Kenya Public Debt Scrutiny (2013-22)

Total Expenditure (Excl Debt Pay; Incl County+Development+Salaries): Ksh 14.6 trillion

Total Tax Revenue Collected: Ksh 13.3 trillion

Deficit: 1.3 Tn

Actual Borrowing: Ksh 7.7 trillion

Excess Borrowing: Ksh 6.4 trillion

@JimiWanjigi @Kimuzi_

Total Expenditure (Excl Debt Pay; Incl County+Development+Salaries): Ksh 14.6 trillion

Total Tax Revenue Collected: Ksh 13.3 trillion

Deficit: 1.3 Tn

Actual Borrowing: Ksh 7.7 trillion

Excess Borrowing: Ksh 6.4 trillion

@JimiWanjigi @Kimuzi_

Why take loans when our economy can sustain itself?

KE taxes leave nothing to steal from.

So they have to take loans to steal, Budgeted Corruption (mtabaki mkilipa baadae)

#RejectFinanceBill2024 @MigunaMiguna @OkiyaOmtatah @Osama_otero

KE taxes leave nothing to steal from.

So they have to take loans to steal, Budgeted Corruption (mtabaki mkilipa baadae)

#RejectFinanceBill2024 @MigunaMiguna @OkiyaOmtatah @Osama_otero

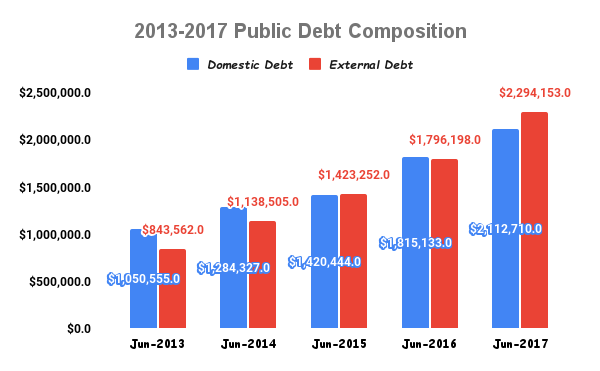

For Ex: Do you want to know where the 2013-17 loans went?

I don't have the resources, but I'll review some whose info is publicly available

Take Note: External Debt grew by 34.9% from 2013-2014, the highest in that period.

#RutoMustGo #RejectFinanceBill

I don't have the resources, but I'll review some whose info is publicly available

Take Note: External Debt grew by 34.9% from 2013-2014, the highest in that period.

#RutoMustGo #RejectFinanceBill

That's some Eurobonds and SGR

The 1st Loans the Jubilee Gov signed

You will not believe what happened next

The king is Naked #RejectTheFinanceBill2024 @city_digest @edgarobare

The 1st Loans the Jubilee Gov signed

You will not believe what happened next

The king is Naked #RejectTheFinanceBill2024 @city_digest @edgarobare

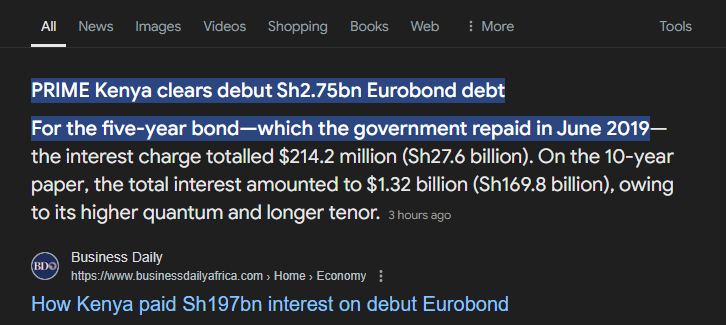

Analysis of Kenya's Eurobond Issuance

Kenya has issued several Eurobonds over the years, each with specific terms and repayment schedules. Here’s an analysis based on the details provided 👇👇👇

Public Notice: Be Very Ready For Tuesday

Kenya has issued several Eurobonds over the years, each with specific terms and repayment schedules. Here’s an analysis based on the details provided 👇👇👇

Public Notice: Be Very Ready For Tuesday

First Eurobond:

Amount: $2 billion

Issuer: Standard Chartered Bank through JP Morgan Chase

Issue Date: 10 years ago (around 2013)

Maturity: Due in June (2024)

Notes: This bond is a 10-year bond, indicating it was issued around 2013 and is maturing in 2024.

#RutoMustGo

Amount: $2 billion

Issuer: Standard Chartered Bank through JP Morgan Chase

Issue Date: 10 years ago (around 2013)

Maturity: Due in June (2024)

Notes: This bond is a 10-year bond, indicating it was issued around 2013 and is maturing in 2024.

#RutoMustGo

Second Eurobond:

Amount: $1 billion

Issuer: Citibank

Maturity: Due in February 2028

Notes: Kenya borrowed another $1 billion from Citibank, with repayment due in February 2028.

TheKingisNaked #BeVeryReadyForTuesday

Amount: $1 billion

Issuer: Citibank

Maturity: Due in February 2028

Notes: Kenya borrowed another $1 billion from Citibank, with repayment due in February 2028.

TheKingisNaked #BeVeryReadyForTuesday

Third Eurobond:

Amount: $900 million

Issuer: Citigroup Global Markets Europe AG

Commencement of Payments: Starting May 2025

Notes: This bond starts repayments in 2025 and is scheduled to be paid off in equal installments.

@bonifacemwangi #MtukufuLies

Amount: $900 million

Issuer: Citigroup Global Markets Europe AG

Commencement of Payments: Starting May 2025

Notes: This bond starts repayments in 2025 and is scheduled to be paid off in equal installments.

@bonifacemwangi #MtukufuLies

Fourth Eurobond:

Amount: $1.2 billion

Issuer: Citigroup Global Markets Europe AG

Commencement of Payments: Starting from 2030 to 2032 in three equal installments

Notes: Scheduled repayments begin in 2030, with the bond maturing by 2032.

Amount: $1.2 billion

Issuer: Citigroup Global Markets Europe AG

Commencement of Payments: Starting from 2030 to 2032 in three equal installments

Notes: Scheduled repayments begin in 2030, with the bond maturing by 2032.

Issuance Date: 2024

Amount: $2 billion

Purpose: Financing unspecified development projects and infrastructure

Account Setup: On June 19, arrangements were made to open an account at JPMorgan Chase in New York, titled "GoK/CBK Sovereign Bond."

@Kimuzi_ @C_NyaKundiH

Amount: $2 billion

Purpose: Financing unspecified development projects and infrastructure

Account Setup: On June 19, arrangements were made to open an account at JPMorgan Chase in New York, titled "GoK/CBK Sovereign Bond."

@Kimuzi_ @C_NyaKundiH

Red Flag

1. Opening a JP-Chase in NY

2. Signatories: Bernard Ndungu and Julius Musyimi were mandated as signatories for the account, facilitating/authorizing transactions related to the Eurobond funds.

@MigunaMiguna @FaithOdhiambo8 @OkiyaOmtatah

1. Opening a JP-Chase in NY

2. Signatories: Bernard Ndungu and Julius Musyimi were mandated as signatories for the account, facilitating/authorizing transactions related to the Eurobond funds.

@MigunaMiguna @FaithOdhiambo8 @OkiyaOmtatah

On June 27, 2014, approximately $1.99 billion was transferred from Standard Chartered to the designated JPMorgan Chase account, ensuring the funds were securely held for Kenya's "national treasury."

@Wanjigi Eric Latiff Saba Saba

@Wanjigi Eric Latiff Saba Saba

Initial Transactions:

Syndicated Loan Repayment: $604 million (equivalent to 53 billion Shillings)

Transfer to National Exchequer: $395 million (equivalent to 34 billion Shillings)

Swift Confirmation: Provided by JPMorgan Chase for transparency

Syndicated Loan Repayment: $604 million (equivalent to 53 billion Shillings)

Transfer to National Exchequer: $395 million (equivalent to 34 billion Shillings)

Swift Confirmation: Provided by JPMorgan Chase for transparency

Audit Requirement: The $395 million transferred to Kenya's treasury requires auditing as it was not allocated to any specific development project or recurrent government expenditure.

There's no proof (Financially) that this money was used to finance any DEVELOPMENT Project

There's no proof (Financially) that this money was used to finance any DEVELOPMENT Project

Si ata heri io Ksh 34B ilifika kwa wallet ya CBK ata kama walitutoka

Jiulize swali, Why have we paid $1 Bn plus interest as loan, enye ata haikufika Kenya.

Only 3 people know where the $1Bn went

(Lakini tumeilipia deni kwa umoja kama wakenya)

#RejectFinaceBill2024 #Maandamano

Jiulize swali, Why have we paid $1 Bn plus interest as loan, enye ata haikufika Kenya.

Only 3 people know where the $1Bn went

(Lakini tumeilipia deni kwa umoja kama wakenya)

#RejectFinaceBill2024 #Maandamano

Interest Earned: $76,000 accrued on the $1 billion held from July to September 2014.

Transfer Out: On September 8, 2014, $999 million was transferred from JP Morgan Chase account to NOWHERE, then from NOWERE to supposedly the National Exchequer account at the Treasury in Nairobi.

Transfer Out: On September 8, 2014, $999 million was transferred from JP Morgan Chase account to NOWHERE, then from NOWERE to supposedly the National Exchequer account at the Treasury in Nairobi.

Wanjigi on Spice FM clarified after pressuring JP-Chase to provide documentation of the $1Bn.

They gave him a redacted transfer history. No Swift Code Proof like the earlier two transactions.

JP: "Ni mm nmekushow doo imefika CBK"

@Kimuzi_

They gave him a redacted transfer history. No Swift Code Proof like the earlier two transactions.

JP: "Ni mm nmekushow doo imefika CBK"

@Kimuzi_

On Kenyan side

Wanjigi was provided just 7 Letters to prove $1Bn arrived at CBK Exchequer Ac

Bernad & Julius opened a "Sovereign Bond account at the Central Bank of Kenya (CBK)" to hold the 1Bn for Kenyans, maybe because hawataki kuchokesha Exchequer Acc, portal isiharibike

Wanjigi was provided just 7 Letters to prove $1Bn arrived at CBK Exchequer Ac

Bernad & Julius opened a "Sovereign Bond account at the Central Bank of Kenya (CBK)" to hold the 1Bn for Kenyans, maybe because hawataki kuchokesha Exchequer Acc, portal isiharibike

Opening accounts like the Sovereign Bond account at the Central Bank of Kenya (CBK) & the JP Morgan Chase account VIOLATE constitutional norms.

Managing public funds in accounts other than the national Exchequer account raises transparency and accountability issues.

@Honeyfarsafi

Managing public funds in accounts other than the national Exchequer account raises transparency and accountability issues.

@Honeyfarsafi

The same individuals authorized as signatories for the JP-Chase Acc are also signatories for the Sovereign Bond Acc at CBK

Red flag for perpetuating money laundering and fraud, avoiding COB.

There is no acknowledgment from CBK that they received the remaining 1B Eurobond.

Red flag for perpetuating money laundering and fraud, avoiding COB.

There is no acknowledgment from CBK that they received the remaining 1B Eurobond.

A folio number typically refers to a unique identifier or reference number assigned to documents or transaction - @JimiWanjigi

#RejectFinanceBill2024 #AusterityMeasuresASAP

#RejectFinanceBill2024 #AusterityMeasuresASAP

Folio Numbers: The folio numbers were the same across the 7 letters.

Amount Matching: The amount mentioned in all 7 letters was 25 billion Shillings.

Such actions can facilitate money laundering and fraud, undermining transparency and accountability in public finances.

SabaSaba

Amount Matching: The amount mentioned in all 7 letters was 25 billion Shillings.

Such actions can facilitate money laundering and fraud, undermining transparency and accountability in public finances.

SabaSaba

جاري تحميل الاقتراحات...