Where is retail right now?

And will they ever return to crypto?

The entire bull market hinges on these 2 questions.

And in this thread, I'll answer them.

🧵: The honest truth about the 2024 crypto cycle (where did retail go?)👇

And will they ever return to crypto?

The entire bull market hinges on these 2 questions.

And in this thread, I'll answer them.

🧵: The honest truth about the 2024 crypto cycle (where did retail go?)👇

To fully answer the question of "is retail ever coming back?", first we need to recap what lead us here.

Although #Bitcoin was a strong performer, altcoins took centre stage.

Coins like $SOL, $FTM, $AVAX and $LUNA all pulled 500x+ multiples.

Asset selection wasn't even that important, you could've basically longed any coin and made a quick buck.

Coins like $SOL, $FTM, $AVAX and $LUNA all pulled 500x+ multiples.

Asset selection wasn't even that important, you could've basically longed any coin and made a quick buck.

But, as bubbles always do, it ended badly.

You have to remember that 80% of gains happen in the last 20% of a cycle (time wise).

It's also in that last 20% that retail pour into the market.

You have to remember that 80% of gains happen in the last 20% of a cycle (time wise).

It's also in that last 20% that retail pour into the market.

Crypto is an extremely reflexive asset class, meaning that the higher prices go, the more attention is driven to the market, fueling further price rises.

It's this effect that creates so much opportunity in the market.

But also, how retail loses money.

It's this effect that creates so much opportunity in the market.

But also, how retail loses money.

Crypto technically topped in November 2021.

But it wasn't until May 2022 that crypto would be delivered its final death blow: The LUNA & UST collapse.

But it wasn't until May 2022 that crypto would be delivered its final death blow: The LUNA & UST collapse.

In a matter of days, $45 billion was wiped off the market, further causing hundreds of billions in losses in the larger crypto market.

Many retail investors got their first taste of the real underlying risk of crypto (and investing in general).

Many retail investors got their first taste of the real underlying risk of crypto (and investing in general).

Unfortunately, this pain would be further amplified by a raft of contagion - fueled by LUNA's collapse (and dubious business practices from a plethora of bad actors).

This includes the collapse of:

• 3AC (crypto's biggest VC at the time)

• Celsius

• BlockFi

• Voyager

And of course, the infamous FTX, one of crypto's biggest, and at the time, most trusted, crypto exchanges.

• 3AC (crypto's biggest VC at the time)

• Celsius

• BlockFi

• Voyager

And of course, the infamous FTX, one of crypto's biggest, and at the time, most trusted, crypto exchanges.

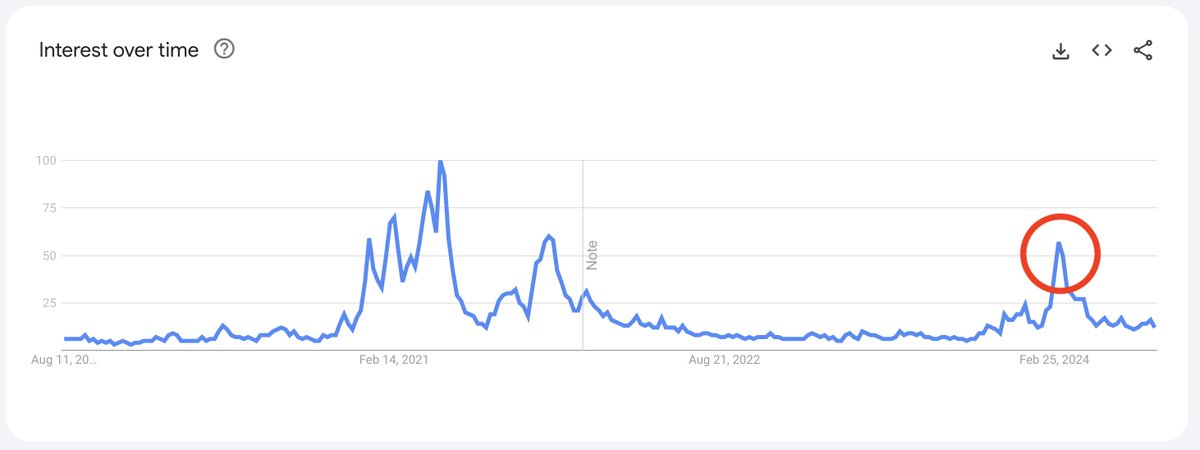

2021 exposed the most amount of people EVER to crypto.

Crypto was everywhere. On football stadiums, national television, celebrity IGs, and all over your feed.

2022 exposed those same new entrants to the biggest losses EVER in crypto.

Crypto was everywhere. On football stadiums, national television, celebrity IGs, and all over your feed.

2022 exposed those same new entrants to the biggest losses EVER in crypto.

It doesn't take a mathematician to postulate the sheer damage this would have on the industry, and its reputation.

If you were burnt financially, you left.

If you weren't burnt financially, you still left (price/time capitulation)

And if you never invested a cent in crypto, you'd likely think the industry is a complete scam, reading the thousands of preposterous headlines.

If you weren't burnt financially, you still left (price/time capitulation)

And if you never invested a cent in crypto, you'd likely think the industry is a complete scam, reading the thousands of preposterous headlines.

Only a select few chose to stay (many of you are likely reading this thread right now).

This is all important context to understand my conclusions later in the thread, as to why this cycle is very different from others.

This is all important context to understand my conclusions later in the thread, as to why this cycle is very different from others.

However, despite all the pain, at some point, a major shift in sentiment began to occur.

Although prices had started to move off the floor in Jan 2023, one moment later in the year changed everything.

Although prices had started to move off the floor in Jan 2023, one moment later in the year changed everything.

On the 16th of June, BlackRock applied for a spot #Bitcoin spot ETF.

Many had tried and failed in the past, but this time was different.

As now, the world's largest asset manager (with an exemplary ETF approval record) had come to the party.

Many had tried and failed in the past, but this time was different.

As now, the world's largest asset manager (with an exemplary ETF approval record) had come to the party.

This not only signaled a positive catalyst on the horizon (a new source of potential inflows), but a paradigm shift in the way $BTC was being viewed by major institutions.

Fast forward to 1st of January 2024, and $BTC was trading at $43k.

The Bitcoin Spot ETF approval was only 10 days away.

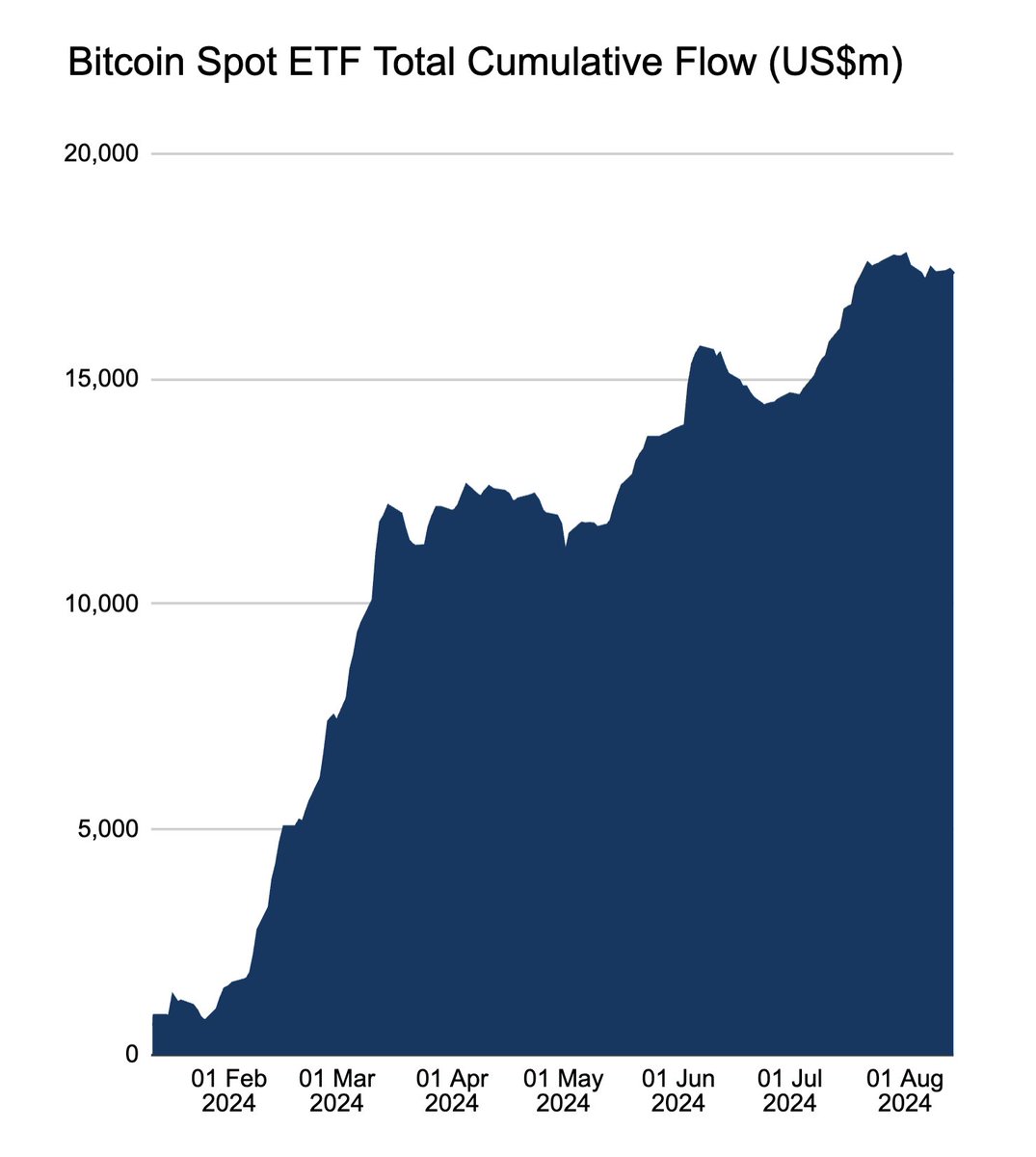

And on the 10th of January, the Bitcoin Spot ETFs went live.

History had been made.

The Bitcoin Spot ETF approval was only 10 days away.

And on the 10th of January, the Bitcoin Spot ETFs went live.

History had been made.

These positive flows helped catalyse a huge $BTC rally to new ATHs ($73k), alongside a variety of other macro factors and strong performance across other asset classes like equities.

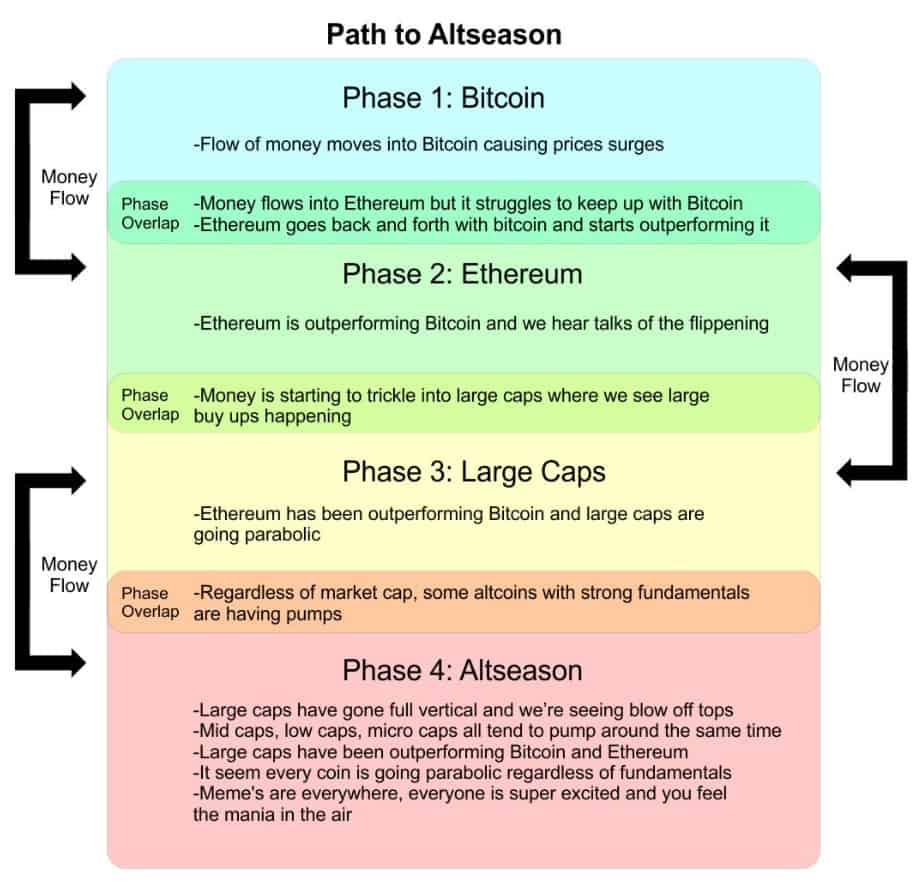

So, with BTC at ATHs - you'd expect altcoins to also be flying, just like in 2021 - right?

Well, wrong.

Well, wrong.

There are a few reasons for this. And they are crucial factors to understand in order to answer the questions proposed at the beginning of this thread.

Let's unpack them.

Let's unpack them.

1. The primary driver of this cycle has been the $BTC ETF.

This is vastly different from the last cycle, where the primary driver was macro conditions.

This is vastly different from the last cycle, where the primary driver was macro conditions.

3. Altcoin dispersion is greater than ever.

The equation is simple: Too many new launches, not enough fresh liquidity.

The equation is simple: Too many new launches, not enough fresh liquidity.

4. Retail was burnt in 2022.

This brings me back to the opening context of this thread.

2022 did a lot of damage, both psychologically and reputationally.

This brings me back to the opening context of this thread.

2022 did a lot of damage, both psychologically and reputationally.

5. Due to the above point, there is lack of fundamental belief in crypto investing.

In 2021, people were investing for the "long term". There was genuine hope and excitement that the space, and its technology, could change the word.

Now things feel.. Jaded.

In 2021, people were investing for the "long term". There was genuine hope and excitement that the space, and its technology, could change the word.

Now things feel.. Jaded.

Most of the existing market participants are seasoned veterans.

Altcoins are viewed as vaporware, people are mistrusting of even well-intentioned project founders (who can blame them).

Altcoins are viewed as vaporware, people are mistrusting of even well-intentioned project founders (who can blame them).

This makes trading extremely PvP, and much more difficult.

There isn't an endless flow of fresh capital to underpin the market, like there was in 2021.

We're all essentially fighting over the same dollars.

There isn't an endless flow of fresh capital to underpin the market, like there was in 2021.

We're all essentially fighting over the same dollars.

Many of the users that did return, went straight to the meme coin casino, and also got burned.

But at least it's a sign that given the right conditions, interest in crypto can quickly return.

But at least it's a sign that given the right conditions, interest in crypto can quickly return.

This leads me to a more optimistic closing argument to this thread.

"What could possibly bring retail back?"

Luckily, there are a few variables in our favor.

"What could possibly bring retail back?"

Luckily, there are a few variables in our favor.

1. Bitcoin breaking ATHs.

To be honest, this may be the only thing that matters right now for altcoins.

BTC breaking highs ($73k), and potentially pushing further towards $100k, would definitely renew interest in crypto as a whole.

To be honest, this may be the only thing that matters right now for altcoins.

BTC breaking highs ($73k), and potentially pushing further towards $100k, would definitely renew interest in crypto as a whole.

Yes, many of the aforementioned issues like altcoin dispersion would still exist, but it would definite pave over some cracks.

A BTC rally = media attention, people front running an altcoin rotation, renewed optimism.

A BTC rally = media attention, people front running an altcoin rotation, renewed optimism.

2. Humans are innate gamblers, and crypto is the world's best casino.

The reason retail hasn't come back is actually super simple: Altcoins haven't managed to sustain a decent rally yet.

What could change this?

What could change this?

3. Pareto principle.

As aforementioned, 80% of gains in a bull market come in the last 20%, of the move.

Retail joins the party late.

We simply may just be too early (in terms of cycle duration we comparatively still are).

As aforementioned, 80% of gains in a bull market come in the last 20%, of the move.

Retail joins the party late.

We simply may just be too early (in terms of cycle duration we comparatively still are).

4. New (and REAL) crypto use cases.

The last 3 points focus mostly on speculation THIS cycle.

But for crypto to truly be sustainable longer term, we need stronger use cases to emerge.

AI, gaming, DeFi all seem like obvious candidates - but they are yet to find their footing.

The last 3 points focus mostly on speculation THIS cycle.

But for crypto to truly be sustainable longer term, we need stronger use cases to emerge.

AI, gaming, DeFi all seem like obvious candidates - but they are yet to find their footing.

Infrastructure has significantly improved since 2021 (despite lower prices).

I'm hopeful that this will facilitate the creation of some killer dApps.

Crypto only really needs 2-3 to take off in order to facilitate wide spread adoption.

I'm hopeful that this will facilitate the creation of some killer dApps.

Crypto only really needs 2-3 to take off in order to facilitate wide spread adoption.

This is a great post by @alpha_pls, which highlights how we tend to overestimate short term progress, but vastly underestimate long term progress.

So in conclusion, yes - retail is (mostly) gone.

There are valid reasons why, and this cycle is fundamentally different because of them.

But it won't take much for retail to return.

And that day may be sooner than you think.

There are valid reasons why, and this cycle is fundamentally different because of them.

But it won't take much for retail to return.

And that day may be sooner than you think.

I hope you enjoyed this thread

Follow me @milesdeutscher for more content like this.

Like/Repost the quote below if you can. 💙

Follow me @milesdeutscher for more content like this.

Like/Repost the quote below if you can. 💙

Loading suggestions...