$KAP Headlines starting to roll...

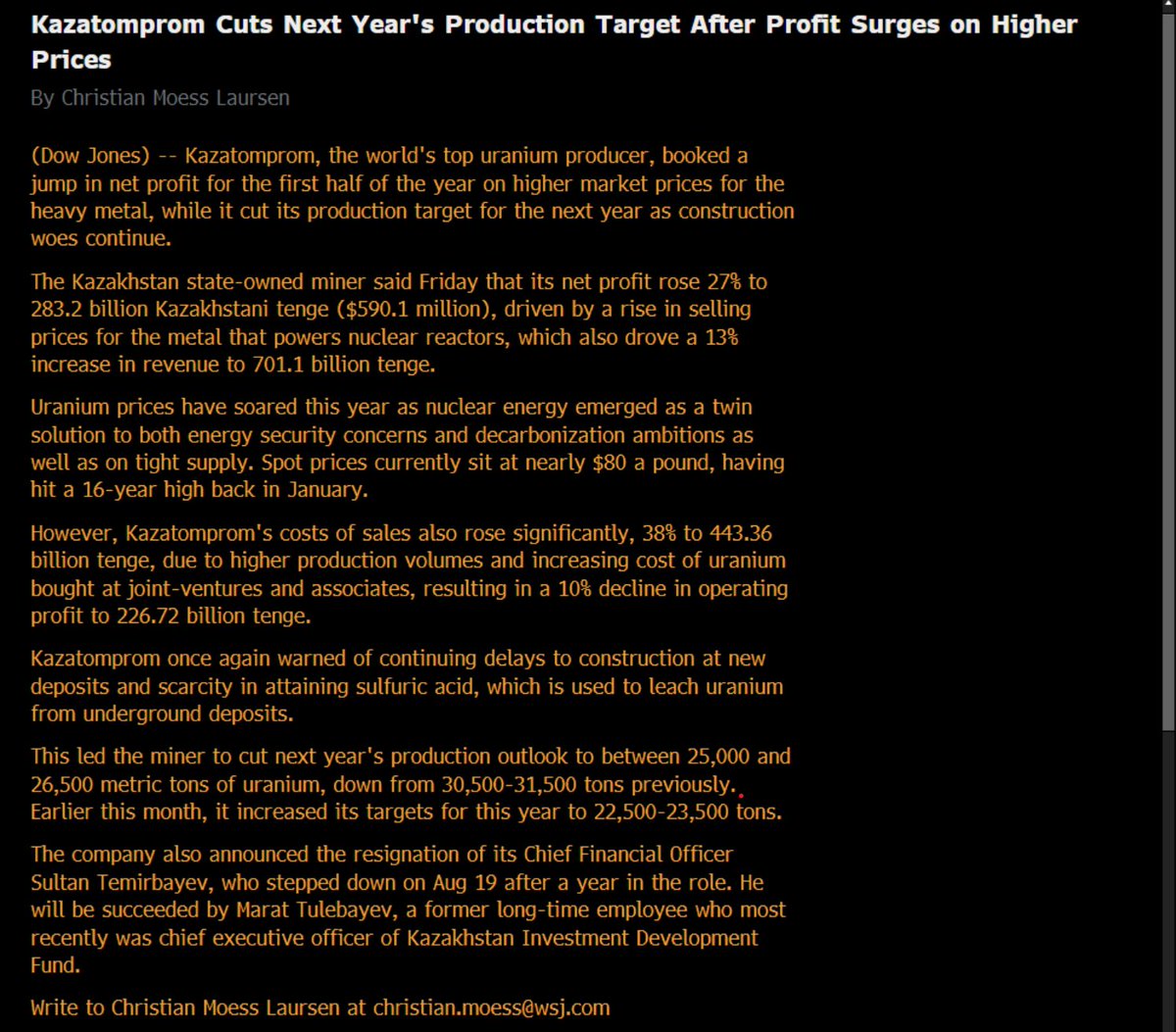

Revised 2025 production guidance of 25,000 to 26,500 tons (equating to 65-68.9mmlbs).

This is a SIGNIFICANT CUT from prior 2025 guidance which was 100% of subsoil use (31,600 tons / over ~82mmlbs). A 14-17mmlb cut vs. what they projected 1 year ago due to acid availability and asset development issues.

Additionally - we get another CFO departure... continued turnover likely won't help with production. We've seen them guide and revise lower in year 4 out of the last 5 years...

#uranium #nuclear

Revised 2025 production guidance of 25,000 to 26,500 tons (equating to 65-68.9mmlbs).

This is a SIGNIFICANT CUT from prior 2025 guidance which was 100% of subsoil use (31,600 tons / over ~82mmlbs). A 14-17mmlb cut vs. what they projected 1 year ago due to acid availability and asset development issues.

Additionally - we get another CFO departure... continued turnover likely won't help with production. We've seen them guide and revise lower in year 4 out of the last 5 years...

#uranium #nuclear

Maybe more importantly for the #uranium market going forward - $KAP are actually re-negotiating subsoil use agreements at several key assets - effectively lowering the production profiles on each asset so they don't risk dropping below the ~80% of subsoil use limit over the next several years. This is a HUGE tell that the risk to future production revisions is lower through 2027... text below:

"Corporate Update

Changes in Subsoil Use Agreements

The Company has highlighted several times that certain uranium mining entities are facing challenges related to delays in completing construction works at the newly developed deposits. The Company has also warned that these entities face the potential challenge of descending beneath the threshold of minus 20% (in relation to the stipulations of the Subsoil Use Agreements). As was noted, such risk is primarily attributed to delays in the construction of surface facilities and infrastructure. These delays, in turn, are a consequence of the extended timelines required for the development and subsequent approval of project design documentation.

Both factors resulted in a significant shift in the production schedules at the newly established deposits. As a result, corresponding Subsoil Use levels for production volumes at the newly established deposits are expected to be decreased in order to comply with production volume obligations under the Subsoil Use Agreements.

The Company expects that JV Budenovskoye LLP and Appak LLP will introduce changes to their current Subsoil Use Agreements that are subject to approval of governmental bodies. If approved, adjusted production levels will be reflected in the next CPR. The changes are adjusting mining works schedule to actual production plans resulting from delays in construction of ground infrastructure:

for JV Budenovskoye LLP: 2024 – 500 tonnes (currently – 2,500 tonnes), 2025 – 1,300 tonnes (currently – 4,000 tonnes), 2026 – 3,750 tonnes (currently – 6,000 tonnes), nameplate capacity of 6,000 tonnes now expected no earlier than 2027;

for Appak LLP: annual mining capacity – 800 tonnes (currently – 1,000 tonnes).

Semizbay-U LLP and Baiken-U LLP signed addendums to corresponding Subsoil Use Agreements that include production schedule adjustments in order to match the actual production results. Semizbay-U LLP’s Addendum also extends the duration of Semizbay-U LLP’s Subsoil Use Agreement until 31 December 2030.

On 30 April 2024, JV KATCO LLP signed Amendment 12 to the Subsoil Use Agreement with the Ministry of Energy of the Republic of Kazakhstan, which updates the production schedule for 2024 to 2,500 tonnes (currently – 3,400 tonnes) and expects a return to the production level of 4,000 tonnes of uranium per year no earlier than 2026."

"Corporate Update

Changes in Subsoil Use Agreements

The Company has highlighted several times that certain uranium mining entities are facing challenges related to delays in completing construction works at the newly developed deposits. The Company has also warned that these entities face the potential challenge of descending beneath the threshold of minus 20% (in relation to the stipulations of the Subsoil Use Agreements). As was noted, such risk is primarily attributed to delays in the construction of surface facilities and infrastructure. These delays, in turn, are a consequence of the extended timelines required for the development and subsequent approval of project design documentation.

Both factors resulted in a significant shift in the production schedules at the newly established deposits. As a result, corresponding Subsoil Use levels for production volumes at the newly established deposits are expected to be decreased in order to comply with production volume obligations under the Subsoil Use Agreements.

The Company expects that JV Budenovskoye LLP and Appak LLP will introduce changes to their current Subsoil Use Agreements that are subject to approval of governmental bodies. If approved, adjusted production levels will be reflected in the next CPR. The changes are adjusting mining works schedule to actual production plans resulting from delays in construction of ground infrastructure:

for JV Budenovskoye LLP: 2024 – 500 tonnes (currently – 2,500 tonnes), 2025 – 1,300 tonnes (currently – 4,000 tonnes), 2026 – 3,750 tonnes (currently – 6,000 tonnes), nameplate capacity of 6,000 tonnes now expected no earlier than 2027;

for Appak LLP: annual mining capacity – 800 tonnes (currently – 1,000 tonnes).

Semizbay-U LLP and Baiken-U LLP signed addendums to corresponding Subsoil Use Agreements that include production schedule adjustments in order to match the actual production results. Semizbay-U LLP’s Addendum also extends the duration of Semizbay-U LLP’s Subsoil Use Agreement until 31 December 2030.

On 30 April 2024, JV KATCO LLP signed Amendment 12 to the Subsoil Use Agreement with the Ministry of Energy of the Republic of Kazakhstan, which updates the production schedule for 2024 to 2,500 tonnes (currently – 3,400 tonnes) and expects a return to the production level of 4,000 tonnes of uranium per year no earlier than 2026."

Additionally - due to high uncertainties around production, no 2026 #uranium production guidance until this time next year...

"Taking into consideration high level of uncertainties related to the sulphuric acid supply and construction delay challenges, no decision has been taken regarding mine development activity and production volumes for 2026 and beyond. In order to improve the forecast quality, the Company expects its 2026 productions plans to be announced not earlier than a year from now as part of the 2025 half-year financial results disclosure."

"Taking into consideration high level of uncertainties related to the sulphuric acid supply and construction delay challenges, no decision has been taken regarding mine development activity and production volumes for 2026 and beyond. In order to improve the forecast quality, the Company expects its 2026 productions plans to be announced not earlier than a year from now as part of the 2025 half-year financial results disclosure."

One big question for the market is how much of this forward production from 2025 - 2027 has already been sold. $KAP opens this update by saying that production increases were driven by success in their long-term contract book (i.e., no ramp of production was ever going to hit the spot market anyway):

"Amid our continued success in long-term contracting activity, Kazatomprom had initially intended to ramp up its 2025 production to a 100% of Subsoil Use Agreement levels. However, the uncertainty around the sulphuric acid supplies for 2025 needs and delays in the construction works at the newly developed deposits resulted in a need to re-evaluate our 2025 plans. Despite 2025 production plan adjustments, Kazatomprom remains steadfast in fulfilling its existing 2025 sales commitments, having maintained an unblemished record of delivery over its 27-year history."

Seems clear they'll be willing to enter the spot market or make other arrangements to meet these contracts regardless of the production guidance downgrade.

Think analysts will focus on this during the call: How flexible is the current contract book given significantly lower guidance and well highlighted uncertainty in 2026 and beyond? How are the Russians impacted by the multi-million pound drop in production for Bud 6&7? And how has the continued management turnover impacted / been related to their ability to deliver pounds? #nuclear #uranium

"Amid our continued success in long-term contracting activity, Kazatomprom had initially intended to ramp up its 2025 production to a 100% of Subsoil Use Agreement levels. However, the uncertainty around the sulphuric acid supplies for 2025 needs and delays in the construction works at the newly developed deposits resulted in a need to re-evaluate our 2025 plans. Despite 2025 production plan adjustments, Kazatomprom remains steadfast in fulfilling its existing 2025 sales commitments, having maintained an unblemished record of delivery over its 27-year history."

Seems clear they'll be willing to enter the spot market or make other arrangements to meet these contracts regardless of the production guidance downgrade.

Think analysts will focus on this during the call: How flexible is the current contract book given significantly lower guidance and well highlighted uncertainty in 2026 and beyond? How are the Russians impacted by the multi-million pound drop in production for Bud 6&7? And how has the continued management turnover impacted / been related to their ability to deliver pounds? #nuclear #uranium

Another helpful piece of information in the release. They outline their potential MET tax rates based on different #uranium spot prices and production profiles. In early August we'd seen a bearish take from a Canadian sell side analyst who claimed the new tax regime incentivized $KAP to cap prices to avoid higher taxes (an absurdly idiotic take)... as you can see, if anything they are incentivized to PRODUCE LESS as production volume has a much bigger impact on tax rates than spot prices do.

Aside from the more macro takeaways from the release it's clear that $KAP continues to print cash in today's market. Nice pop in realized prices which should continue to increase as 2024 goes on (tend to have a 14-16 month delay in prices vs. spot so you're yet to see last fall's big spot price ramp flow through results).

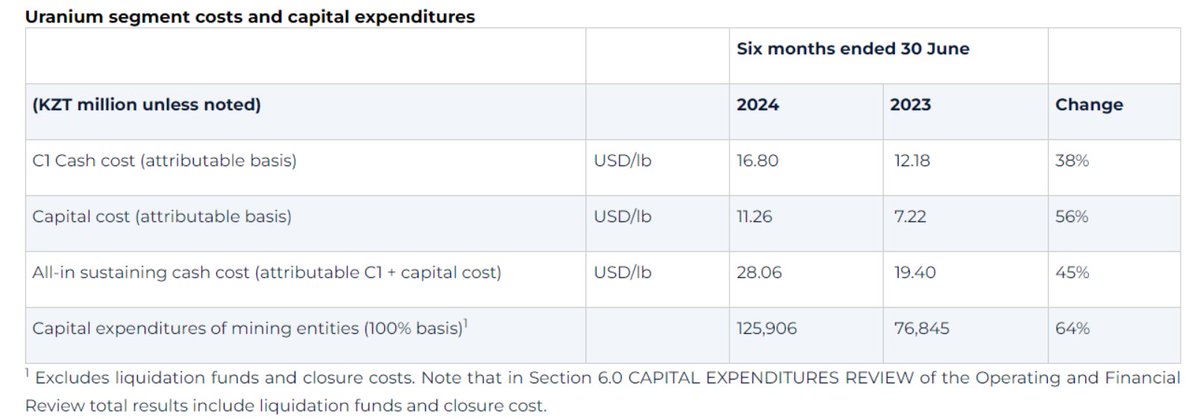

Maybe one other factor I'd highlight is that, given the Kazakh's ARE the bottom quartile of the #uranium cost curve - if the following table doesn't tell you that the cost curve is rising for this industry, I don't know what will... this will lead to structurally higher prices for uranium in the future.

Maybe one other factor I'd highlight is that, given the Kazakh's ARE the bottom quartile of the #uranium cost curve - if the following table doesn't tell you that the cost curve is rising for this industry, I don't know what will... this will lead to structurally higher prices for uranium in the future.

Loading suggestions...