Rule 1: Never risk more than 1-2% of your capital on a single trade.

This ensures that no single loss will blow up your account.

Swing trading is about survival first, profits second. x.com

This ensures that no single loss will blow up your account.

Swing trading is about survival first, profits second. x.com

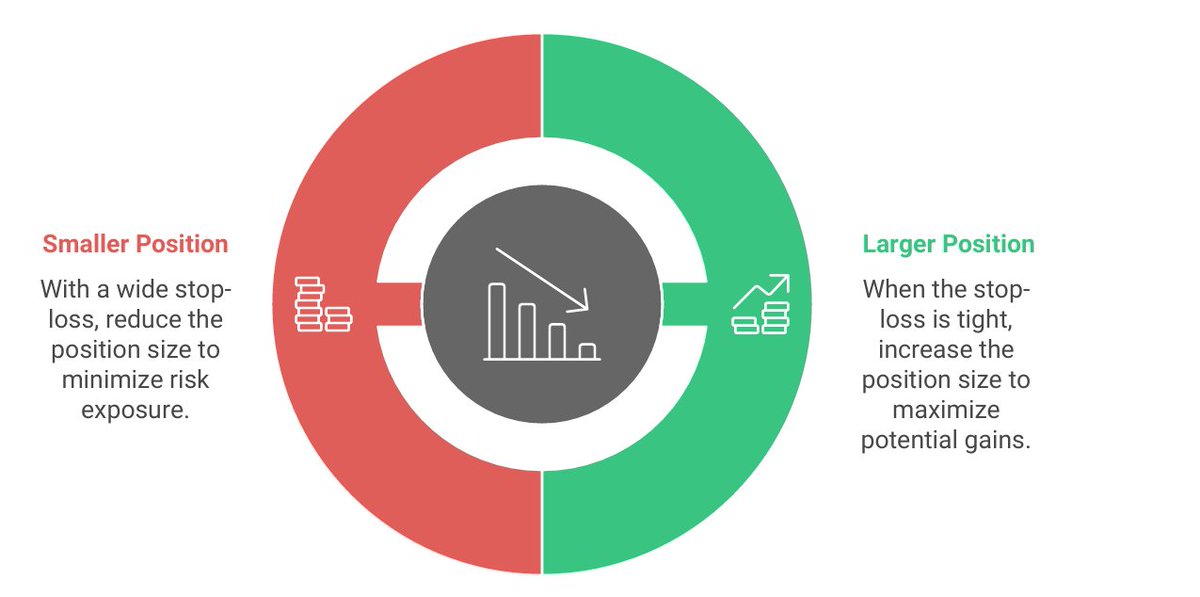

Rule 2: Adjust position size based on stop-loss distance.

- Tight stop-loss? Take a larger position.

- Wide stop-loss? Reduce your position size.

Always calculate risk per trade before entering. x.com

- Tight stop-loss? Take a larger position.

- Wide stop-loss? Reduce your position size.

Always calculate risk per trade before entering. x.com

Rule 3: Use volatility to guide position sizing.

High-volatility stocks = smaller positions.

Low-volatility stocks = larger positions.

This helps you avoid oversized losses during wild swings. x.com

High-volatility stocks = smaller positions.

Low-volatility stocks = larger positions.

This helps you avoid oversized losses during wild swings. x.com

Rule 4: Keep a consistent risk % across trades.

Don’t risk 1% on one trade and 5% on another.

Consistency in risk keeps your performance steady over time. x.com

Don’t risk 1% on one trade and 5% on another.

Consistency in risk keeps your performance steady over time. x.com

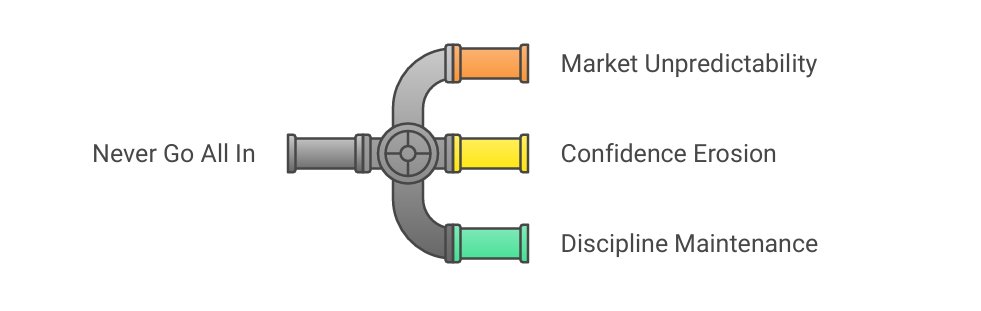

Rule 5: Never go all in, no matter how confident you feel.

Markets are unpredictable. Even the “perfect setup” can fail.

Confidence kills discipline—stick to your risk limits. x.com

Markets are unpredictable. Even the “perfect setup” can fail.

Confidence kills discipline—stick to your risk limits. x.com

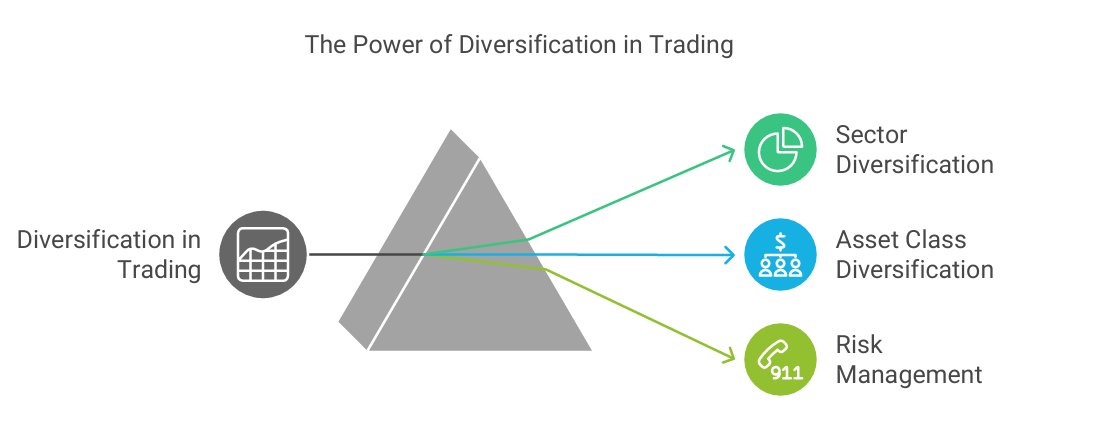

Rule 6: Diversify your trades.

Avoid overloading your portfolio with similar trades.

If one sector tanks, your entire account shouldn’t go with it. x.com

Avoid overloading your portfolio with similar trades.

If one sector tanks, your entire account shouldn’t go with it. x.com

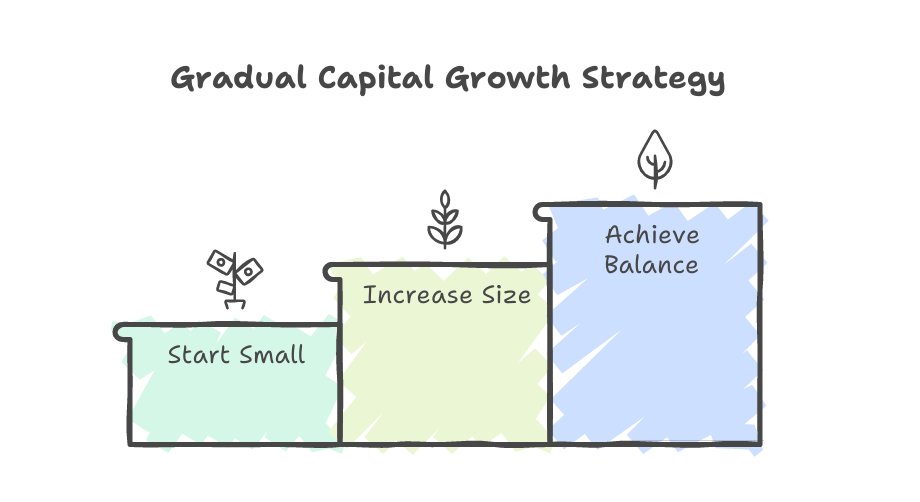

Rule 7: Recalculate position size as your capital grows.

Start with smaller sizes when your account is small.

As you grow, increase size gradually while maintaining the same risk %. x.com

Start with smaller sizes when your account is small.

As you grow, increase size gradually while maintaining the same risk %. x.com

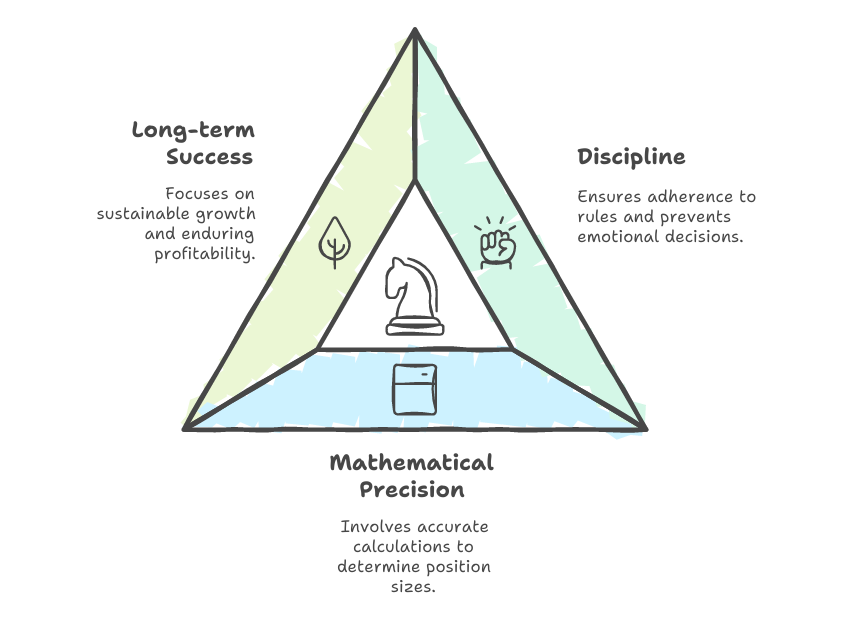

Rule 8: Respect the math.

Position sizing isn’t guesswork—it’s part of your edge.

A disciplined approach protects you from emotional decisions and ensures long-term success. x.com

Position sizing isn’t guesswork—it’s part of your edge.

A disciplined approach protects you from emotional decisions and ensures long-term success. x.com

If you like Such Learning Posts

( 1 ) Please Follow me on X

@ankurpatel59

Bookmark and Retweet this Post

( 1 ) Please Follow me on X

@ankurpatel59

Bookmark and Retweet this Post

Loading suggestions...