The bull cycle—how long will we stay in this cycle?

Is it really going to be a supercycle, as they say?

Or is it just another narrative to trap you?

Let's find out 🧵

Is it really going to be a supercycle, as they say?

Or is it just another narrative to trap you?

Let's find out 🧵

Let me break some myths around the supercycle first.

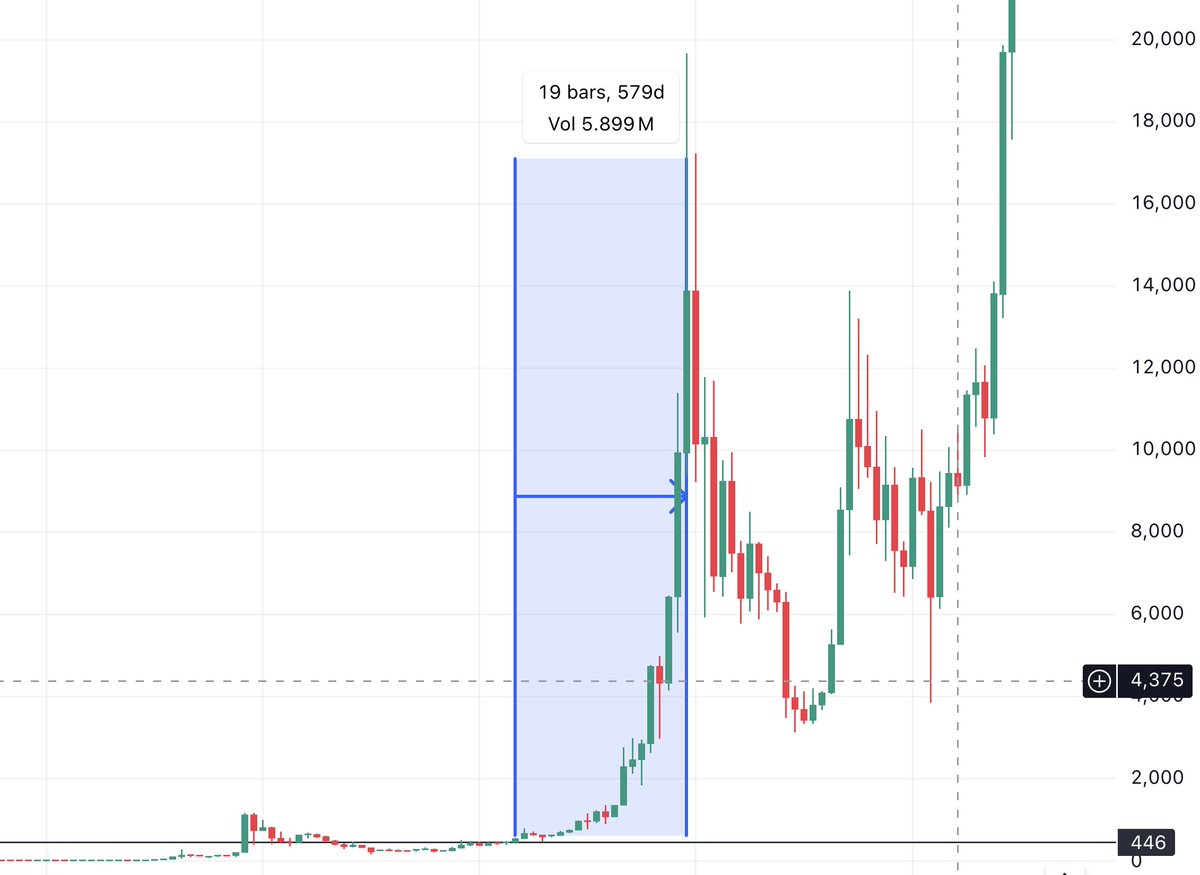

We had only one supercycle in the past, which happened between 2016-17 when Bitcoin went from $232 to $20K in 24 months.

The super cycle started when btc reclaimed previous bull cycle support which was around $446 in may'16, length was somewhere around 19 months.

And some of the altcoins of that time, like $XRP and $LTC, also pulled some massive gains for investors during that period.

We had only one supercycle in the past, which happened between 2016-17 when Bitcoin went from $232 to $20K in 24 months.

The super cycle started when btc reclaimed previous bull cycle support which was around $446 in may'16, length was somewhere around 19 months.

And some of the altcoins of that time, like $XRP and $LTC, also pulled some massive gains for investors during that period.

Based on historical data, we could expect the length of a supercycle to be more than 19 months to start with, and then it could extend as long as we get incoming liquidity in the market from new money.

If you look at the current cycle closely, #BTC has spent almost 11 months in a bull cycle...the current bull cycle officially begins when btc reclaimed $30K support on monthly timeframe in Oct'23

Since BTC has become a recognized asset class now, you can't really expect it to go to Valhalla like in 2016-17.

The growth is capped now, and the volatility will eventually dry up over time.

Since BTC has become a recognized asset class now, you can't really expect it to go to Valhalla like in 2016-17.

The growth is capped now, and the volatility will eventually dry up over time.

Now, in the context of an alts run, could we expect a supercycle?

Yes, you could expect it in those coins that have survived two bear cycles and are now maturing as solid businesses.

Never forget, most of these alts were used as instruments to raise money for a business.

And when the business is being built, usage should be growing, and revenue should be coming in.

Yes, you could expect it in those coins that have survived two bear cycles and are now maturing as solid businesses.

Never forget, most of these alts were used as instruments to raise money for a business.

And when the business is being built, usage should be growing, and revenue should be coming in.

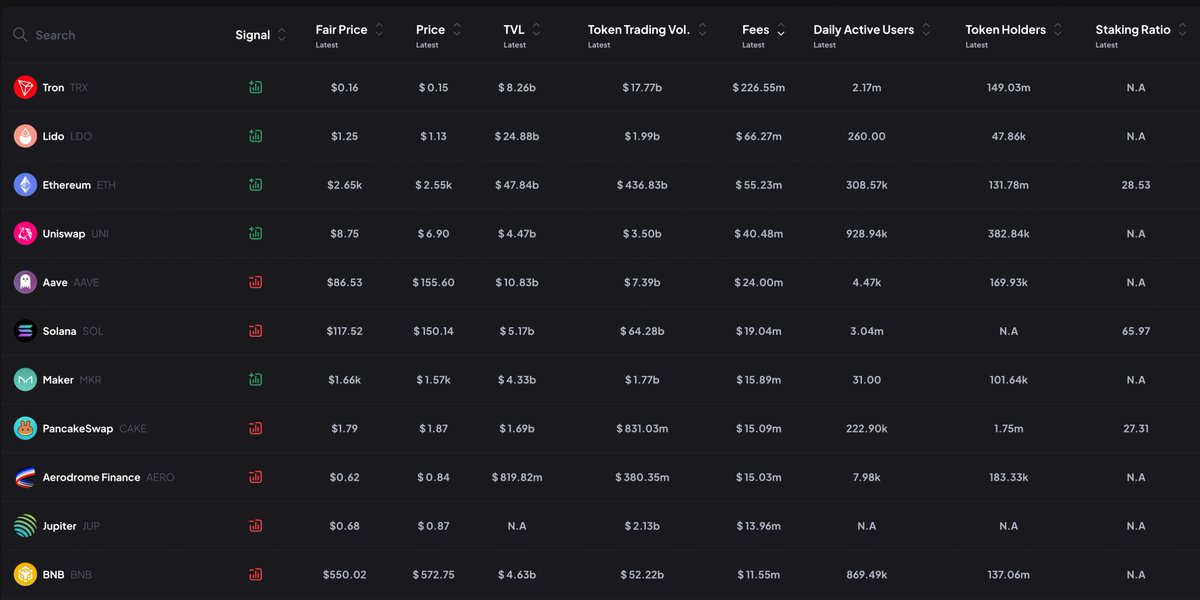

In that context, could we have a supercycle for Blue Chip DeFi coins? Yes, we can.

Projects like AAVE, MakerDAO, Uniswap, Lido, PancakeSwap—they all survived, stayed afloat with new innovations, and their tokens could go for a run as long as the community sticks with them as long-term supporters.

And the stickiness from the community comes only when most of the community members have great memories of making token gains and yields with that project.

Projects like AAVE, MakerDAO, Uniswap, Lido, PancakeSwap—they all survived, stayed afloat with new innovations, and their tokens could go for a run as long as the community sticks with them as long-term supporters.

And the stickiness from the community comes only when most of the community members have great memories of making token gains and yields with that project.

Also, when we look at the supercycle in the context of speculative gains, it’s going to be a rotational market, as that’s what we have observed as the nature of this cycle.

You will get disappointed if you stick to one thesis; you need to revise your thesis based on how things are moving.

You will get disappointed if you stick to one thesis; you need to revise your thesis based on how things are moving.

But at the same time, you can’t rotate after taking losses from each position that isn’t moving—that could be a rushed decision.

You need to consider your choices based on detailed research, not on some random tweets. An informed investor would manage to recover losses from the past cycle.

You need to consider your choices based on detailed research, not on some random tweets. An informed investor would manage to recover losses from the past cycle.

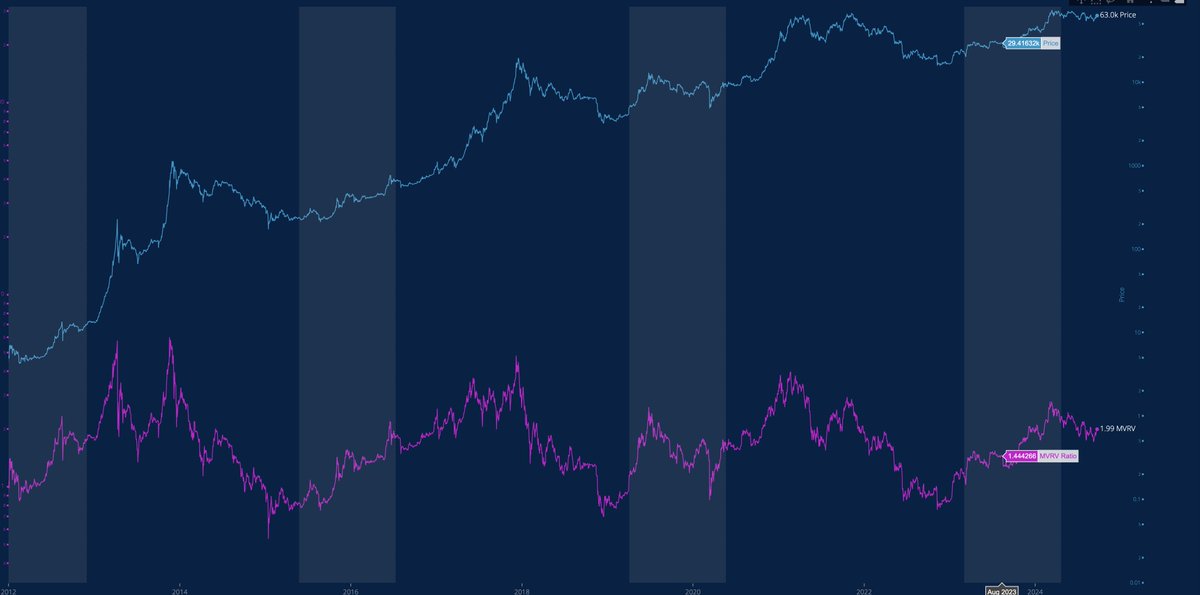

If Bitcoin decides to pull an impulsive move to $100K from here, then the MVRV ratio could hit that 3.5 level in the next 3-4 months, IMO.

so there is strong case of MVRV ratio extending above 4.5 this time, if we are still looking for a supercycle which should at least have 8 months to go based on the past historical data.

so there is strong case of MVRV ratio extending above 4.5 this time, if we are still looking for a supercycle which should at least have 8 months to go based on the past historical data.

another possible way:

since markets also matured as lot as compare to 2016-17 cycle, we could also expect the market to operate in the ongoing behavior which suggest an ongoing rotational cycle as long we have incoming liquidity coming in.. and that could happen through series of corrections and gains quarter wise.

since markets also matured as lot as compare to 2016-17 cycle, we could also expect the market to operate in the ongoing behavior which suggest an ongoing rotational cycle as long we have incoming liquidity coming in.. and that could happen through series of corrections and gains quarter wise.

I hope you enjoyed reading this thread.

If you appreciate my work, please like, share, and repost the tweet below

x.com

If you appreciate my work, please like, share, and repost the tweet below

x.com

Loading suggestions...