(Side note) FOMC Discount!

We have daily zoom calls, daily live trading sessions daily with alerts and callouts and do complex market analysis like this daily. Don't miss out.

Over 6000 members and 4.9/5 star reviews. Learn how to read the markets with us for only $1/day while the offer lasts

rocketscooter.com

We have daily zoom calls, daily live trading sessions daily with alerts and callouts and do complex market analysis like this daily. Don't miss out.

Over 6000 members and 4.9/5 star reviews. Learn how to read the markets with us for only $1/day while the offer lasts

rocketscooter.com

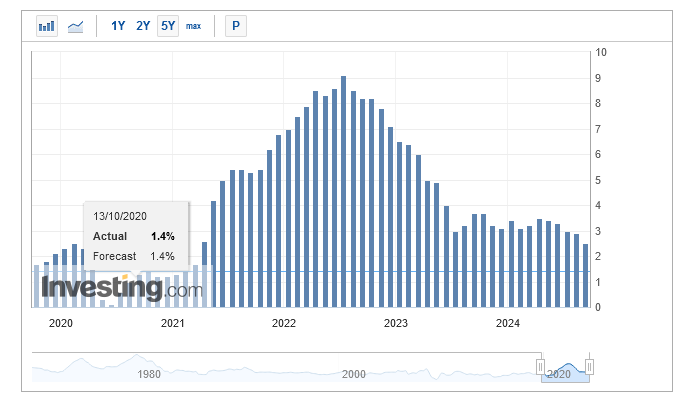

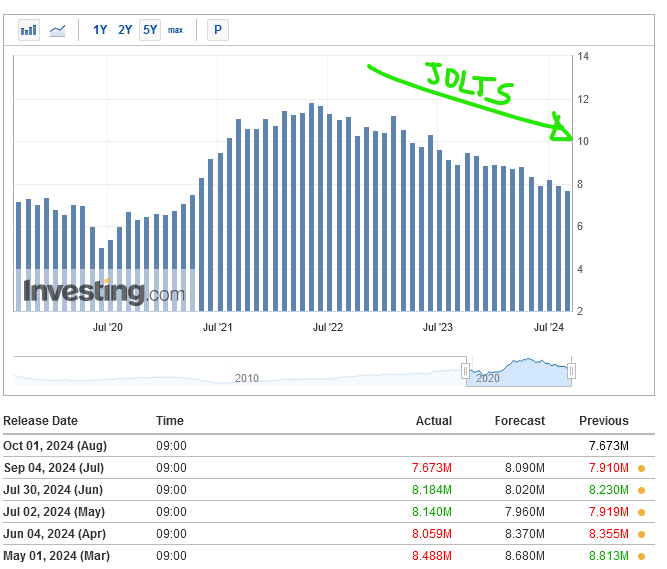

4) At Jackson Hole Powell built a case that inflation is decreasing and they likely don't need to wait for their 2% target to begin making moves. But more importantly it is time to support job growth because of the muted jobs market right now (more on that)

But does that mean rate cuts will help this too?

But does that mean rate cuts will help this too?

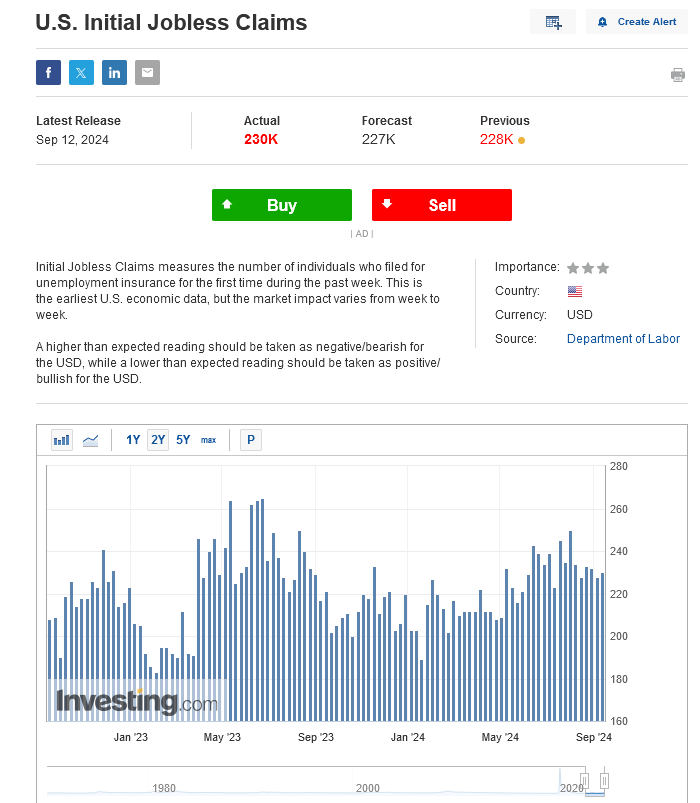

6) The initial jobless claims are people qualifying and filing for unemployment that week - meaning they are laid off for non-performance related reasons (meaning the company is downsizing)

These are flat and around the normal of 200-300k/wk, so nothing alarming there (no major layoff spree), so this is good for the bullish job's market case.

But what about those already unemployed? (Read on)

These are flat and around the normal of 200-300k/wk, so nothing alarming there (no major layoff spree), so this is good for the bullish job's market case.

But what about those already unemployed? (Read on)

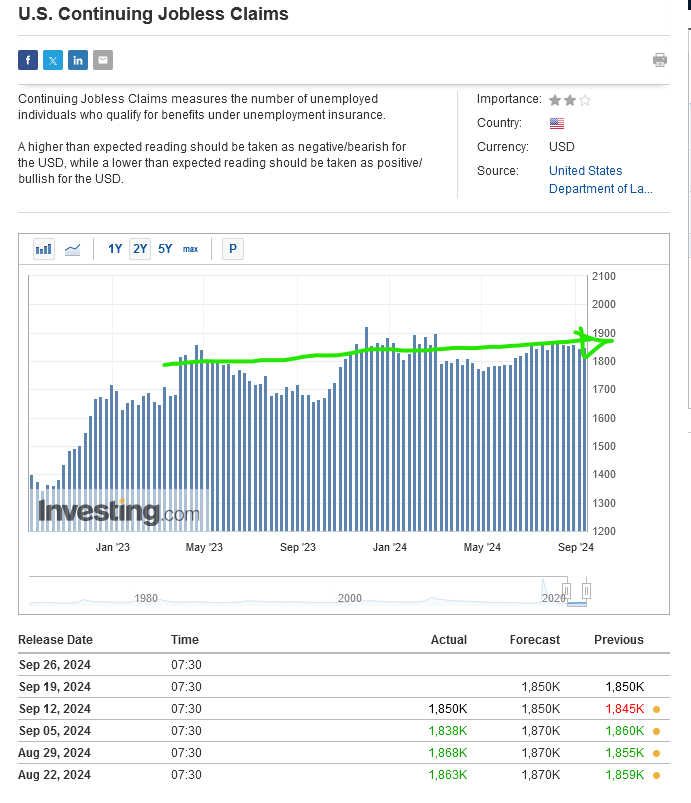

7) Continuing jobless claims, people filed for unemployment beyond the first week of claiming is also flat. And not higher than usual in a bull market (<2 million is normal) - so combining that with Initial claims and the JOLTS:

We're not in a hiring spree, explosive growth isn't imminent. We're not laying off so we're not necessarily eliminating jobs. Therefore we're in that "slow growth" phase where we're just outpacing hiring with job creation.

So growth is around the corner.

We're not in a hiring spree, explosive growth isn't imminent. We're not laying off so we're not necessarily eliminating jobs. Therefore we're in that "slow growth" phase where we're just outpacing hiring with job creation.

So growth is around the corner.

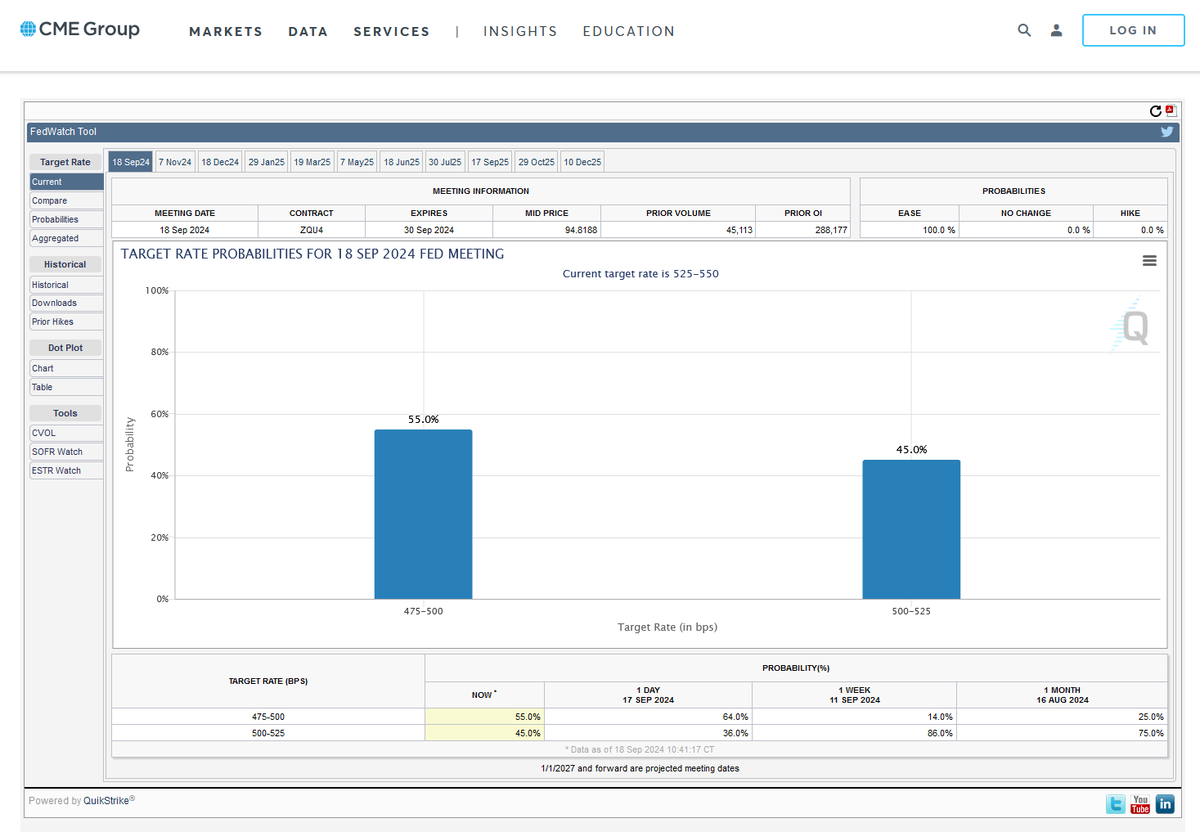

8) So will Powell cut rates? It's likely, but it's likely to meet and not exceed expectation. A 25 BPS cut is likely but that won't rally the market because the expectation is that we get 50 BPS. And when the market meets expectation rather than beat it, the effect is priced in and we sell off after the optimism in the first 5 min of the announcement.

So what will make the rally happen?

So what will make the rally happen?

9) The press conference 30 minutes after the initial announcement will be everything. We will listen for Powell to say *anything* about the plans for the next few months. If there is even a hint at progressive rate cuts in a single month or multiple months beyond today if we get one, will be catalyzed by election volatility, and we'll go up

Scenario 1

Scenario 1

10) Today's initial selling into the announcement is allowing the market to move lower to expect this rate cut to pop without causing a volatility event, market is giving it some room to move only. So it can likely sell when we don't hit expectations without causing a crash.

And if the press conference shows no action in 2024, we sell. Scenario II

And if the press conference shows no action in 2024, we sell. Scenario II

11) I'm a chemical engineer turned trader and CEO of the @RocketScooterAI trading platform. I stream on YouTube and I train thousands on how to read the markets and discover true probabilistic edge.

To an engineer - data matters! Not random market nonsense.

Join us or learn more at rocketscooter.com

To an engineer - data matters! Not random market nonsense.

Join us or learn more at rocketscooter.com

Loading suggestions...