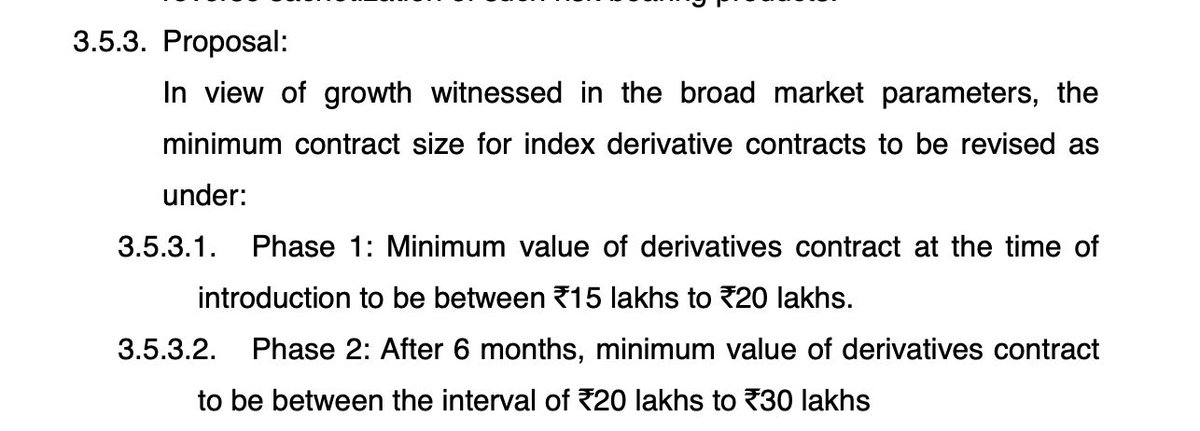

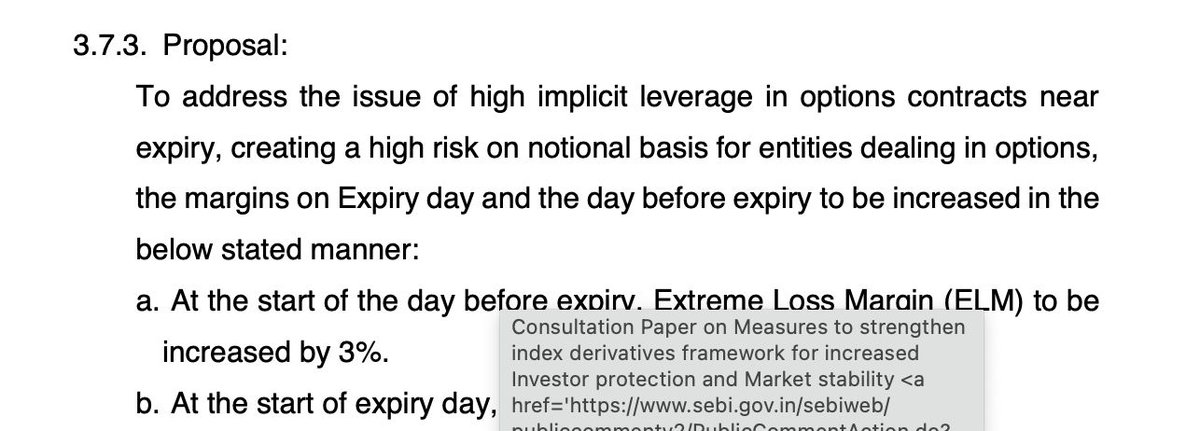

SEBI has released a 18 pages consultation paper related to F&O Trading, more than 78 lacs traders lost close to 50k crores in FY24, this is the major reason for SEBI's action, here's the short summary what it means and how it can impact active traders,especially Option Traders🧵

At the max Index can have 50 strikes only, in the above example we have close to 40 strikes, so remaining 10 strikes can be added, 5 in put and 5 in call. So below 24000 and above 26000, strike intervals will not be in 50s, it could be in 100s or 200s or 500s.

Since SEBI data says, lot many traders dabble with deep OTM options during expiry days, they want to curb the availability of strikes which are much away from spot. By limiting the strikes available to trade, they expect the speculation could go down in options trading.

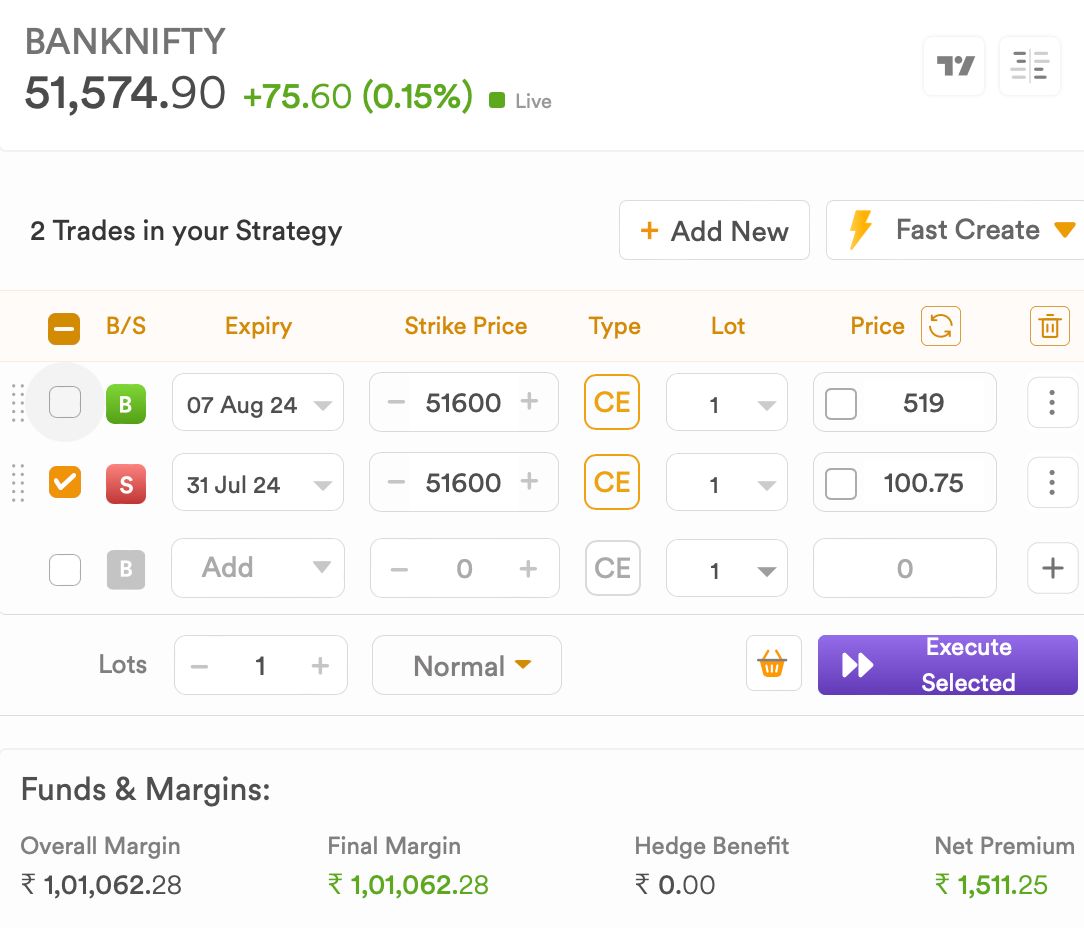

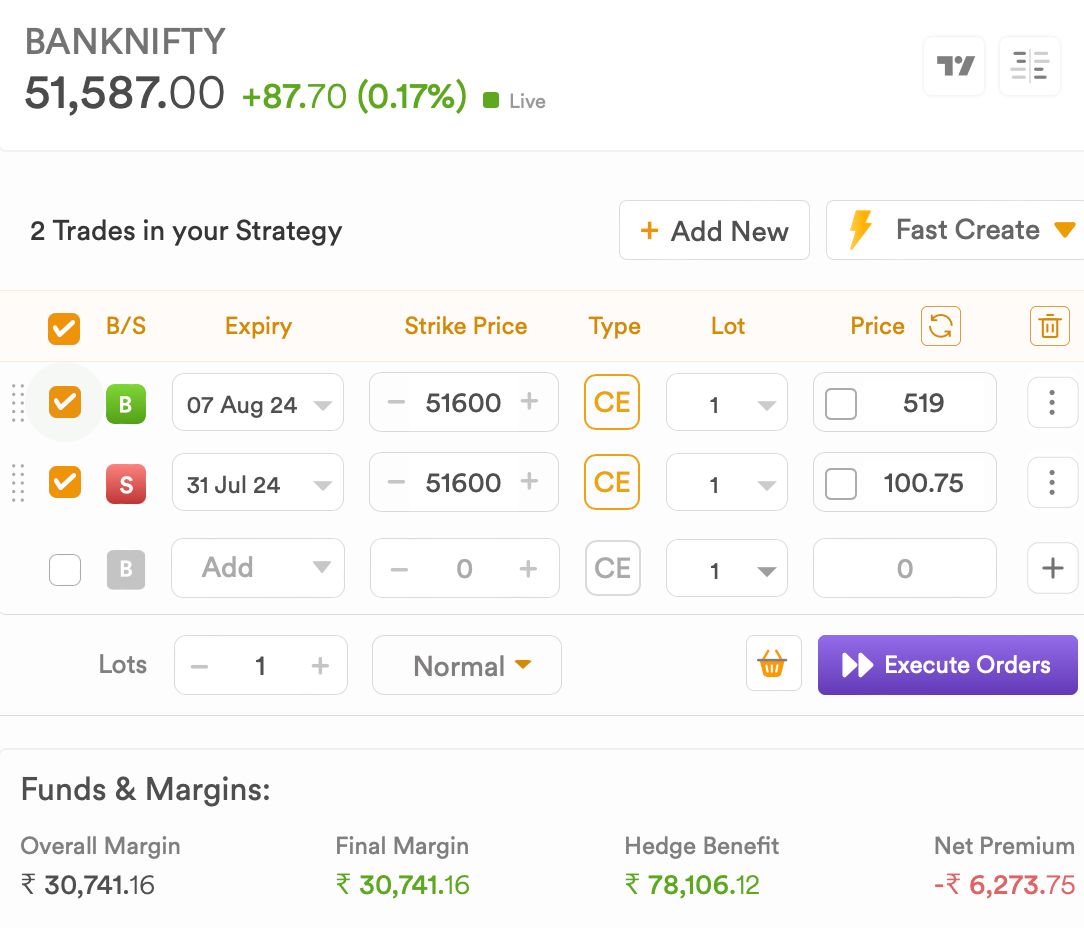

2. Upfront collection of Option premiums from Buyers: There are some brokers who allows leverage in Option buying, since exchange collections necessary funds from brokers for Futures trading and option selling, but for option buying brokers doesn't show margin at client level

Going forward, with this new rule leverage for option buying given by certain brokers are not possible and they cant show margin at broker level, it has to be on client level. There is no impact for Option buyers here due to this move, same capital is required as before.

4. Position limit monitoring: Earlier if you try to short certain option strikes, some brokers doesn't allow because if x% of position is crossed from certain broker, exchange doesn't allow further new positions to be initiated from that broker. But it was EOD calculation,

going forward it will be monitored on intraday basis, as soon as a broker cross certain threshold of Open Interest for any index derivatives. This will curb high concentration of volumes pertaining to certain large brokers leading to tech issues. This might really help.

6. Weekly Options for Nifty & Sensex: Just one weekly expiry allowed per exchange which should be single benchmark index. So no finnifty, midcap, bankex etc. This is a big blow for active traders who have spent huge time & effort to build strategies for 0DTE.

Many Weekly Option sellers initially started with BankNifty followed by other indices, in my case majority of the profits I made is from BankNifty since premiums were relatively higher in BNF compared to Nifty. Removal of BNF weekly expiry is a big set back.

Because of this move from SEBI, the entire trading ecosystem will suffer and could see a big setback. We cant worry about the things which aren't in our control, when you deal with highly regulated business, its always wise to expect the unexpected. We need to adapt and move on.

Remember, most of the strategies are just one circular away in losing its edge. Strategies which are built based on core logic like trend following has been working for 100s of years, but the kind of trending moves we saw in our markets in recent times is very minimal,

every strategy will sail through rough phase, but too much emphasis given on backtest based on past market data should be avoided. Try to build core logics based on market behaviour rather than market data. This SEBI circular hopefully brings in new regime, lets adapt & move on.

Loading suggestions...