In this detailed #thread🧵 I'll analyse the business of ‘Allied Digital Services Ltd’ 🛜

each and every aspect of #AlliedDigitalServices will be cover in this thread.

#ADSL has Data Center Proxy 🛜+ Smart City 🏙️ + Cloud ☁️ Triggers

each and every aspect of #AlliedDigitalServices will be cover in this thread.

#ADSL has Data Center Proxy 🛜+ Smart City 🏙️ + Cloud ☁️ Triggers

⭐️Services Offered:-

a) Cloud Computing Services:-

Cloud Management Services, Cloud Enablement Services, AWS Partner, Cloud Migration

b) Cybersecurity:-

AIM360 Degrees, CERT-IN Guidelines,

Threat Intelligence, Cloud Security, Management, Endpoint Security Management,

a) Cloud Computing Services:-

Cloud Management Services, Cloud Enablement Services, AWS Partner, Cloud Migration

b) Cybersecurity:-

AIM360 Degrees, CERT-IN Guidelines,

Threat Intelligence, Cloud Security, Management, Endpoint Security Management,

Anti-Fraud & Identity Management, Risk Management

c)Integrated Solutions:-

IoT, Cognitive Technologies, System Integration, Smart Cities, Safe Cities, Industrial IoT 4.0

d) Infrastructure Management:-

Enterprise Infrastructure Management, Work From Anywhere

c)Integrated Solutions:-

IoT, Cognitive Technologies, System Integration, Smart Cities, Safe Cities, Industrial IoT 4.0

d) Infrastructure Management:-

Enterprise Infrastructure Management, Work From Anywhere

e) Software Services:-

FinoAllied, Analytics to AI, DevOps, Enterprise Digitization, ADiTaaS (Now Digital Desk), SAP Support, Robotic Process, Automation

f) Workplace Services:-

Next Gen, Service Desk, Unified Endpoint Management, Workplace Services, Work place Modernisation

FinoAllied, Analytics to AI, DevOps, Enterprise Digitization, ADiTaaS (Now Digital Desk), SAP Support, Robotic Process, Automation

f) Workplace Services:-

Next Gen, Service Desk, Unified Endpoint Management, Workplace Services, Work place Modernisation

⭐️Geographical Revenue Split - FY24:-

Overseas:- 68%, Domestic:- 32%

⭐️Segment Revenue - FY24:-

Solutions:- 17%, Services:- 83%

⭐️Revenue by Customer Profile:-

Government Customers:- 18%, Enterprise:- 82%

Overseas:- 68%, Domestic:- 32%

⭐️Segment Revenue - FY24:-

Solutions:- 17%, Services:- 83%

⭐️Revenue by Customer Profile:-

Government Customers:- 18%, Enterprise:- 82%

⭐️ Key Business Developments:-

✅Boston based Bank has chosen ADSL to provide Managed service for their Bank and customers filed services support.

✅Subsidiary of BP America, focused on oil and Natural gas exploration and production in Texas, has participated with ADSL.

✅Boston based Bank has chosen ADSL to provide Managed service for their Bank and customers filed services support.

✅Subsidiary of BP America, focused on oil and Natural gas exploration and production in Texas, has participated with ADSL.

✅Firm from Texas has selected ADSL to provide Managed services for 20,000 end users in the Asia pacific region across 17 countries.

✅Wind Turbine Manufacturer in Aurich, Germany partnered with ADSL to streamline LT operations in their Germany production facilities.

✅Wind Turbine Manufacturer in Aurich, Germany partnered with ADSL to streamline LT operations in their Germany production facilities.

⭐️Concall Notes📝

Aug 2023(Highlights)

✅The company has an order book worth Rs 1700 Crore to be executed over next 3 to 4 Years.

✅Anticipate substantial growth in smart cities, cloud migration, cybersecurity services, end manufacturing solutions.

Aug 2023(Highlights)

✅The company has an order book worth Rs 1700 Crore to be executed over next 3 to 4 Years.

✅Anticipate substantial growth in smart cities, cloud migration, cybersecurity services, end manufacturing solutions.

✅Optimistic about maintaining 14-15% Margins.

✅Targets top line of Rs 1000 Crore with 16-18% Margins in next 2-3 Years.

⭐️Concall Notes📝

Nov 2023(Highlights)

✅Order book at Rs 1600 Crore with execution period of around three years.

✅Expectation of improved performance

✅Targets top line of Rs 1000 Crore with 16-18% Margins in next 2-3 Years.

⭐️Concall Notes📝

Nov 2023(Highlights)

✅Order book at Rs 1600 Crore with execution period of around three years.

✅Expectation of improved performance

and improved margins in H2 & FY25.

✅Progress in smart city projects, with completed phases and new clients such as Lodha group, Tata Motors Group & Vedanta Group.

✅Confidence in achieving Revenue target of Rs 1000 Crore.

✅Progress in smart city projects, with completed phases and new clients such as Lodha group, Tata Motors Group & Vedanta Group.

✅Confidence in achieving Revenue target of Rs 1000 Crore.

⭐️Concall Notes📝

Nov 2023

The company won contract for Ayodhya Smart city project.

⭐️Concall Notes📝

June 2024

✅Completed 12 smart city projects with 2 new wins.

✅Expecting an opportunity size of Rs 50,000 Crore in the smart city projects in next 5 years.

Nov 2023

The company won contract for Ayodhya Smart city project.

⭐️Concall Notes📝

June 2024

✅Completed 12 smart city projects with 2 new wins.

✅Expecting an opportunity size of Rs 50,000 Crore in the smart city projects in next 5 years.

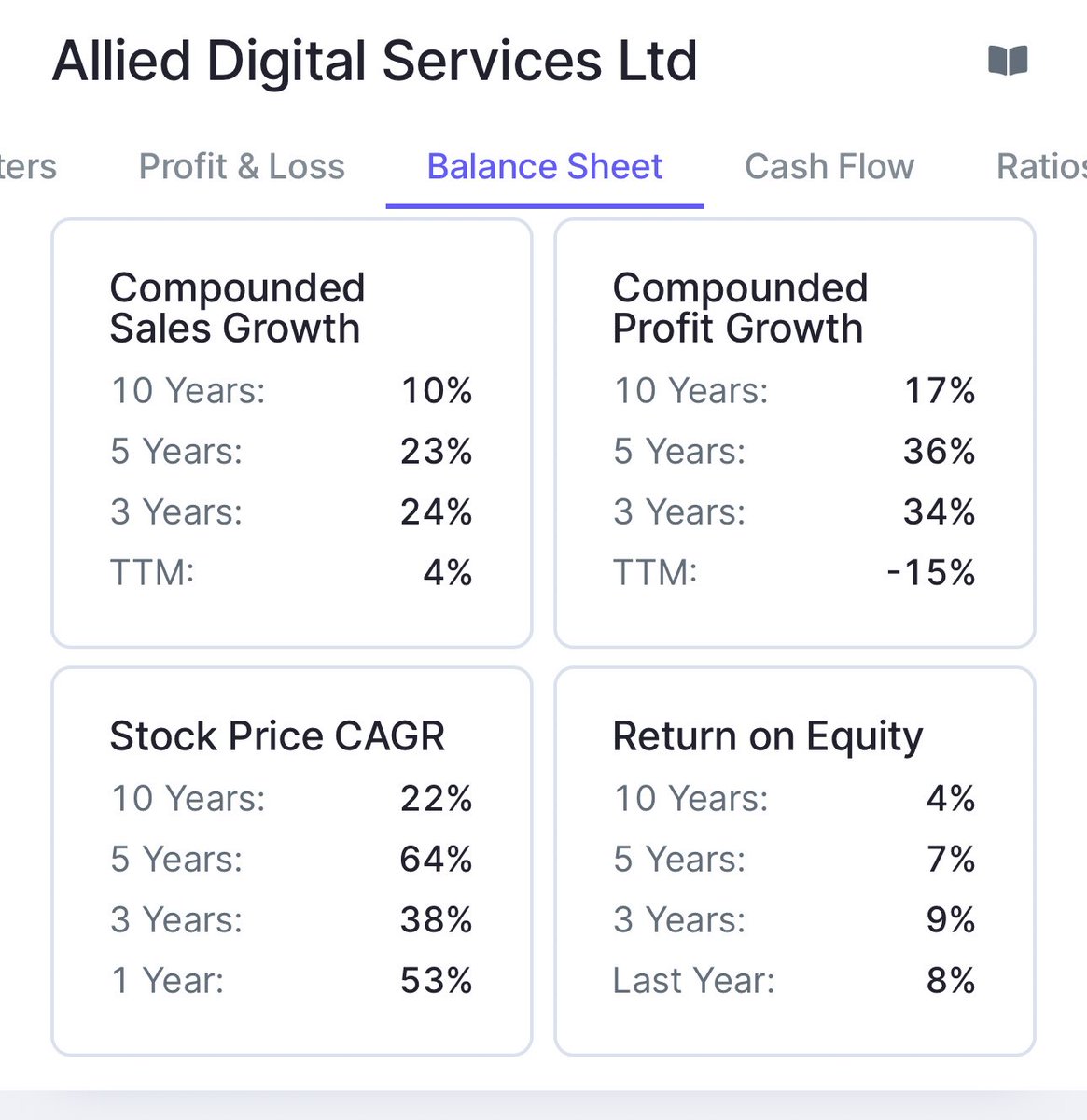

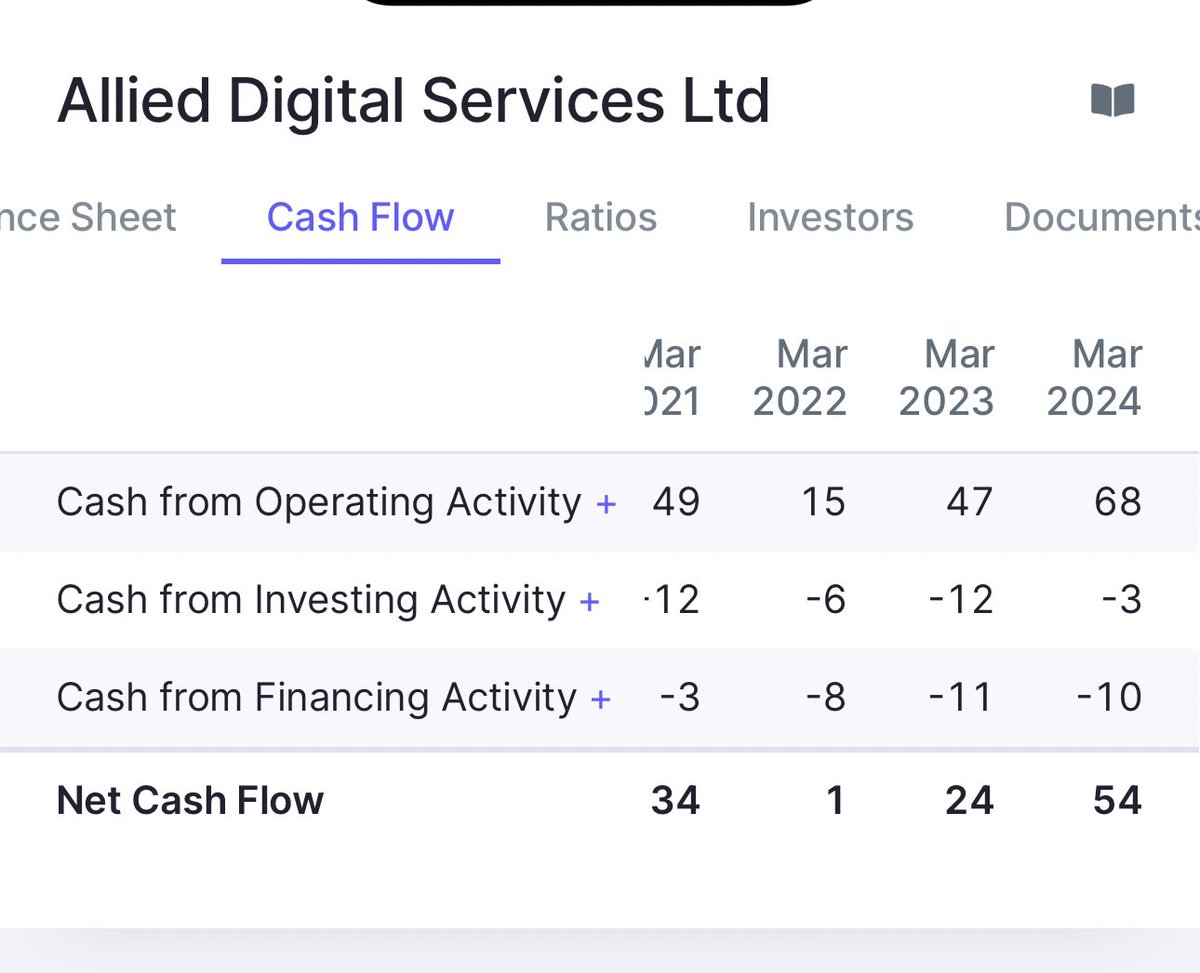

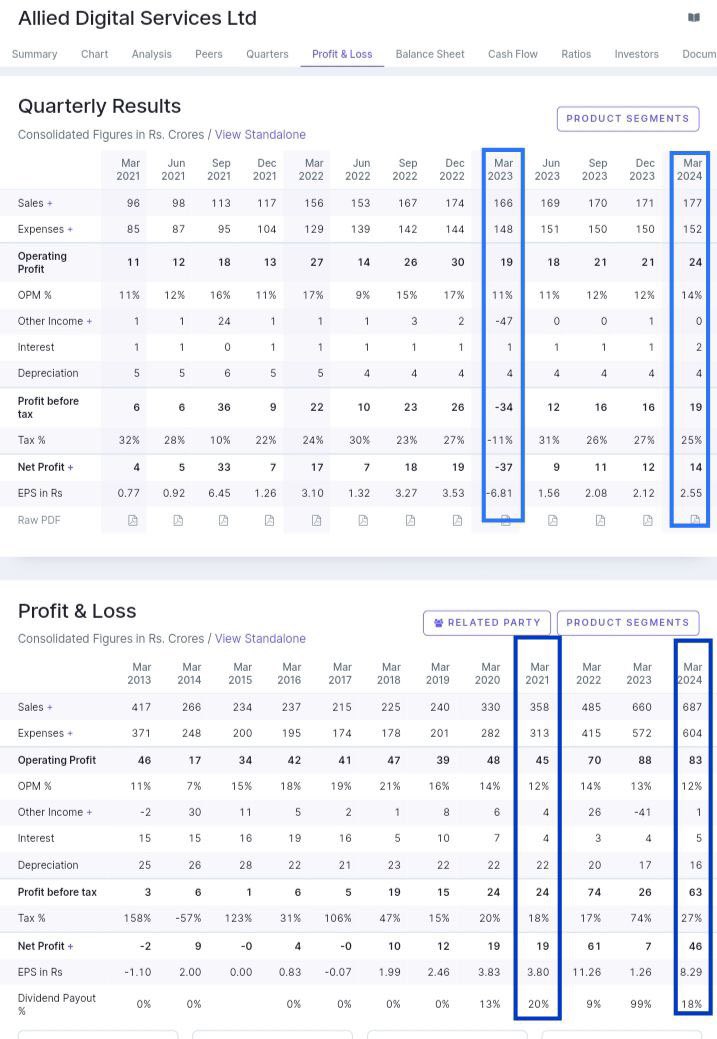

Fundamental Analysis♎⚖️

☑️Market Cap:- Rs 927 Cr(Smallcap)

☑️Stock PE:- 20.02Undervalued)

☑️Industry PE:- 34.6

☑️Book Value:- Rs 105

☑️Dividend Yield:- 0.72%

☑️ROCE:- 10.6%

☑️ROE:- 8.23%

☑️ROA:- 6.23%

☑️Face Value:- 5

☑️Intrinsic Value:- Rs 224

☑️Graham No:- Rs 140

☑️Market Cap:- Rs 927 Cr(Smallcap)

☑️Stock PE:- 20.02Undervalued)

☑️Industry PE:- 34.6

☑️Book Value:- Rs 105

☑️Dividend Yield:- 0.72%

☑️ROCE:- 10.6%

☑️ROE:- 8.23%

☑️ROA:- 6.23%

☑️Face Value:- 5

☑️Intrinsic Value:- Rs 224

☑️Graham No:- Rs 140

⭐️ Valuation Metrics ⚖️📝

☑️ADSL has a Vision to clock a Revenue of Rs 1000 Crores in the next 2-3 Years it means that ADSL Sales can grow at 13.33% CAGR pace(As per the Concall)

☑️The company has guided for 16-18% Margins(Previously between FY15 to FY19 ADSL has seen 15-21% Margins)

☑️ADSL has a Vision to clock a Revenue of Rs 1000 Crores in the next 2-3 Years it means that ADSL Sales can grow at 13.33% CAGR pace(As per the Concall)

☑️The company has guided for 16-18% Margins(Previously between FY15 to FY19 ADSL has seen 15-21% Margins)

☑️If ADSL is able to achieve Rs 1000 Cr Sales with 14% Margins it Forward PE is coming to 9.65

☑️If ADSL is able to achieve Rs 1000 Cr Sales with 16% Margins it Forward PE is coming to 8.53

☑️If ADSL is able to achieve Rs 1000 Cr Sales with 18% Margins its Forward

☑️If ADSL is able to achieve Rs 1000 Cr Sales with 16% Margins it Forward PE is coming to 8.53

☑️If ADSL is able to achieve Rs 1000 Cr Sales with 18% Margins its Forward

PE is coming to 7.52

Conclusion:- If ADSL is able to achieve its top-line Sales target of Rs 1000+ Crores in next 2-3 Years with a margins of 14-18% we can possibly see a big Re-rating happening in this stock.

Conclusion:- If ADSL is able to achieve its top-line Sales target of Rs 1000+ Crores in next 2-3 Years with a margins of 14-18% we can possibly see a big Re-rating happening in this stock.

Disclaimer:- The above content is solely for the educational purposes. Do not take it as a Buy/Sell recom. I’ll not be responsible for the Profit/Loss made.

جاري تحميل الاقتراحات...