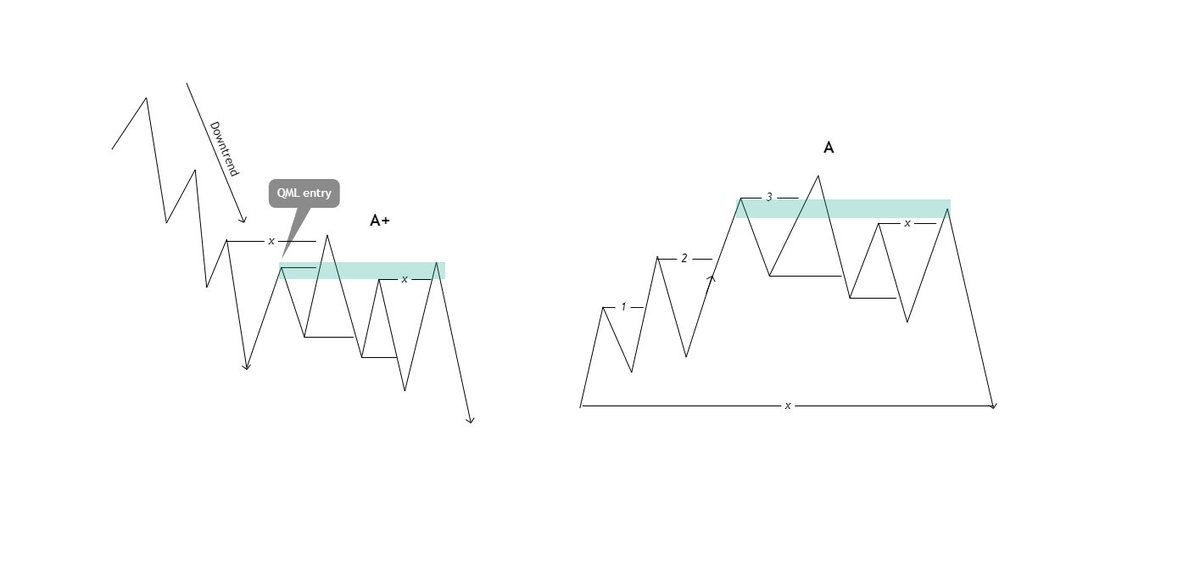

What is structural liquidity?

It is one type of liquidity that market makers left behind to induce traders with various orders placed at it just for them to take it later as a fuel for price to move further.

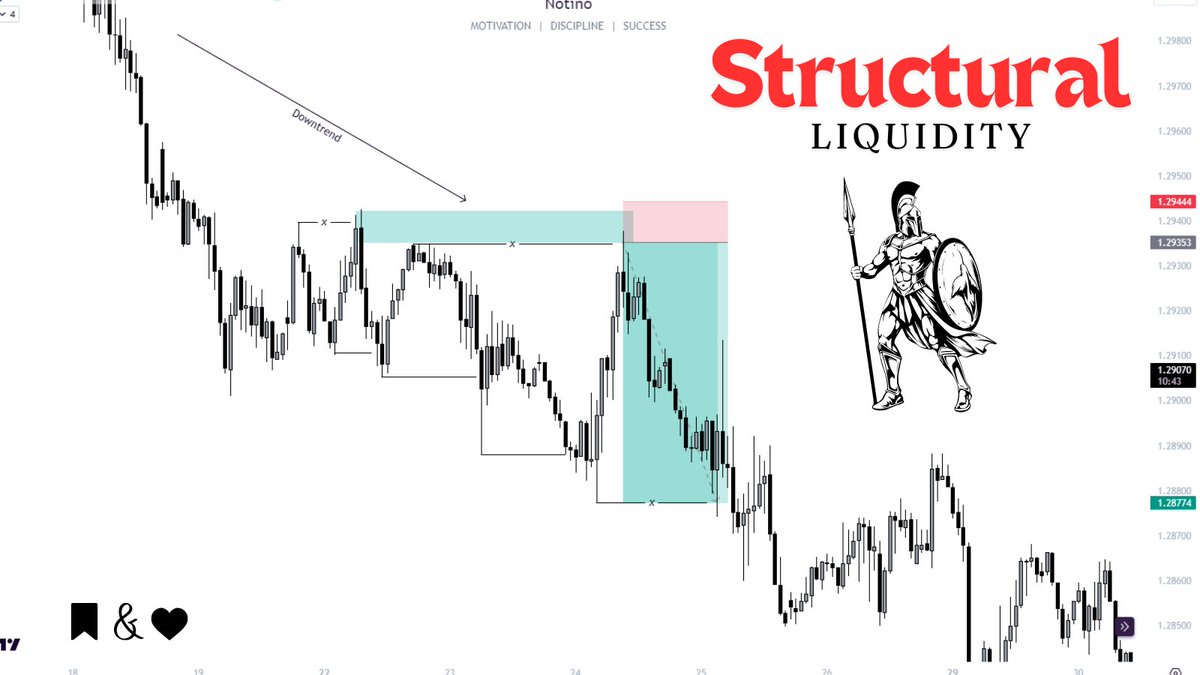

Example below shows that we are in downtrending market, price engineered our setup and structural liquidity under POI, entry once SLQ (structural liquidity) is taken out stops just above our main high.

Since we are in downtrend expecting shorts with this setup is very likely to play out with 3R.

It is one type of liquidity that market makers left behind to induce traders with various orders placed at it just for them to take it later as a fuel for price to move further.

Example below shows that we are in downtrending market, price engineered our setup and structural liquidity under POI, entry once SLQ (structural liquidity) is taken out stops just above our main high.

Since we are in downtrend expecting shorts with this setup is very likely to play out with 3R.

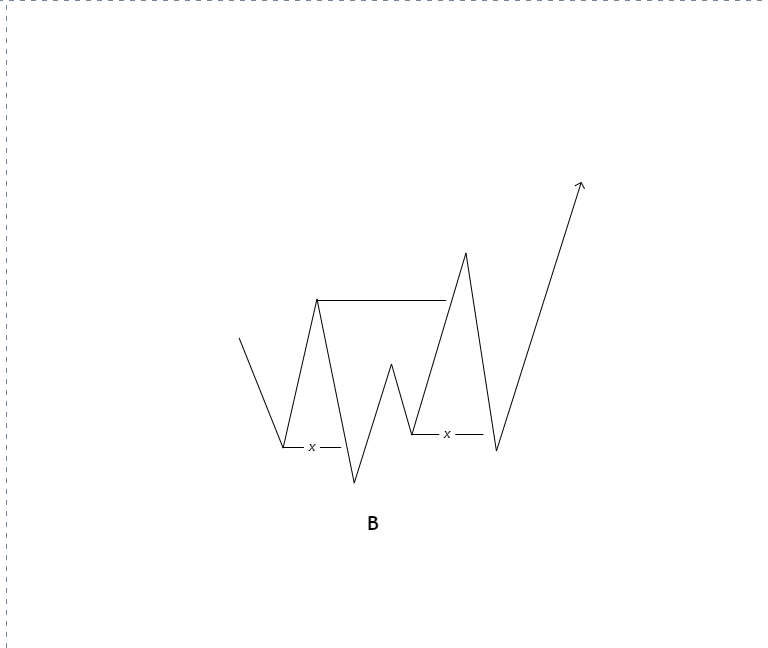

Here is another example on #btc

We have clean SLQ and wick as POI (HTF wick consist of 2 orderblocks one and the back of the wick and second one at 50% of the wick).

We have clean SLQ and wick as POI (HTF wick consist of 2 orderblocks one and the back of the wick and second one at 50% of the wick).

Hope you enjoyed and learned something new!❤️

Trade with me and enjoy massive benefits and bonuses on : u.primexbt.com

Trade with me and enjoy massive benefits and bonuses on : u.primexbt.com

Loading suggestions...