In this quick thread, you'll get Python code to:

• Fetch options data using Python

• Generate long straddle prices

• Design a risk profile

Let's go!

• Fetch options data using Python

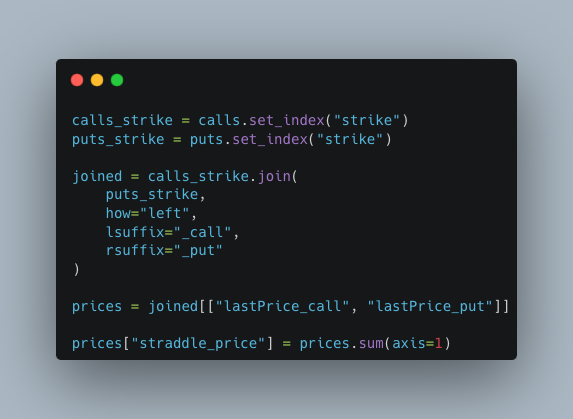

• Generate long straddle prices

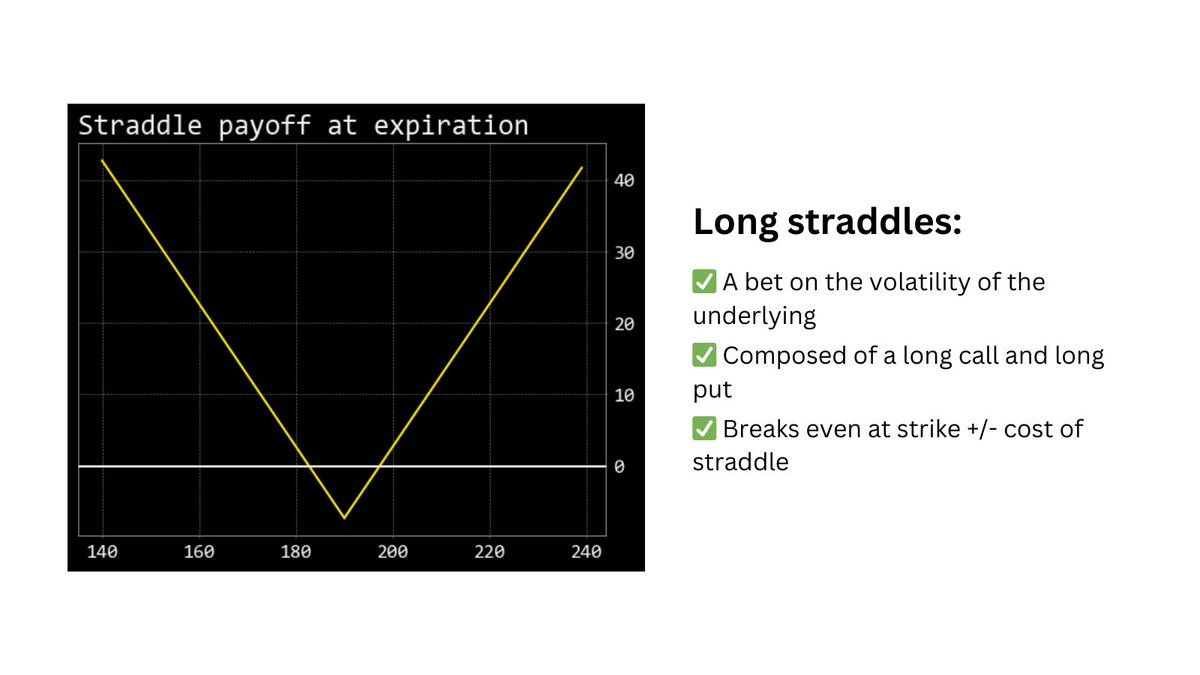

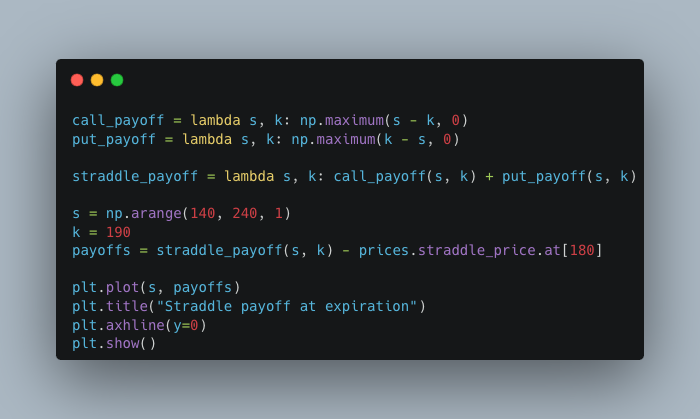

• Design a risk profile

Let's go!

So what's next?

1. Model a short straddle (hint: it’s the opposite of a long straddle)

2. Use an options pricing model to model the options price before expiration

1. Model a short straddle (hint: it’s the opposite of a long straddle)

2. Use an options pricing model to model the options price before expiration

Looking to start using Python for quant finance?

Here's a free Ultimate Guide with everything you need to get started.

Join the 1,000s of people who finally started with Python after reading it:

links.pyquantnews.com

Here's a free Ultimate Guide with everything you need to get started.

Join the 1,000s of people who finally started with Python after reading it:

links.pyquantnews.com

Loading suggestions...