Company Name: Oriana Power

All of the highlighted are items that do not belong under Cash Flow from operations

Reasons

Insurance Claim - Incorrect, insurance claims are usually considered an extraordinary item and should be under investing activities unless the company has an insurance business.

Adjustment in Reserve - Incorrect, this is a balance sheet item and should not affect the cash flow.

Unrealized profit from Subsidiary - Incorrect, unrealized gains/losses are non-cash and should not impact operating cash flows.

Minority Interest - Incorrect, as it relates to ownership in subsidiaries and should not affect cash flow from operations directly.

(Decrease)/Increase in Short Term Borrowings - Incorrect, as borrowings are financing activities, not operating.

(Decrease)/Increase in Long Term Provisions - Incorrect, as long-term provisions relate to financing activities.

(Decrease)/Increase in Current Investments - Incorrect, as investments are an investing activity.

(Decrease)/Increase in Short Term Loan & Advances - Incorrect, short-term loans and advances are generally classified under investing activities.

(Decrease)/Increase in Deferred Tax - Incorrect, deferred tax is a non-cash item and doesn't typically affect operating cash flows.

(Decrease)/Increase in Other Current Assets - Incorrect, these should be classified under investing activities.

All of the highlighted are items that do not belong under Cash Flow from operations

Reasons

Insurance Claim - Incorrect, insurance claims are usually considered an extraordinary item and should be under investing activities unless the company has an insurance business.

Adjustment in Reserve - Incorrect, this is a balance sheet item and should not affect the cash flow.

Unrealized profit from Subsidiary - Incorrect, unrealized gains/losses are non-cash and should not impact operating cash flows.

Minority Interest - Incorrect, as it relates to ownership in subsidiaries and should not affect cash flow from operations directly.

(Decrease)/Increase in Short Term Borrowings - Incorrect, as borrowings are financing activities, not operating.

(Decrease)/Increase in Long Term Provisions - Incorrect, as long-term provisions relate to financing activities.

(Decrease)/Increase in Current Investments - Incorrect, as investments are an investing activity.

(Decrease)/Increase in Short Term Loan & Advances - Incorrect, short-term loans and advances are generally classified under investing activities.

(Decrease)/Increase in Deferred Tax - Incorrect, deferred tax is a non-cash item and doesn't typically affect operating cash flows.

(Decrease)/Increase in Other Current Assets - Incorrect, these should be classified under investing activities.

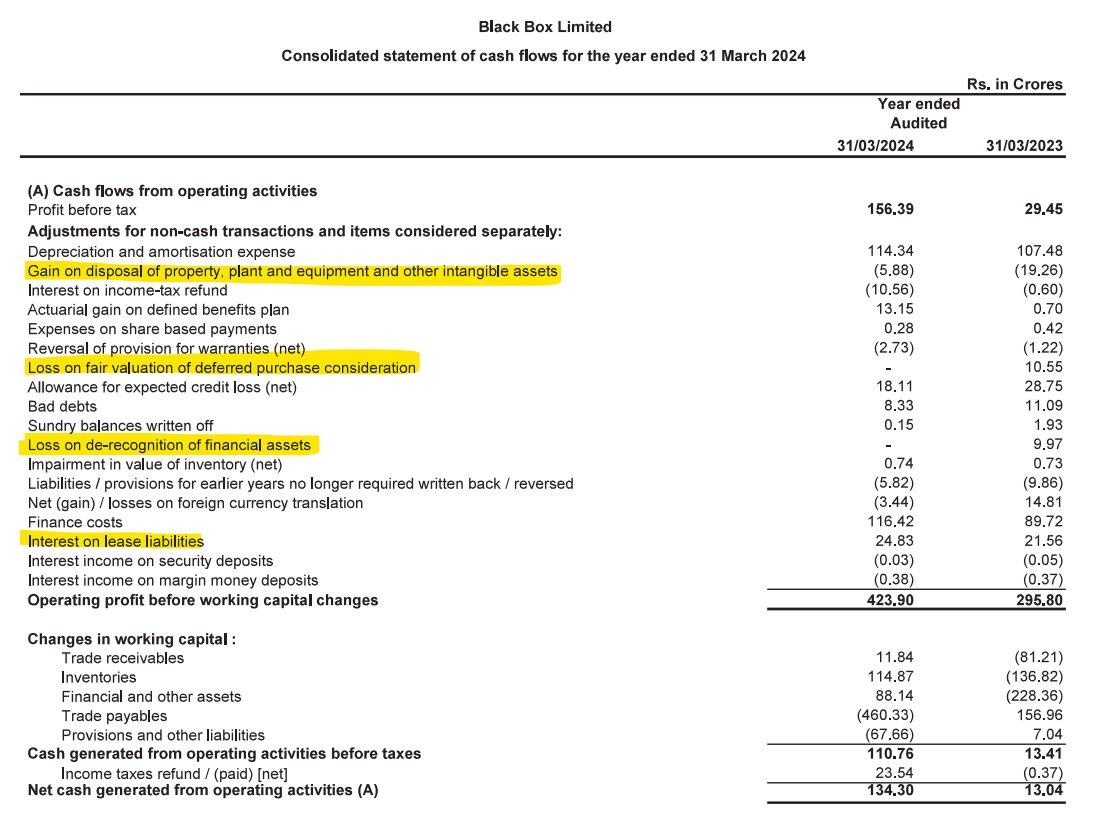

Company Name: Black Box Ltd

All of the highlighted are items that do not belong under Cash Flow from operations

Reasons

Gain on disposal of property, plant and equipment (PPE) and other intangible assets should be included under cash flow from investing activities. Gain arises from the sale of long-term assets, which are part of investing activities

Loss on fair valuation of deferred purchase consideration should be included under cash flow from investing activities. Loss is related to the valuation of liabilities associated with a past acquisition, impacting the investing cash flows as it pertains to the adjustments in the value of investments and financial assets acquired through investing activities.

Loss on de-recognition of financial assets should be included under cash flow from investing activities. This loss is related to the sale or disposal of financial assets, and its impact is associated with investing activities because it pertains to the adjustments in the value or disposal of investments.

Interest on lease liabilities should be included under cash flow from financing activities. This is because the interest on lease liabilities is considered part of the cost of financing the lease, similar to interest on other forms of debt, and thus it is classified under financing activities.

All of the highlighted are items that do not belong under Cash Flow from operations

Reasons

Gain on disposal of property, plant and equipment (PPE) and other intangible assets should be included under cash flow from investing activities. Gain arises from the sale of long-term assets, which are part of investing activities

Loss on fair valuation of deferred purchase consideration should be included under cash flow from investing activities. Loss is related to the valuation of liabilities associated with a past acquisition, impacting the investing cash flows as it pertains to the adjustments in the value of investments and financial assets acquired through investing activities.

Loss on de-recognition of financial assets should be included under cash flow from investing activities. This loss is related to the sale or disposal of financial assets, and its impact is associated with investing activities because it pertains to the adjustments in the value or disposal of investments.

Interest on lease liabilities should be included under cash flow from financing activities. This is because the interest on lease liabilities is considered part of the cost of financing the lease, similar to interest on other forms of debt, and thus it is classified under financing activities.

Loading suggestions...