What in the world is happening to Gold?

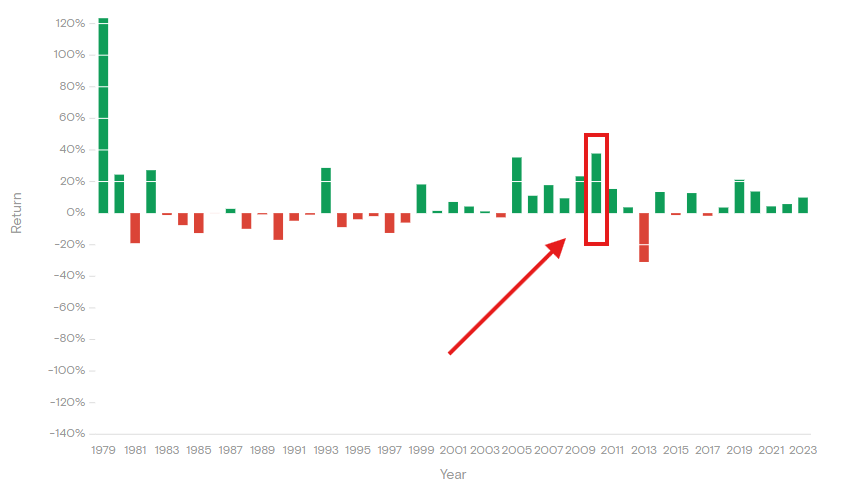

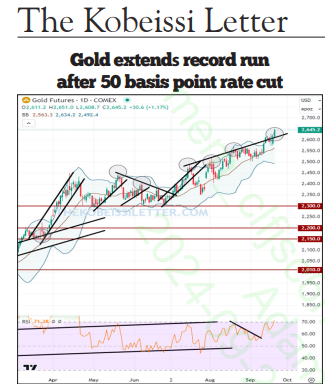

Gold prices are up a MASSIVE 28% in 2024 to a fresh record high of $2,660/oz.

This puts Gold on track for its best annual return since 1979, all while the Fed is calling for a "soft landing."

Is Gold telling us something?

(a thread)

Gold prices are up a MASSIVE 28% in 2024 to a fresh record high of $2,660/oz.

This puts Gold on track for its best annual return since 1979, all while the Fed is calling for a "soft landing."

Is Gold telling us something?

(a thread)

We've been providing outlook for interest rate policy and how it is a MAJOR driver of ALL markets.

Get ahead of the Fed move and you win in this market.

Consider subscribing at thekobeissiletter.com to see our latest outlook.

But, this isn't the main driver of gold.

Get ahead of the Fed move and you win in this market.

Consider subscribing at thekobeissiletter.com to see our latest outlook.

But, this isn't the main driver of gold.

Sum it all up and you have:

1. An economy that is weakening

2. Geopolitical tensions across the world

3. The weakest US Dollar since July 2023

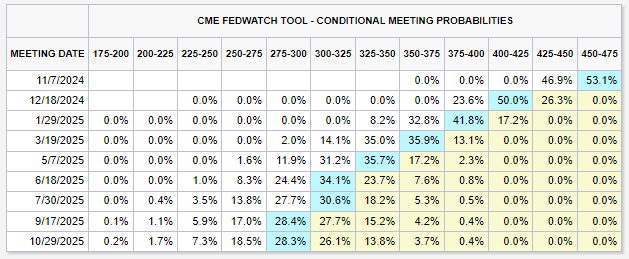

4. 2008-style Fed interest rate cuts

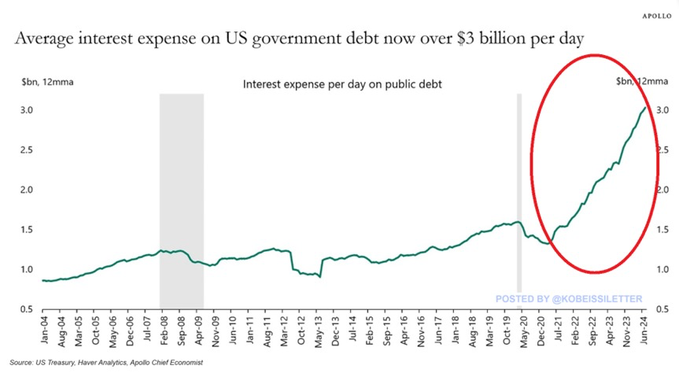

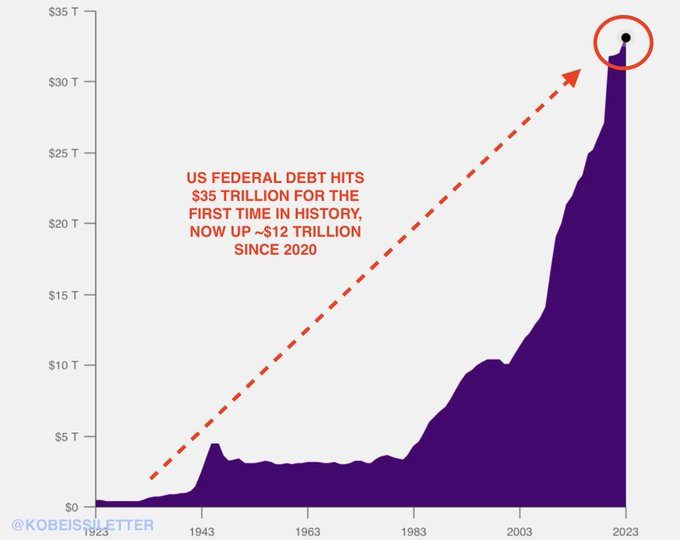

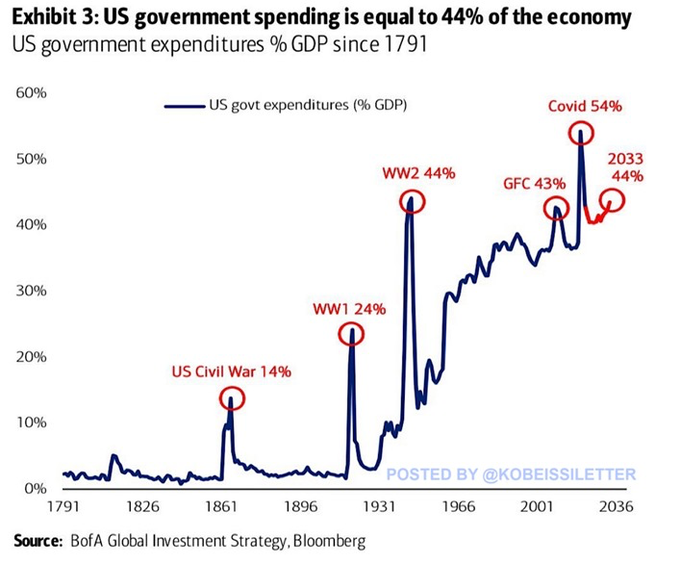

5. Government deficit spending at World War 2 levels

Gold knows this is not a "soft landing."

1. An economy that is weakening

2. Geopolitical tensions across the world

3. The weakest US Dollar since July 2023

4. 2008-style Fed interest rate cuts

5. Government deficit spending at World War 2 levels

Gold knows this is not a "soft landing."

We've been trading gold for over a decade now through our premium member analysis.

All commodities and bonds are beginning to show similar signs.

Interested in receiving our analysis and alerts?

Subscribe now for instant access at the link below:

thekobeissiletter.com

All commodities and bonds are beginning to show similar signs.

Interested in receiving our analysis and alerts?

Subscribe now for instant access at the link below:

thekobeissiletter.com

Since 2020, our calls are up over +340%.

We just published our most recent trades for premium members.

Subscribe below to see how we are positioned into this week and access our private alert feed:

thekobeissiletter.com

We just published our most recent trades for premium members.

Subscribe below to see how we are positioned into this week and access our private alert feed:

thekobeissiletter.com

Loading suggestions...