Narayana Hrudayalaya- Preparing for next capex cycle📈

A hospital chain reported good #Q1FY25 results + Good growth prospects in both Indian & Cayman business

(#NarayanaHrudalaya)

A thread🧵

A hospital chain reported good #Q1FY25 results + Good growth prospects in both Indian & Cayman business

(#NarayanaHrudalaya)

A thread🧵

📌About:

🔸Narayana Hrudayalaya operates a chain of multispecialty, tertiary & primary healthcare facilities that focuses on Cardiac, Renal, Cancer, Neurology, Neurosurgery, Orthopaedics and Gastroenterology specialties

Revenue mix📊

🔸India: ₹ 1085.5 crore; (Bengaluru: 34%, Southern Peripheral: 9%, Kolkata: 25%, Eastern Peripheral: 10%, Western: 5%, Northern: 17%); Cayman Islands: US$32 million

2/n

🔸Narayana Hrudayalaya operates a chain of multispecialty, tertiary & primary healthcare facilities that focuses on Cardiac, Renal, Cancer, Neurology, Neurosurgery, Orthopaedics and Gastroenterology specialties

Revenue mix📊

🔸India: ₹ 1085.5 crore; (Bengaluru: 34%, Southern Peripheral: 9%, Kolkata: 25%, Eastern Peripheral: 10%, Western: 5%, Northern: 17%); Cayman Islands: US$32 million

2/n

📌India Business👇

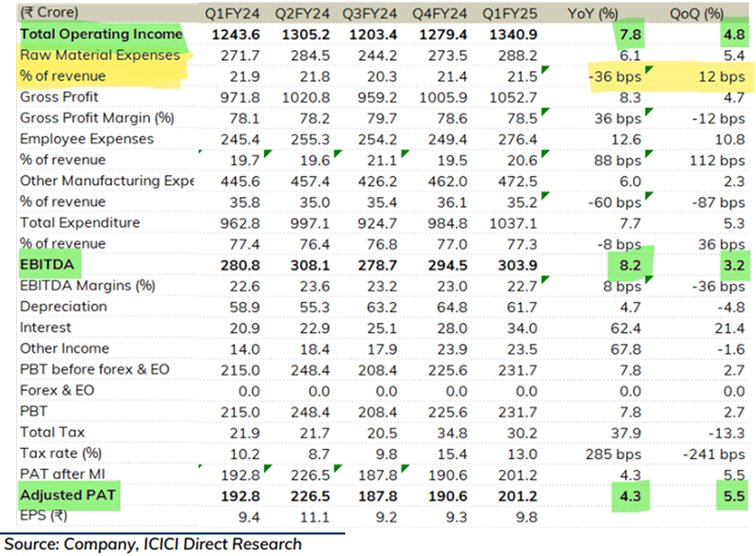

🔸Revenues improved ~8% YoY to ₹ 1341 crore, driven by ~10% growth in India to ₹ 1086 crore

🔸EBITDA grew ~8% to ₹ 304 crore and margins stood at ~23%

🔸ARPOB for Indian hospitals during the quarter came in at ₹ 41370, a growth of 11% YoY

🔸India In-patient (IP) average revenue per patient grew 6% YoY to ₹ 130000. Similarly, IP footfall grew 6% to 650000 during the quarter

3/n

🔸Revenues improved ~8% YoY to ₹ 1341 crore, driven by ~10% growth in India to ₹ 1086 crore

🔸EBITDA grew ~8% to ₹ 304 crore and margins stood at ~23%

🔸ARPOB for Indian hospitals during the quarter came in at ₹ 41370, a growth of 11% YoY

🔸India In-patient (IP) average revenue per patient grew 6% YoY to ₹ 130000. Similarly, IP footfall grew 6% to 650000 during the quarter

3/n

📌Cayman Business👇

🔸Cayman growth was subdued at ~5% to ₹ 267 crore

🔸Cayman Islands hospital average revenue per patient grew 3% to US$ 31900 during the quarter

🔸During the quarter leading Specialty profile was as follows- Cardiac Sciences- 33%, Oncology- 16%, Medicine and GI Sciences- 13%, Renal Sciences- 10%, Neuro Sciences- 8%

🔸Payor profile during the quarter was as follows Domestic Walk-in patients- 42%, Insured Patients- 29%, Schemes (Government) Patients- 21%, International Patients- 8%

4/n

🔸Cayman growth was subdued at ~5% to ₹ 267 crore

🔸Cayman Islands hospital average revenue per patient grew 3% to US$ 31900 during the quarter

🔸During the quarter leading Specialty profile was as follows- Cardiac Sciences- 33%, Oncology- 16%, Medicine and GI Sciences- 13%, Renal Sciences- 10%, Neuro Sciences- 8%

🔸Payor profile during the quarter was as follows Domestic Walk-in patients- 42%, Insured Patients- 29%, Schemes (Government) Patients- 21%, International Patients- 8%

4/n

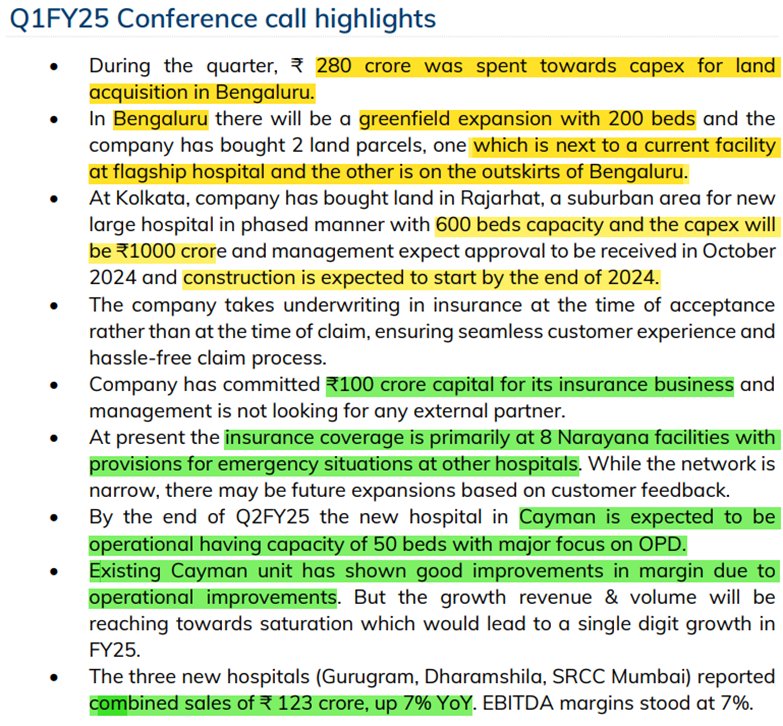

📌Capex plans

(i) Insurance: The company is targeting aggressive capex (+₹ 3000 crore in the next 2-3 years) in cities such as Bengaluru and Kolkata where it has strong presence and brand loyalty

(ii) Cayman:

🔸Likely to commence operations in H2FY25

🔸While the capex phase would be by far the largest in the last ten years, we believe the company is far better poised (despite negative FCF in FY25-26) to fathom the impact on the balance sheet as the margins and the return ratios are in good shape

5/n

(i) Insurance: The company is targeting aggressive capex (+₹ 3000 crore in the next 2-3 years) in cities such as Bengaluru and Kolkata where it has strong presence and brand loyalty

(ii) Cayman:

🔸Likely to commence operations in H2FY25

🔸While the capex phase would be by far the largest in the last ten years, we believe the company is far better poised (despite negative FCF in FY25-26) to fathom the impact on the balance sheet as the margins and the return ratios are in good shape

5/n

Our Rating and Target price🎯

🔸Our SOTP valuation of ₹ 1485 is based on 24xFY26E Indian hospitals EBITDA and 15x FY26E Cayman hospital EBITDA

🚩Key risks

(i) Delay in Capex plan

(ii) Slower than expected ramp-up at new Cayman hospital

7/n

🔸Our SOTP valuation of ₹ 1485 is based on 24xFY26E Indian hospitals EBITDA and 15x FY26E Cayman hospital EBITDA

🚩Key risks

(i) Delay in Capex plan

(ii) Slower than expected ramp-up at new Cayman hospital

7/n

Let us know in comments which Company’s #Q1FY25 you want us to cover next!👇

Loading suggestions...