Don't waste your hard earned money💸 on Technical analysis course.

I will teach you how to find Good Stocks using Technical analysis:

Please bookmark this thread 🧵👇

I will teach you how to find Good Stocks using Technical analysis:

Please bookmark this thread 🧵👇

𝐒𝐔𝐏𝐏𝐎𝐑𝐓 & 𝐑𝐄𝐒𝐈𝐒𝐓𝐀𝐍𝐂𝐄 :- Support and resistance as areas of value on our charts to help us buy low and sell high.

support and resistance, how they work, and how to tell when they’ll break. In essence, support and resistance tell us where to buy and sell.

support and resistance, how they work, and how to tell when they’ll break. In essence, support and resistance tell us where to buy and sell.

SUPPORT AND RESISTANCE ARE DEVELOPED :-

👉In any time frame is the prior bar’s

🔹high=resistance

🔹low=support

👉swing high and swing low

👉Consolidation area

👉Rejection from an area

👉Gap (invisible tail), EMOTIONAL POINT

👉Fibo retracement level

👉Trend line and MA

👉In any time frame is the prior bar’s

🔹high=resistance

🔹low=support

👉swing high and swing low

👉Consolidation area

👉Rejection from an area

👉Gap (invisible tail), EMOTIONAL POINT

👉Fibo retracement level

👉Trend line and MA

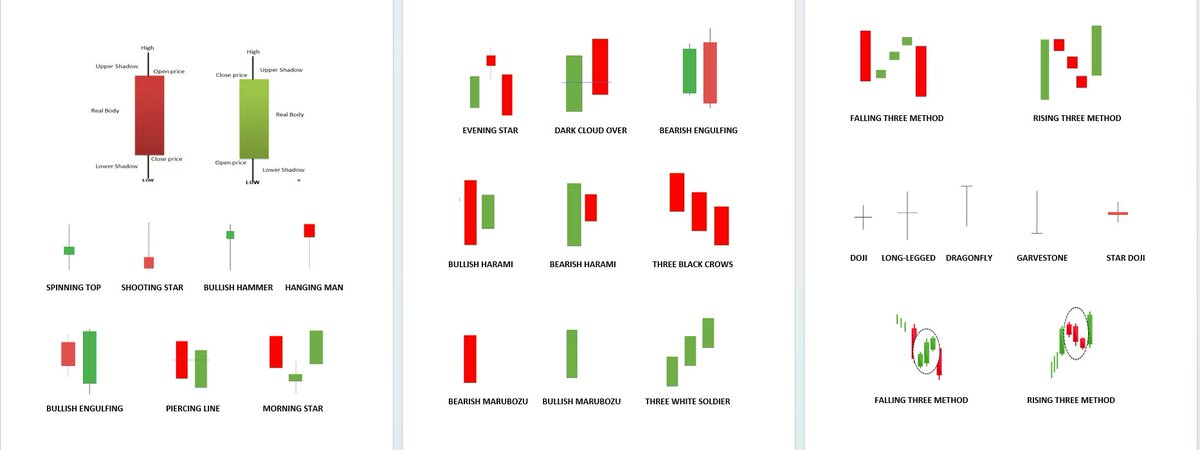

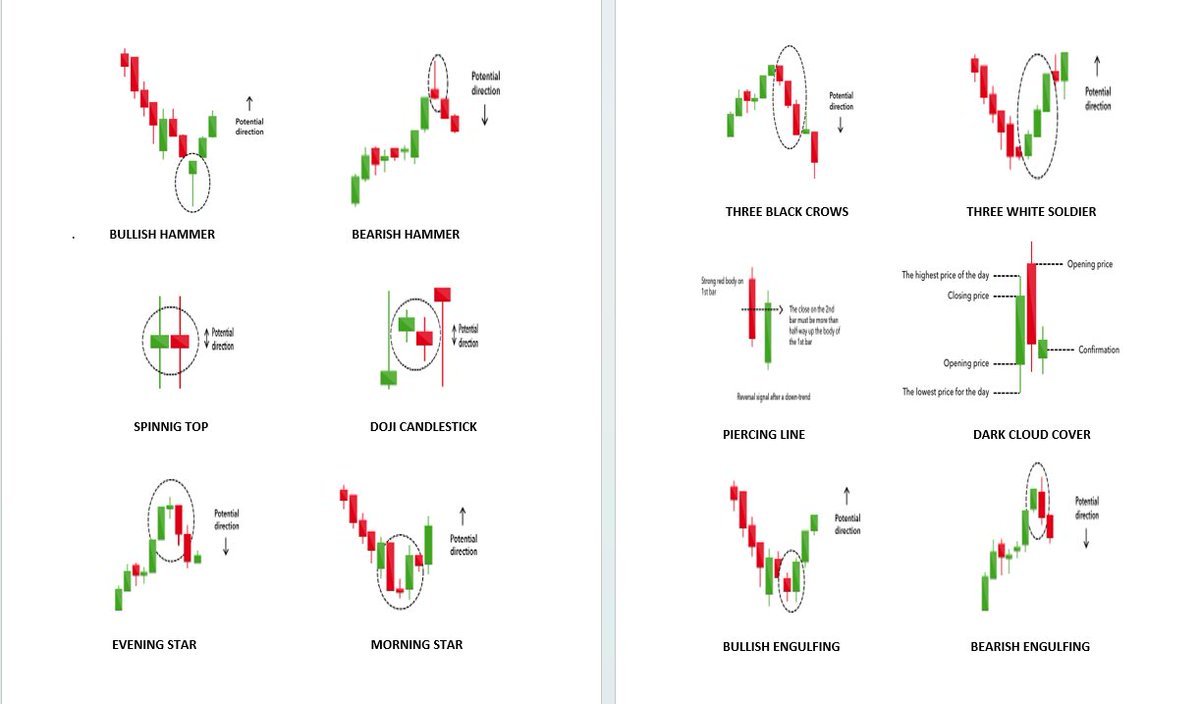

𝐂𝐀𝐍𝐃𝐋𝐄𝐒𝐓𝐈𝐂𝐊𝐒 𝐏𝐀𝐓𝐓𝐄𝐑𝐍 :-

🔹Candlestick patterns are useful as entry triggers to help you time your entry.

🔹Candlestick patterns tell us when to enter in sell or buy.

🔹Candlestick patterns give us an idea of who’s currently in control of the markets.

🔹Candlestick patterns are useful as entry triggers to help you time your entry.

🔹Candlestick patterns tell us when to enter in sell or buy.

🔹Candlestick patterns give us an idea of who’s currently in control of the markets.

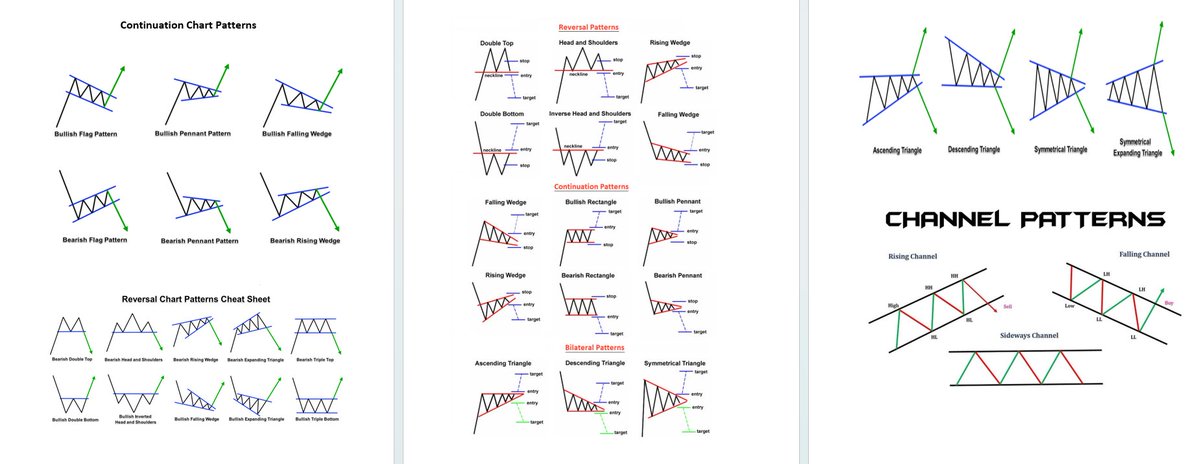

𝐂𝐇𝐀𝐑𝐓 𝐏𝐀𝐓𝐓𝐄𝐑𝐍: -

A chart pattern is a set price action that is repeated again and again. The idea behind chart pattern analysis is that by knowing what happened after a pattern in the past, you can take an educated guess as to what might happen when it appears again.

A chart pattern is a set price action that is repeated again and again. The idea behind chart pattern analysis is that by knowing what happened after a pattern in the past, you can take an educated guess as to what might happen when it appears again.

𝐑𝐢𝐬𝐤 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 :-

🔸You can have the best trading strategy in the world, but without proper risk management, you will eventually blow up your trading account.

🔸If you want to ride a trend, you need to trail your stop loss as the price moves in your favor.

🔸You can have the best trading strategy in the world, but without proper risk management, you will eventually blow up your trading account.

🔸If you want to ride a trend, you need to trail your stop loss as the price moves in your favor.

HOW TO SET A PROPER STOP LOSS :-

🔸When you set your stop loss, you want to have a “barrier” working in your favor to prevent the price from moving against you.

🔸When you set your stop loss, you want to have a “barrier” working in your favor to prevent the price from moving against you.

𝐒𝐔𝐌𝐌𝐀𝐑𝐘 :-

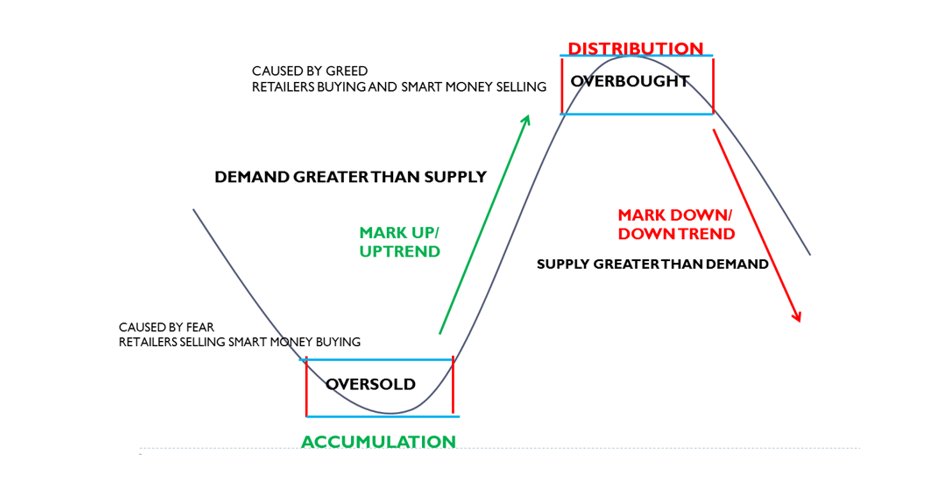

🔹Market structure whether to buy, sell, or stay out of the markets.

🔹support and resistance tell you where to buy and sell.

🔹candlestick patterns tell you when to enter.

🔹Risk management how to keep stop loss.

🔹Market structure whether to buy, sell, or stay out of the markets.

🔹support and resistance tell you where to buy and sell.

🔹candlestick patterns tell you when to enter.

🔹Risk management how to keep stop loss.

That's a wrap! 🙏

If you found this useful:

✔️ Follow @jitendrakirar21 for more such threads.

✔️ Bookmark this thread for future.

✔️Like, Retweet & share with your friends.

#learning #trading

If you found this useful:

✔️ Follow @jitendrakirar21 for more such threads.

✔️ Bookmark this thread for future.

✔️Like, Retweet & share with your friends.

#learning #trading

Loading suggestions...