In the Indian stock market, the Large and Midcap category was introduced by Securities and Exchange Board of India (SEBI) as an investment segment that offers a strategic blend of stability and growth.

This category mandates at least 35% of the assets...

This category mandates at least 35% of the assets...

…must be invested in large cap stocks and another 35% in the midcap stocks ensuring a balanced portfolio.

This balance allows investors to benefit from the relative safety of large caps, while also taking advantage of the higher growth potential offered by midcaps.

This balance allows investors to benefit from the relative safety of large caps, while also taking advantage of the higher growth potential offered by midcaps.

Investing in the Large & Midcap category in Indian markets makes sense in the present scenario for 2 key

reasons:

1. India’s economy is experiencing robust growth fuelled by rising domestic consumption, ongoing govt reforms and increasing investment in infrastructure.

reasons:

1. India’s economy is experiencing robust growth fuelled by rising domestic consumption, ongoing govt reforms and increasing investment in infrastructure.

2. With the ongoing global realignment, large-cap stocks provide a cushion due to their established market presence and consistent cash flows.

Meanwhile, midcaps, despite higher volatility, present

significant growth potential.

Meanwhile, midcaps, despite higher volatility, present

significant growth potential.

And now this popularity is clearly reflected in the significant increase in net flows into large and midcap funds,

– which surged by 276%, reaching ₹2,622.29 Cr in July 2024, compared to ₹697.13 Cr in July 2019.

(Source: ICRA Analytics)

– which surged by 276%, reaching ₹2,622.29 Cr in July 2024, compared to ₹697.13 Cr in July 2019.

(Source: ICRA Analytics)

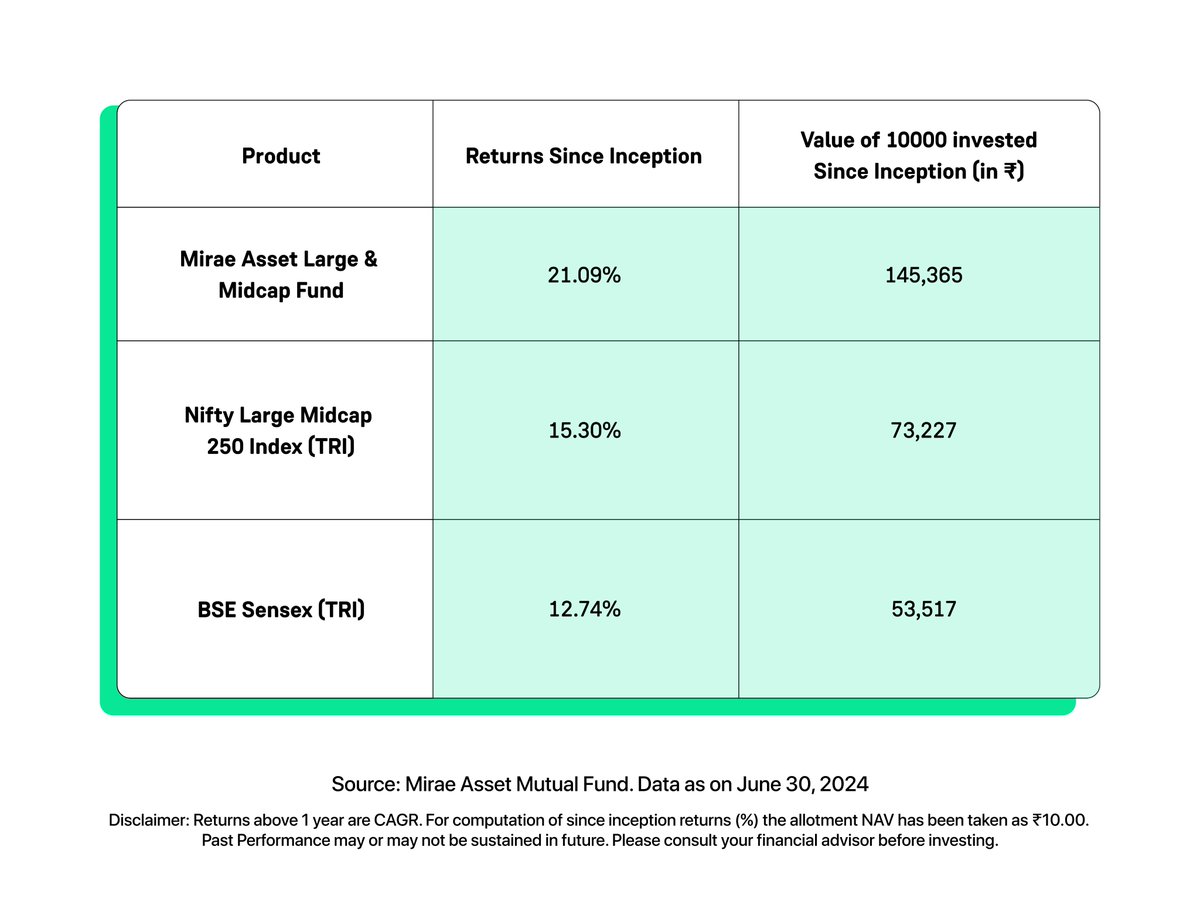

This has been possible because the fund has employed a bottom-up investment strategy driven by value

investing in growth-oriented businesses.

investing in growth-oriented businesses.

This involves seeking out companies which are undervalued relative to their intrinsic value, with a particular emphasis on those with strong growth potential.

These points underscore the significant growth and increased diversification in the mid-cap sector, aligning

well with the bottom-up investing approach that emphasises evaluating individual company performance and fundamentals.

well with the bottom-up investing approach that emphasises evaluating individual company performance and fundamentals.

If you need more information on Mirae Asset Large & Midcap Fund and invest in it, hop on to:

Know more: bit.ly

Invest Now: bit.ly

Know more: bit.ly

Invest Now: bit.ly

bit.ly/3WYQ5gA

Mutual Funds | Mutual Fund Investment Online India - Mirae Asset

We welcome you to Mirae Asset Mutual Fund and sincerely thank you for choosing to invest with us. We...

bit.ly/4dA5BXi

Invest in Mirae Asset Large & Midcap Fund Online

Erstwhile known as Mirae Asset Emerging Bluechip Fund, this fund gives investors opportunity to part...

Loading suggestions...