Korea declared Martial Law. It was one of the most spectacular trading events I've ever witnessed in my trading career. I've prepared detailed explanations of what exactly happened in the market and why it was so different from any other event. If you enjoyed it, please retweet! x.com

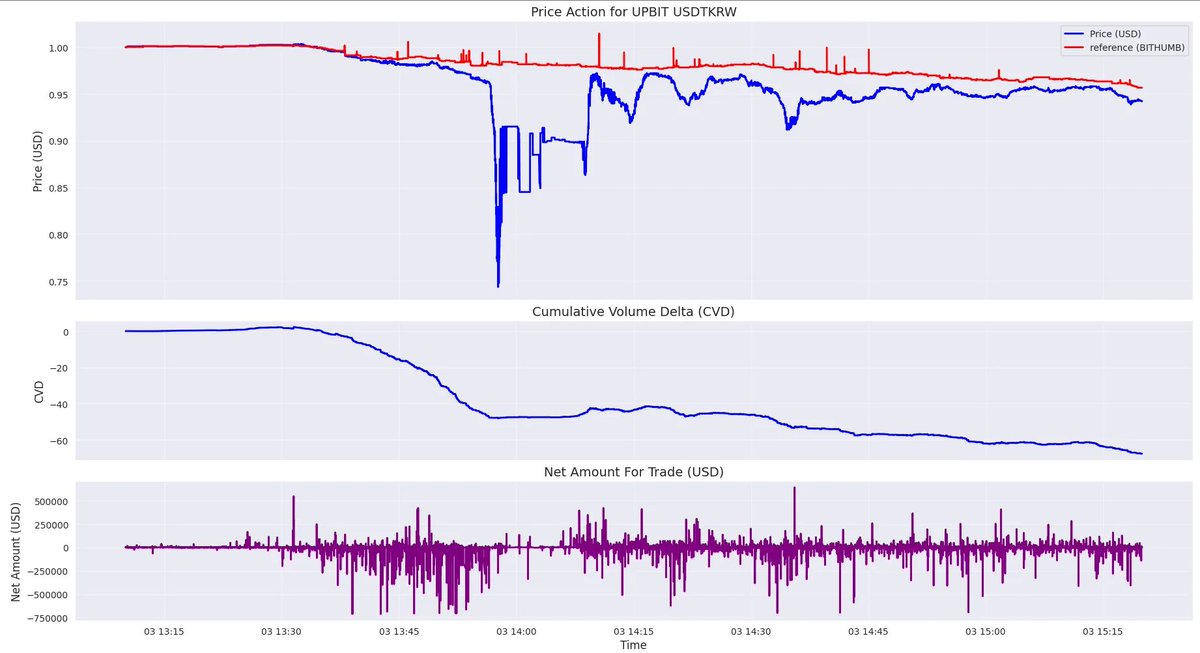

BTC on Upbit was priced under $65k, while we saw almost $95k on Binance— $30k difference between Korea and the rest of the world. That was absolutely crazy. We observed big sell pressure, with almost $7mm more in sell orders than buy orders. The next plot is the most important.

Here, we have the price action as well as CVD for USDTKRW. You can see that about $50mm was sold in a couple of minutes. With normal liquidity, that would not have been so brutal, but all the players just disappeared from the market, causing a drop to 75 cents. x.com

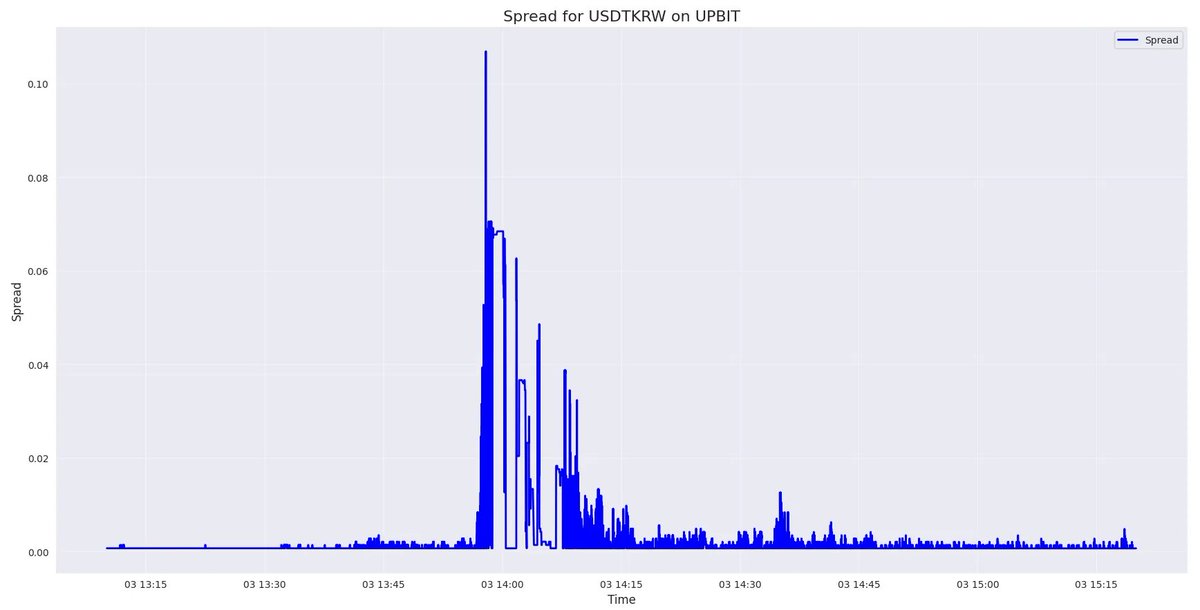

Why was there no liquidity? The reason is simple—it is shockingly hard to enter the Korean market and trade there. This means that only a few players can provide liquidity and arbitrage those discrepancies. You can see that the spread jumped to 10% (!!!). x.com

Koreans paid the price for limiting the market to a few players. It would be quite easy to arbitrage these discrepancies if there were a lot more market makers and HFT players there. You can see the discrepancies even between two Korean markets (Upbit and Bithumb).

The most important aspect here is liquidity. You see that the liquidity just disappeared. Not only was there no liquidity on the bid side, but there was also huge liquidity on the ask side. There was a moment where liquidity on the ask side was 200 times bigger than on the bid. x.com

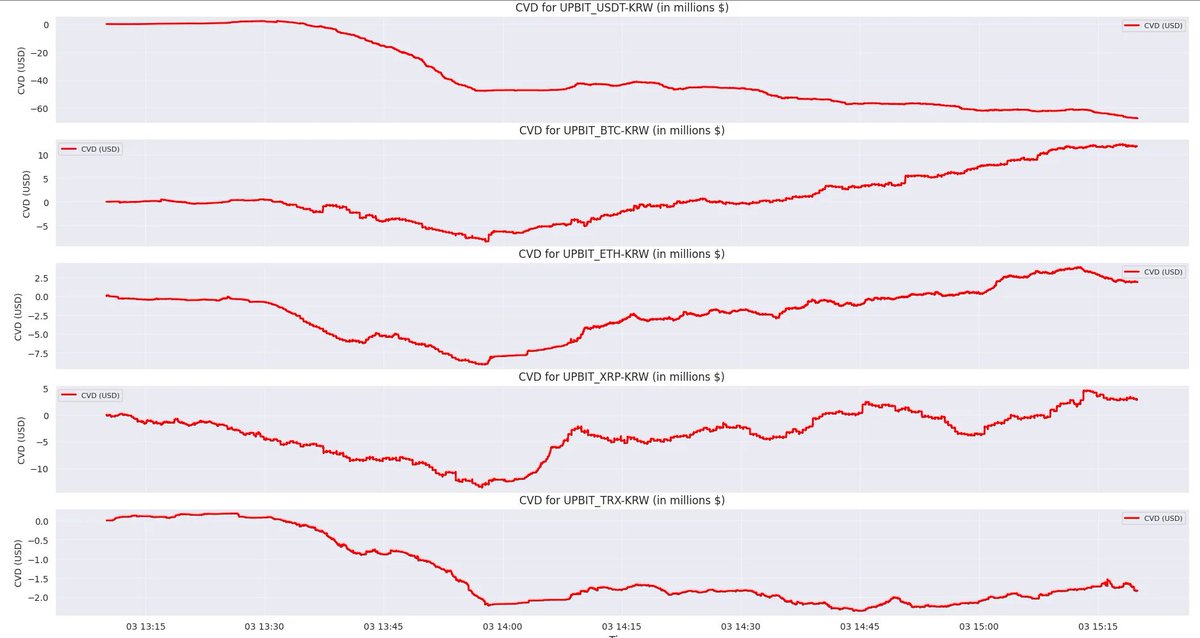

Let’s look at the CVD (the SELL amount - BUY amount). It indicates aggressive pressure on the market. You see big sell pressure on all instruments, which, combined with the liquidity drop, caused a huge dip. x.com

The most important thing to note here is that the market overreacted, and the reason we saw such a brutal drop was not the level of the news but the lack of liquidity providers who were unable to arbitrage USDT and BTC. You will not find a better example of this mechanism.

Loading suggestions...