But before I start...

I've put a lot of effort and time into this research and share a lot of alpha totally FREE. If you don't mind, please like and retweet the first tweet and FOLLOW me - @DeFiTracer

This will help me provide you with even more ALPHA, thank you 🫶

I've put a lot of effort and time into this research and share a lot of alpha totally FREE. If you don't mind, please like and retweet the first tweet and FOLLOW me - @DeFiTracer

This will help me provide you with even more ALPHA, thank you 🫶

✜ Yesterday, the Federal Reserve acknowledged their MISTAKE and lowered the interest rate for the first time since 2020 by a full 50 basis points.

✜ Inflation has significantly decreased, but the Fed is still far from reaching its target rate levels.

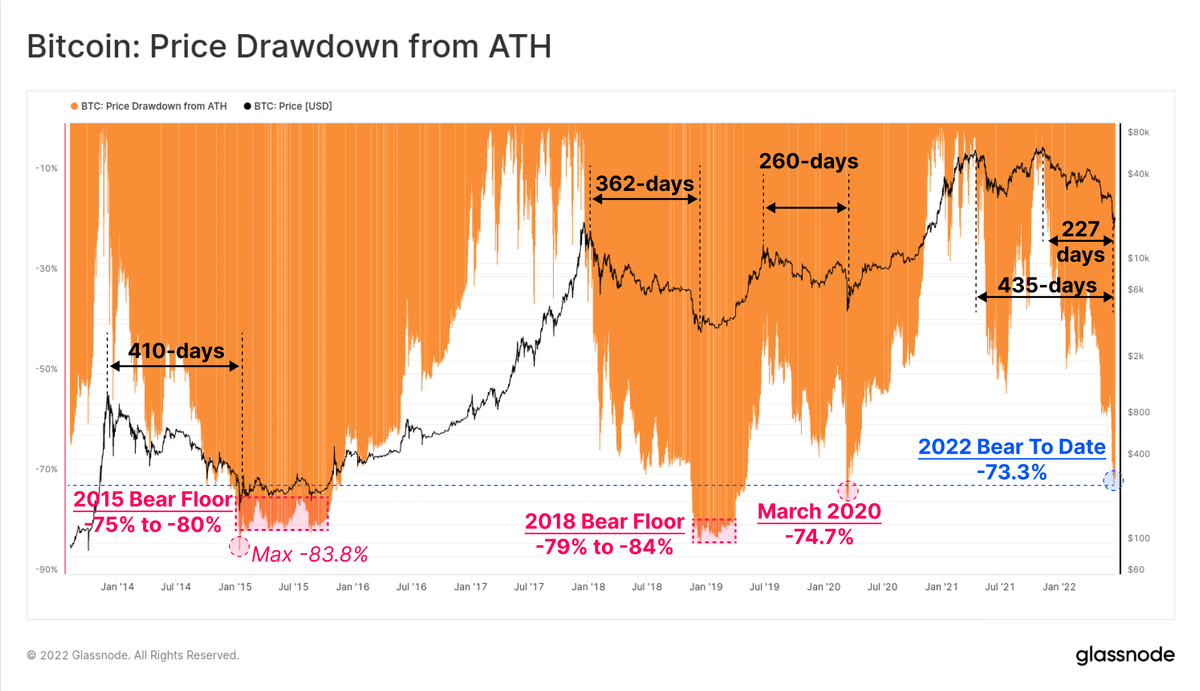

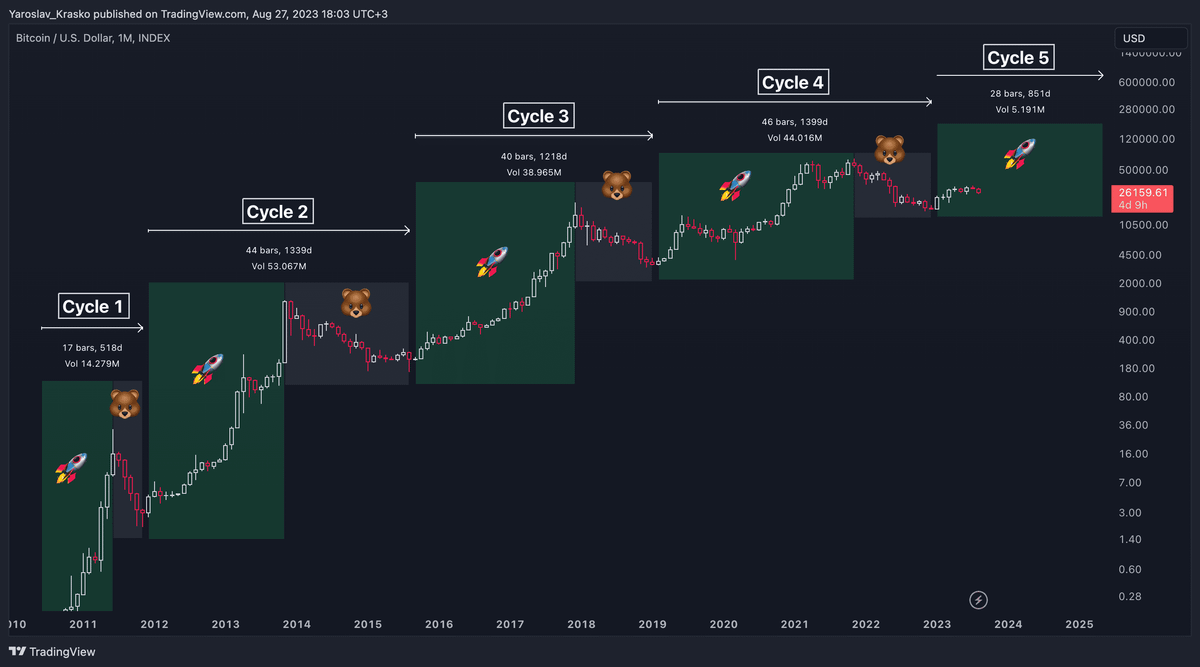

✜ Is this really a bullish piece of news, and is Bitcoin heading for new all-time highs?

✜ Inflation has significantly decreased, but the Fed is still far from reaching its target rate levels.

✜ Is this really a bullish piece of news, and is Bitcoin heading for new all-time highs?

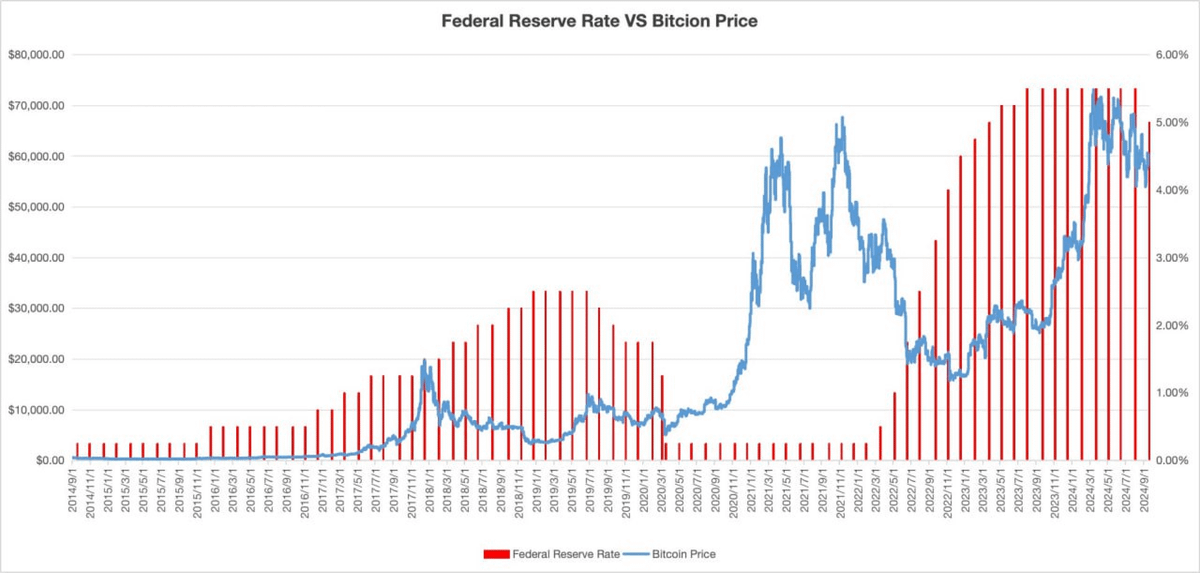

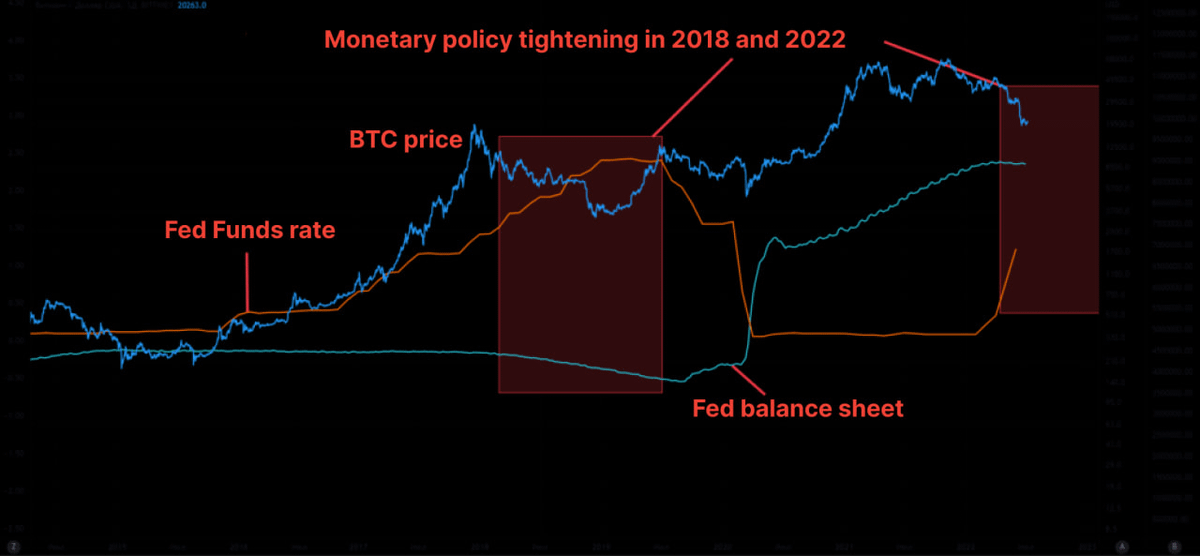

✜ Since this rate reflects the state of the U.S. economy and the global economy as a whole, $BTC is heavily influenced by it.

✜ The Fed rate itself is the interest rate at which banks lend to each other.

✜ Historically, a Fed rate cut leads to an increase in $BTC market capitalization, and vice versa.

✜ The Fed rate itself is the interest rate at which banks lend to each other.

✜ Historically, a Fed rate cut leads to an increase in $BTC market capitalization, and vice versa.

✜ During periods of economic growth, the Fed keeps the base rate low, which stimulates investment.

✜ In such times, high-risk assets are the most attractive to investors.

✜ However, a rate hike leads to a recession, prompting investors to increase savings, sell high-risk assets, and seek a “safe haven.”

✜ In such times, high-risk assets are the most attractive to investors.

✜ However, a rate hike leads to a recession, prompting investors to increase savings, sell high-risk assets, and seek a “safe haven.”

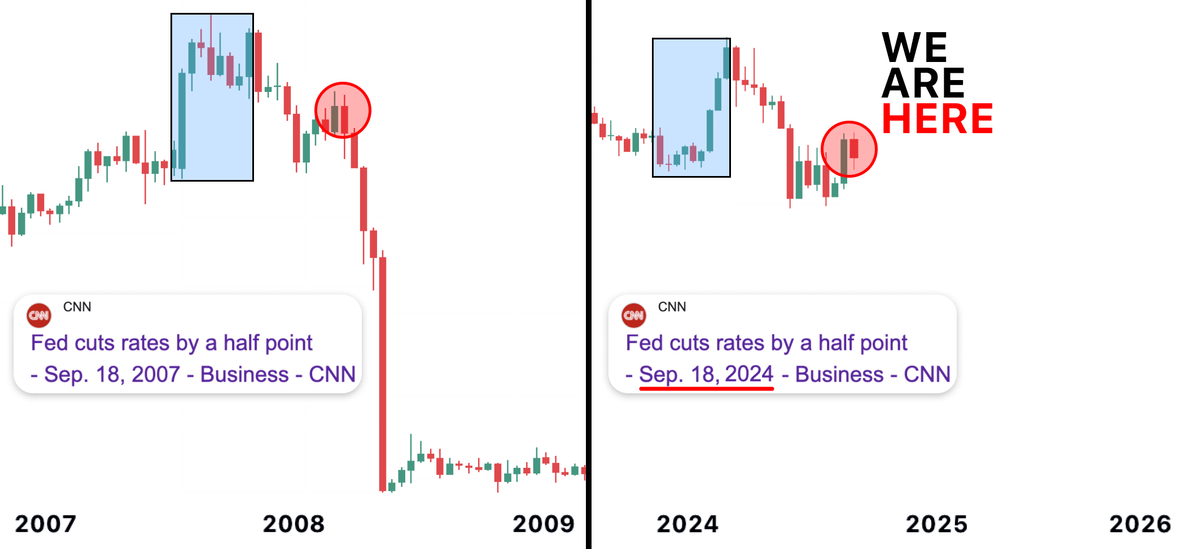

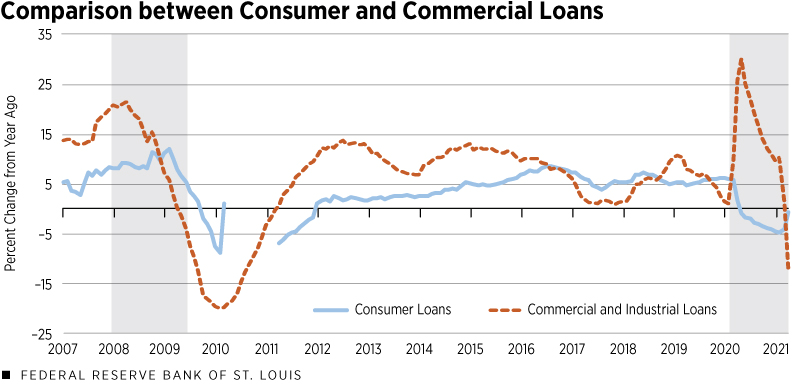

✜ After understanding what the Fed rate is, let's draw parallels with the Fed's actions during two key periods and now:

- The 2007-2008 financial crisis

- The Crypto Bull Market of 2020-2021

✜ By thoroughly studying those events, one can arrive at quite interesting conclusions

- The 2007-2008 financial crisis

- The Crypto Bull Market of 2020-2021

✜ By thoroughly studying those events, one can arrive at quite interesting conclusions

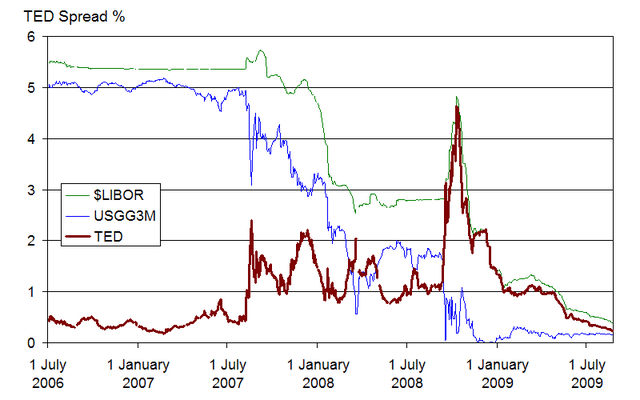

✜ In 2007, the start of the subprime mortgage crisis led to the Global Financial Crisis, which initiated the restructuring of the financial sector.

✜ If you believe in numbers, on September 18, 2007, the Fed first lowered the rate from 5.25% to 4.75%.

✜ They eventually brought the rate down to a record low of 0-0.25%

✜ If you believe in numbers, on September 18, 2007, the Fed first lowered the rate from 5.25% to 4.75%.

✜ They eventually brought the rate down to a record low of 0-0.25%

✜ But at that time, it wasn't just the Fed's rate that led to the crisis, but also:

- Weak regulation of complex financial instruments

- Delayed recognition of the crisis's scale

- Prolonged maintenance of low interest rates

- Inadequate oversight of subprime lending

- Weak regulation of complex financial instruments

- Delayed recognition of the crisis's scale

- Prolonged maintenance of low interest rates

- Inadequate oversight of subprime lending

✜ Although the Fed is now more experienced, @CryptoHayes remains pessimistic.

✜ According to his first prediction, the era of central banks will end, and we are heading toward a situation similar to 2007.

✜ The demand for tokenization and various technologies may decline if rates stay low for too long.

✜ According to his first prediction, the era of central banks will end, and we are heading toward a situation similar to 2007.

✜ The demand for tokenization and various technologies may decline if rates stay low for too long.

✜ However, his opinion has recently adjusted slightly.

✜ Now he urges everyone to watch the USDJPY pair closely like a hawk:

- Weak JPY = Strong BTC

- Strong JPY = Weak BTC

x.com

✜ Now he urges everyone to watch the USDJPY pair closely like a hawk:

- Weak JPY = Strong BTC

- Strong JPY = Weak BTC

x.com

✜ The situation in 2020 during the COVID era showed that rate cuts don’t always lead to negative outcomes.

✜ The Fed learned from the bitter experience of 2007 and responded with much faster and more confident support.

✜ All measures were aimed at stimulating consumption and liquidity.

✜ The Fed learned from the bitter experience of 2007 and responded with much faster and more confident support.

✜ All measures were aimed at stimulating consumption and liquidity.

✜ In conclusion, we see that the Fed rate is only one of many factors in the global economy, and thus, the markets.

✜ In 2007, the Fed faced its first crisis, from which they gained substantial experience.

✜ Later, in 2020, they managed to solve a HUGE problem, which allowed the market to grow, even though rates were lowered.

✜ In 2007, the Fed faced its first crisis, from which they gained substantial experience.

✜ Later, in 2020, they managed to solve a HUGE problem, which allowed the market to grow, even though rates were lowered.

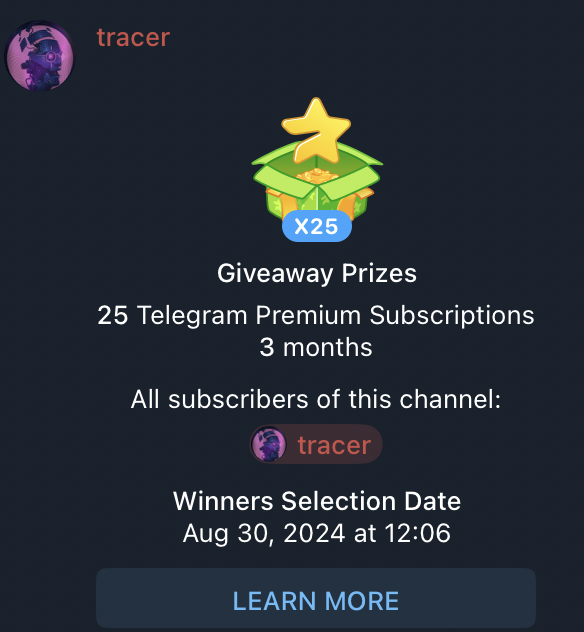

In a few days, I'll start running $1,000+ giveaways, giving calls in my TG channel

Make sure to follow, while it's still open for FREE!

Also I am running giveaway here rn, make sure to participate.

Link: t.me

Make sure to follow, while it's still open for FREE!

Also I am running giveaway here rn, make sure to participate.

Link: t.me

If you loved this thread, don't forget to:

• Follow me @DeFiTracer for more exciting content!

• Like, retweet, and leave a comment 👾

x.com

• Follow me @DeFiTracer for more exciting content!

• Like, retweet, and leave a comment 👾

x.com

Loading suggestions...