Here’s what the UPS is all about:

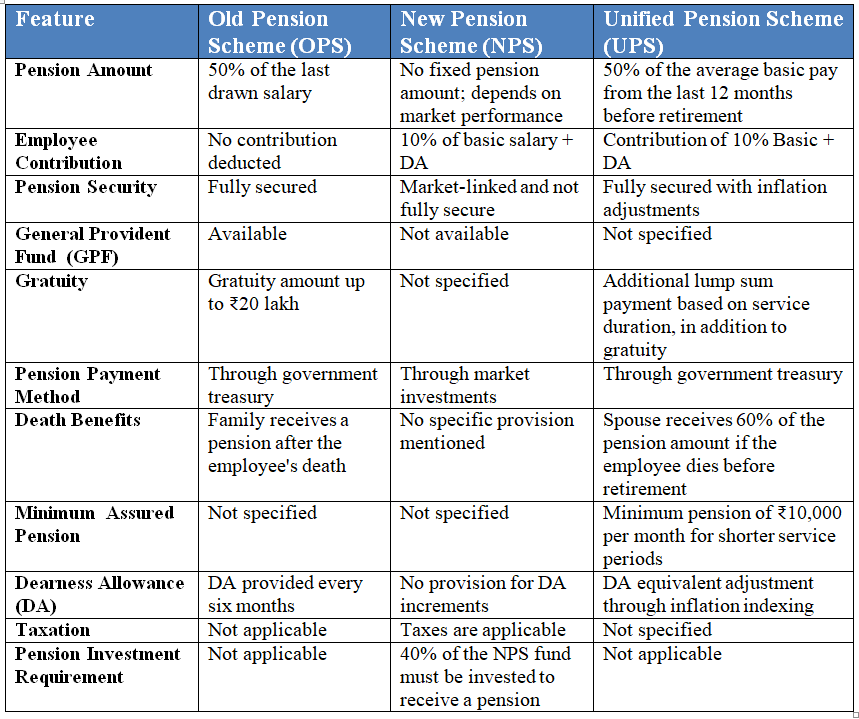

- Assured Pension: If you’ve worked for at least 25 years, you’ll get half of your average salary from the last year as a pension. If you’ve worked less, you’ll still get a part of it.

- Family Pension: If something happens to you, your family will get 60% of your pension to help them out.

- Minimum Pension: Everyone will get at least ₹10,000 every month after retiring if they’ve worked for 10 years or more.

- Inflation Protection: Your pension will go up a bit each year to keep up with the cost of living.

- Extra Lump-Sum: When you retire, you’ll get a one-time payment along with your pension, which is a bit of your salary for every six months you’ve worked.

- Assured Pension: If you’ve worked for at least 25 years, you’ll get half of your average salary from the last year as a pension. If you’ve worked less, you’ll still get a part of it.

- Family Pension: If something happens to you, your family will get 60% of your pension to help them out.

- Minimum Pension: Everyone will get at least ₹10,000 every month after retiring if they’ve worked for 10 years or more.

- Inflation Protection: Your pension will go up a bit each year to keep up with the cost of living.

- Extra Lump-Sum: When you retire, you’ll get a one-time payment along with your pension, which is a bit of your salary for every six months you’ve worked.

Why UPS is Great? :

- For Everyone: It’s for all workers, even those in small jobs or without a formal pension plan.

- Take It With You: You can move your pension to a new job or place without any trouble.

- One System for All: A single group will look after the pension, so it’s the same for everyone.

- Better Benefits: Because everything is together, you might get more money when you retire.

- Learn About Money: People will be helped to learn how to plan their money for when they stop working.

- For Everyone: It’s for all workers, even those in small jobs or without a formal pension plan.

- Take It With You: You can move your pension to a new job or place without any trouble.

- One System for All: A single group will look after the pension, so it’s the same for everyone.

- Better Benefits: Because everything is together, you might get more money when you retire.

- Learn About Money: People will be helped to learn how to plan their money for when they stop working.

Some Challenges:

- Making the Change: It’s tricky to bring all the old plans into this new one without problems.

- Money Matters: The plan needs to have enough money to last and work well for a long time.

- New Rules: There will need to be some changes in the laws and how things are done.

- Making the Change: It’s tricky to bring all the old plans into this new one without problems.

- Money Matters: The plan needs to have enough money to last and work well for a long time.

- New Rules: There will need to be some changes in the laws and how things are done.

How is UPS different from the old plans?

- Old Pension Scheme (OPS): The government paid for everything, and you knew exactly how much pension you’d get.

- National Pension System (NPS): You and the government both put money in, and how much pension you got depended on how well the investments did.

- Unified Pension Scheme (UPS): It’s a mix of both. You get some guaranteed money and a chance for your pension to grow with the market.

- Old Pension Scheme (OPS): The government paid for everything, and you knew exactly how much pension you’d get.

- National Pension System (NPS): You and the government both put money in, and how much pension you got depended on how well the investments did.

- Unified Pension Scheme (UPS): It’s a mix of both. You get some guaranteed money and a chance for your pension to grow with the market.

Loading suggestions...