Subscribe Here - shorturl.at

Bookmark and Retweet this Post

( 1 ) Please Follow me on X

@ankurpatel59

My YouTube Videos will also help you to Up Your Trading Game.

( 2 )Subscribe Here - shorturl.at

Bookmark and Retweet this Post

Loading suggestions...