📌In 1848, gold was discovered in California, leading to a sudden influx of 300,000 people digging for gold

⚒️During the California Gold Rush, investing in supplies like picks, shovels, & denims was more profitable than mining for gold

💡One company that stood out ~ Levi Strauss & Co (Popular denim brand we know today)

2/n

⚒️During the California Gold Rush, investing in supplies like picks, shovels, & denims was more profitable than mining for gold

💡One company that stood out ~ Levi Strauss & Co (Popular denim brand we know today)

2/n

📌Proxy Investing:

🔸Investing in supporting sectors that benefit from a primary market trend rather than the trend itself

📌How to benefit from Proxy Investing:

🔸Recognize the main trend ~ like "Financialisation" (Gold Rush)

🔸Target Beneficiary Businesses: Look for companies that benefit from the trend (such as Exchanges, Brokers, Wealth management firms)

3/n

🔸Investing in supporting sectors that benefit from a primary market trend rather than the trend itself

📌How to benefit from Proxy Investing:

🔸Recognize the main trend ~ like "Financialisation" (Gold Rush)

🔸Target Beneficiary Businesses: Look for companies that benefit from the trend (such as Exchanges, Brokers, Wealth management firms)

3/n

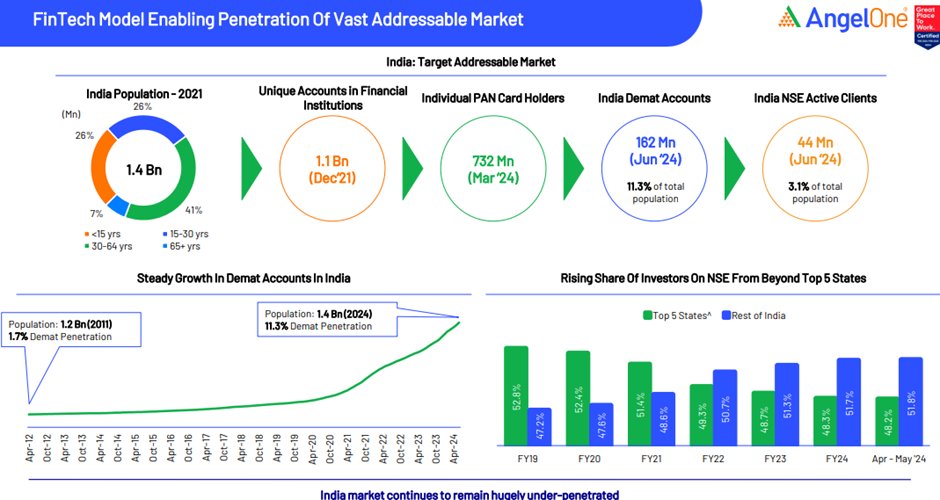

📌Proxy To Financialisation

🔸Rising middle class & increasing financial inclusion has led to shifting household savings into investment products and financial markets

🔸Data for FY24 reveals that 70% of household savings lie in physical assets this underlines the vast untapped potential for capital formation

💡Total Demat Accounts in India grew from 3.59 Cr in FY19 to ~16.2 Cr in Jun'24

💡India NSE Active Clients ~ 4.4 Cr ( 3.1 % of total population)

⚡The Under penetration presents a huge opportunity

4/n

🔸Rising middle class & increasing financial inclusion has led to shifting household savings into investment products and financial markets

🔸Data for FY24 reveals that 70% of household savings lie in physical assets this underlines the vast untapped potential for capital formation

💡Total Demat Accounts in India grew from 3.59 Cr in FY19 to ~16.2 Cr in Jun'24

💡India NSE Active Clients ~ 4.4 Cr ( 3.1 % of total population)

⚡The Under penetration presents a huge opportunity

4/n

📌Investing in companies that provides financial services serves as a proxy to play the financialisation trend

🔸Exchanges: NSE, BSE, MCX

🔸Brokers: AngelOne, Motilal Oswal, 5 Paisa

🔸Depositories: NSDL, CDSL

🔸Registrar and Transfer Agents (RTA): CAMS, Kfintech

🔸Wealth Management: Nuvama, Anand Rathi, 360 One

🔸Asset Management Companies (AMC): HDFC AMC, NAM India

5/n

🔸Exchanges: NSE, BSE, MCX

🔸Brokers: AngelOne, Motilal Oswal, 5 Paisa

🔸Depositories: NSDL, CDSL

🔸Registrar and Transfer Agents (RTA): CAMS, Kfintech

🔸Wealth Management: Nuvama, Anand Rathi, 360 One

🔸Asset Management Companies (AMC): HDFC AMC, NAM India

5/n

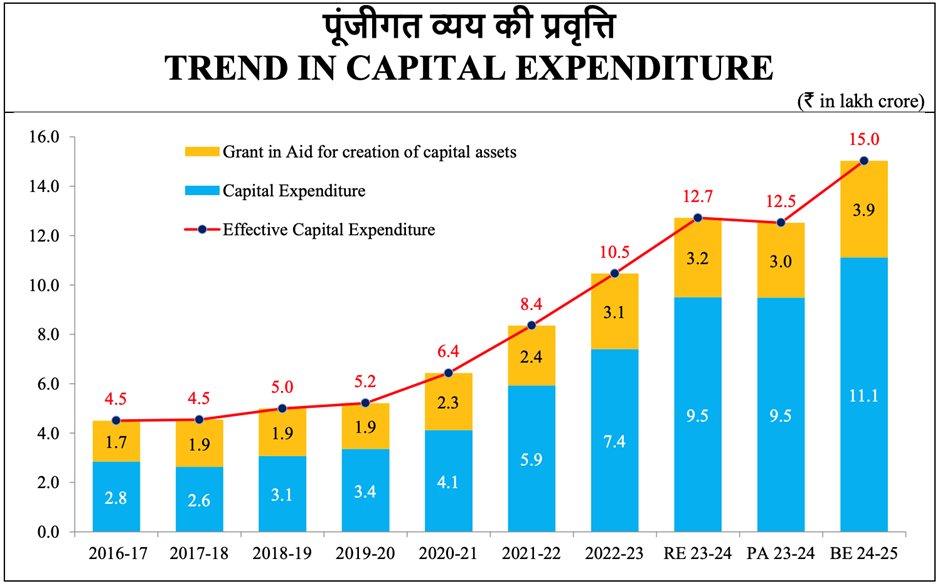

📌Proxy to CAPEX

🔸Capex refers to Government spending on long-term assets, supporting infrastructure development

🔸It leads to a multiplier effect on the economy

🔸Capex Outlay of ~ 11.1 Lakh Cr, contributing 3.4% of GDP in FY25 Union Budget

💡Capex increases as the country invests in building and upgrading physical assets, in sectors such as urban infra, railways, highways, and manufacturing

6/n

🔸Capex refers to Government spending on long-term assets, supporting infrastructure development

🔸It leads to a multiplier effect on the economy

🔸Capex Outlay of ~ 11.1 Lakh Cr, contributing 3.4% of GDP in FY25 Union Budget

💡Capex increases as the country invests in building and upgrading physical assets, in sectors such as urban infra, railways, highways, and manufacturing

6/n

📌Investing in companies that are involved in infrastructure and industrial development projects serves as a capex proxy

🔸Cranes: Action Construction, Sanghvi Movers

🔸Wire & Cables: Polcab, KEI Industries

🔸Power: Voltamp, TRIL, Elecon

🔸Construction: Ultratech, Ambuja, Jindal Stainless, Tata Steel

🔸Capital Goods: Siemens, Cummins, RHI Magnesita

7/n

🔸Cranes: Action Construction, Sanghvi Movers

🔸Wire & Cables: Polcab, KEI Industries

🔸Power: Voltamp, TRIL, Elecon

🔸Construction: Ultratech, Ambuja, Jindal Stainless, Tata Steel

🔸Capital Goods: Siemens, Cummins, RHI Magnesita

7/n

📌Proxy To Consumption

🔸India is moving beyond 'roti, kapda, makaan' phase, where consumption skyrockets and shifts from basic needs to indulging in desires & wants

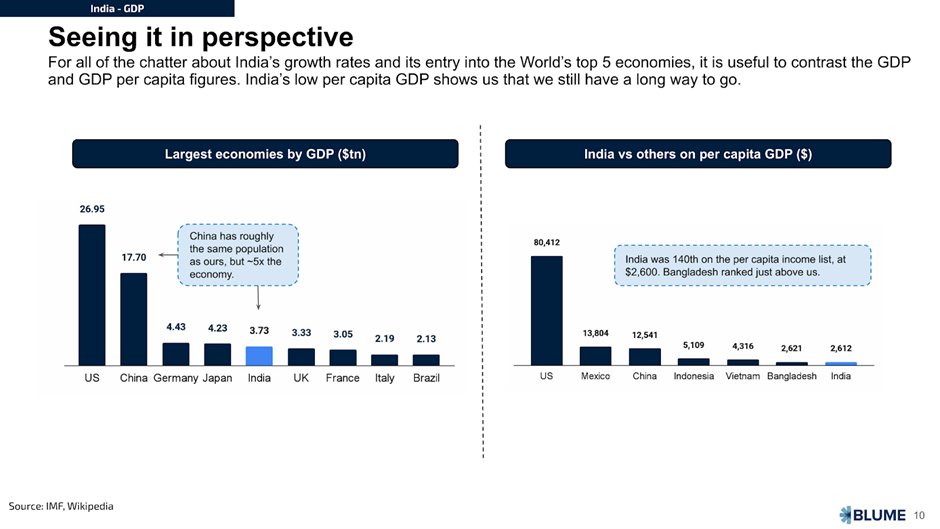

🔸As per capita GDP has exceeded $2,500, consumption is at its inflection point

A similar trend was observed in the

🔸United States in 1950/60s

🔸Japan in the 1970s

🔸South Korea in 1980s

🔸China in 2000s

💡Domestic consumption, contributing over 60% of GDP is expected to surpass $4 trillion by 2030, and will be driven by India’s youthful 1.4 billion population

8/n

🔸India is moving beyond 'roti, kapda, makaan' phase, where consumption skyrockets and shifts from basic needs to indulging in desires & wants

🔸As per capita GDP has exceeded $2,500, consumption is at its inflection point

A similar trend was observed in the

🔸United States in 1950/60s

🔸Japan in the 1970s

🔸South Korea in 1980s

🔸China in 2000s

💡Domestic consumption, contributing over 60% of GDP is expected to surpass $4 trillion by 2030, and will be driven by India’s youthful 1.4 billion population

8/n

📌Investing in companies related to the consumption theme will benefit from the growing consumer market in India

🔸FMCG: VBL, Tata Consumer, Nestle

🔸Retail: Phoenix Mills, Trent, Ethos, Dmart, Vedant Fashions

🔸QSR: Jubilant Foodworks, Westlife Foodworld, Devyani International

🔸Jewellery Retailer: Titan, Kalyan, Senco Gold

🔸Alcoholic beverage: United Spirits, United Breweries, Sula Vineyards

🔸Travel & Tourism: Indigo, Indian Hotels, EIH

9/n

🔸FMCG: VBL, Tata Consumer, Nestle

🔸Retail: Phoenix Mills, Trent, Ethos, Dmart, Vedant Fashions

🔸QSR: Jubilant Foodworks, Westlife Foodworld, Devyani International

🔸Jewellery Retailer: Titan, Kalyan, Senco Gold

🔸Alcoholic beverage: United Spirits, United Breweries, Sula Vineyards

🔸Travel & Tourism: Indigo, Indian Hotels, EIH

9/n

Sources used for the thread:

- World Economic Forum, CMS Consumption Report, Blume Ventures Indus Valley Report, Wikipedia, AngelOne Investor ppt

Let us know which proxy sectors are you tracking in comments below? 👇

10/n

- World Economic Forum, CMS Consumption Report, Blume Ventures Indus Valley Report, Wikipedia, AngelOne Investor ppt

Let us know which proxy sectors are you tracking in comments below? 👇

10/n

Loading suggestions...