The crypto market is about to catch A LOT of investors off guard.

Don't let that be you.

With Q4 right around the corner, there are some critical factors you NEED to know.

🧵: Here are 10 reasons why Q4 could spark a MONUMENTAL market shift.👇

Don't let that be you.

With Q4 right around the corner, there are some critical factors you NEED to know.

🧵: Here are 10 reasons why Q4 could spark a MONUMENTAL market shift.👇

This thread is going to break down the 10 most important factors that are set to impact the market in Q4.

It will be divided into 3 sections: Seasonality, Macro, and Crypto-Specific factors.

Let's dive in.

It will be divided into 3 sections: Seasonality, Macro, and Crypto-Specific factors.

Let's dive in.

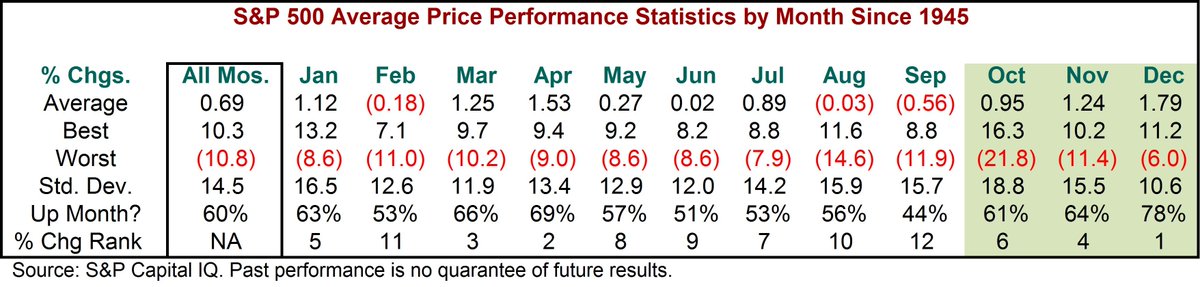

Firstly, let's discuss SEASONALITY.

Although market moves (on face value) may seem random, there is compelling evidence to suggest markets (especially crypto) are highly cyclical and are responsive to certain months/periods in the calendar year.

Although market moves (on face value) may seem random, there is compelling evidence to suggest markets (especially crypto) are highly cyclical and are responsive to certain months/periods in the calendar year.

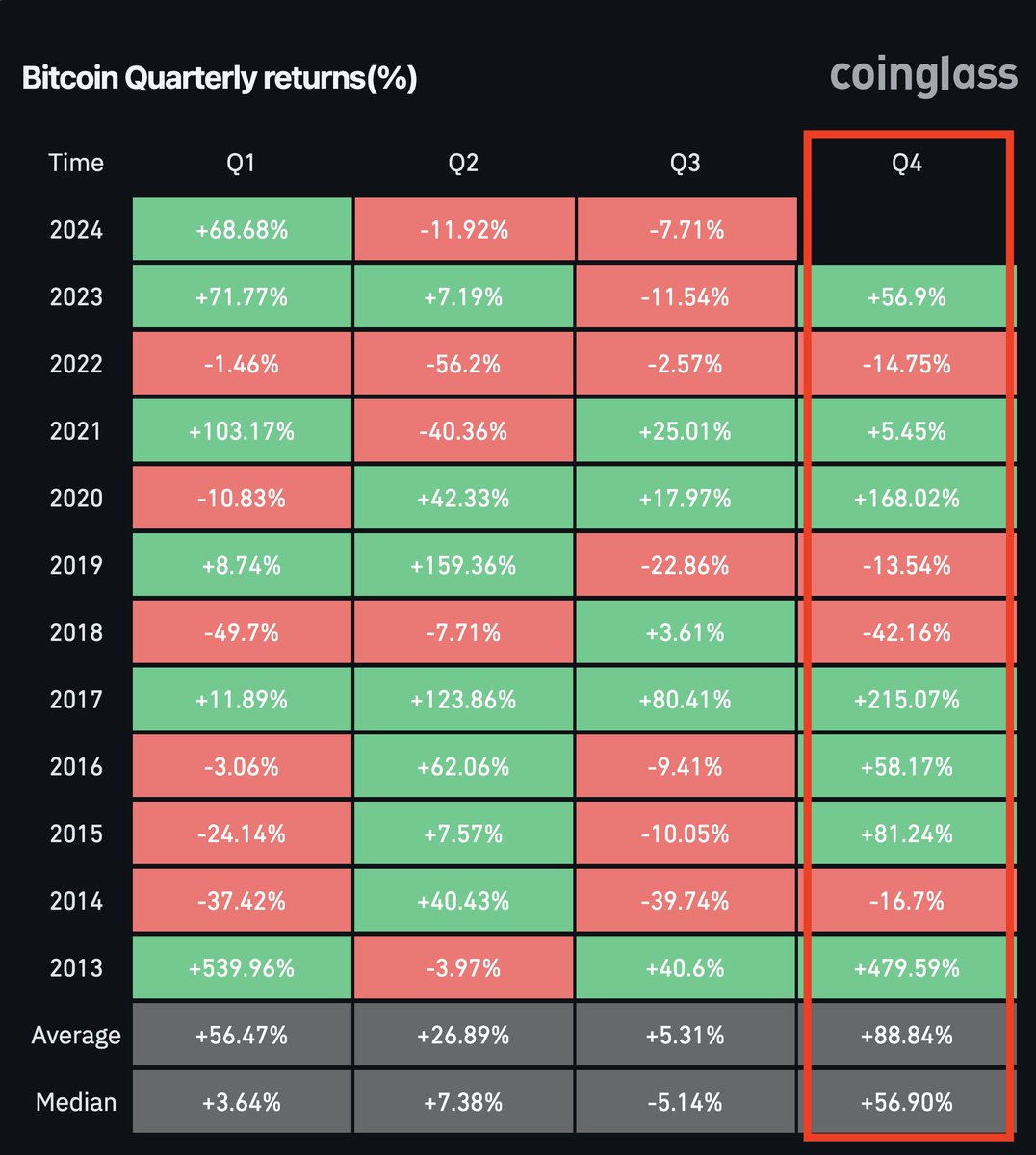

2. Q4 is also the strongest quarter for #Bitcoin (by far).

During this period, $BTC averages a return of +88.84%.

During the last 2 halving years (like this one), BTC rose by +58.17% (2016) and +168.02% (2020).

Q3 is also it's WORST period, which we have experienced this year.

During this period, $BTC averages a return of +88.84%.

During the last 2 halving years (like this one), BTC rose by +58.17% (2016) and +168.02% (2020).

Q3 is also it's WORST period, which we have experienced this year.

3. October-April is historically crypto's "boom period".

If we zoom out even further than months or quarters, the data is quite clear.

$BTC historical returns:

May-Sep = +619.5%

Oct-April = +13,656,203%

A.k.a.

May-Sep = Accumulation season.

Oct-April = Bull season.

If we zoom out even further than months or quarters, the data is quite clear.

$BTC historical returns:

May-Sep = +619.5%

Oct-April = +13,656,203%

A.k.a.

May-Sep = Accumulation season.

Oct-April = Bull season.

Now let's discuss MACRO.

Crypto doesn't operate in a vacuum, there are macro factors at play which are set to drastically impact markets.

Let's break down some of the main ones.

Crypto doesn't operate in a vacuum, there are macro factors at play which are set to drastically impact markets.

Let's break down some of the main ones.

4. The election.

We're less than 2 months away from the US federal election.

I'll be straight: I do believe a Trump presidency is much better for crypto.

However, Kamala winning isn't a death blow imo - it might just limit upside + create regulatory issues down the track.

We're less than 2 months away from the US federal election.

I'll be straight: I do believe a Trump presidency is much better for crypto.

However, Kamala winning isn't a death blow imo - it might just limit upside + create regulatory issues down the track.

5. The market may not be (fully) pricing in a Trump presidency.

As it sits (according to Polymarket) the odds are roughly 50/50.

When Trump recently spoke at the BTC 2024 conference, he glowingly endorsed Bitcoin and crypto.

If elected, I think markets respond favourably.

As it sits (according to Polymarket) the odds are roughly 50/50.

When Trump recently spoke at the BTC 2024 conference, he glowingly endorsed Bitcoin and crypto.

If elected, I think markets respond favourably.

6. Inflation is cooling down, and rate cuts are coming.

The recent CPI reading was the lowest since February 2021.

Powell has been vocal about inflation being brought under control, and a FED pivot is potentially only days away.

The recent CPI reading was the lowest since February 2021.

Powell has been vocal about inflation being brought under control, and a FED pivot is potentially only days away.

Whilst I've seen the common take that rate cuts are bearish, the data suggests that they are only bearish when they're for recessionary reasons.

In fact, during non-recessionary periods, the first rate cut has been bullish.

In fact, during non-recessionary periods, the first rate cut has been bullish.

7. The weakening of the US dollar.

A Federal Reserve rate cut would also lead to the weakening of the Dollar Index, which would act as a boon for risk on assets such as equities and $BTC.

A Federal Reserve rate cut would also lead to the weakening of the Dollar Index, which would act as a boon for risk on assets such as equities and $BTC.

8. Global liquidity is on the rise.

Out of EVERY single variable, $BTC is the MOST correlated to global liquidity. More so than equities or gold.

Global Liquidity has already started increasing, and is forecasted to continue rising into 2025.

Out of EVERY single variable, $BTC is the MOST correlated to global liquidity. More so than equities or gold.

Global Liquidity has already started increasing, and is forecasted to continue rising into 2025.

Let's now turn our attention to some CRYPTO-SPECIFIC factors which have the potential to impact markets in Q4.

Starting simply with an observation:

Starting simply with an observation:

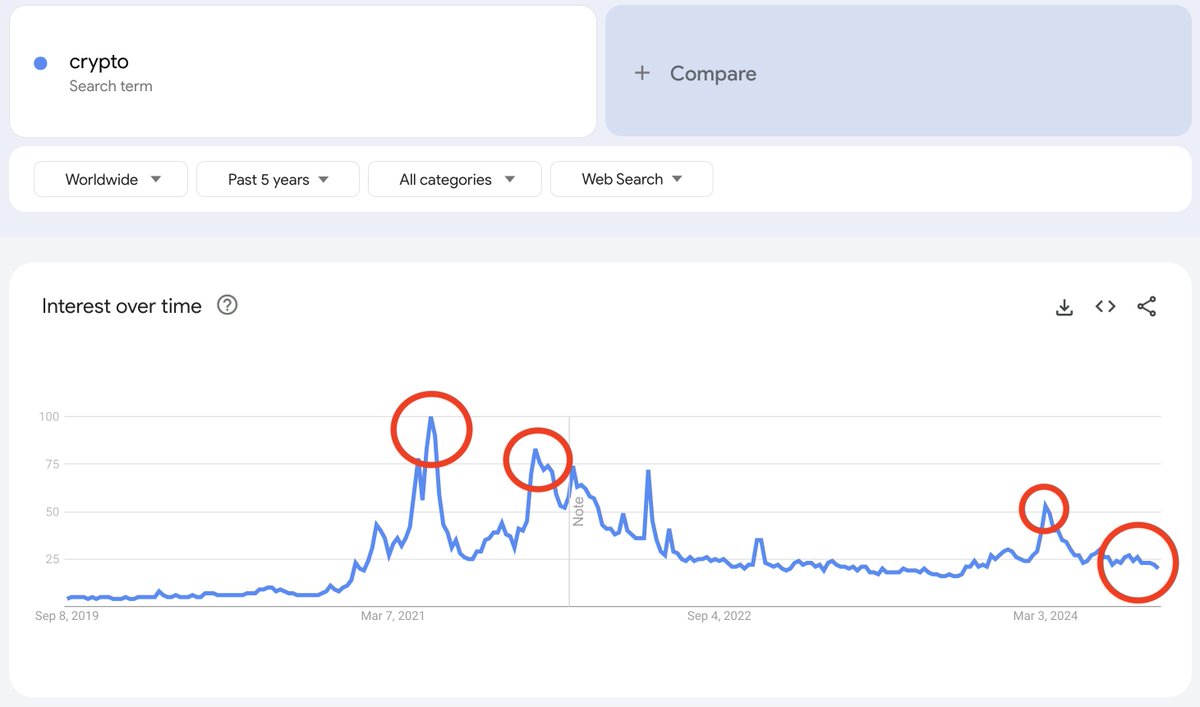

Another interesting data point is the Coinbase App ranking.

During the March highs, the Coinbase App quickly rose to the Top 50 most downloaded apps in the US.

However, the past 6 months has led to widespread apathy and thus the app falling down the rankings to <500.

During the March highs, the Coinbase App quickly rose to the Top 50 most downloaded apps in the US.

However, the past 6 months has led to widespread apathy and thus the app falling down the rankings to <500.

This is a powerful dynamic, as heightened off-side positioning typically leads to more aggressive expansionary phases.

This, in and of itself, is a major reason why I believe the best is still yet to come.

This, in and of itself, is a major reason why I believe the best is still yet to come.

10. FTX is repaying $16B to creditors.

The Mt. Gox/German selling caused massive downside.

But, the FTX repayments are the exact OPPOSITE (cash injection vs cash extraction).

$12b will be paid out in cash, with many users likely to funnel this capital back into the market.

The Mt. Gox/German selling caused massive downside.

But, the FTX repayments are the exact OPPOSITE (cash injection vs cash extraction).

$12b will be paid out in cash, with many users likely to funnel this capital back into the market.

So those are the 10 reasons why I believe the crypto market is poised to turn around in Q4.

There may still be shakeouts (the road is always bumpy in crypto), but i do anticipate by mid-next year, things are much higher.

There may still be shakeouts (the road is always bumpy in crypto), but i do anticipate by mid-next year, things are much higher.

Also, keep in mind that although (at face value) most of these points are bullish, a tailwind can also become a headwind.

i.e. there is an external event that sways economic data, or macro conditions worsening.

i.e. there is an external event that sways economic data, or macro conditions worsening.

That's why it's always wise to stay adaptive and assess new information as it arises.

The points outlined in this post are the major factors I'm monitoring.

But before I go, just remember these two things.

The points outlined in this post are the major factors I'm monitoring.

But before I go, just remember these two things.

1. Crypto is highly asymmetrical.

Unlike other markets, due to the massive upside on offer, it's actually riskier NOT to be exposed to the market, than it is to be exposed to it.

Unlike other markets, due to the massive upside on offer, it's actually riskier NOT to be exposed to the market, than it is to be exposed to it.

2. Things change QUICKLY.

Whilst sentiment isn't great right now, all it takes is one singular pump to inject momentum again.

This is the fastest-moving and most reflexive industry in the world. Things are never as bad as they seem.

Whilst sentiment isn't great right now, all it takes is one singular pump to inject momentum again.

This is the fastest-moving and most reflexive industry in the world. Things are never as bad as they seem.

Next week, I'm going to post a thread focusing on exactly HOW you can position yourself for Q4.

Including my top narratives, altcoins and strategy.

Make sure to follow me @milesdeutscher so you don't miss it.

And if you enjoyed this post, Like/Repost the quote below. 💙

Including my top narratives, altcoins and strategy.

Make sure to follow me @milesdeutscher so you don't miss it.

And if you enjoyed this post, Like/Repost the quote below. 💙

Loading suggestions...