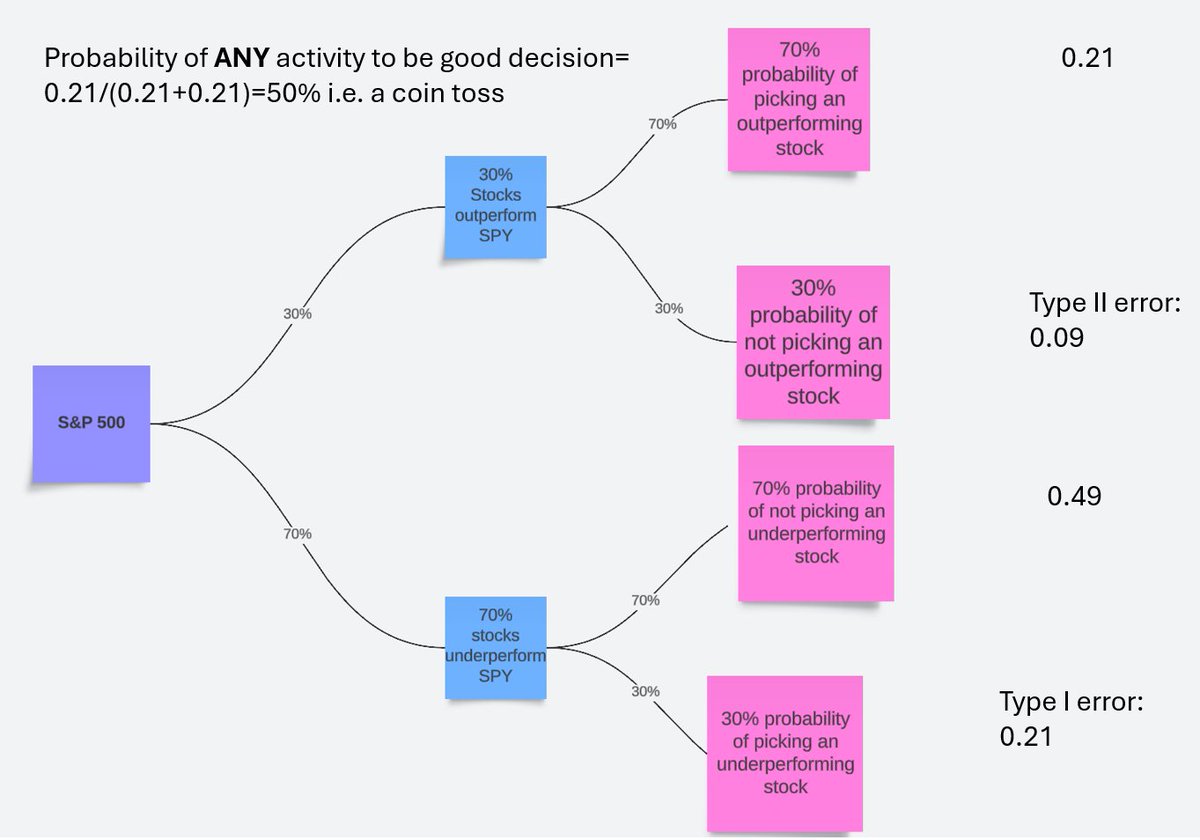

Imagine you're building a portfolio of stocks for the next 10 years. Let's assume ~30% stocks in S&P 500 will outperform and the rest ~70% will underperform the $SPY total return after 10 years.

Now the question: when you pick ANY stock, what is the probability that it will turn out to be a good decision based on these probabilities?

Good decision here is to pick the outperforming stocks and avoid the underperforming ones.

Good decision here is to pick the outperforming stocks and avoid the underperforming ones.

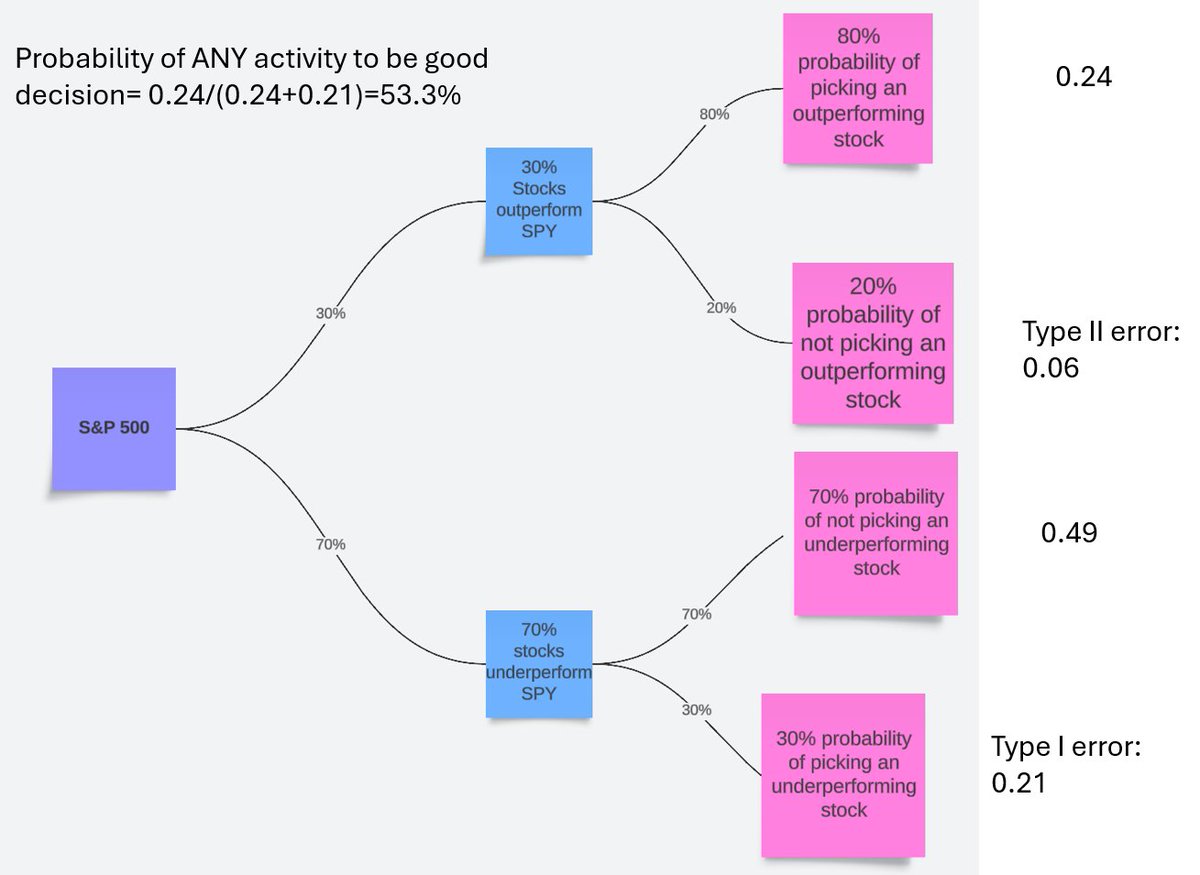

Now, let's imagine you get better at reducing error of commission (type I error) from 30% to 20% while keeping the error of omission (type II error) at 30%.

What's the probability that ANY activity will turn out to be good decision? The answer is ~60%.

What's the probability that ANY activity will turn out to be good decision? The answer is ~60%.

One takeaway is be careful before any trading. It is most likely to prove to be a coin toss in terms whether such decision will turn out to be good in 5-10 years.

And if you are picking stocks for the "next 12 months", it is almost by definition a coin toss (2023 and 2024 are bit of an anomaly).

x.com

x.com

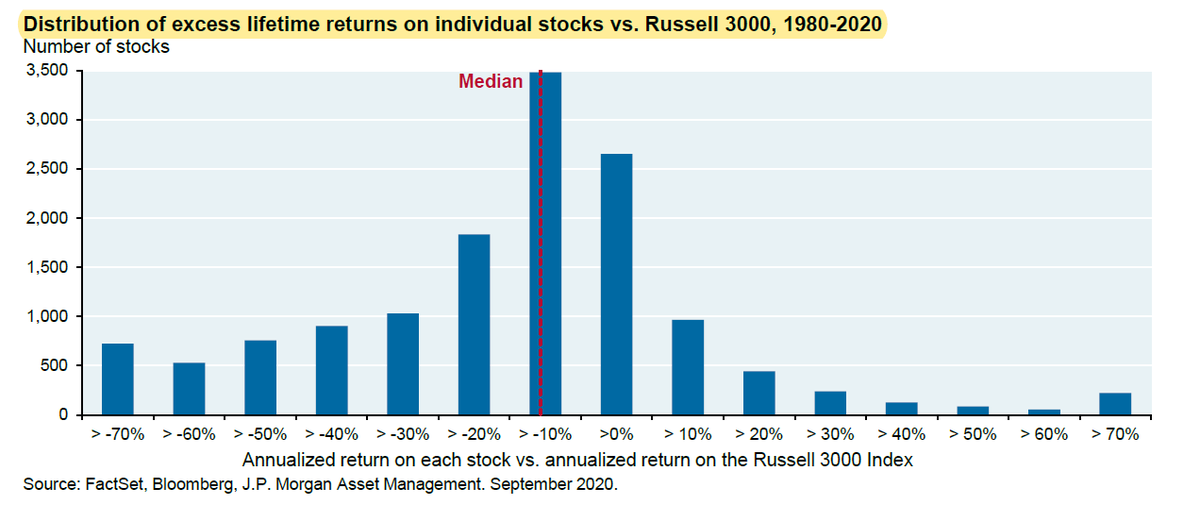

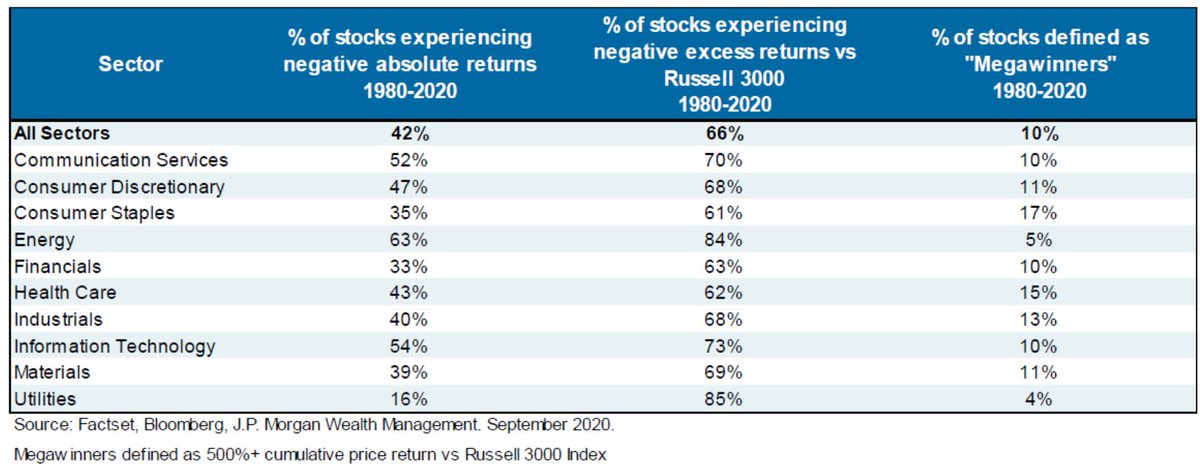

So, having mega-winners in portfolio can hide plenty of underperformers over time.

The challenge is to keep them the entire time because mega-winners lead to massive concentration and supermajority active investors hate such concentration.

x.com

The challenge is to keep them the entire time because mega-winners lead to massive concentration and supermajority active investors hate such concentration.

x.com

The whole point of the thread is just a reminder to myself that active investing is very, very difficult and only a slim minority of investors will turn out to be successful.

(was DM-ing with some friends in the morning on this topic, so thought about just writing it down)

(was DM-ing with some friends in the morning on this topic, so thought about just writing it down)

cool graph to show the relationship between batting average, and win/loss ratio.

x.com

x.com

Loading suggestions...