99% of money advice is trash.

Millionaires get rich because they know what to ignore. My net worth increased by 6 figures *per year* once I ignored bad advice.

Here are 17 of the worst pieces of advice you need to ignore to get rich.

Millionaires get rich because they know what to ignore. My net worth increased by 6 figures *per year* once I ignored bad advice.

Here are 17 of the worst pieces of advice you need to ignore to get rich.

2: A 9 to 5 can't make you rich.

I'm proof-positive that's a lie.

With proper money management skills, your 9-to-5 CAN MAKE YOU RICH.

It happens all the time.

I'm proof-positive that's a lie.

With proper money management skills, your 9-to-5 CAN MAKE YOU RICH.

It happens all the time.

3: Follow your passion.

That’s terrible advice.

Your passion won’t pay your bills, your strengths will.

Pursue a career that aligns with your strengths.

Maximize your earning potential.

That’s terrible advice.

Your passion won’t pay your bills, your strengths will.

Pursue a career that aligns with your strengths.

Maximize your earning potential.

4: Save 10% and you'll be set.

On so many levels, this is nonsensical.

▫ Life spans are expanding

▫ Taxation on the rise

▫ Jobs are changing

▫ Inflation

10% may not cut it.

Fund your 401(k) and Roth IRA.

Build an emergency fund.

Your future will thank you.

On so many levels, this is nonsensical.

▫ Life spans are expanding

▫ Taxation on the rise

▫ Jobs are changing

▫ Inflation

10% may not cut it.

Fund your 401(k) and Roth IRA.

Build an emergency fund.

Your future will thank you.

5: The mortgage you're approved for is what you can afford.

2009 is proof that's a lie.

Your approved mortgage is the risk the lender is willing to take on YOU. Nothing more.

Don't let the lender make you house-poor.

2009 is proof that's a lie.

Your approved mortgage is the risk the lender is willing to take on YOU. Nothing more.

Don't let the lender make you house-poor.

6: Watching Netflix will make you poor.

Watching Netflix isn't the issue.

It's a lack of motivation.

An unmotivated person who cancels Netflix will replace it with another distraction.

You aren’t a lazy bastard if you watch Netflix.

Just keep it in moderation.

Watching Netflix isn't the issue.

It's a lack of motivation.

An unmotivated person who cancels Netflix will replace it with another distraction.

You aren’t a lazy bastard if you watch Netflix.

Just keep it in moderation.

7: You only live once.

In other words, "Spend your cash on temporary happiness crap".

How about this: You only live once. Achieve FI and do whatever the fuck you want.

That sounds much better to me.

In other words, "Spend your cash on temporary happiness crap".

How about this: You only live once. Achieve FI and do whatever the fuck you want.

That sounds much better to me.

8: Never use a credit card.

Using a credit card responsibly is one of the best ways to maximize your dollar.

Why?

▫ Points

▫ Build credit

▫ Fraud protection

▫ Acquire airline miles

▫ Warranties on purchase

Let credit work for you.

Using a credit card responsibly is one of the best ways to maximize your dollar.

Why?

▫ Points

▫ Build credit

▫ Fraud protection

▫ Acquire airline miles

▫ Warranties on purchase

Let credit work for you.

9: Renting is throwing your money away.

Homeownership is MUCH more expensive than people realize.

▫ Taxes

▫ Interest

▫ Maintenance

▫ Repairs

▫ Opportunity cost

Renting gives you options that homeownership doesn't.

Homeownership is MUCH more expensive than people realize.

▫ Taxes

▫ Interest

▫ Maintenance

▫ Repairs

▫ Opportunity cost

Renting gives you options that homeownership doesn't.

10: You gotta hustle 24/7.

This awful advice traps people into a life of burnout.

Your rest and relaxation time is required to hustle.

It's healthy.

Without rest, there's no hustle.

This awful advice traps people into a life of burnout.

Your rest and relaxation time is required to hustle.

It's healthy.

Without rest, there's no hustle.

11: There is no such thing as good debt.

Untrue.

Smart debts pay off.

▫ Student loans

▫ Business loans

▫ Home equity loans

▫ Mortgages (sometimes)

"All debt is bad" is elementary school thinking.

Untrue.

Smart debts pay off.

▫ Student loans

▫ Business loans

▫ Home equity loans

▫ Mortgages (sometimes)

"All debt is bad" is elementary school thinking.

12: Crypto is the future.

Nobody knows that. Not you. Not me.

Never take advice from people who believe they can predict the future.

Ever.

Nobody knows that. Not you. Not me.

Never take advice from people who believe they can predict the future.

Ever.

13: College is useless.

College graduates earn more than non-grads.

Them's the facts.

Exceptions apply but never count on being an exception.

Don't allow people to talk you out of a smart career foundation.

College graduates earn more than non-grads.

Them's the facts.

Exceptions apply but never count on being an exception.

Don't allow people to talk you out of a smart career foundation.

14: Read 5,000 books a year.

Reading is overrated.

Doing is underrated.

The marketplace does not care how many books you've read.

It cares about what you can do.

Stop stacking knowledge and start gaining experience.

Reading is overrated.

Doing is underrated.

The marketplace does not care how many books you've read.

It cares about what you can do.

Stop stacking knowledge and start gaining experience.

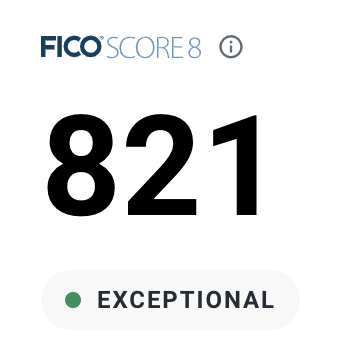

15: Your credit score doesn't matter.

It does. A good credit score means things are cheaper.

What types of things?

▫ Car loans

▫ Mortgages

▫ Business loans

▫ Insurance rates

▫ Security deposits

And, don't forget: Employers/landlords can check your credit.

It does. A good credit score means things are cheaper.

What types of things?

▫ Car loans

▫ Mortgages

▫ Business loans

▫ Insurance rates

▫ Security deposits

And, don't forget: Employers/landlords can check your credit.

16. Don't worry about saving, just earn more.

This is a fallacy.

The more you earn, the worse your spending problem gets.

You will NEVER be able to out-earn destructive spending habits.

Ever.

This is a fallacy.

The more you earn, the worse your spending problem gets.

You will NEVER be able to out-earn destructive spending habits.

Ever.

17. Investing is gambling.

With gambling, your odds are not good.

Investments, however, have a clear and direct history of making a LOT of people filthy rich.

▫ Not your salary

▫ Not your savings

▫ Not your upbringing

Your investments.

With gambling, your odds are not good.

Investments, however, have a clear and direct history of making a LOT of people filthy rich.

▫ Not your salary

▫ Not your savings

▫ Not your upbringing

Your investments.

Like this thread?

These threads take a lot of time to write. Leave a comment and RT the first tweet in this thread to help more people see it. It helps them and it also helps me.

Appreciate it!

These threads take a lot of time to write. Leave a comment and RT the first tweet in this thread to help more people see it. It helps them and it also helps me.

Appreciate it!

Loading suggestions...