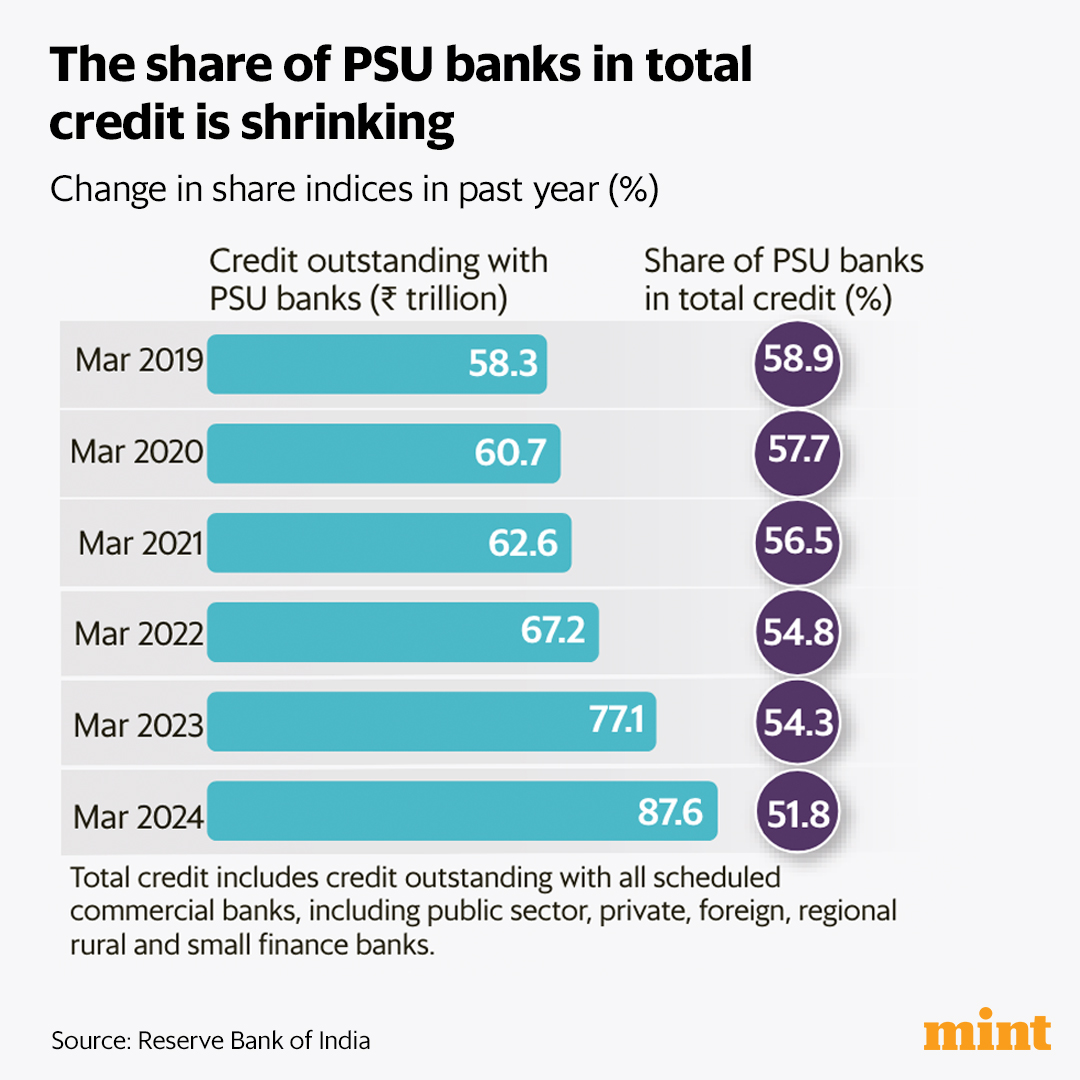

#MintPlainFacts | #PSUBanks have outperformed private banks on stock market, despite losing market share to them. Lower valuations and government investments are helping.

Read here: read.ht

Read here: read.ht

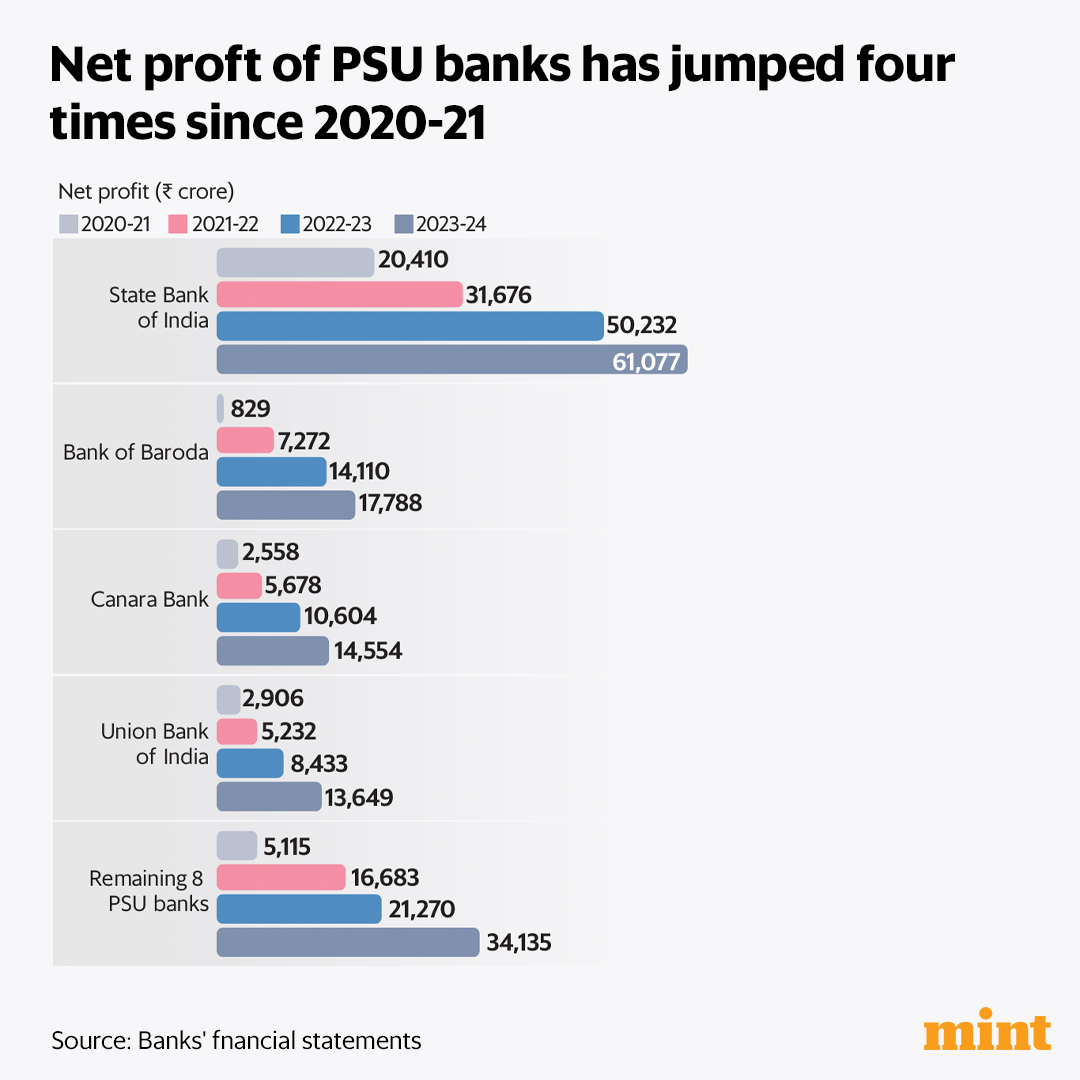

#MintPlainFacts | The combined net profit of the 12 #PSUBanks crossed ₹1.4 trillion in 2023-24, up 35% from the previous fiscal, and up four times compared to 2020-21, reflecting a turnaround in this segment.

Read here: read.ht

Read here: read.ht

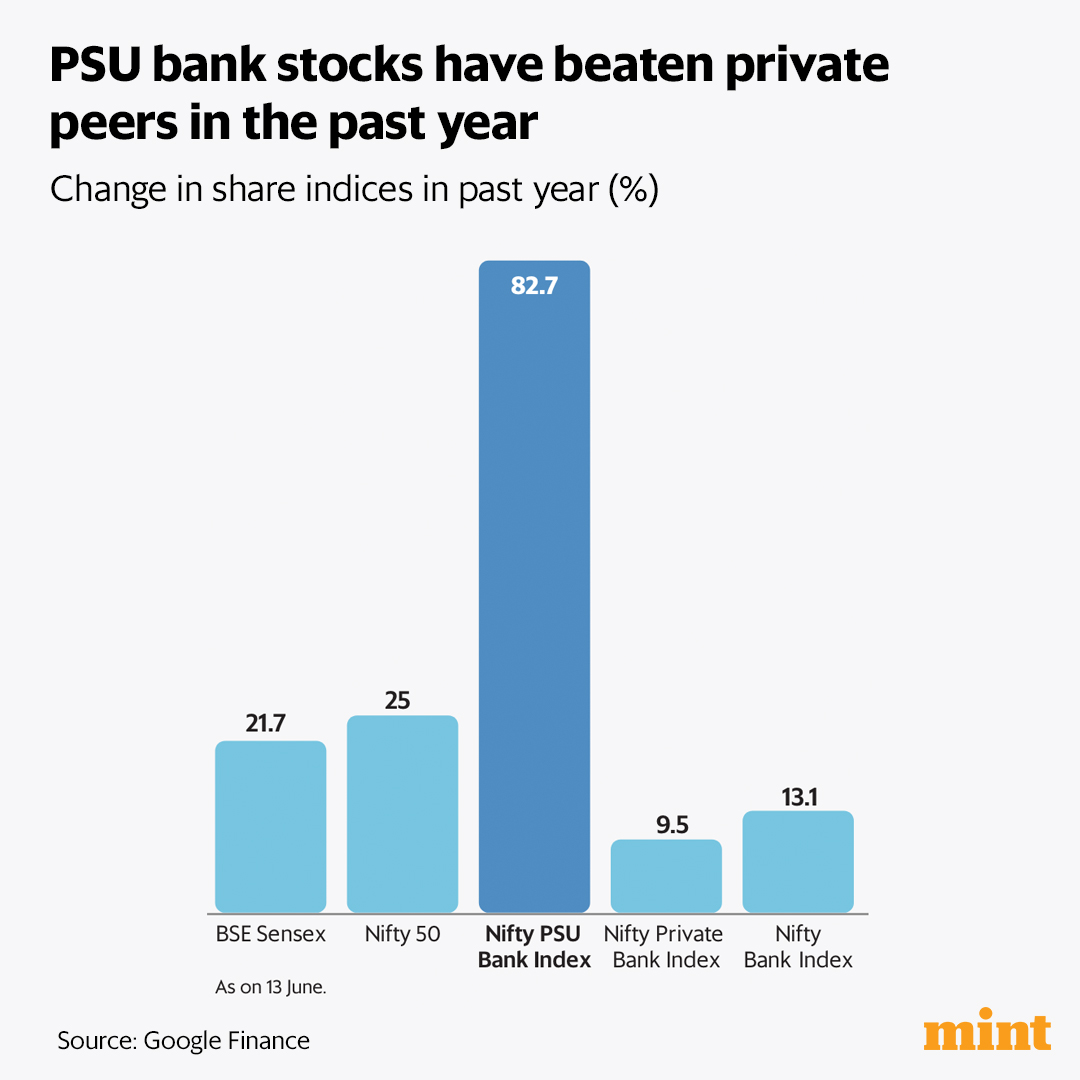

#MintPlainFacts | The #NiftyPSUBankIndex has surged over 83% in the past year, compared to a 9% rise in the #NiftyPrivateBank Index and a 22% increase in the BSE #Sensex.

Read here: read.ht

Read here: read.ht

#MintPlainFacts | PSU banks reduced their net #NPAs by over ₹50,000 crore in 2022-23 compared to 2021-22, the Reserve Bank of India had said in a report in December 2023.

Read here: read.ht

Read here: read.ht

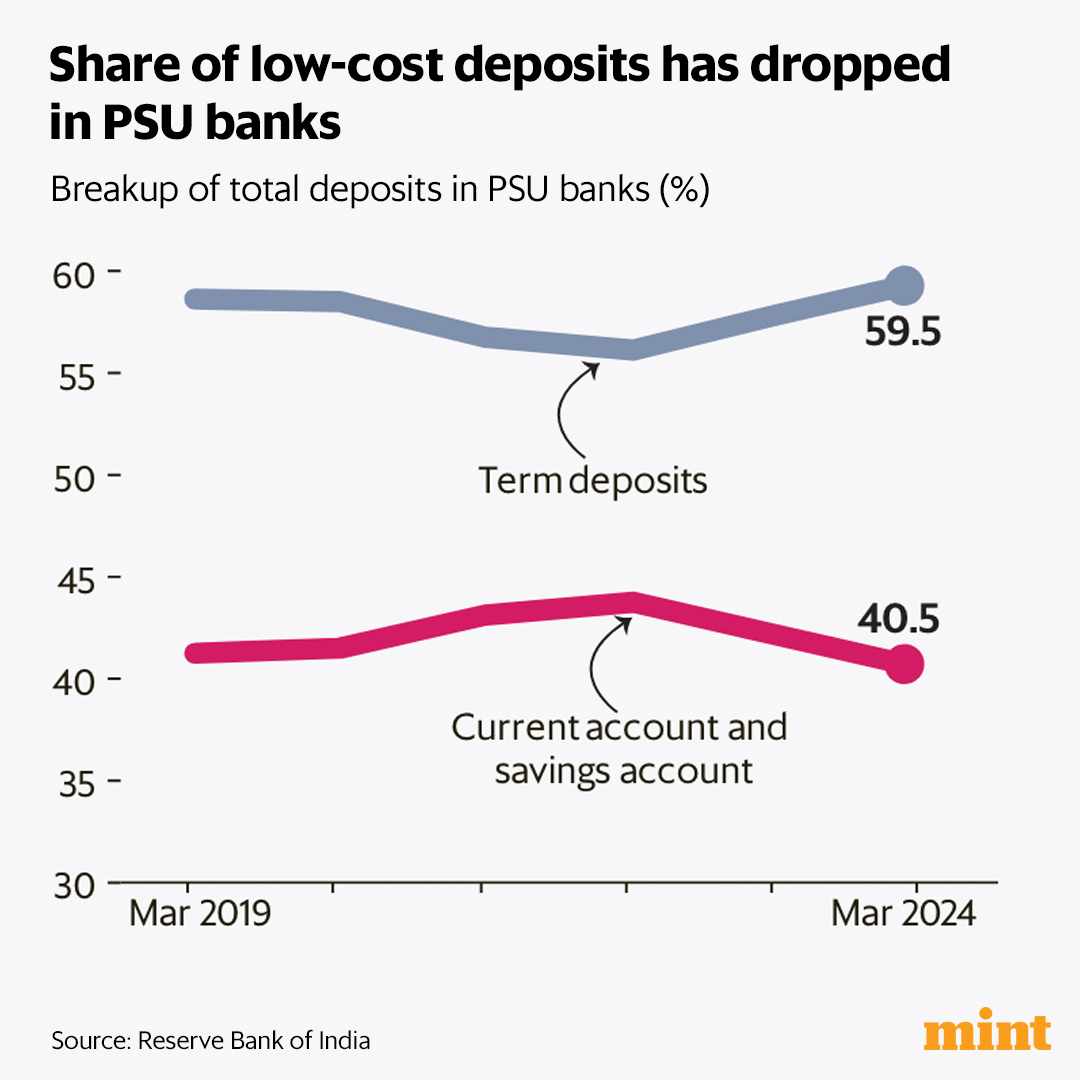

#MintPlainFacts | To improve profitability, #PSUbanks have been aggressively pursuing low-cost deposits through current and savings accounts.

These deposits grew by 48% during the period, but their proportion of total deposits decreased.

Read here: read.ht

These deposits grew by 48% during the period, but their proportion of total deposits decreased.

Read here: read.ht

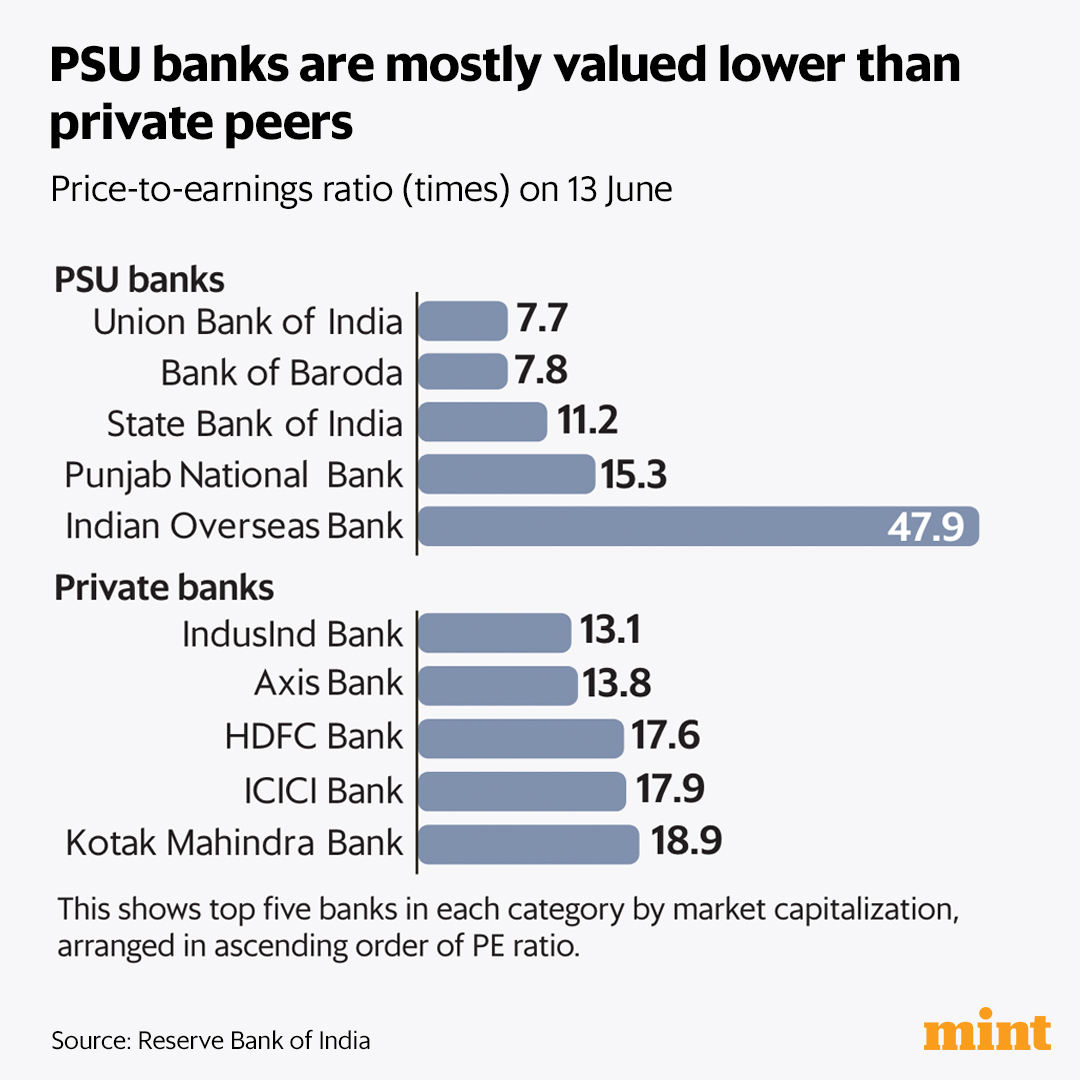

#MintPlainFacts | Part of the reason why #PSUBank stocks have outperformed their private peers, despite certain drawbacks, is their historically lower valuations.

Read here: read.ht

Read here: read.ht

جاري تحميل الاقتراحات...