AI is the utility sector I'm most bullish on for 2025.

We're already starting to see the early signs of a rotation, but the real upside is yet to come.

This could be the biggest opportunity of the bull run.

🧵: Revealing my top 10 AI altcoins for huge upside.👇

We're already starting to see the early signs of a rotation, but the real upside is yet to come.

This could be the biggest opportunity of the bull run.

🧵: Revealing my top 10 AI altcoins for huge upside.👇

In this thread, I'll cover:

• The current state of the AI sector

• My thesis on AI x crypto

• The top AI verticals

• My AI crypto portfolio (10 picks + 1 bonus)

Let's dive in.👇

• The current state of the AI sector

• My thesis on AI x crypto

• The top AI verticals

• My AI crypto portfolio (10 picks + 1 bonus)

Let's dive in.👇

Firstly, let's discuss the opportunity at hand.

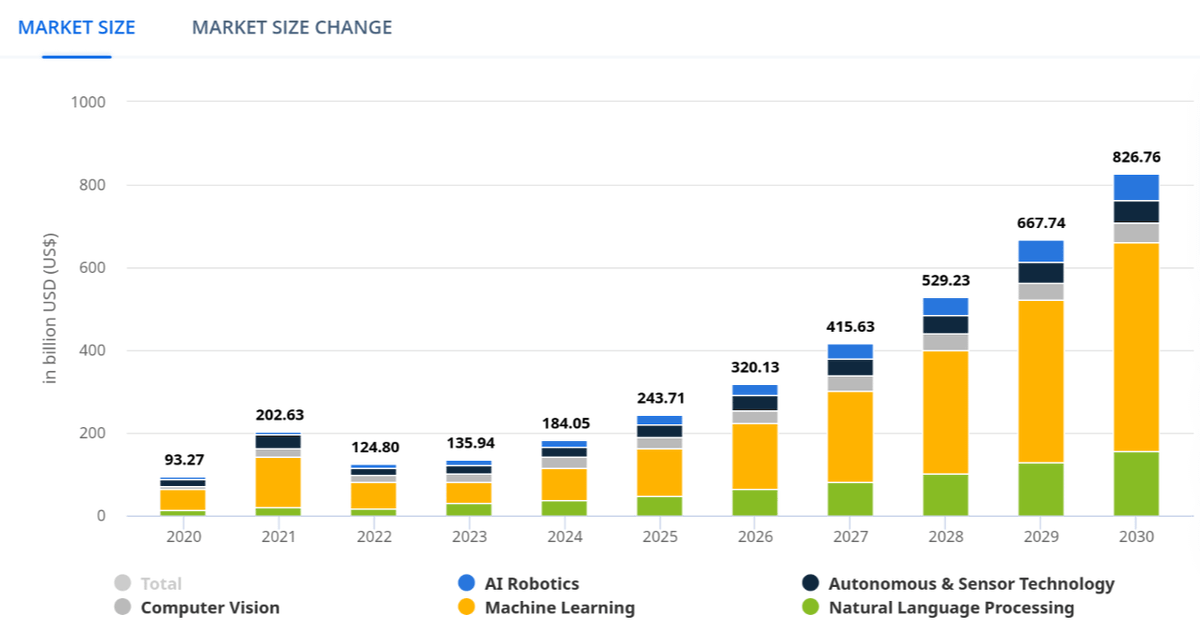

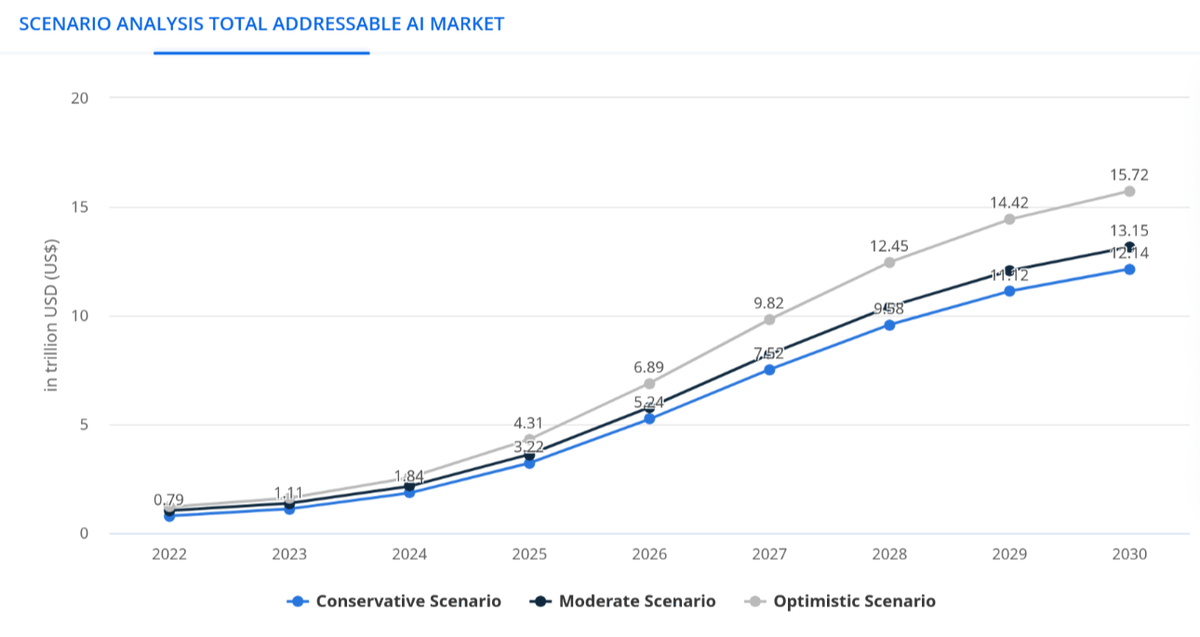

The global AI market grew ~$50B between 2023-2024.

It's expected to grow at a 28.46% CAGR from here, crossing $826B by 2030. x.com

It's expected to grow at a 28.46% CAGR from here, crossing $826B by 2030. x.com

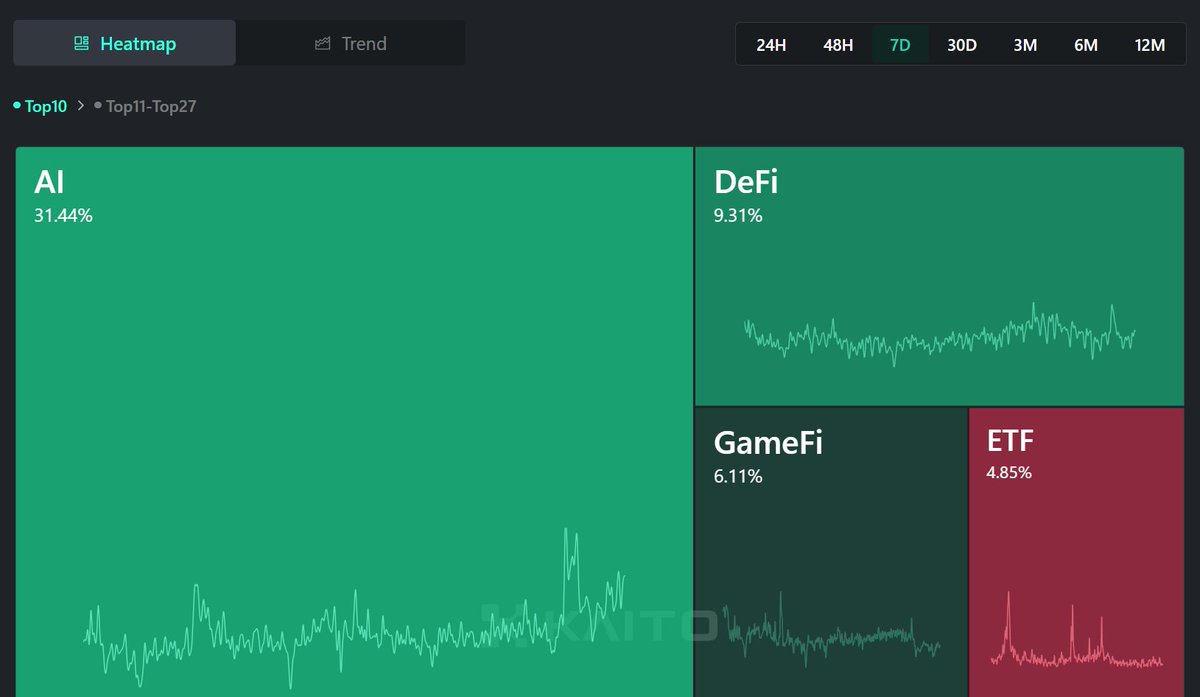

Over the past few months, we've seen AI dominate mindshare, accounting for almost 1/3 of attention in crypto. x.com

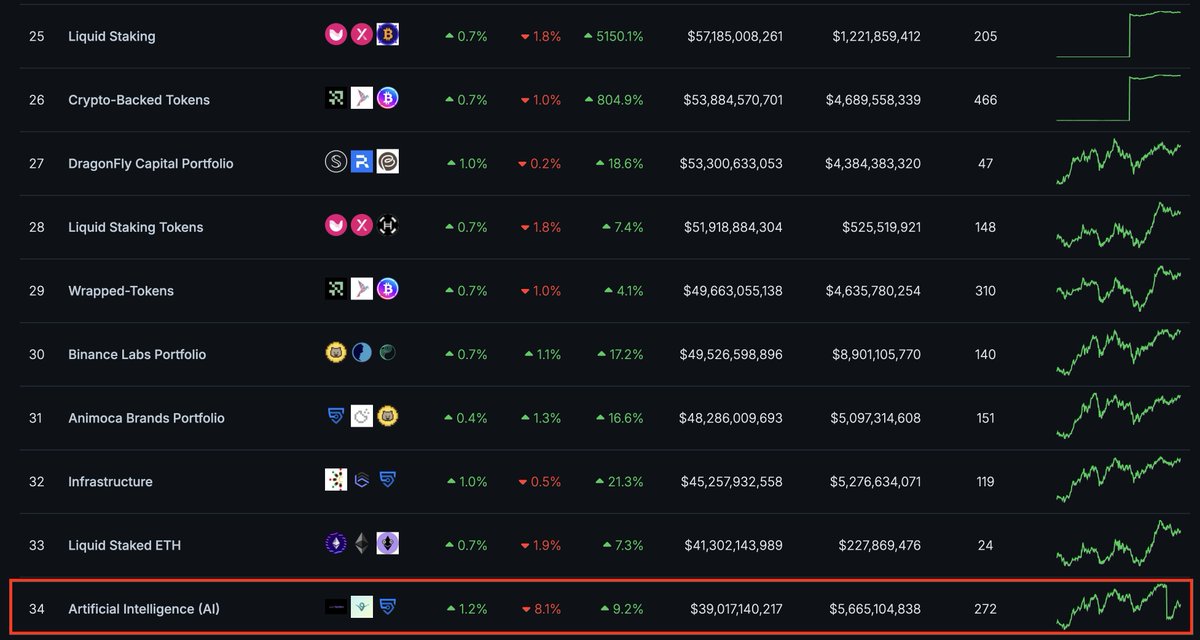

Yet, AI is still only the 34th ranked crypto sector by market cap (on CG), behind liquid staking, dog memes, DeFi and more.

I could easily see AI as a top 5-10 sector in a year's time. x.com

I could easily see AI as a top 5-10 sector in a year's time. x.com

This means there is still a massive opportunity.

Many mid-low cap AI tokens are still sitting at ridiculously low valuations.

All it takes is a strong rotation into AI for many of these to quickly reprice 5-10x higher.

Many mid-low cap AI tokens are still sitting at ridiculously low valuations.

All it takes is a strong rotation into AI for many of these to quickly reprice 5-10x higher.

Here's my fundamental thesis as to why AI crypto is set for huge growth:

1. EVERYONE is becoming aware of just how impactful AI will be on society.

Either people are scared, excited, or intrigued by the latest developments.

This already cements AI in general in the minds of the masses.

Either people are scared, excited, or intrigued by the latest developments.

This already cements AI in general in the minds of the masses.

2. AI is constantly innovating, and new products are regularly shipping.

Every time a new AI product is released, this puts even more focus on the sector.

And crypto is an attention economy. More eyeballs = more speculation.

Every time a new AI product is released, this puts even more focus on the sector.

And crypto is an attention economy. More eyeballs = more speculation.

3. Crypto is a lower barrier/friction proxy to get exposure to the growth of AI.

Crypto is easier to access, able to be fractionalised, and generally "cheaper" than investing in, let's say, AI equities.

For retail, this is a massive benefit.

Crypto is easier to access, able to be fractionalised, and generally "cheaper" than investing in, let's say, AI equities.

For retail, this is a massive benefit.

4. The recent rise of AI agents has FINALLY made people aware of the power of AI x crypto.

We're haven't even realised 0.01% of their potential yet, but it has served as a powerful "aha moment" for the AI sector in general.

We're haven't even realised 0.01% of their potential yet, but it has served as a powerful "aha moment" for the AI sector in general.

I personally believe we're moving into a future where AI agents will trade autonomously on chain for you, manage your portfolio/risk, DeFi and more.

It's going to completely change the landscape of crypto.

It's going to completely change the landscape of crypto.

And it's also happening in traditional tech too.

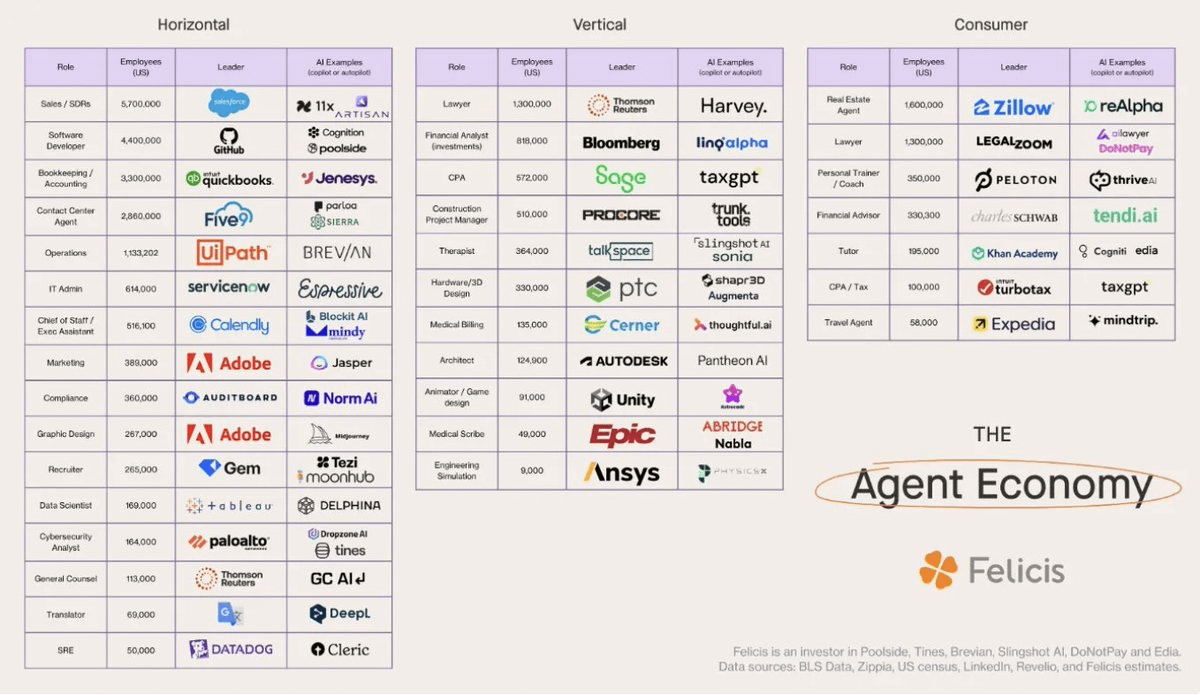

From Adobe to Expedia, many top corporations have built & integrated AI Agents in the past 1-2 years. This trend is only going to increase. x.com

From Adobe to Expedia, many top corporations have built & integrated AI Agents in the past 1-2 years. This trend is only going to increase. x.com

So, how does the overall landscape of the AI x Crypto space currently look?

Primarily, we have:

1. AI Agents & agent infra

2. Computation + DePIN

3. Decentralised LLMs

4. AI blockchains/infra for AI dApps

1. AI Agents & agent infra

2. Computation + DePIN

3. Decentralised LLMs

4. AI blockchains/infra for AI dApps

I'm investing in all of these verticals, with a particular focus on agent/AI infrastructure.

Today, I'm not going to focus on individual AI agents/memes or broader DePIN plays, instead focusing primarily on pick-and-shovel infrastructure protocols.

Today, I'm not going to focus on individual AI agents/memes or broader DePIN plays, instead focusing primarily on pick-and-shovel infrastructure protocols.

Disclaimer: I hold all of the following projects in my portfolio.

To ensure transparency:

* = strategic advisor + investor

^ = invested via OTC

(I'm also working on a new website page which discloses all of my personal financial interests), which should be live next week.

To ensure transparency:

* = strategic advisor + investor

^ = invested via OTC

(I'm also working on a new website page which discloses all of my personal financial interests), which should be live next week.

This list will be ordered from the largest market cap, to the lowest market cap.

Typically, the risk of a project increases as the market cap decreases.

More upside, but more risk.

Thus, not all of these tokens should be weighted equally in your portfolio.

Typically, the risk of a project increases as the market cap decreases.

More upside, but more risk.

Thus, not all of these tokens should be weighted equally in your portfolio.

I recommend that you do your own research, and if you DO decide to take a position in any of these protocols, make sure to manage position sizing/risk in line with your goals/overall strategy.

My personal balance is ~70% large caps/30% small-mid caps.

My personal balance is ~70% large caps/30% small-mid caps.

Let's dive in.👇

1. @bittensor_

$TAO is the AI market leader, and if it performs well, the entire sector is set to benefit.

TAO focuses on decentralising AI research, and has already seen significant adoption in scientific communities.

$TAO is the AI market leader, and if it performs well, the entire sector is set to benefit.

TAO focuses on decentralising AI research, and has already seen significant adoption in scientific communities.

With the recent rollout of EVM compatibility, the network has taken a huge step forward, opening the door for developers to build DeFi ecosystems and unlock new use cases.

2. @NEARProtocol

$NEAR stands out in the crypto sector as the leading L1 x AI play.

For those bullish on both verticals, NEAR serves as a solid proxy. x.com

$NEAR stands out in the crypto sector as the leading L1 x AI play.

For those bullish on both verticals, NEAR serves as a solid proxy. x.com

Fun fact: Since its mainnet launch in October 2020, it has maintained 100% uptime.

3. @getgrass_io

$GRASS has become a standout launch this cycle, thanks to its data pipeline that seamlessly connects the real world with AI x Crypto.

@Rewkang predicts explosive growth, forecasting revenues could soar to high 9 figures by next year.

$GRASS has become a standout launch this cycle, thanks to its data pipeline that seamlessly connects the real world with AI x Crypto.

@Rewkang predicts explosive growth, forecasting revenues could soar to high 9 figures by next year.

As highlighted by this tweet from @0xdrej, the demand for the $GRASS network is undeniable, and the protocol's future looks incredibly promising.

This was aided by a well-conducted airdrop which has managed to organically build a loyal community.

This was aided by a well-conducted airdrop which has managed to organically build a loyal community.

4. @Spectral_Labs

$SPEC is one of the leading AI agent infra plays, allowing anyone deploy and engage with AI Agents.

$SPEC is one of the leading AI agent infra plays, allowing anyone deploy and engage with AI Agents.

With Syntax V2, you'll be able to interact with sentient agents with personalities, which trade on Hyperliquid in accordance with the community's input.

It's an interesting mix of fun/collaboration + speculation.

It's an interesting mix of fun/collaboration + speculation.

5. @modenetwork^

Although many know mode as an L2, behind the scenes they've been building AI tech for over a year.

They are leading the future of DeFi via facilitating the deployment of AI-driven agents, which will autonomously farm yield/optimise your portfolio on your behalf.

Although many know mode as an L2, behind the scenes they've been building AI tech for over a year.

They are leading the future of DeFi via facilitating the deployment of AI-driven agents, which will autonomously farm yield/optimise your portfolio on your behalf.

6. @GoNeuralAI^

$NEURAL connects AI & gaming, two of crypto's biggest adoption drivers.

They just announced SentiOS, which supplies autonomous AI to create, populate, and bring virtual worlds and economies to life.

$NEURAL connects AI & gaming, two of crypto's biggest adoption drivers.

They just announced SentiOS, which supplies autonomous AI to create, populate, and bring virtual worlds and economies to life.

7. @PinLinkAi*

PinLink is the first RWA-tokenised DePIN platform, empowering the fractional ownership of yield-bearing assets, physical or digital.

Their latest Medium article dives deeper into the latest updates (I recommend reading when doing DD).

PinLink is the first RWA-tokenised DePIN platform, empowering the fractional ownership of yield-bearing assets, physical or digital.

Their latest Medium article dives deeper into the latest updates (I recommend reading when doing DD).

They have also recently partnered with @akashnet_, @pendle_fi, @Fetch_ai, @opensea, @alephium, @ParallelAIx and more.

Their BD is on another level.

Their BD is on another level.

8. @zero1_labs*

$DEAI enables innovators to build decentralised AI applications with FHE encryption, ensuring secure data governance and complete privacy.

Think of it as a pick-and-shovel AI infra play.

With a market cap of ~76M, this is one of my "higher upside" AI bets.

$DEAI enables innovators to build decentralised AI applications with FHE encryption, ensuring secure data governance and complete privacy.

Think of it as a pick-and-shovel AI infra play.

With a market cap of ~76M, this is one of my "higher upside" AI bets.

$DEAI has recently announced the debut of @seraphnet, the first of many projects planned through their incubator.

It's clear that their ecosystem is developing rapidly and is definitely one to watch.

It's clear that their ecosystem is developing rapidly and is definitely one to watch.

Now onto some of my "riskier" AI plays (based on market cap).

Something I've been focusing on recently is finding lower-cap AI gems.

These obviously constitute more risk, so make sure you do your DD and risk-manage accordingly.

Something I've been focusing on recently is finding lower-cap AI gems.

These obviously constitute more risk, so make sure you do your DD and risk-manage accordingly.

9. @EmpyrealSDK*

As I mentioned earlier, I'm a big believer in AI agents.

$EMP provides AI infra to turn social media messages into on-chain actions: trades, swaps etc. through @SimulacrumIO.

It's super cool.

As I mentioned earlier, I'm a big believer in AI agents.

$EMP provides AI infra to turn social media messages into on-chain actions: trades, swaps etc. through @SimulacrumIO.

It's super cool.

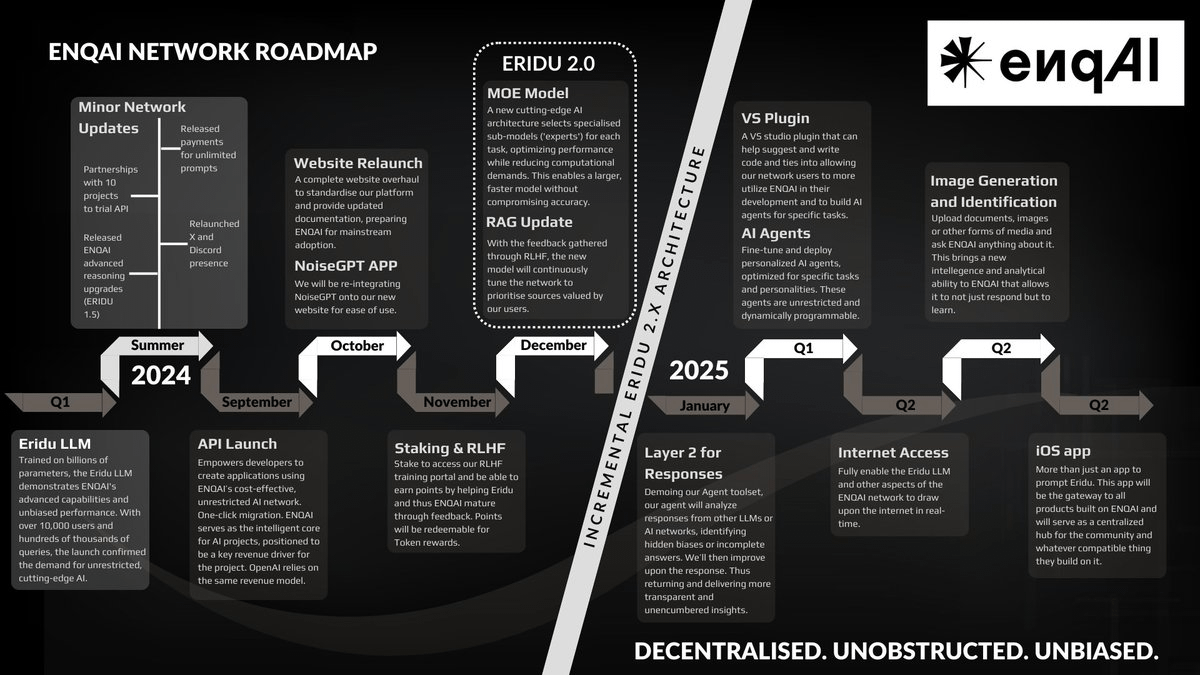

10. @enq_AI*

$ENQAI is a decentralised LLM network solving the bias & censorship issues common to centralised AI.

As legacy AI risks become increasingly blatant, the anti-censorship approach will appeal to lots of users.

$ENQAI is a decentralised LLM network solving the bias & censorship issues common to centralised AI.

As legacy AI risks become increasingly blatant, the anti-censorship approach will appeal to lots of users.

Despite its $20M market cap, enqAI already has 20,000 monthly active users across 50+ countries.

And it has already handled 1M+ API requests with minimal downtime or lags.

See their roadmap below. x.com

And it has already handled 1M+ API requests with minimal downtime or lags.

See their roadmap below. x.com

Bonus (11). @xgurunetwork*

With its Layer 3 mainnet now live, $GURU powers AI processors & chatbots with a DEX, stablecoin support, bridges, & base chain integration.

With its Layer 3 mainnet now live, $GURU powers AI processors & chatbots with a DEX, stablecoin support, bridges, & base chain integration.

I've been working with Guru to launch a Telegram/Discord mini-app, delivering a full turnkey solution for DeFi on TG.

It's going to be very cool!

It's going to be very cool!

There are many other AI projects I'm interested in, but I tried to keep the list today as concise as possible, with a focus on infra.

It's a vertical I'm continuously researching, and as I find new projects, I'll keep you in the loop.

It's a vertical I'm continuously researching, and as I find new projects, I'll keep you in the loop.

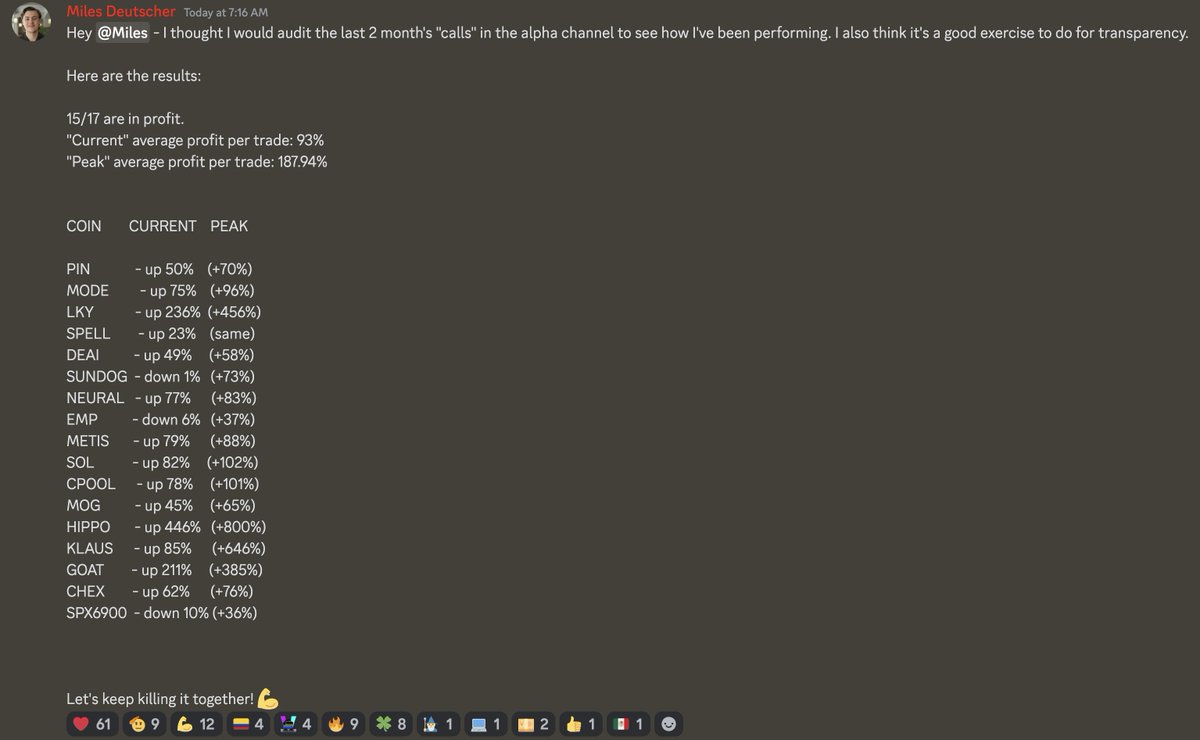

I do live portfolio updates in the Miles High Club whenever I add/find new coins.

That's the place where I post my earliest alpha.

Come be apart of the community if you want to take your game to the next level - we've been on a big win streak lately!

(link is in @mileshighclub_ bio).

That's the place where I post my earliest alpha.

Come be apart of the community if you want to take your game to the next level - we've been on a big win streak lately!

(link is in @mileshighclub_ bio).

I hope you've found this thread helpful.

Follow me @milesdeutscher for more alpha + deep dive sector analysis.

Also, Like/Repost the quote below if you can. 💙

Follow me @milesdeutscher for more alpha + deep dive sector analysis.

Also, Like/Repost the quote below if you can. 💙

Loading suggestions...