Previous day sweeps:

monitor above & below previous day for excess in:

- volume

- liquidations

- trapped traders in general

recognising a sweep above/below the previous day can help you get on the right side of a newly forming engulfing candle. x.com

monitor above & below previous day for excess in:

- volume

- liquidations

- trapped traders in general

recognising a sweep above/below the previous day can help you get on the right side of a newly forming engulfing candle. x.com

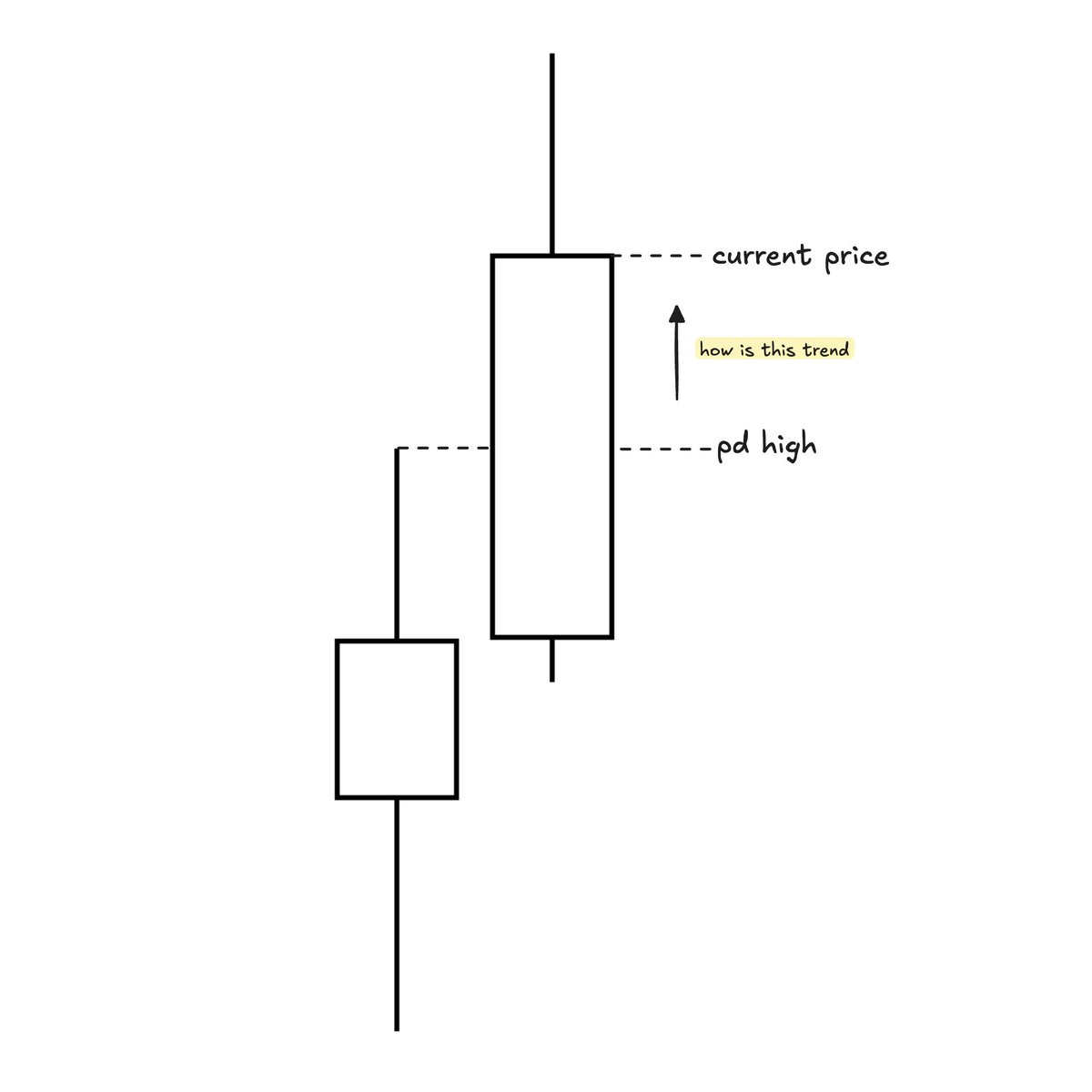

Price vs. previous day:

where is current price in relation to previous day, is it above or below previous days highs/lows.

If it is above previous day for example, then monitor the strength of that trend above previous day's high.

When monitoring the trend check for:

- strength in relative volume (for continuation)

- aggressive OI increase, as if price reverses away from these positions could fuel for a large reversal back into pd values.

where is current price in relation to previous day, is it above or below previous days highs/lows.

If it is above previous day for example, then monitor the strength of that trend above previous day's high.

When monitoring the trend check for:

- strength in relative volume (for continuation)

- aggressive OI increase, as if price reverses away from these positions could fuel for a large reversal back into pd values.

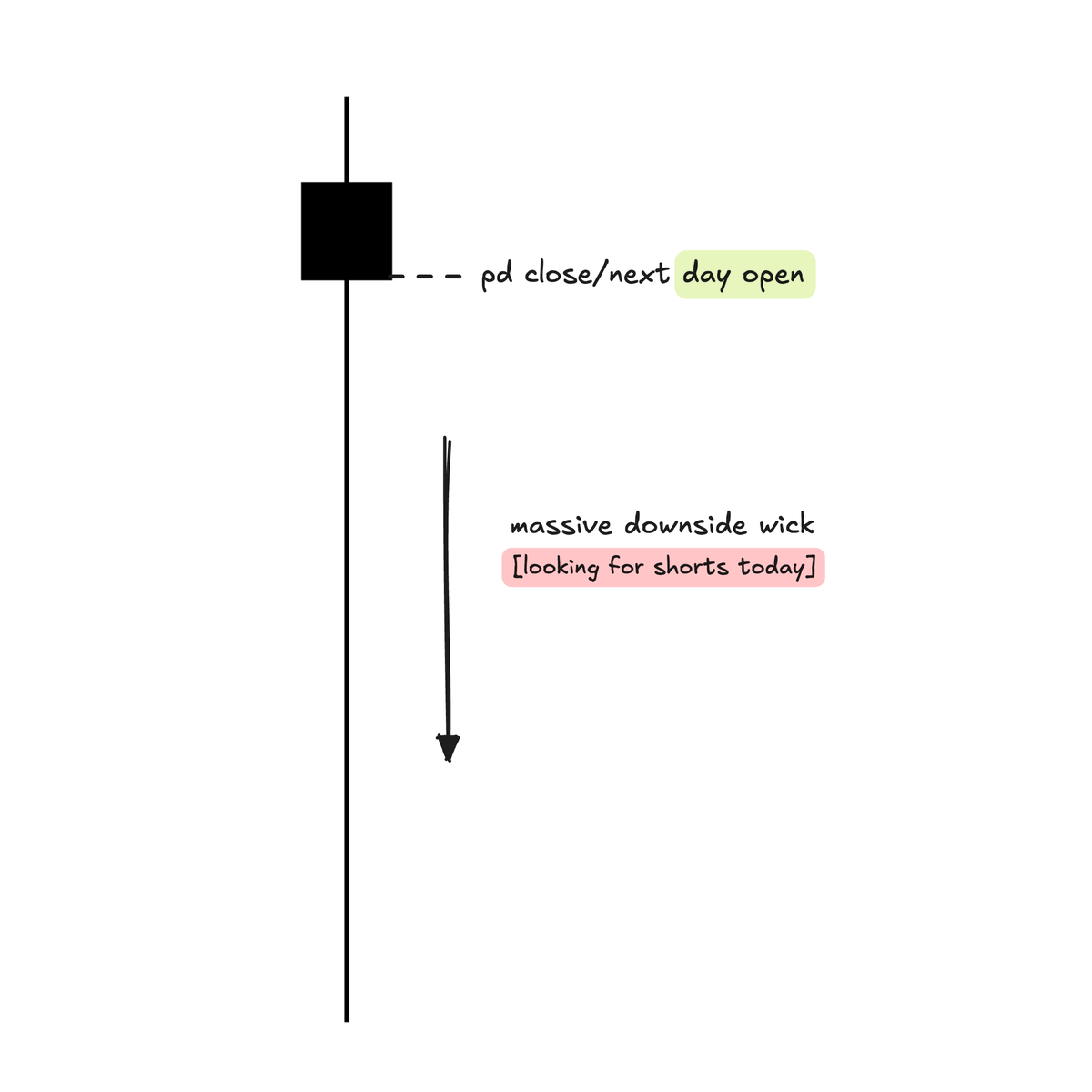

Wick fills:

Does previous day have a large wick either to the downside or the upside.

If yes, I look for that large wick to see at least a partial fill. Note, this can date back a few days, not just the previous day.

These large wick fills can act as magnets to price, allowing me to look for trades in the direction of the wick fill.

[works especially well when the market is aggressively trending]

example ↓

Does previous day have a large wick either to the downside or the upside.

If yes, I look for that large wick to see at least a partial fill. Note, this can date back a few days, not just the previous day.

These large wick fills can act as magnets to price, allowing me to look for trades in the direction of the wick fill.

[works especially well when the market is aggressively trending]

example ↓

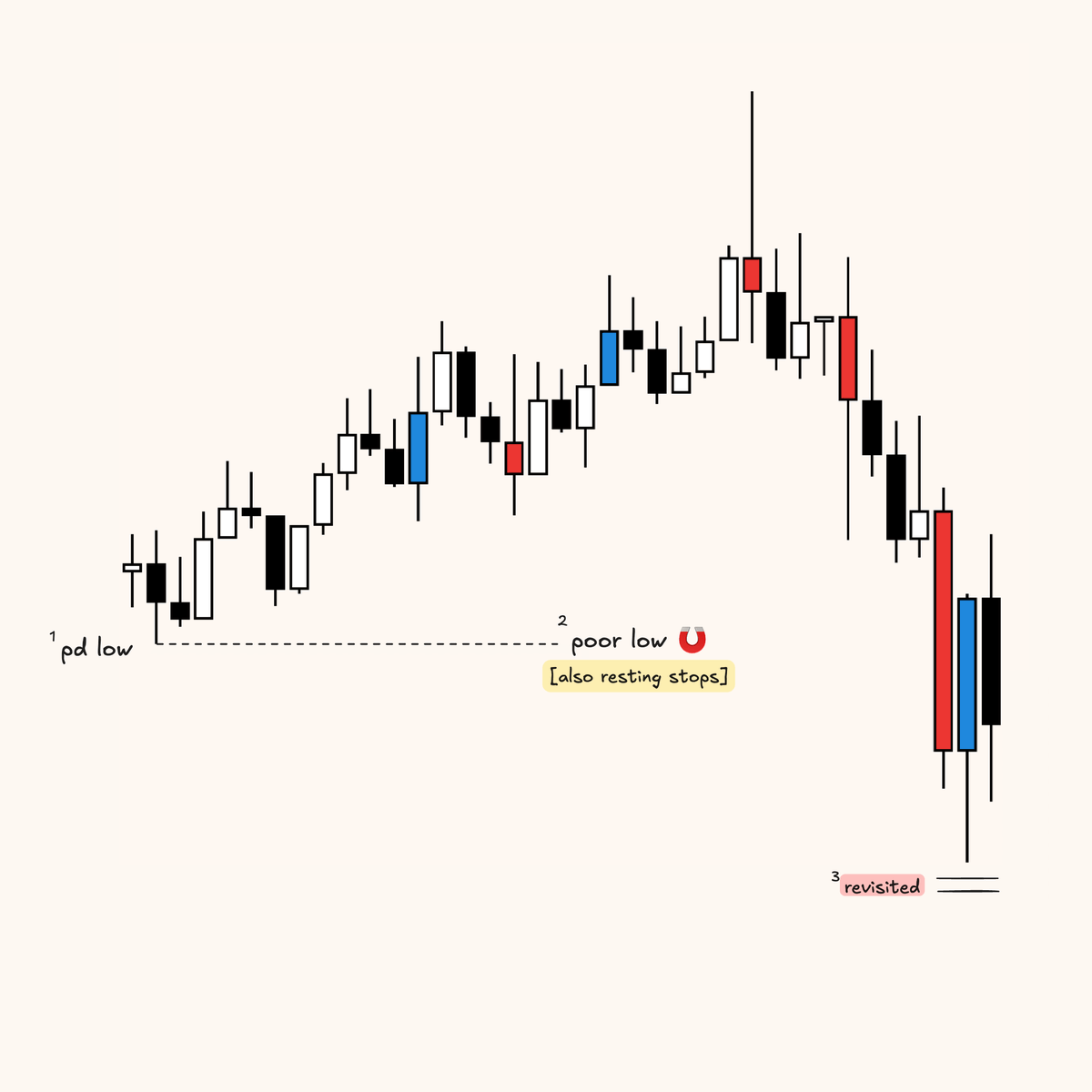

Clean pivots:

Zoom in on previous day's highs/lows to identify any weak pivots that can be revisited.

A weak pivot can be identified as a poor high/low on that day.

These are more common during weekend price action, particularly on Saturdays.

example ↓ x.com

Zoom in on previous day's highs/lows to identify any weak pivots that can be revisited.

A weak pivot can be identified as a poor high/low on that day.

These are more common during weekend price action, particularly on Saturdays.

example ↓ x.com

Tools:

I use this key levels indicator by Leviathan to automatically mark out tonnes of previous day/week/month levels.

I use this key levels indicator by Leviathan to automatically mark out tonnes of previous day/week/month levels.

Currently building @EntropiaTrading where we will be bringing a stats based edge to your trading - follow to keep up to date with details.

Free resources - check my pinned post:

- Youtube

- Newsletter

- Free Exocharts

likes/reposts on the original post are appreciated. x.com

Free resources - check my pinned post:

- Youtube

- Newsletter

- Free Exocharts

likes/reposts on the original post are appreciated. x.com

Loading suggestions...