⚡️Negative Earnings Trading Setup – How to take a Bullish Trade after Negative Earnings⚡️

As traders, we are always on a lookout for stocks with positive earnings in the current quarter but what if we can trade ignored stocks that just received a bad result or a neutral result.

Yes, I’m talking about taking a bullish Trade in a stock that just announced negative earnings.

Surprised?

Let’s see how it’s possible and if it is even possible or not…

As traders, we are always on a lookout for stocks with positive earnings in the current quarter but what if we can trade ignored stocks that just received a bad result or a neutral result.

Yes, I’m talking about taking a bullish Trade in a stock that just announced negative earnings.

Surprised?

Let’s see how it’s possible and if it is even possible or not…

The Psychology behind a 1 day Panic:

If a stock announces negative earnings in just 1 quarter, a lot of newbie investors and scared traders tend to quickly sell their holdings usually on the first day itself.

Because of this behaviour, the stock shows signs of strong selling on the day of earnings release or at max on the next day. But but but just one day of selling doesn’t mean that the stock has become weak.

If the stock quickly goes into a sideways consolidation, we might have an interesting stock to trade in the next few days.

If a stock announces negative earnings in just 1 quarter, a lot of newbie investors and scared traders tend to quickly sell their holdings usually on the first day itself.

Because of this behaviour, the stock shows signs of strong selling on the day of earnings release or at max on the next day. But but but just one day of selling doesn’t mean that the stock has become weak.

If the stock quickly goes into a sideways consolidation, we might have an interesting stock to trade in the next few days.

What actually drives the Stock's Price:

The price of the stock is usually driven by the future growth expectations from the company and not the current quarter’s result.

So, it is always important to see how the market reacts to a particular set of financial numbers. What might seem like a great result to you might feel like an ordinary or below par result to its investors because they expected more.

Similarly, a flat or negative result might be cheered by the market. We as traders should only be concerned about how the market reacts to a Result.

The price of the stock is usually driven by the future growth expectations from the company and not the current quarter’s result.

So, it is always important to see how the market reacts to a particular set of financial numbers. What might seem like a great result to you might feel like an ordinary or below par result to its investors because they expected more.

Similarly, a flat or negative result might be cheered by the market. We as traders should only be concerned about how the market reacts to a Result.

Things to Look for:

1. Stock shouldn’t be in a strong downtrend (Sideways is the Best)

2. A very short negative reaction or no bad reaction at all

3. Sideways consolidation or positive reaction soon after

4. Stock sets up near KMAs

Let's look at a few Examples:

1. Stock shouldn’t be in a strong downtrend (Sideways is the Best)

2. A very short negative reaction or no bad reaction at all

3. Sideways consolidation or positive reaction soon after

4. Stock sets up near KMAs

Let's look at a few Examples:

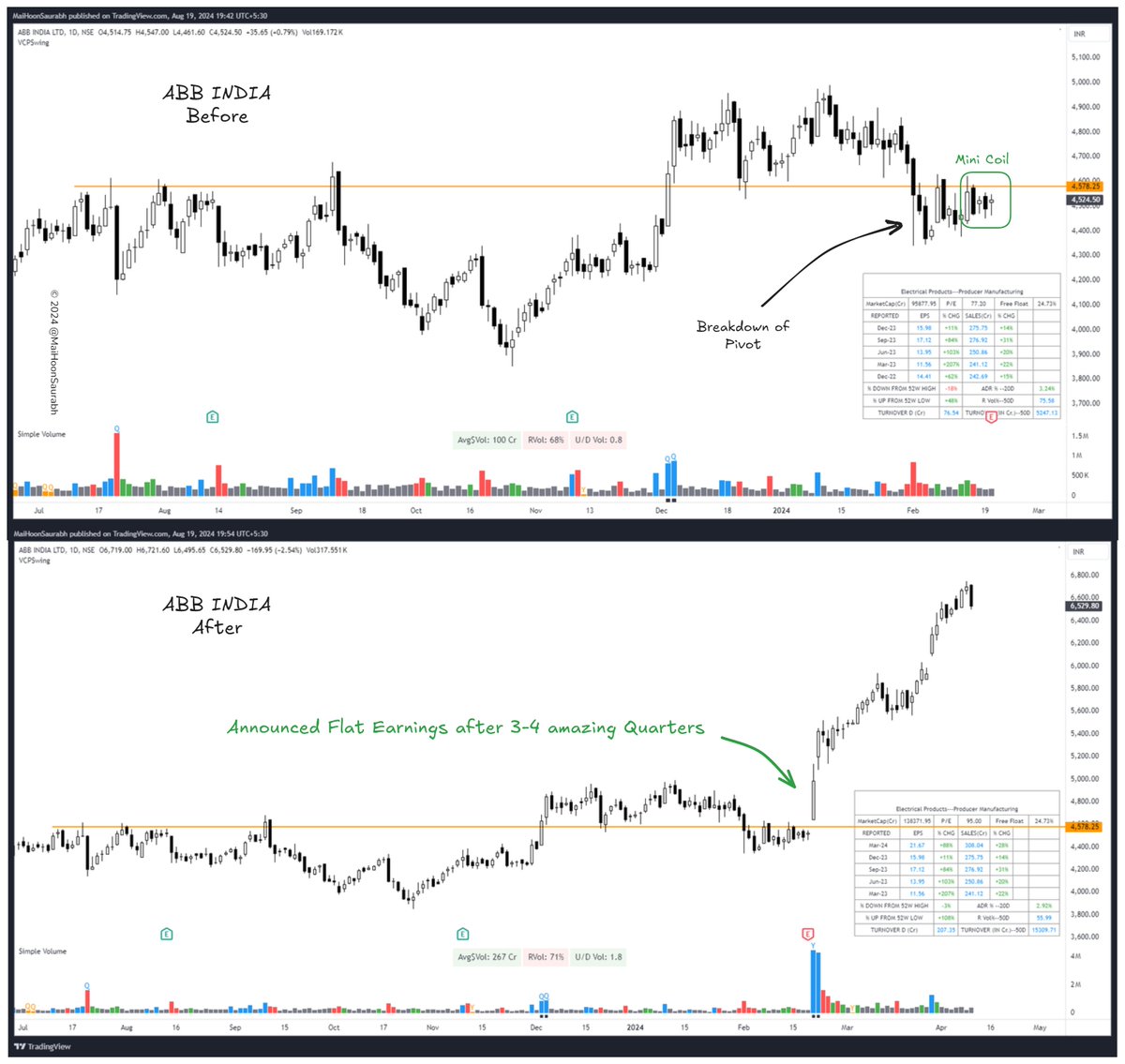

#ABB Announced a flat result after 3-4 amazing quarters but the market was really happy with it and see what happened

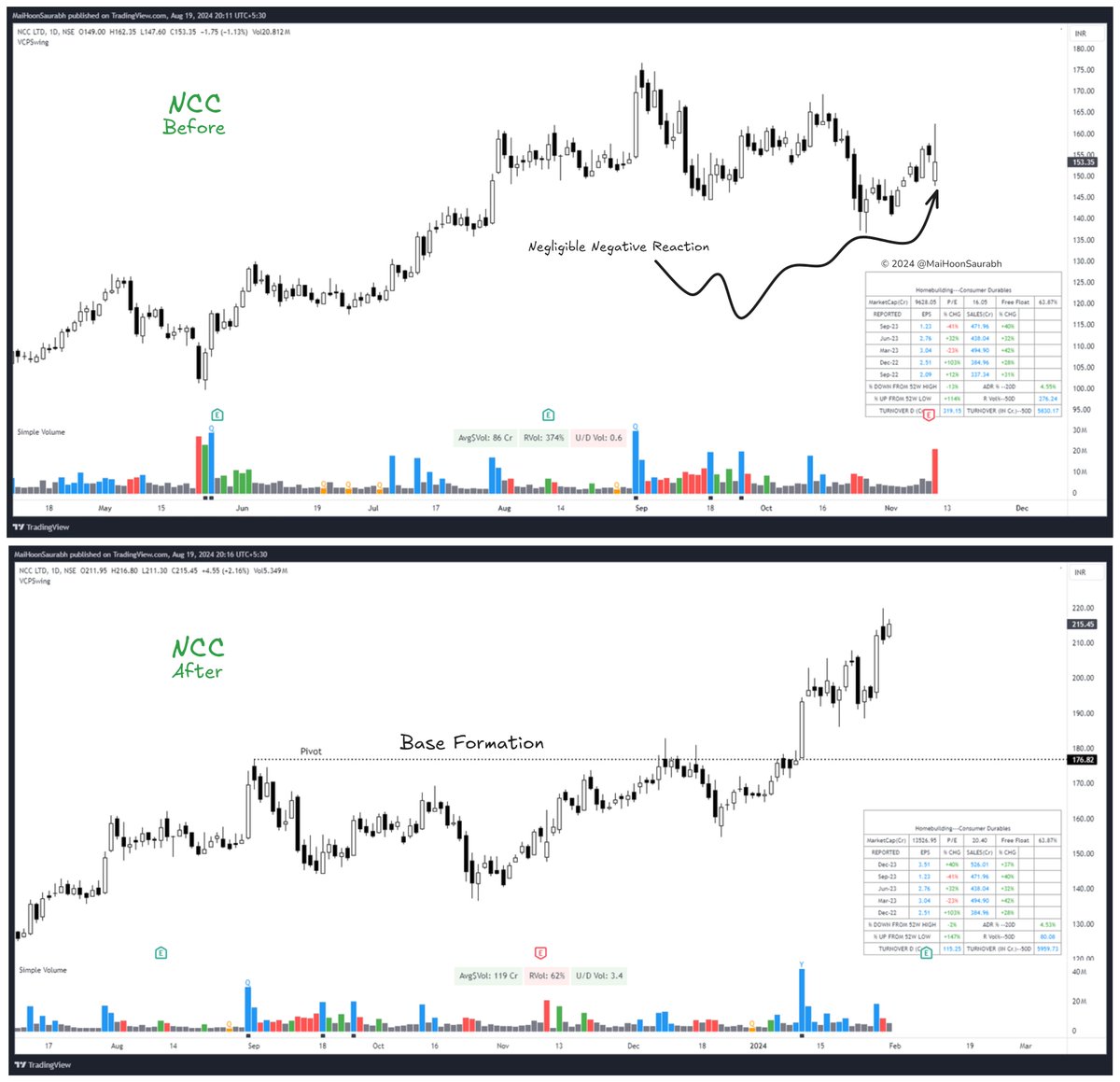

#NCC Announced a loss of 41% YoY but the stock closed just 1% down even after a gap down

This wasn't tradeable for many days, but I'm adding it here to show how the stock showed strength even after such bad result.

This wasn't tradeable for many days, but I'm adding it here to show how the stock showed strength even after such bad result.

Loading suggestions...