An example:

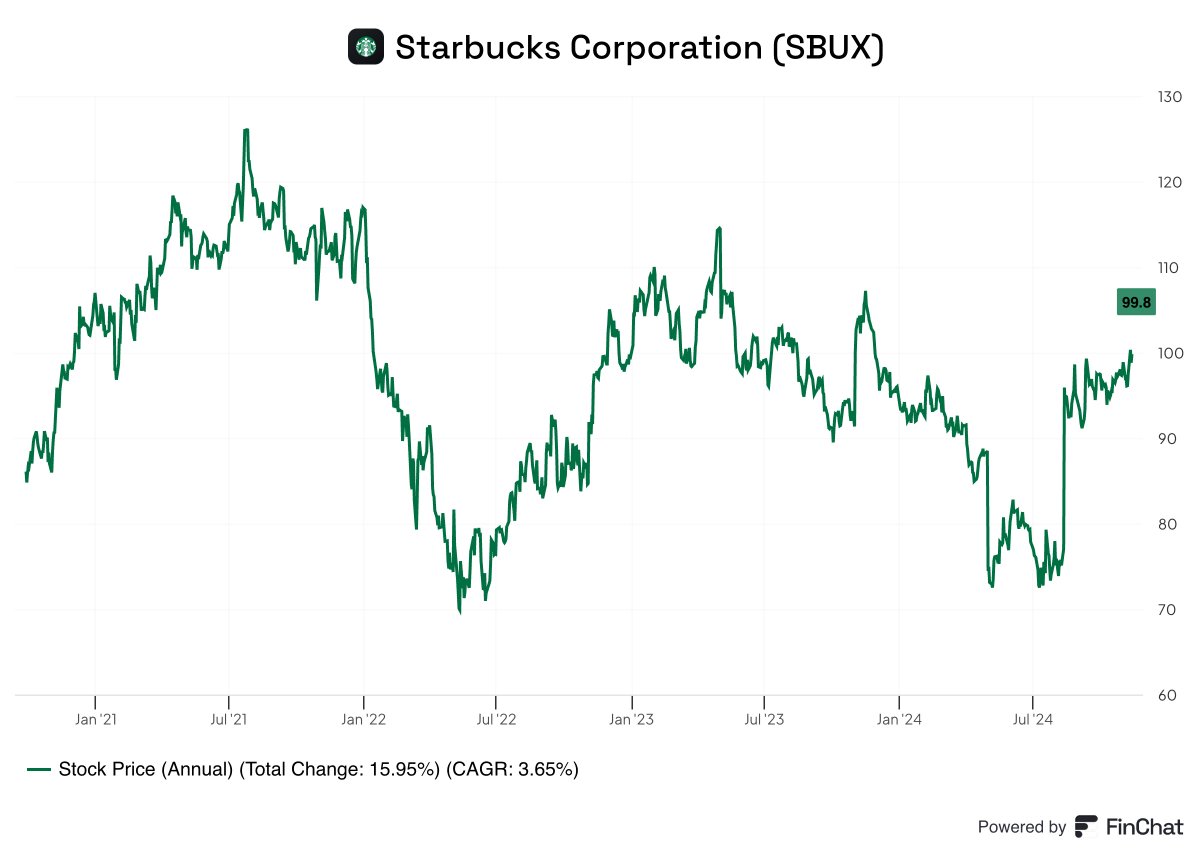

I sold Starbucks in 2021 after realizing its competitive moat wasn’t as strong as I thought. x.com

I sold Starbucks in 2021 after realizing its competitive moat wasn’t as strong as I thought. x.com

2. You’ve Found a Better Opportunity

Investing is about opportunity costs.

Don’t be afraid to shift to stocks with better risk-return potential. x.com

Investing is about opportunity costs.

Don’t be afraid to shift to stocks with better risk-return potential. x.com

Example:

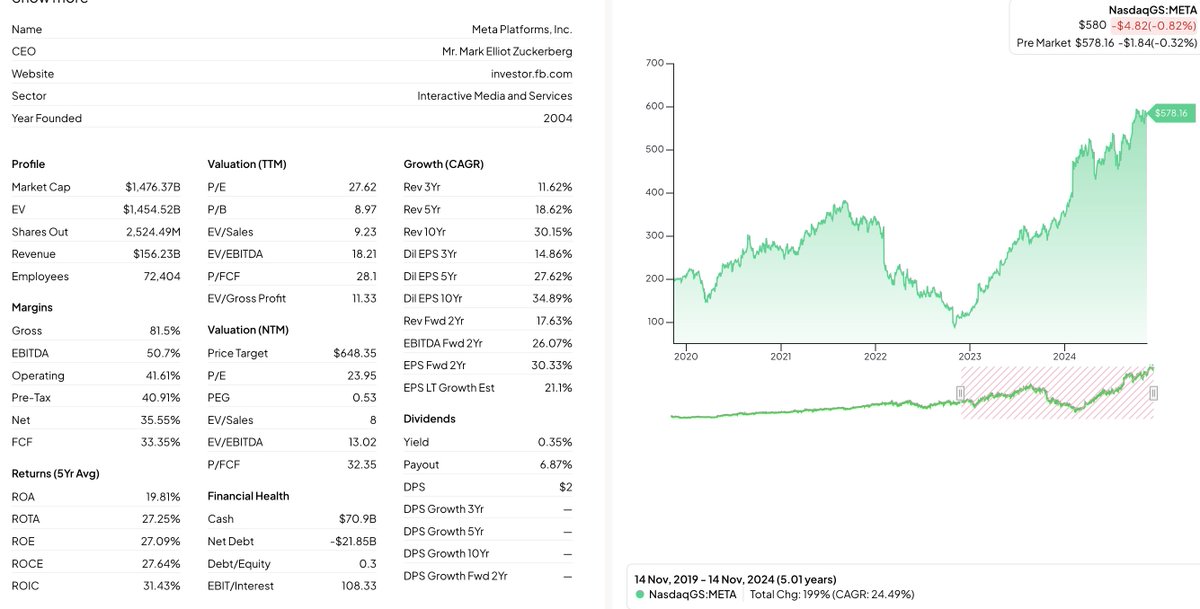

A while ago, I sold Meta Platforms position and moved funds to a promising US-quality stock. x.com

A while ago, I sold Meta Platforms position and moved funds to a promising US-quality stock. x.com

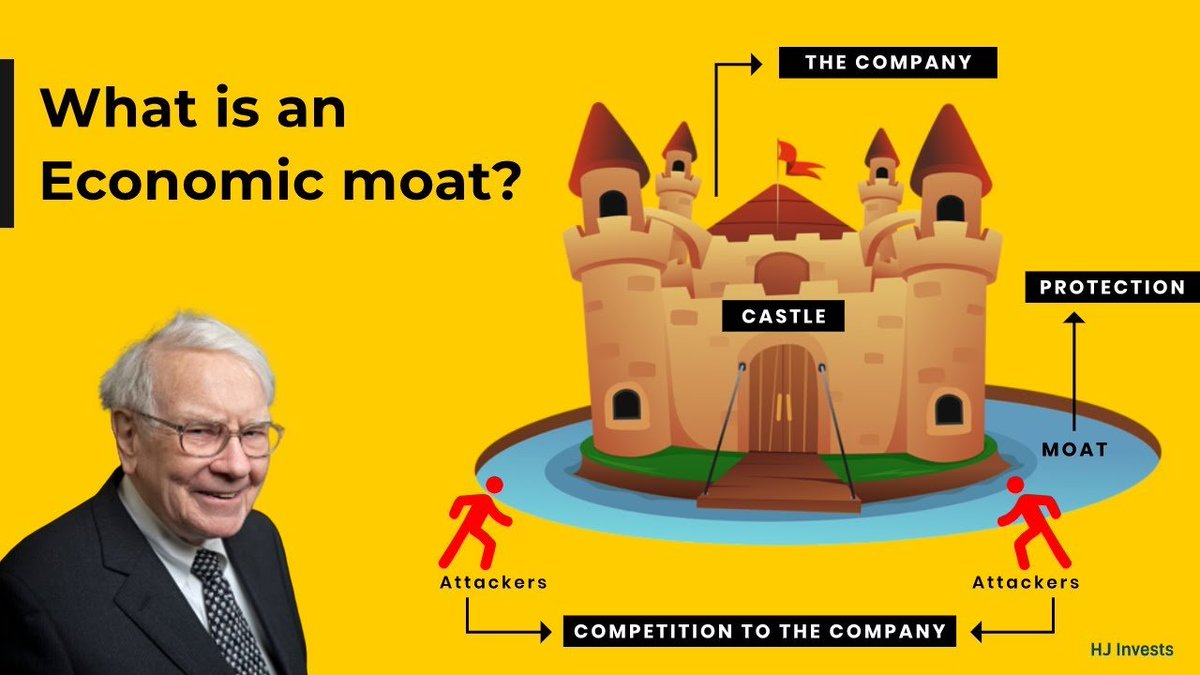

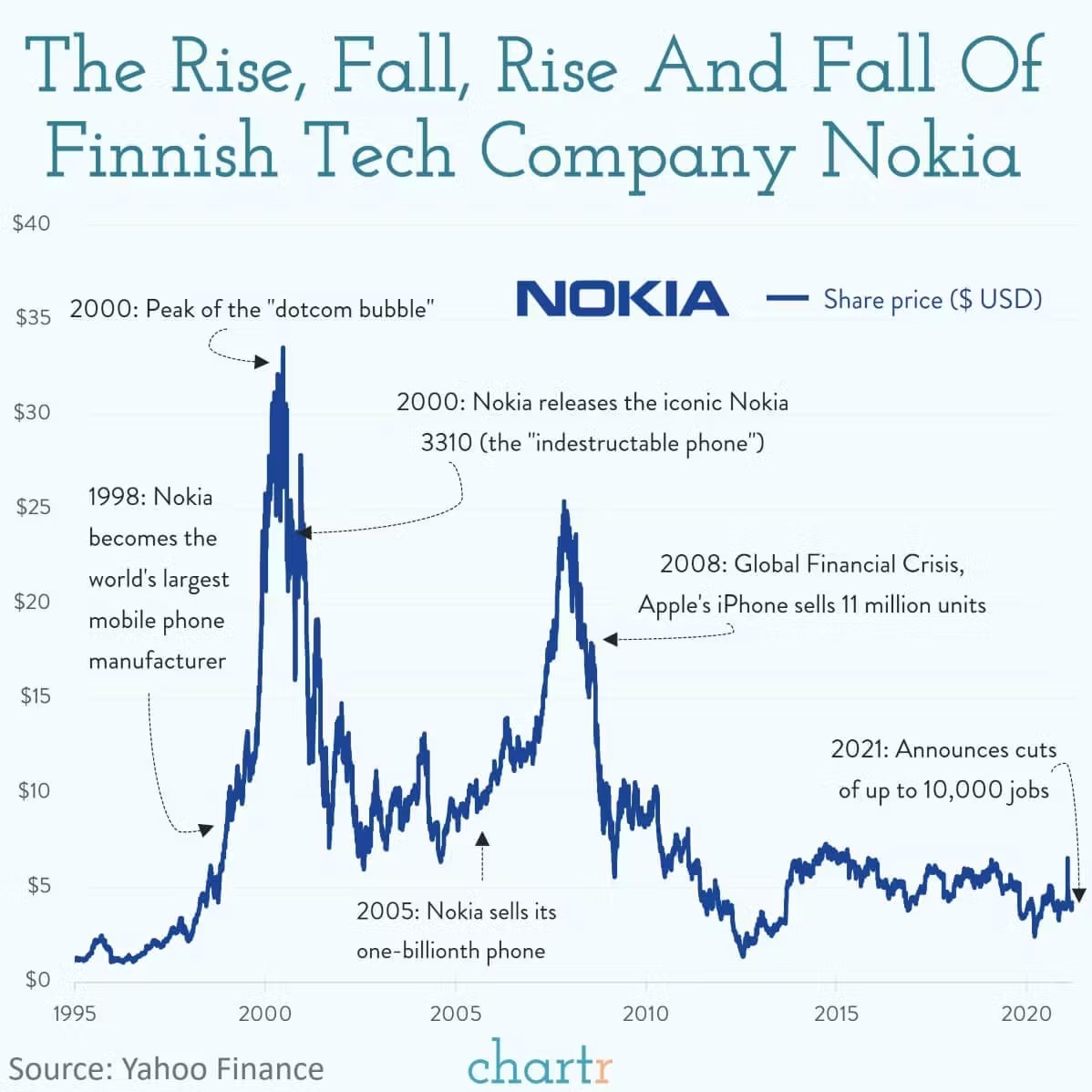

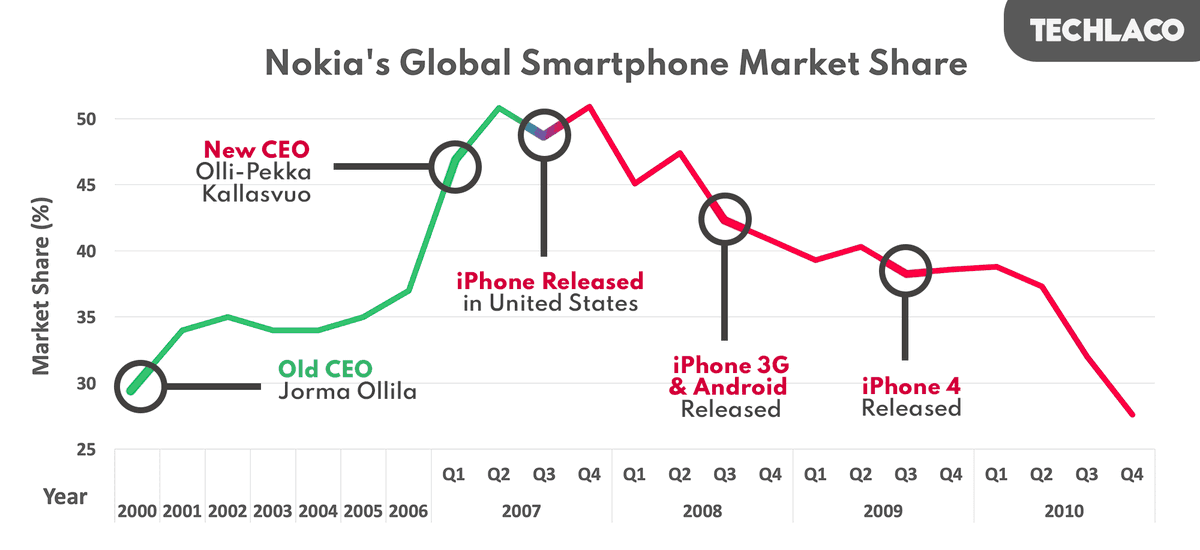

3. The Company is Losing Its Moat

A moat protects a company’s market position.

Re-evaluate your investment when a competitive advantage weakens, x.com

A moat protects a company’s market position.

Re-evaluate your investment when a competitive advantage weakens, x.com

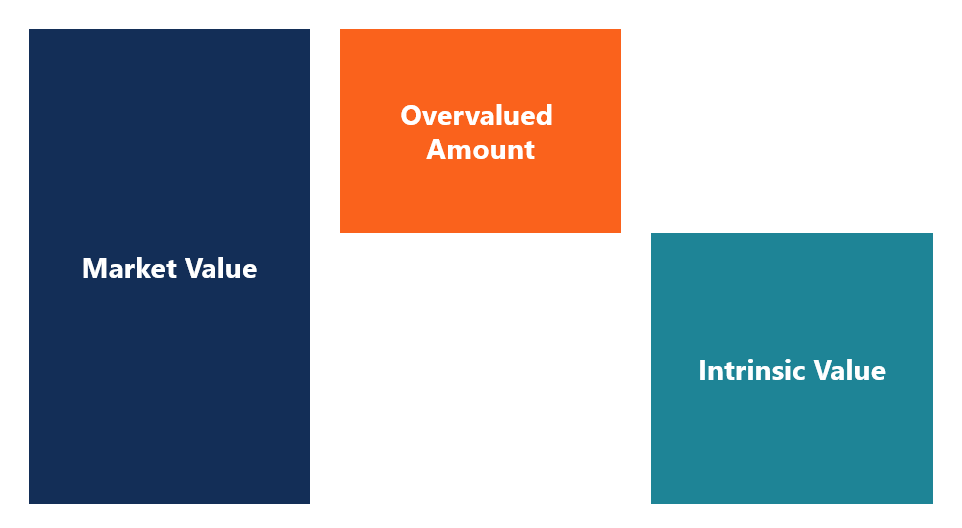

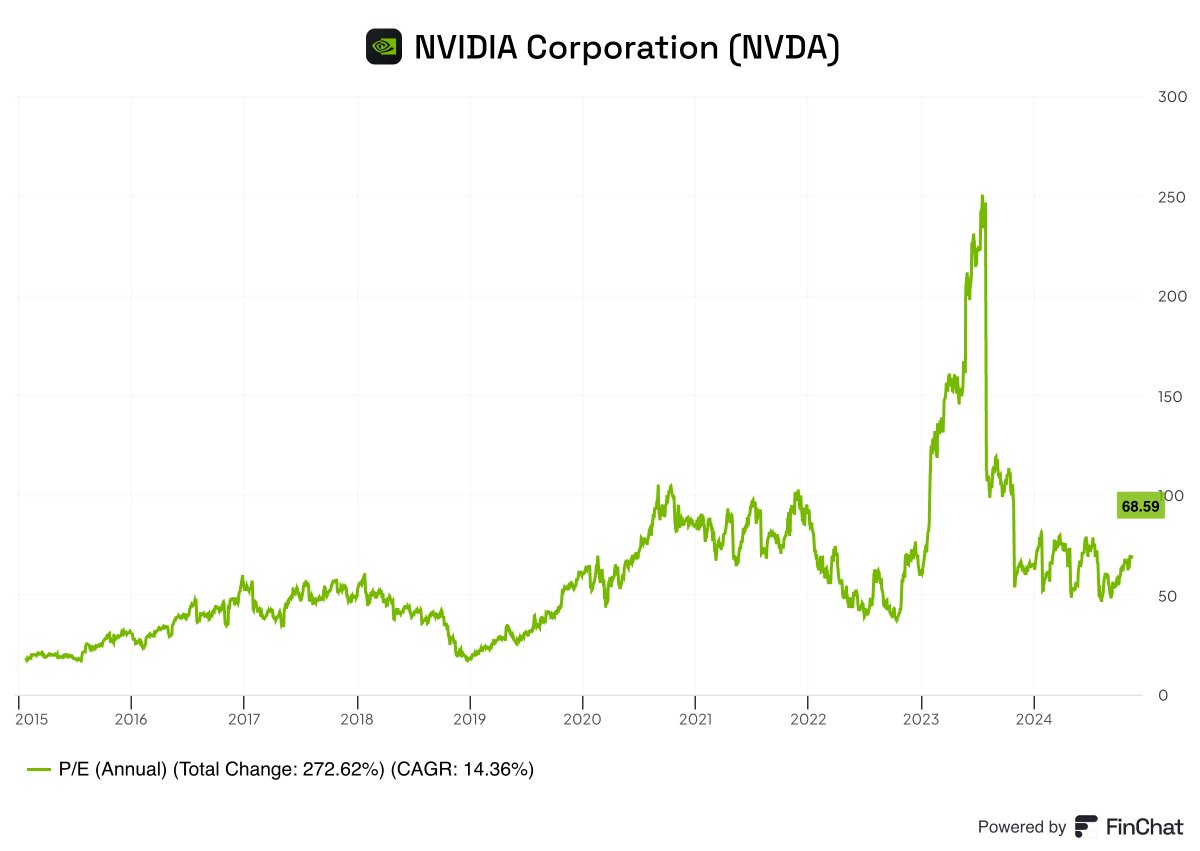

4. The Stock Is Overvalued

Price matters, but don’t sell too soon. Great companies often exceed expectations.

Avoid selling unless it’s ridiculously overvalued, as growth can justify high prices. x.com

Price matters, but don’t sell too soon. Great companies often exceed expectations.

Avoid selling unless it’s ridiculously overvalued, as growth can justify high prices. x.com

5. Change in Management

“Skin in the game” is key. Good managers are invaluable for growth and integrity. x.com

“Skin in the game” is key. Good managers are invaluable for growth and integrity. x.com

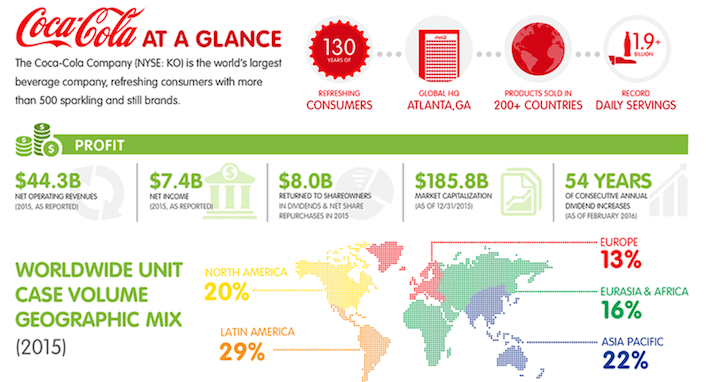

6. Growth Is Slowing Down

Earnings growth is all that matters in the long term.

Look for companies with above-average growth for higher returns. x.com

Earnings growth is all that matters in the long term.

Look for companies with above-average growth for higher returns. x.com

Example:

Coca-Cola is iconic but unlikely to grow fast due to its size. Slow growth is why I don’t own it. x.com

Coca-Cola is iconic but unlikely to grow fast due to its size. Slow growth is why I don’t own it. x.com

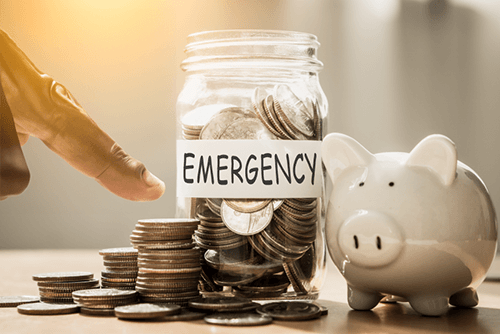

7: Need for Cash

Liquidity needs may require selling, but choose stocks wisely. If you must sell, prioritize the least promising positions first.

Stocks compound over time; holding investments maximizes their future worth. x.com

Liquidity needs may require selling, but choose stocks wisely. If you must sell, prioritize the least promising positions first.

Stocks compound over time; holding investments maximizes their future worth. x.com

That's it for today.

If you liked this, you’ll LOVE our free Financial Analysis course.

Grab it for free here: compounding-quality.ck.page

If you liked this, you’ll LOVE our free Financial Analysis course.

Grab it for free here: compounding-quality.ck.page

Loading suggestions...