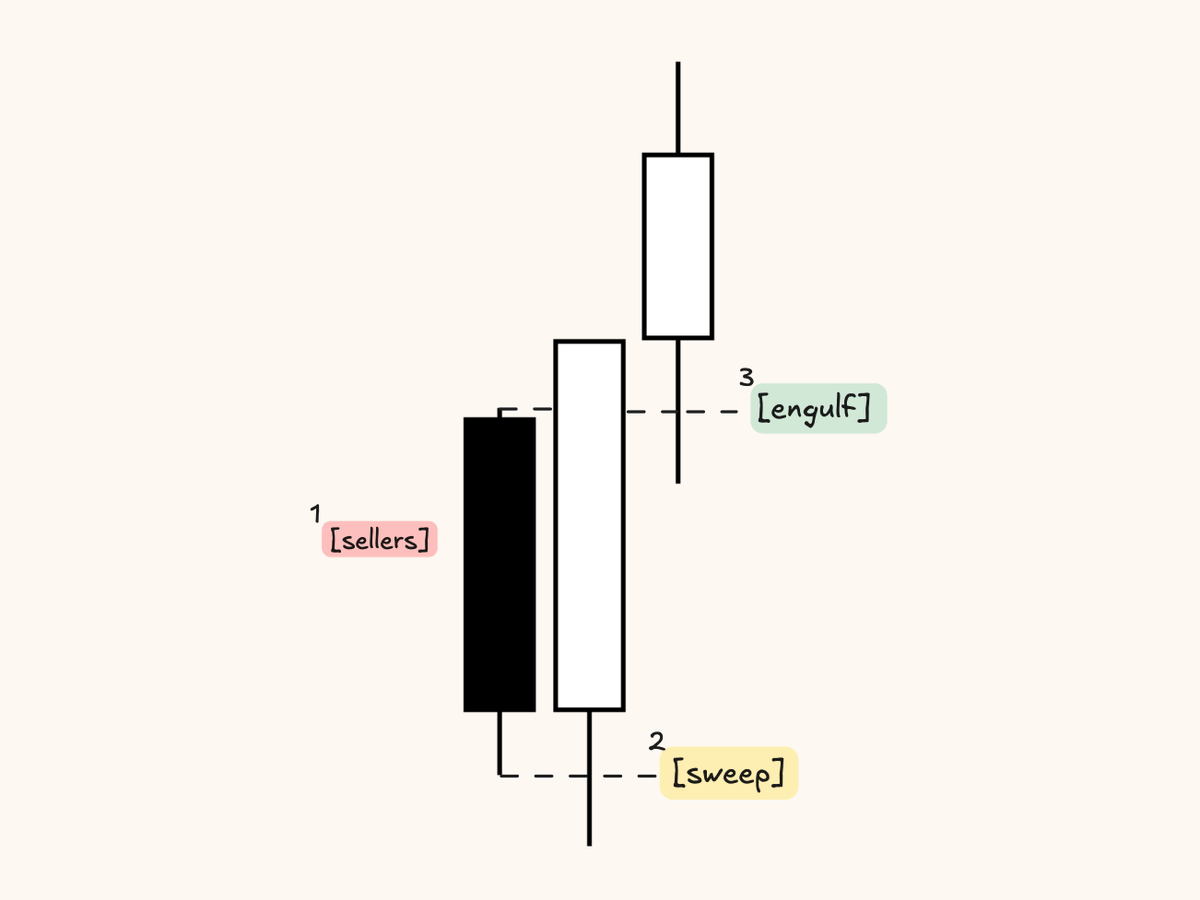

Swing failures:

simple premise:

wick above or below a level with a close back in the opposing direction.

one of the more simple patterns although extremely effective if you know where to look for it.

It's extremely important not to trade these randomly but only at proven selective levels, especially at pivots/levels where others may stop out or pile in for a breakout trade.

some things I look for:

- internal liquidity [internal from major pivots - least expecting stops hit]

- distance between pivots - time to build up positions before stopping out

- sfp of specific sessions [of London high/low]

nonetheless, an sfp traps excess before allowing it to fuel a reversal.

note - invalidations for a swing failure pattern trade are commonly strictly above/below the sfp candle.

example ↓

simple premise:

wick above or below a level with a close back in the opposing direction.

one of the more simple patterns although extremely effective if you know where to look for it.

It's extremely important not to trade these randomly but only at proven selective levels, especially at pivots/levels where others may stop out or pile in for a breakout trade.

some things I look for:

- internal liquidity [internal from major pivots - least expecting stops hit]

- distance between pivots - time to build up positions before stopping out

- sfp of specific sessions [of London high/low]

nonetheless, an sfp traps excess before allowing it to fuel a reversal.

note - invalidations for a swing failure pattern trade are commonly strictly above/below the sfp candle.

example ↓

Engulfed candles:

I most commonly use this for trading against trapped traders.

The engulfed candle likely includes traders opening new positions in that direction, instantly placing them in an offside position.

For further confirmation I check the OI + delta to dial in further whether there is offside traders within the engulfed candle.

Same as any other execution method is to look for this solely at pre planned locations:

- naked pocs

- s/r levels

- intra session pocs

Do not just blindly trade this reversal, there has to be some pre planned substance behind the level.

example ↓

I most commonly use this for trading against trapped traders.

The engulfed candle likely includes traders opening new positions in that direction, instantly placing them in an offside position.

For further confirmation I check the OI + delta to dial in further whether there is offside traders within the engulfed candle.

Same as any other execution method is to look for this solely at pre planned locations:

- naked pocs

- s/r levels

- intra session pocs

Do not just blindly trade this reversal, there has to be some pre planned substance behind the level.

example ↓

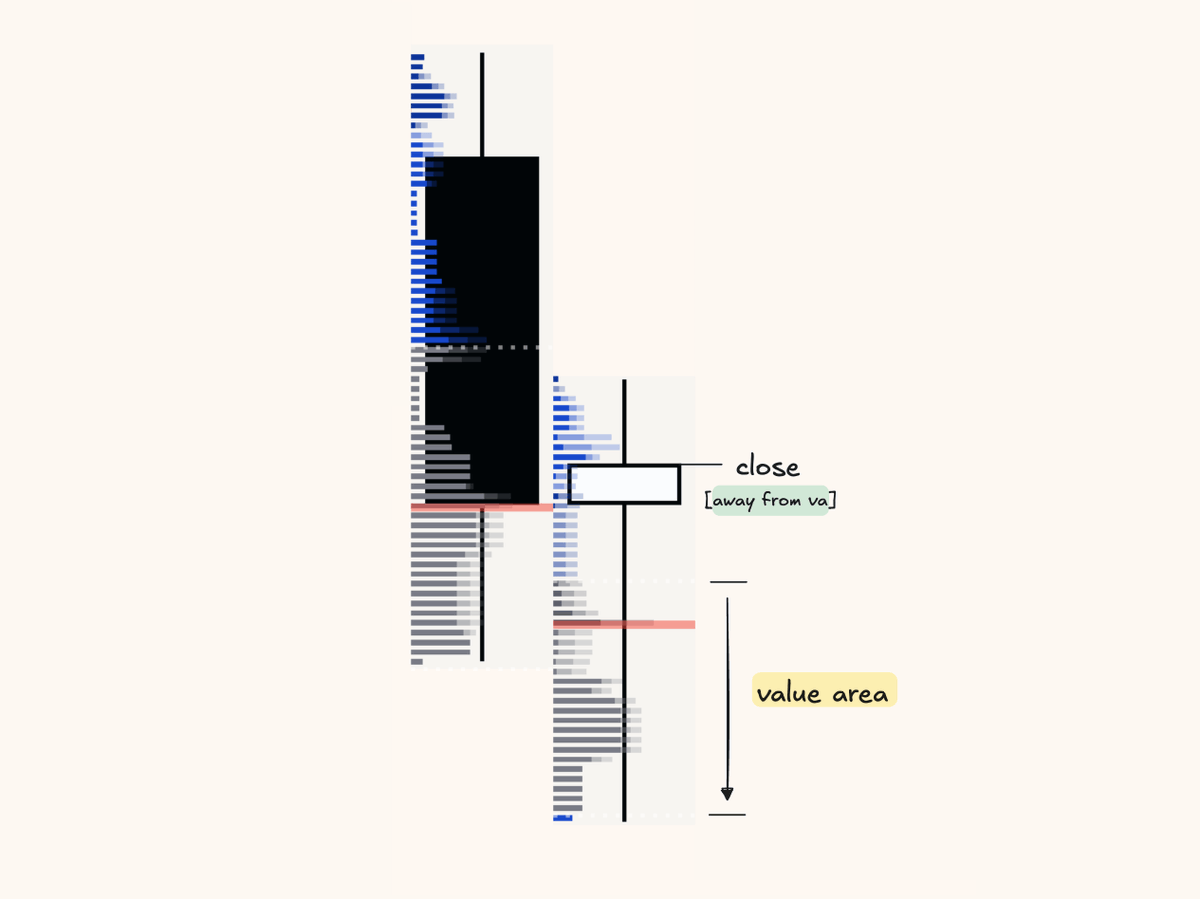

Trapping value:

Although not a specific "candlestick pattern" it still can be seen through tradingview using an indicator or even without the indicator can be anticipated.

Price closing away from its candles value area - i.e the largest proportion of its volume profile.

In essence I view this as an intra candle breakout.

Invalidation of this trade can be used by placing a stop above or below the HVN-POC within the trapped value area.

This value trapping method can also be used with engulfing candles and swing failure patterns for added confluence.

example ↓

Although not a specific "candlestick pattern" it still can be seen through tradingview using an indicator or even without the indicator can be anticipated.

Price closing away from its candles value area - i.e the largest proportion of its volume profile.

In essence I view this as an intra candle breakout.

Invalidation of this trade can be used by placing a stop above or below the HVN-POC within the trapped value area.

This value trapping method can also be used with engulfing candles and swing failure patterns for added confluence.

example ↓

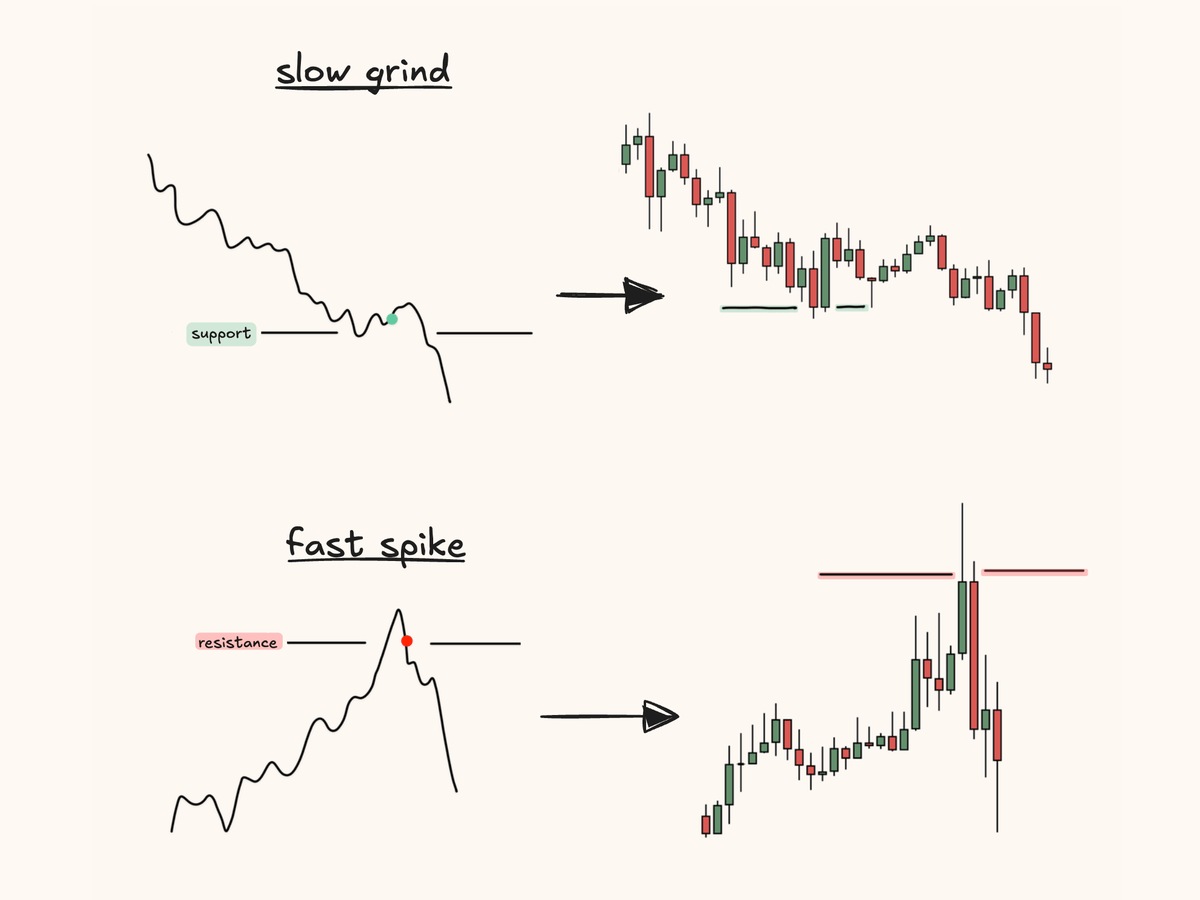

Speed of reversal:

From my experience, trading reversals should be more violent than a slow grind.

Slow grinds into and away from a level give traders too much time, whether they're offside or looking to get involved.

Moral of the story: I prefer quick moves, and this point is key to whether I will trade a level or not.

an example ↓

From my experience, trading reversals should be more violent than a slow grind.

Slow grinds into and away from a level give traders too much time, whether they're offside or looking to get involved.

Moral of the story: I prefer quick moves, and this point is key to whether I will trade a level or not.

an example ↓

Loading suggestions...

![Candlestick Reversals

[patterns & confirmations]

a thread 🧵 https://t.co/x7cbqcRmRH](https://pbs.twimg.com/media/GX2FPqebcAA5Af-.png)