PG Electroplast LTD

A detailed Analysis

Summary of concall ✨

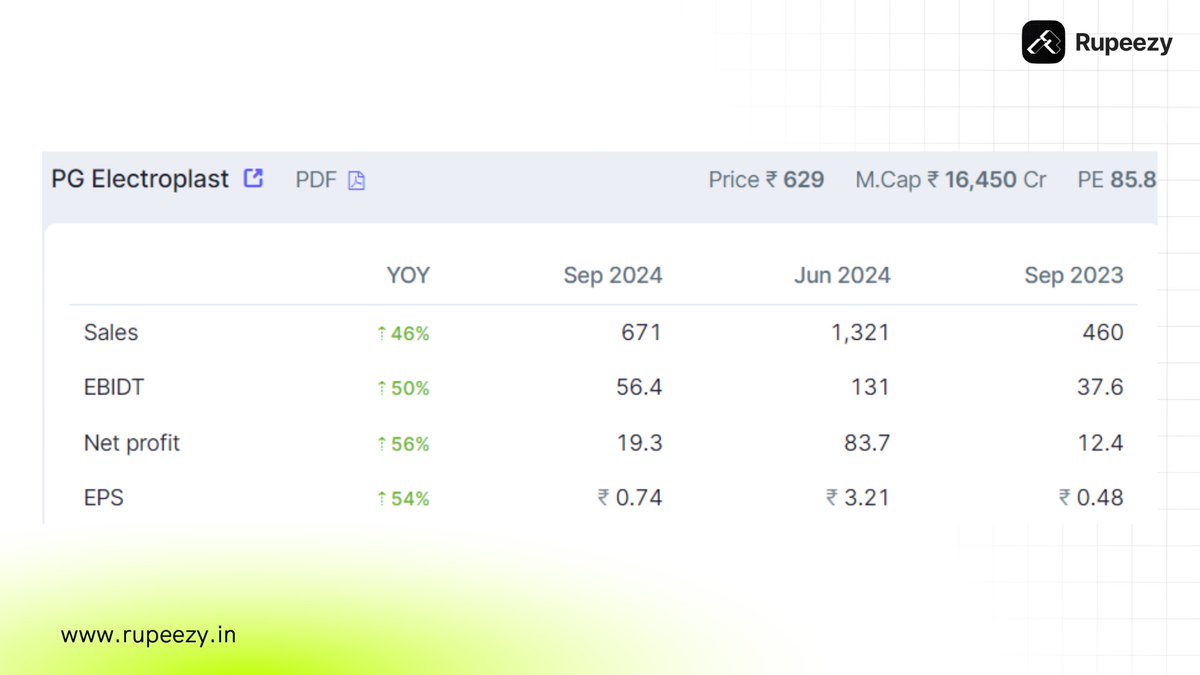

👉M Cap: ₹ 16,450 Cr.

👉CMP: ₹ 629

👉P/E: 85.8

#stockmarketscrash #StocksInFocus #stockmarkets #electronics #manufacturing #PGEL x.com

A detailed Analysis

Summary of concall ✨

👉M Cap: ₹ 16,450 Cr.

👉CMP: ₹ 629

👉P/E: 85.8

#stockmarketscrash #StocksInFocus #stockmarkets #electronics #manufacturing #PGEL x.com

👉PG Electroplast Ltd business model

It specializes in Original Design Manufacturing (ODM), Original Equipment Manufacturing (OEM) and Plastic Injection Molding, catering to 50+ leading Indian and Global brands x.com

It specializes in Original Design Manufacturing (ODM), Original Equipment Manufacturing (OEM) and Plastic Injection Molding, catering to 50+ leading Indian and Global brands x.com

👉Major Highlights

⚡1HFY2025 has been a robust growth period as Consolidated Revenues grew 75.0% and closed at INR 1991.98 crores for the company. This is despite the TV business shift to Goodworth Electronics – 50% JV.

⚡1HFY2025 has been a robust growth period as Consolidated Revenues grew 75.0% and closed at INR 1991.98 crores for the company. This is despite the TV business shift to Goodworth Electronics – 50% JV.

⚡The Product business contributed 68% of the total revenues in 1HFY2025. Room AC business at INR 1118 crores grew 143% during the period while the Washing Machines business had a

growth of 41% YoY.

growth of 41% YoY.

👉 Industries Served

⚡Air Conditioners

⚡Washing Machines

⚡LED Televisions

⚡Air Coolers

⚡Automotive Components

⚡Bathroom Fittings

⚡Consumer Electronics

⚡Air Conditioners

⚡Washing Machines

⚡LED Televisions

⚡Air Coolers

⚡Automotive Components

⚡Bathroom Fittings

⚡Consumer Electronics

👉Key clients

⚡Haier

⚡Havells

⚡Lava

⚡LG

⚡Hyundai

⚡Voltas

⚡BPL

⚡Godrej

⚡Honeywell

⚡Foxconn

⚡Crompton

⚡AO Smith

⚡Haier

⚡Havells

⚡Lava

⚡LG

⚡Hyundai

⚡Voltas

⚡BPL

⚡Godrej

⚡Honeywell

⚡Foxconn

⚡Crompton

⚡AO Smith

👉 Guidance For FY 25

⚡For PGEL Consolidated Revenue guidance is of at least INR 4250 crores which is a growth of 54.7% over FY2024

⚡Revenues of INR 2746.5 crores. This is despite TV business revenues shifting to JV company Goodworth Electronics

⚡For PGEL Consolidated Revenue guidance is of at least INR 4250 crores which is a growth of 54.7% over FY2024

⚡Revenues of INR 2746.5 crores. This is despite TV business revenues shifting to JV company Goodworth Electronics

⚡For Goodworth, Revenues we expect at INR 600 crores.

⚡Implying Group Revenues to be around 4850 crores.

⚡PGEL Net profit guidance of INR 250 crores which is a growth of 82.5% over FY2024 Net profit of INR 137 crores.

⚡Implying Group Revenues to be around 4850 crores.

⚡PGEL Net profit guidance of INR 250 crores which is a growth of 82.5% over FY2024 Net profit of INR 137 crores.

👉 Future Growth strategies:

Company foresees large opportunities in plastic moulding and in consumer durables like washing machine, Washing Machines Room Air conditioner

Company foresees large opportunities in plastic moulding and in consumer durables like washing machine, Washing Machines Room Air conditioner

Improving operational efficiencies leading to Better profitability & higher cash flowsReinvesting to improve Strategic capabilities To reap future benefits

👉 Shareholding Pattern

⚡Promoter holding: 53.4 %

⚡Change in Prom Hold: -0.14 %

⚡DII holding: 9.80 %

⚡Chg in DII Hold: -0.09 %

⚡FII holding: 10.7 %

⚡Chg in FII Hold: -0.38 %

⚡Public holding: 25.9 % x.com

⚡Promoter holding: 53.4 %

⚡Change in Prom Hold: -0.14 %

⚡DII holding: 9.80 %

⚡Chg in DII Hold: -0.09 %

⚡FII holding: 10.7 %

⚡Chg in FII Hold: -0.38 %

⚡Public holding: 25.9 % x.com

The content in this post is only for educational purpose and not investment advice. Please consult your financial advisors before investing.

Loading suggestions...