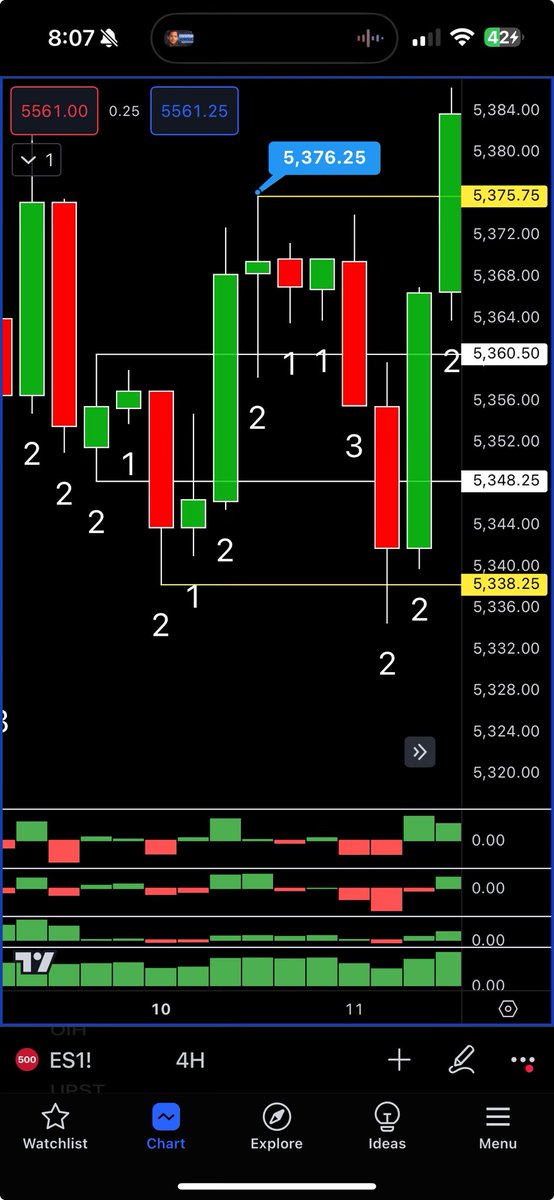

Notice how all of this price action goes compound 3 of the previous range. The reason we can identify this broadening formation (yellow).

The 4hr shows how we went 4 bars outside of the initial tri from the 60.

This is a universal truth and will be true across all timeframes (until the timeframe higher than the 1)

The 4hr shows how we went 4 bars outside of the initial tri from the 60.

This is a universal truth and will be true across all timeframes (until the timeframe higher than the 1)

The breakout of the range is either TRUE or FALSE.

If the range is broken and price makes no lower low the breakout is true. If it reverses and reclaims those highs the breakout is false.

Yes the range may be tested more than 1x but once those highs are made during FTFC we want it to break and never come back.

The equilibrium can be seen as a tug of war. While it’s forming it’s a battle back n forth between the smaller timeframe participation groups.

Once the equilibrium breaks it is 100% up to the HTF participants to take the offer or hit the bid.

That initial breakout must **just go** or we will heavily reduce our positions.

The end goal is to find the biggest 3 you can. Trade with continuity back through the 3. If the breakout is true add if it is false reduce heavily.

Since we can gauge both sides of the range we must add to winning positions aggressively. This is how the big tri’s pay you. If you know it’s going “from there” “to there” you should be as long as you can be before your target is hit!

If the range is broken and price makes no lower low the breakout is true. If it reverses and reclaims those highs the breakout is false.

Yes the range may be tested more than 1x but once those highs are made during FTFC we want it to break and never come back.

The equilibrium can be seen as a tug of war. While it’s forming it’s a battle back n forth between the smaller timeframe participation groups.

Once the equilibrium breaks it is 100% up to the HTF participants to take the offer or hit the bid.

That initial breakout must **just go** or we will heavily reduce our positions.

The end goal is to find the biggest 3 you can. Trade with continuity back through the 3. If the breakout is true add if it is false reduce heavily.

Since we can gauge both sides of the range we must add to winning positions aggressively. This is how the big tri’s pay you. If you know it’s going “from there” “to there” you should be as long as you can be before your target is hit!

If this post taught you something please share & follow! 🥂

Loading suggestions...