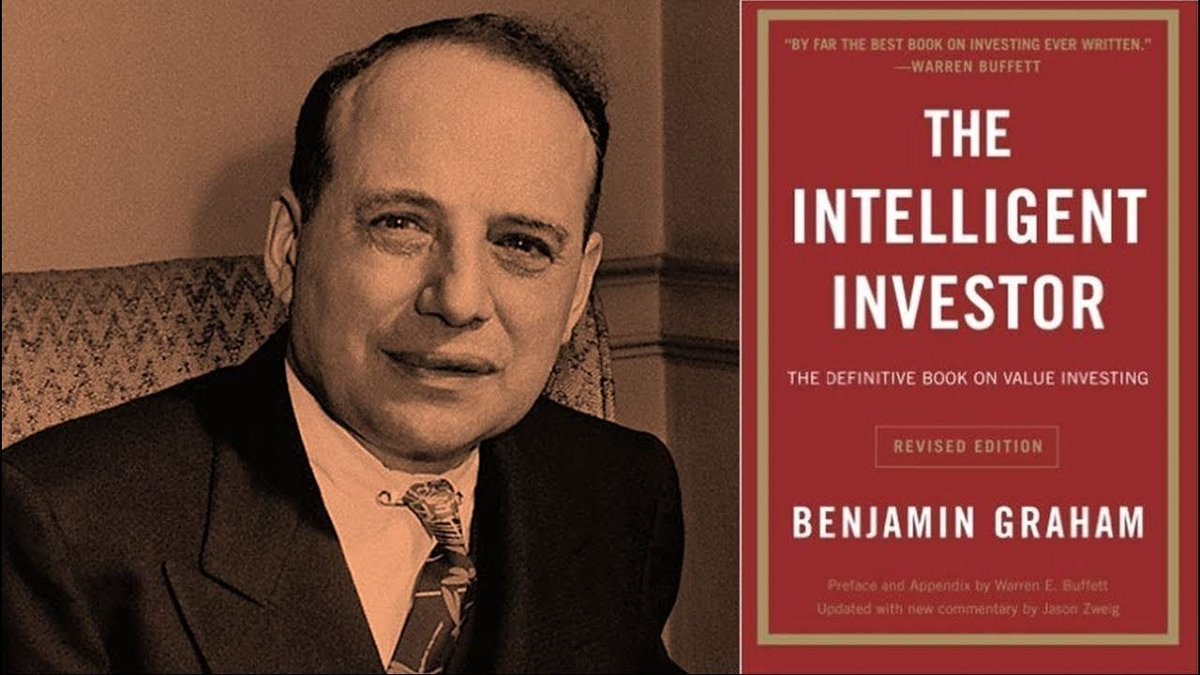

Benjamin Graham once said:

“In the short run, the market is a voting machine, but in the long run it is a weighing machine.”

Here are 10 things I learned from him: x.com

“In the short run, the market is a voting machine, but in the long run it is a weighing machine.”

Here are 10 things I learned from him: x.com

“All the math you need in the stock market you get in the fourth grade.”

- Benjamin Graham

- Benjamin Graham

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

- Benjamin Graham

- Benjamin Graham

“The essence of investment management is the management of risks, not the management of returns.”

- Benjamin Graham

- Benjamin Graham

“The intelligent investor is a realist who sells to optimists and buys from pessimists.”

- Benjamin Graham

- Benjamin Graham

“Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

- Benjamin Graham

- Benjamin Graham

“The intelligent investor should recognize that market panics can create great prices for good companies and good prices for great companies.”

- Benjamin Graham

- Benjamin Graham

“Investing is most intelligent when it is most businesslike.”

- Benjamin Graham

- Benjamin Graham

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

- Benjamin Graham

- Benjamin Graham

“Losing some money is an inevitable part of investing, and there’s nothing you can do to prevent it. But to be an intelligent investor, you must take responsibility for ensuring that you never lose most or all of your money.”

- Benjamin Graham

- Benjamin Graham

That's it for today.

If you liked this, you'll love this compiliation of all writings by Benjamin Graham.

You can grab it here: compounding-quality.ck.page

If you liked this, you'll love this compiliation of all writings by Benjamin Graham.

You can grab it here: compounding-quality.ck.page

Loading suggestions...