How do you invest in global stocks and ETFs?

You need to open a brokerage account that gives you access to global markets.

Here are the 5 options available for Kenyan investors and how they compare:

1. Interactive Brokers.

You need to open a brokerage account that gives you access to global markets.

Here are the 5 options available for Kenyan investors and how they compare:

1. Interactive Brokers.

Interactive brokers one is the biggest stock broker outside the U.S.

It is licensed and regulated in over 10 countries and was founded in 1978.

The company is also listed on the New York Stock Exchange.

It is licensed and regulated in over 10 countries and was founded in 1978.

The company is also listed on the New York Stock Exchange.

What do I like about Interactive brokers?

1. Low cost. Charges as low as $0.35 per trade and no more than 1% of trade value

2. Good margin rates for those who love investing with borrowed money.

3. Cash balances in your brokerage account earn decent interest rates(4.8%)

4. Access to ETFs and stocks domiciled all over Europe. This means you can strategically reduce your tax expenses on dividends from 30% to 15%

5. The trading platform has amazing tools that simply investment decisions and analysis.

1. Low cost. Charges as low as $0.35 per trade and no more than 1% of trade value

2. Good margin rates for those who love investing with borrowed money.

3. Cash balances in your brokerage account earn decent interest rates(4.8%)

4. Access to ETFs and stocks domiciled all over Europe. This means you can strategically reduce your tax expenses on dividends from 30% to 15%

5. The trading platform has amazing tools that simply investment decisions and analysis.

What I don't like about them? Only one thing

1. You are limited on how you can transfer money to your brokerage account.

You either use your wise wallet or SWIFT transfer from your bank.

SWIFT transfers can be expensive unless you are moving high amounts (at least $3K)

You can't use card, mpesa, paypal or those other methods.

2. Opening account takes time. You need a non P.O. Box residential address to proof your residential address.

1. You are limited on how you can transfer money to your brokerage account.

You either use your wise wallet or SWIFT transfer from your bank.

SWIFT transfers can be expensive unless you are moving high amounts (at least $3K)

You can't use card, mpesa, paypal or those other methods.

2. Opening account takes time. You need a non P.O. Box residential address to proof your residential address.

2. Hisa

Hisa being a Kenya company simplifies much of the account opening access and you can easily deposit money to your trading account via Mpesa, Card,

They only charge 1% of trade amount.

You can start with as low as $1

Hisa being a Kenya company simplifies much of the account opening access and you can easily deposit money to your trading account via Mpesa, Card,

They only charge 1% of trade amount.

You can start with as low as $1

3. Ndovu

Ndovu curates ETFs for you hence you are limited on the options that you have.

They also don't have individual stocks if you wanted to invest in them

And their fees are a quite high to be honest.

They have subscriptions and if you are on the basic plan you have to pay 4.5% of the investment amount every time you place a trade.

Minimum investment is $50

Ndovu curates ETFs for you hence you are limited on the options that you have.

They also don't have individual stocks if you wanted to invest in them

And their fees are a quite high to be honest.

They have subscriptions and if you are on the basic plan you have to pay 4.5% of the investment amount every time you place a trade.

Minimum investment is $50

There are also other brokers available but I haven't tried them so I don't know much about them

4. Scope Markets

5. HF Markets

6. Etore (Stopped accepting new kenyan investors)

4. Scope Markets

5. HF Markets

6. Etore (Stopped accepting new kenyan investors)

In general when looking for a stock broker for offshore stocks consider these factors:

1. Investment costs- Both trading commissions and transaction fees.

The lower the better. ETFs are passive investments. Anyone charging you trade commissions of above 1% is honestly not prioritizing the interests of investors.

1. Investment costs- Both trading commissions and transaction fees.

The lower the better. ETFs are passive investments. Anyone charging you trade commissions of above 1% is honestly not prioritizing the interests of investors.

2. Options available to you.

When we talk global markets, trading experience may get complex real quick.

Most brokers that I have not mentioned here, don't offer physical or paid up stocks. They offer Contract for Differences (CFDs)

You want to avoid them unless you are a day trader and not a long term investor.

Also, the stocks & ETFs available to you, the more the merrier.

Have a broker who can help you invest in global giants all over the world.

When we talk global markets, trading experience may get complex real quick.

Most brokers that I have not mentioned here, don't offer physical or paid up stocks. They offer Contract for Differences (CFDs)

You want to avoid them unless you are a day trader and not a long term investor.

Also, the stocks & ETFs available to you, the more the merrier.

Have a broker who can help you invest in global giants all over the world.

3. Regulation by all relevant authorities.

Very important for obvious reasons to avoid losing your money to untrusted partners.

Very important for obvious reasons to avoid losing your money to untrusted partners.

Investing in global stocks and ETFs is one of those opportunities that will accelerate your wealth creation journey due to the opportunities it creates.

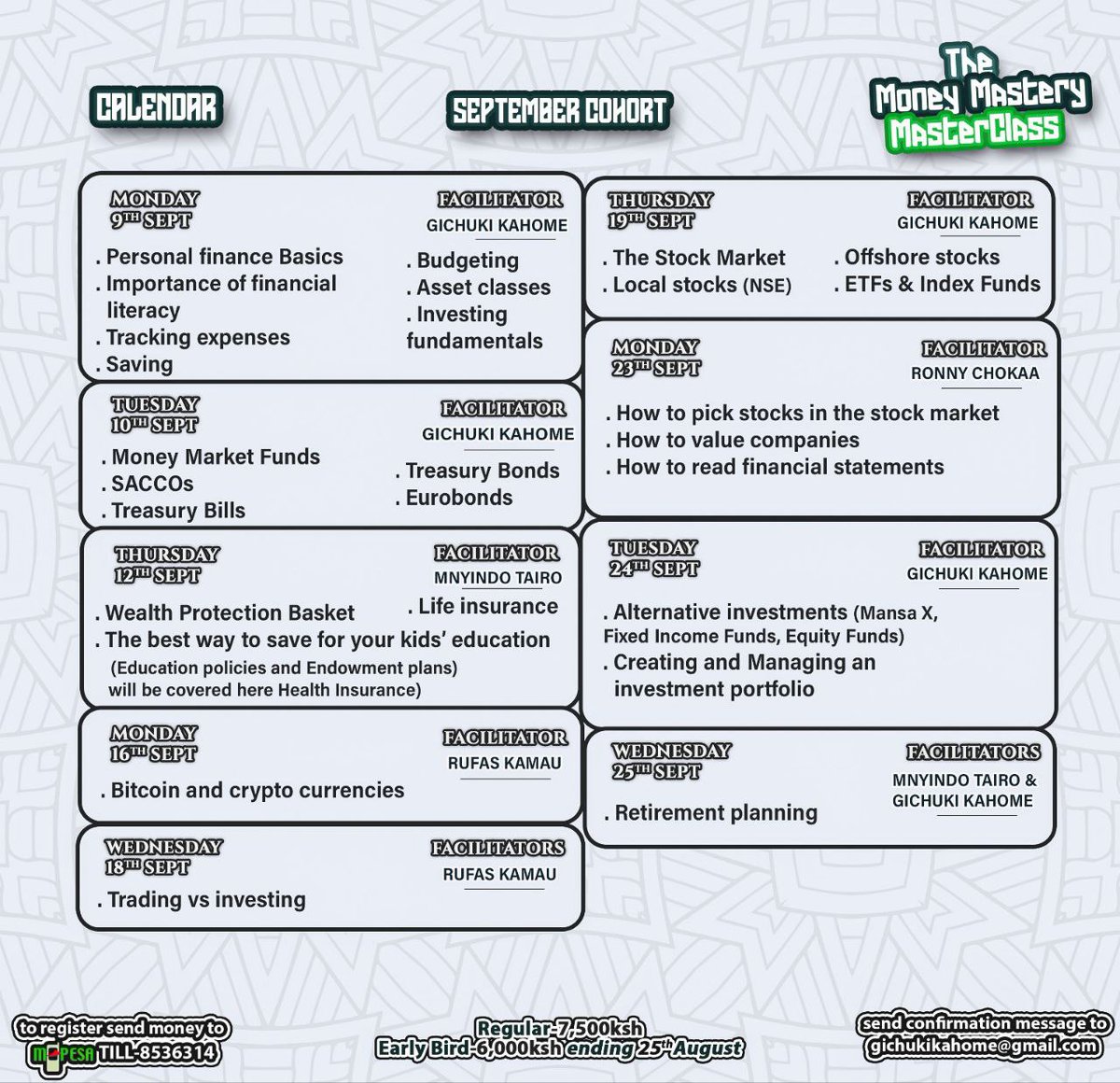

This is one of our key focus areas in our money mastery masterclass

Enroll for our September Cohort to learn more about investing in financial markets

To enroll click link below

gichukikahome.com

This is one of our key focus areas in our money mastery masterclass

Enroll for our September Cohort to learn more about investing in financial markets

To enroll click link below

gichukikahome.com

You can also join our free communities where we discuss about personal finance and investing in financial markets

1. WhatsApp whatsapp.com

2. Telegram t.me

1. WhatsApp whatsapp.com

2. Telegram t.me

Loading suggestions...