What is Filter Candle?

Filter Candle is similar to CSD candle but it is different in terms of how to determine, where it forms and has different types of it based on quality one and one of lesser quality.

Filter candle helps you out either to determine if market is still trending or it has potentially shifted direction on HTF.

On LTF it can serve as a confirmation entry and better RR if it aligns with HTF.

Filter Candle is similar to CSD candle but it is different in terms of how to determine, where it forms and has different types of it based on quality one and one of lesser quality.

Filter candle helps you out either to determine if market is still trending or it has potentially shifted direction on HTF.

On LTF it can serve as a confirmation entry and better RR if it aligns with HTF.

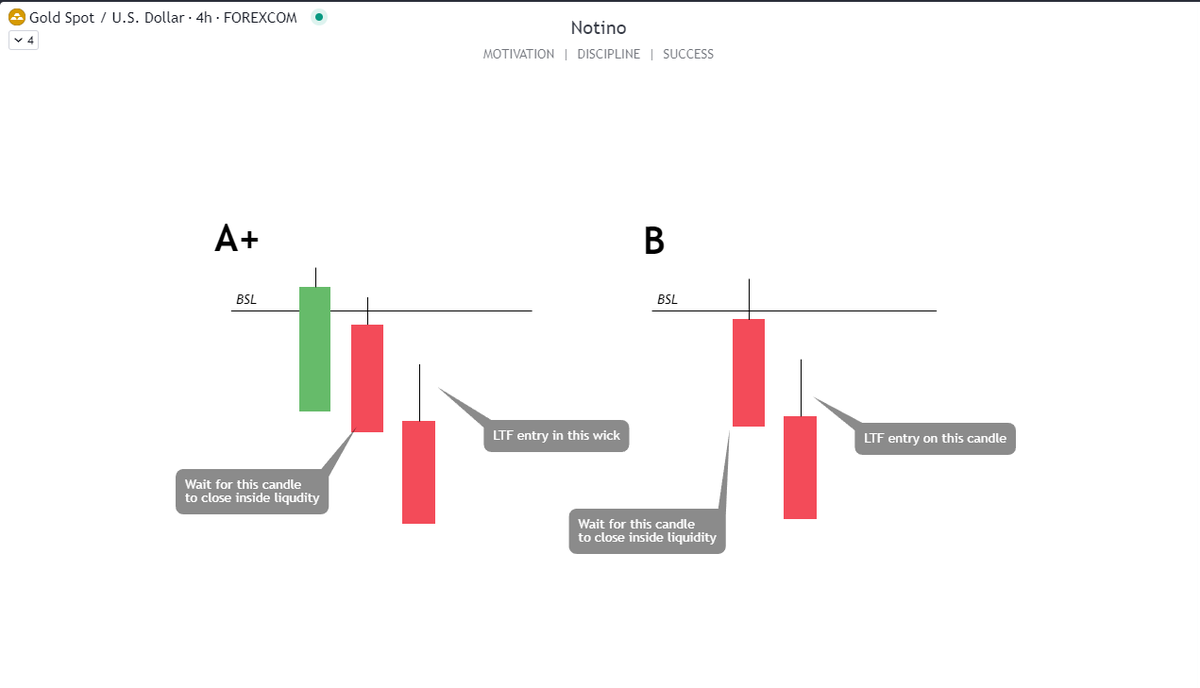

Types of Filter Candle

Here are 2 types of Filter candle. A+ one has bullish candle closing above liquidity level, then next candle either engulfs it (like CSD) and breaks its low and 3rd candle is your entry candle here, you could use fibonacci retracements here like 0.5%.

B type is clear rejection without body closing above liquidity level and entry is on the next candle (LTF entry). Also could use fibonacci retracements to enter on 2nd candle

Here are 2 types of Filter candle. A+ one has bullish candle closing above liquidity level, then next candle either engulfs it (like CSD) and breaks its low and 3rd candle is your entry candle here, you could use fibonacci retracements here like 0.5%.

B type is clear rejection without body closing above liquidity level and entry is on the next candle (LTF entry). Also could use fibonacci retracements to enter on 2nd candle

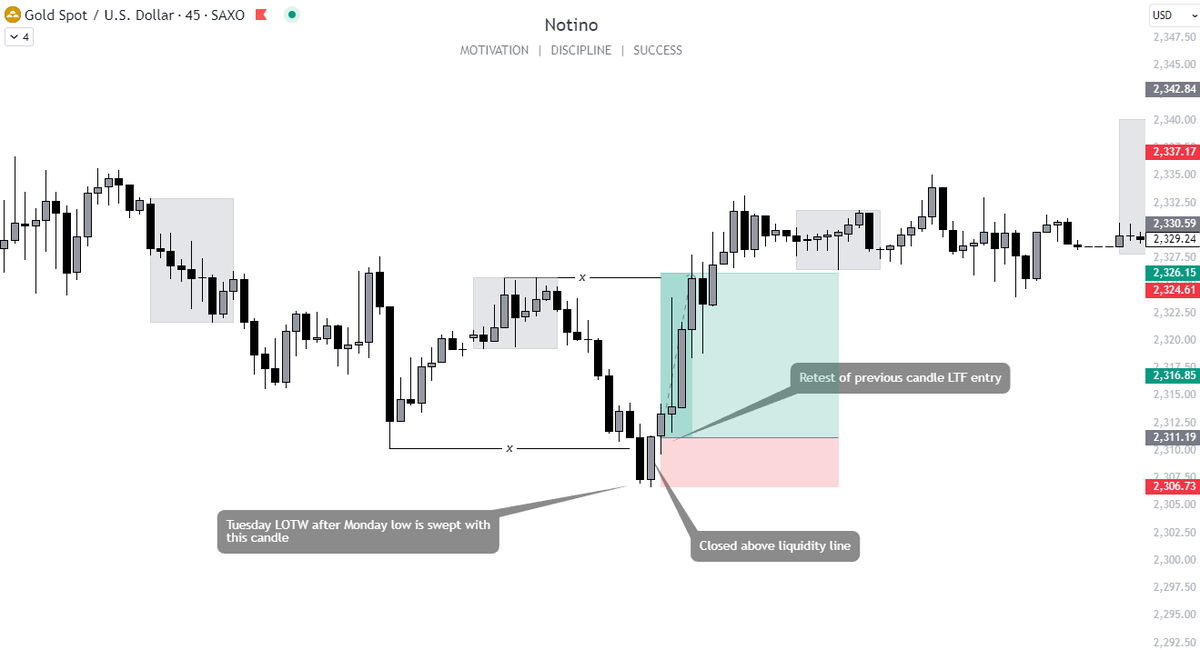

Example for B type.

Here is an example for B type of FC. Liquidity is swept, candle rejected liquidity level (bearish candle) and next candle gave 50% fibo entry or LTF entry at FVG could be used.

FC (Filter Candle) most of the times you could use candle math (getting 2 candles together on M15) and counting the close of M30 then by putting them together here equals a rejection candle of B type.

Important thing to make FC work efficient is that liquidity level should be time based to work even better. That means PDH/PDL, PWH/PWL, London high/low, Asia high/low and NY high/low sweeps.

Here is an example for B type of FC. Liquidity is swept, candle rejected liquidity level (bearish candle) and next candle gave 50% fibo entry or LTF entry at FVG could be used.

FC (Filter Candle) most of the times you could use candle math (getting 2 candles together on M15) and counting the close of M30 then by putting them together here equals a rejection candle of B type.

Important thing to make FC work efficient is that liquidity level should be time based to work even better. That means PDH/PDL, PWH/PWL, London high/low, Asia high/low and NY high/low sweeps.

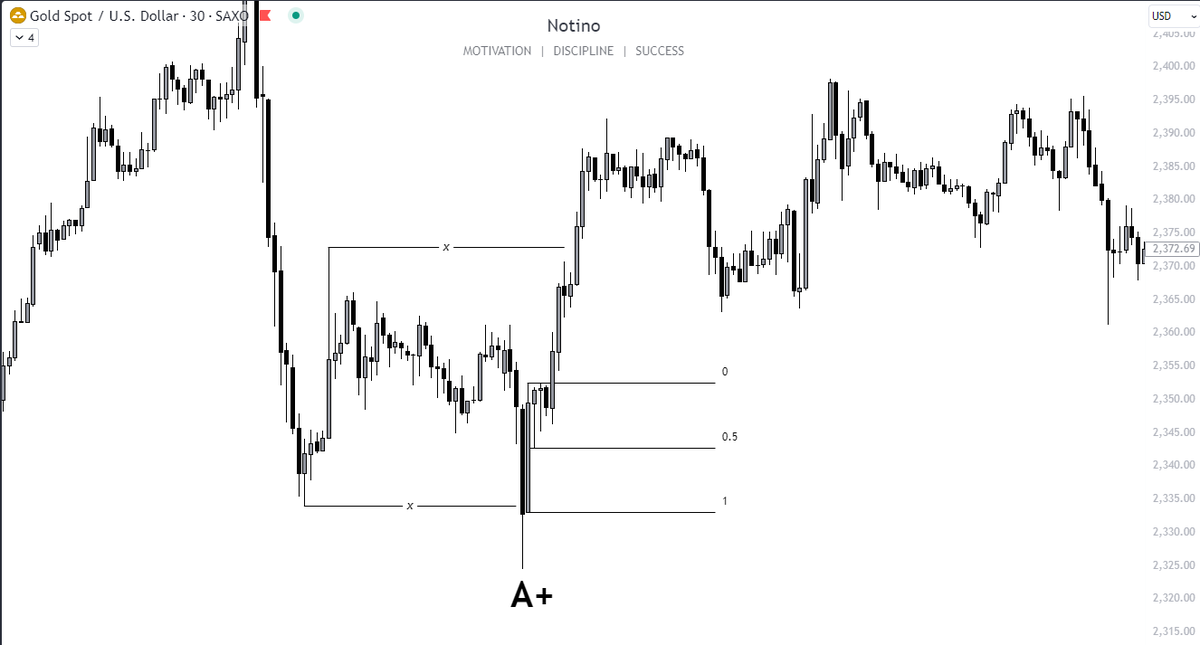

A setup example.

Here is A setup example, it didn't give you the entry on 3rd candle and that could happen sometimes but you could see from candle closing back above liquidity level potential indication of reversal from there.

A setup could give either re entry on FVG made by 2nd and 3rd candle or straight up retrace without an entry so this one is tricky to enter.

Here is A setup example, it didn't give you the entry on 3rd candle and that could happen sometimes but you could see from candle closing back above liquidity level potential indication of reversal from there.

A setup could give either re entry on FVG made by 2nd and 3rd candle or straight up retrace without an entry so this one is tricky to enter.

Here is an another example, we took out Asia highs and PDH also with it (very strong if we take out both timed liquidity levels such as PDH and Asian high both).

Entry on 2nd candle as it closed below liquidity level and in this example it didn't gave retrace entry on 3rd candle. You could treat this as a CSD.

Entry on 2nd candle as it closed below liquidity level and in this example it didn't gave retrace entry on 3rd candle. You could treat this as a CSD.

FC vs CSD

Basically FC is very similar to CSD but for FC we use closing above/below liquidity level and potential B setup play with rejecting liquidity level.

I would suggest you to use it with timeframe alignment so 4H >15M - 1H > 5M and 15M > 1M

Basically FC is very similar to CSD but for FC we use closing above/below liquidity level and potential B setup play with rejecting liquidity level.

I would suggest you to use it with timeframe alignment so 4H >15M - 1H > 5M and 15M > 1M

Take profit for FC should always be opposite time liquidity level. You could manage it by putting breakeven once it reached midpoint of overall TP.

Stop Loss should be below/above the low/high of the candle that closes below/above liquidity level.

Stop Loss should be below/above the low/high of the candle that closes below/above liquidity level.

Leave a like, follow if you are new, great week ahead guys!❤️

If you want to trade with me and earn bonus on deposit >> u.primexbt.com

Thank you, and more to come🤝💚

If you want to trade with me and earn bonus on deposit >> u.primexbt.com

Thank you, and more to come🤝💚

Loading suggestions...

![Filter Candle [a Thread🧵] #XAUUSD #Gold

Avoid getting stopped out so much!

1. What is Filter Can...](https://pbs.twimg.com/media/GSx646vWwAAwxWC.jpg)