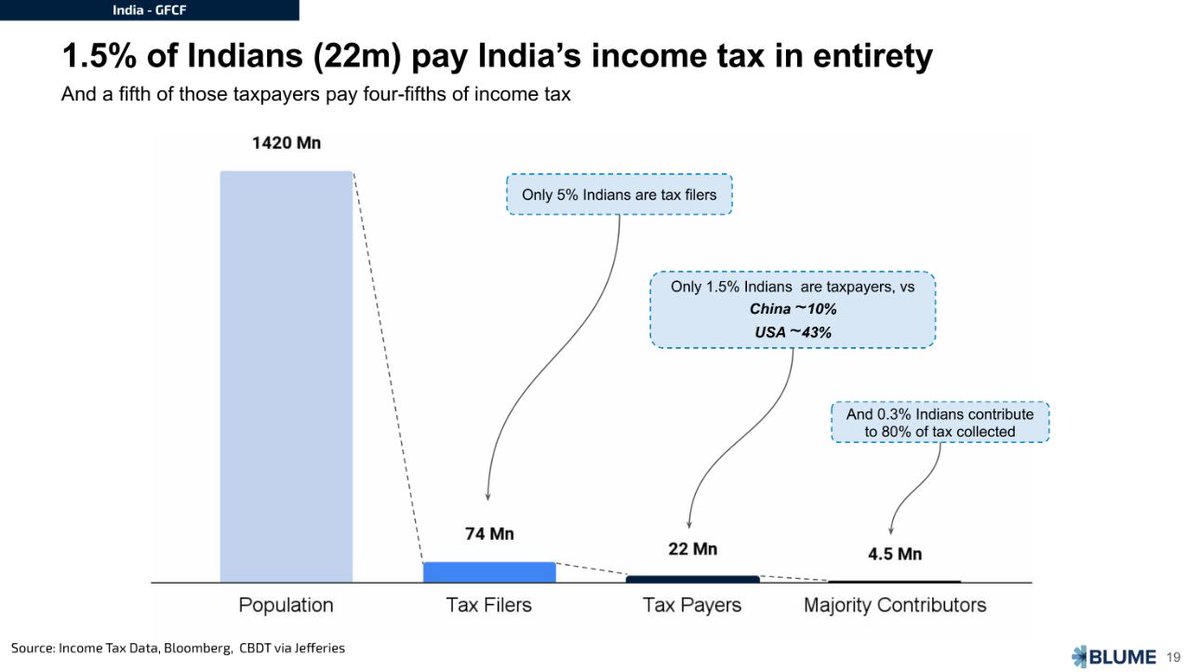

The figure—1.5%—is not just small; its shocking & disheartening! It raised some significant doubts in our minds.

The buzz surrounding the recent Indus Valley Report published by Blume Ventures prompted us to delve deeper into the topic.

The buzz surrounding the recent Indus Valley Report published by Blume Ventures prompted us to delve deeper into the topic.

So without wasting our time anymore, let’s get straight to understanding the fundamentals of this no.

See, out of our population of 140 Cr, only about 54.45 Cr people, or roughly 53%, are active participants in the workforce.

See, out of our population of 140 Cr, only about 54.45 Cr people, or roughly 53%, are active participants in the workforce.

The term Work Force refers to the total no. of people who are actually employed.

This means that the remaining 47% of the population is not liable to pay any tax.

Within these 54.45 Cr employed individuals, around 14.4 Cr are a part of the formal workforce.

This means that the remaining 47% of the population is not liable to pay any tax.

Within these 54.45 Cr employed individuals, around 14.4 Cr are a part of the formal workforce.

Now, we need to understand that only these 14.4 Cr people are falling under the tax jurisdiction because of

- several inefficient economic structures &

- low administrative feasibility.

The remaining informal workforce often operates outside formal employment contracts

- several inefficient economic structures &

- low administrative feasibility.

The remaining informal workforce often operates outside formal employment contracts

— and their income may not be systematically recorded or reported.

This makes it challenging for tax authorities to enforce compliance & accurately assess taxable income.

Finally, out of these 14.4 Cr, 7.4 Cr (till July 2023) and 7.78 Cr (till Jan 2024) had filed their ITRs.

This makes it challenging for tax authorities to enforce compliance & accurately assess taxable income.

Finally, out of these 14.4 Cr, 7.4 Cr (till July 2023) and 7.78 Cr (till Jan 2024) had filed their ITRs.

And as we all know, only 2.2 Cr of them actually paid their taxes!

So the first question that came to mind was, if so many people filed their ITR why didn't everyone pay?

1️⃣ Tax Bracket- Under the new tax regime, individuals earning up to Rs.3L are exempted from paying any tax.

So the first question that came to mind was, if so many people filed their ITR why didn't everyone pay?

1️⃣ Tax Bracket- Under the new tax regime, individuals earning up to Rs.3L are exempted from paying any tax.

So there are many people earning up to Rs.3L, who file their return, but are not required to pay any tax.

2️⃣ Tax Evasion- Some individuals underreport their income or engage in other forms of tax evasion to avoid paying the full amount of taxes owed.

2️⃣ Tax Evasion- Some individuals underreport their income or engage in other forms of tax evasion to avoid paying the full amount of taxes owed.

3️⃣ Financial Hardships- Certain economic circumstances or financial difficulties may prevent taxpayers sometimes from paying their taxes.

Now shall we turn our focus to the US for a moment?

Although the tax compliance mechanisms in India and the USA are somewhat similar, the USA has achieved better results. Let's explore how.

Although the tax compliance mechanisms in India and the USA are somewhat similar, the USA has achieved better results. Let's explore how.

👉 Formal Employment

A larger portion of the U.S. workforce is engaged in formal employment, where taxes are automatically withheld from wages, leading to a more comprehensive collection of income taxes.

In contrast, a significant portion of India’s workforce is employed

A larger portion of the U.S. workforce is engaged in formal employment, where taxes are automatically withheld from wages, leading to a more comprehensive collection of income taxes.

In contrast, a significant portion of India’s workforce is employed

— in the informal sector, where income is not consistently reported or taxed.

👉 Progressive Taxation

This tax system is considered to be more inclusive as it actively involves lower-income individuals as well.

👉 Progressive Taxation

This tax system is considered to be more inclusive as it actively involves lower-income individuals as well.

It ensures they contribute to the tax system in a manner proportional to their ability to pay.

The U.S. tax system, maintains a simpler rate structure compared to India's complex array of exemptions, deductions, & varying tax rates, which can complicate compliance.

The U.S. tax system, maintains a simpler rate structure compared to India's complex array of exemptions, deductions, & varying tax rates, which can complicate compliance.

After comprehending the primary practices through which the US has improved income tax payments, let's now explore how we can achieve better results using the following modalities.

1️⃣ Sector-Specific Taxation Approach

Designing customized tax collection strategies for various sectors, including real estate, digital economy, & small businesses,

— keeping their unique characteristics & challenges in mind, can significantly enhance the no. of tax payers.

Designing customized tax collection strategies for various sectors, including real estate, digital economy, & small businesses,

— keeping their unique characteristics & challenges in mind, can significantly enhance the no. of tax payers.

2️⃣ Tax Pardon Program

Some program which allows individuals & businesses to disclose previously unreported income without incurring penalties, would encourage a broader compliance & expand the tax base of our country.

Some program which allows individuals & businesses to disclose previously unreported income without incurring penalties, would encourage a broader compliance & expand the tax base of our country.

3️⃣ Automatic Tax Filing System

By Implementing this system, similar to Nordic nations where taxpayers receive pre-filled returns, could significantly increase the no. of income tax payers in India by simplifying the filing process & reducing the burden on taxpayers.

By Implementing this system, similar to Nordic nations where taxpayers receive pre-filled returns, could significantly increase the no. of income tax payers in India by simplifying the filing process & reducing the burden on taxpayers.

Using tech to automatically fill in tax information from employers & financial institutions will simplify the process, reduce mistakes, & encourage greater voluntary tax compliance among people.

4️⃣ Use of Big Data & AI

If the govt starts using AI and Big Data to analyze extensive datasets, they’ll be able to track intricate income & expenditure patterns.

This approach will facilitate

- the identification of potential tax evaders &

- enhances compliance monitoring.

If the govt starts using AI and Big Data to analyze extensive datasets, they’ll be able to track intricate income & expenditure patterns.

This approach will facilitate

- the identification of potential tax evaders &

- enhances compliance monitoring.

5️⃣ Cross-Border Cooperation

Partnering with international tax authorities is a great way

- to exchange taxpayer information, especially regarding foreign income & assets and

- to combat offshore tax evasion.

This collaboration will in turn enhance overall revenue collection.

Partnering with international tax authorities is a great way

- to exchange taxpayer information, especially regarding foreign income & assets and

- to combat offshore tax evasion.

This collaboration will in turn enhance overall revenue collection.

Special Deduction

Introducing targeted deductions for expenses like children's education, healthcare costs for serious illnesses, and rent will incentivize greater participation in the income tax system.

Introducing targeted deductions for expenses like children's education, healthcare costs for serious illnesses, and rent will incentivize greater participation in the income tax system.

This will attract more taxpayers while easing financial burdens on families for essential expenditures.

While progress is evident, we are still far from achieving the ideal state.

While progress is evident, we are still far from achieving the ideal state.

If you liked this read, do RePost🔄 the 1st post

and follow us @FinFloww for such reads every Monday, Wednesday and Friday!

and follow us @FinFloww for such reads every Monday, Wednesday and Friday!

Get our WhatsApp newsletter: whatsapp.com

Subscribe to WHAT THE FLOWW?, our weekly email newsletter where we dive deeper into such concepts: soshals.app

Loading suggestions...